Quick Take: What does living debt-free entail in the Philippines?

That means you have no debts to pay. No outstanding payments for credit cards, loans, mortgages, hospital bills, or any other types of debts!

Debt can be a significant source of stress and anxiety for many Filipinos. Whether it's credit card debt, personal loans, or informal loans, being in debt can feel overwhelming. But trust us, luv. You can get out of it. It might be difficult; it might take long… but getting out of debt definitely possible.

In this article, we’ll tell you everything you need to know about how to get out and stay out of debt once and for all.

Let’s get started, shall we?

Table of Contents

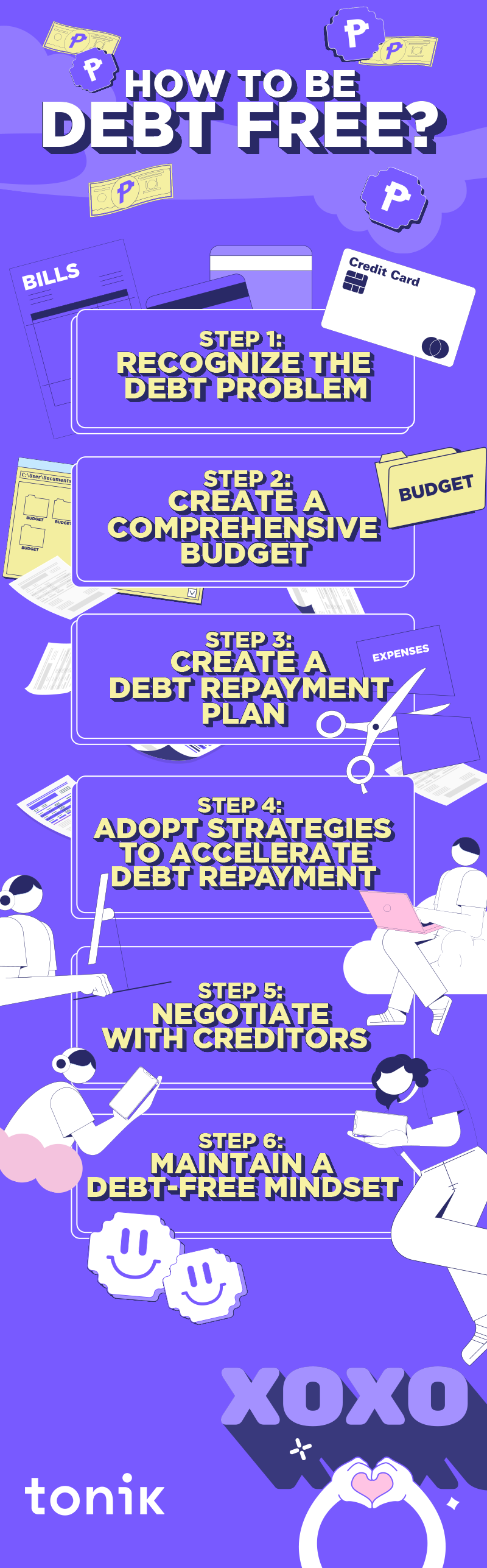

Recognize the Debt Problem

Nearly 1 out of every 2 adult Filipinos have at least one loan. So, having debt is more common than you might think. But if you really want to get out of debt, then the first step you must take is to recognize the problem.

You see, there is nothing inherently wrong about taking out loans. But when it’s already piling up, then it becomes a problem. It’s essential that you accept the gravity of the situation before it gets any worse. Then and only then can you truly do something about it.

How much is your total debt?

To be able to get out of debt, you need to know just how bad your credit is. Here’s a three-step process to help you out:

- Compile All Debt Statements: Start by gathering all your debt statements, including credit cards, personal loans, car loans, student loans, and any other outstanding obligations. These statements will serve as your roadmap to debt recovery.

- List Each Debt: Create a detailed list that includes the name of the creditor, outstanding balance, interest rate, minimum monthly payment, and the due date for each debt. This organized list will provide you with a snapshot of your financial situation.

- Create a Spreadsheet: Many individuals find it helpful to use a spreadsheet tool like Excel or Google Sheets to organize their debt information. These platforms allow you to create customizable tables and track your progress over time.

Why do people go into debt?

Debt can be caused by a variety of factors. These include:

- Low income or underemployment

- Relationship issues – yes, luv! It can be a big trigger.

- Poor money management like overuse of credit and issues with personal spending

- High costs of living

However, according to financial therapists, most money problems are rooted in self-esteem, trauma recovery, or scarcity mindset issues. That’s why understanding the root cause of debt is crucial to avoid repeating the same mistakes in the future.

TOCCreate a Comprehensive Budget

Creating a comprehensive budget is an essential step in getting out of debt. Here are some tips to help you create a budget that works for you.

- Assess expenses: Start by listing your expenses, starting with expenses that provide basic needs for living. Some of these are fixed, such as rent or mortgage payments, car payments, or installment loan payments. Some are variable, such as clothing or consumer goods. These expenses have some flexibility.

- Allocate funds for essentials: Once you have a better understanding of where your money is going, it’s time to look at ways to make the best use of your hard-earned income. Allocate funds for essentials like fixed expenses, savings, and paying off debt.

- Highlighting and cutting unnecessary expenses: If you find that your expenses are more than your income, you can cut back on unnecessary expenses. These could mean avoiding eating out or leisure expenses.

- Set realistic goals: Set realistic goals for your budget. This can help you stay motivated and focused on your financial goals. For instance, you can set a goal to pay off a certain amount of debt each month or save a certain amount of money.

With a solid budget in place, you can take control of your finances and work toward a debt-free future.

Creating a Debt Repayment Plan: Snowball vs. Avalanche

Now, you're ready to craft a debt repayment plan that suits your financial situation and goals. Two popular methods for tackling debt are the snowball and avalanche approaches, and we'll explore both so you can choose the one that aligns best with your circumstances.

1. The Snowball Method

Imagine building a snowball by rolling a small snowflake until it becomes a massive, unstoppable force. The snowball method works in a similar way, focusing on paying off your smallest debts first. Here's how it works:

- List Your Debts by Size: Start by arranging your debts in ascending order, from the smallest balance to the largest.

- Pay Minimums on All Debts: Continue making minimum payments on all your debts to avoid late fees and penalties.

- Make Extra Payment on Smallest Debt: Allocate any extra funds you have to the smallest debt. This might be from savings, side gigs, or windfalls. With each paid-off debt, the extra funds you can allocate to the next debt increase, like a snowball rolling downhill, gaining momentum.

2. The Avalanche Method

Picture an avalanche, where the snow and ice on a mountain peak break loose, cascading down with incredible force. The avalanche method targets your highest-interest debts first. Here's how to get started:

- List Debts by Interest Rate: Organize your debts from the highest to lowest interest rates.

- Pay Minimums on All Debts: As with the snowball method, keep up with minimum payments on all your debts.

- Extra Payment on Highest-Interest Debt: Allocate any extra funds toward the debt with the highest interest rate. This approach minimizes the overall interest you'll pay in the long run.

- Repeat the Process: Once the highest-interest debt is paid off, move on to the next one in line and continue until all debts are cleared.

Choosing Your Strategy

Now, the big question: which method should you choose? The answer depends on your financial personality and goals, luv.

The snowball method is excellent if you need quick wins and emotional boosts. Paying off smaller debts can give you a sense of accomplishment that keeps you motivated. It's particularly effective if you feel overwhelmed by debt.

Meanwhile, if your primary concern is minimizing interest payments and you're financially disciplined, the avalanche method is a smart choice. It's mathematically efficient and will save you the most money over time.

The Hybrid Approach

Can’t choose between the snowball and avalanche method? The good news is you’re not limited to just one method. Some people prefer a hybrid approach, combining elements of both the snowball and avalanche strategies. For example, you might start with the snowball method to gain momentum and switch to the avalanche method when you've built more confidence.

Regardless of your choice, remember that consistency is key. Stick to your chosen method, make on-time payments, and allocate extra funds toward debt reduction whenever possible. Over time, you'll see your debts shrink, and your financial freedom grow.

Keep your eyes on the prize—debt-free living. The choice of method is less important than your commitment to the process!

TOCStrategize to Accelerate Debt Payment

Congratulations on creating a debt repayment plan! Now, let's explore strategies that can help you accelerate your journey to debt freedom. Let’s start with some strategies that can help you increase your income.

- Freelancing: Consider taking up freelance work or side gigs to supplement your income. Many online platforms offer opportunities in various fields, allowing you to earn extra money in your free time. But fair warning, luv. If you’re employed, better check with your HR if you can take on a side hustle based on your contract!

- Selling Unused Items: Declutter your home and sell items you no longer need. Online marketplaces make it easy to turn unused possessions into cash that can be directed toward debt repayment.

- Switch Jobs: If you can’t get a side gig and your income is not enough to pay off your debt, then it might be time to look for other employment opportunities. Consider applying for a new job and find out if you’ll get a better offer elsewhere.

Aside from increasing your income, here are other ways to help you fast track your debt repayment:

- Allocate bonuses for debt repayments: When you receive unexpected windfalls, such as tax refunds or bonuses, resist the temptation to splurge. Instead, allocate these funds directly to your debt. Windfalls can significantly reduce your debt burden.

- Restructure or refinance loans: Investigate the possibility of doing debt restructuring or refinancing high-interest loans to secure lower interest rates. This can reduce the overall cost of your debt and make repayment more manageable.

- Explore debt consolidation options: By combining multiple debts into a single, lower-interest loan, you can simplify your repayment process. This may also reduce monthly payments.

Negotiate with Creditors to Get Better Debt Terms

Negotiating with creditors is an invaluable skill that can help you secure more favorable terms for your existing debts. To embark on this journey effectively, consider the following steps:

Step 1: Preparation is Key: Before reaching out to your creditors, ensure you've gathered all the essential information about your debts, your current financial situation, and your proposed terms for negotiation. Being well-prepared sets the stage for productive discussions.

Step 2: Be Honest and Transparent: Be honest when talking to your lender about your financial challenges. By sharing your situation openly, you're more likely to gain their understanding and cooperation.

Debt Settlement: Weighing the Pros and Cons

Debt settlement is a financial negotiation process where a borrower, who is unable to meet their financial obligations, works with their lender/s to agree on a reduced amount that will fully satisfy the debt. It's often used as a last resort by individuals facing financial hardships and struggling to make their loan or credit card payments. Here are its pros and cons:

| Pros | Cons |

|

|

Waivers, Penalties, and How to Address Them

In certain cases, you may successfully negotiate the removal of late fees, penalties, or accrued interest. Be sure to explain your circumstances and respectfully request leniency.

But another option is to explore the possibility of setting up a manageable payment plan with your lenders. This approach helps you avoid additional penalties while gradually working towards debt repayment.

Seeking Professional Assistance: A Game-Changer

Sometimes, seeking professional assistance can be a game-changer in your debt repayment journey. Here are some avenues you can explore:

- Financial Counseling: Financial counselors provide personalized guidance, assisting you in creating a budget, managing your debt, and setting achievable financial goals.

- Debt Management Programs: These programs consolidate your debts into one monthly payment and may offer lower interest rates. They are particularly useful if managing multiple creditors becomes overwhelming.

- Credit Counseling: Credit counselors can equip you with essential knowledge about credit management, budgeting, and financial literacy, empowering you to make informed decisions. They can also negotiate with your creditors on your behalf to secure better terms for debt repayment. Financial Counseling: Financial counselors provide personalized guidance, assisting you in creating a budget, managing your debt, and setting achievable financial goals.

Seek Professional Assistance

Achieving a debt-free life goes beyond financial strategies. It involves cultivating the right mindset. Here’s how you can do it:

- Avoid Adding More Debt: The foundation of a debt-free mindset is a commitment to stop accumulating additional debt. This requires discipline and self-control. Avoid using credit cards excessively and live within your means. Create a budget to track your expenses and ensure that your spending aligns with your income.

- Cultivate a Saving Mentality: Building an emergency fund is a crucial aspect of financial stability. By saving money regularly, you create a financial safety net that reduces the need to rely on credit when unexpected expenses arise. This fund can help you weather financial storms without going further into debt.

The Importance of Financial Literacy in the Philippines

Investing in your financial literacy is like investing in your future financial well-being. In the Philippines, where financial literacy is still an evolving concept for many, taking steps to educate yourself is essential. These baby steps can include:

- Reading Books: There are numerous books on personal finance and debt management that can provide valuable insights and strategies. Look for books that cater to your specific financial goals and challenges.

- Taking Online Courses: Many online platforms offer courses on personal finance, budgeting, and debt management. These courses can be a convenient way to enhance your financial knowledge at your own pace.

- Attending Seminars and Workshops: Attend financial seminars and workshops in your area. These events often feature experts who can provide practical advice and answer your questions.

Psychological and Emotional Aspects of Debt

Dealing with debt isn't just about numbers; it also involves managing the psychological and emotional aspects like:

- Managing Stress and Stigma: Understand that being in debt is a common challenge faced by many individuals. Avoid self-blame and be compassionate towards yourself. Focus on finding practical solutions to your debt problems rather than dwelling on guilt or shame.

- Open Communication: Discuss your financial situation with trusted friends or family members who can offer emotional support and practical advice. Sharing your concerns can alleviate some of the emotional burden.

- Celebrate Small Victories: Debt repayment can be a long journey, so it's important to acknowledge and celebrate every milestone, no matter how small. Recognizing your progress can boost your motivation and keep you on track.

- Seeking Emotional and Mental Support: If the emotional toll of debt becomes overwhelming, consider seeking the assistance of a therapist or counselor who specializes in financial stress. They can help you cope with the anxiety and emotional challenges associated with debt.

You’ve Got This, Luv!

Congratulations on taking the first steps to becoming debt-free and financially stable, luv! Remember, your journey to financial wellness isn't just about numbers. It's about building resilience and developing healthy spending and saving habits.

Stay focused, stay positive, and keep moving forward on your path to financial freedom.

Most Popular