Quick Take: How to Check Your Credit Score in the Philippines

Wanna flex a strong credit score? Here’s how you can check yours like a pro 👇

Step 1: Head over to the Credit Information Corporation (CIC) or any legit credit bureau – like CIBI, TransUnion, CRIF, or Compuscan.

Step 2: Fill out the online form, book a video call for verification, and settle the small fee. Easy peasy! ✅

Step 3: Get your report, review it carefully, and dispute any errors ASAP – accuracy matters!

💡 Why it matters:

A higher score = easier loan approval, lower interest rates, and higher credit limits. Basically, better financial vibes all around! ✨

Tonik Tip: Check your score at least once a year or before applying for big things (like a home loan, new credit card, or car).

Bonus Hack: Keep your score glowing by paying bills on time, keeping credit card balances low, and avoiding too many loan or card applications in a short period of time.

If you have credit cards or if you’ve ever borrowed money through a loan, it’s crucial that you know how to check your credit score.

Your credit score is a number that represents your creditworthiness. As a result, it can have a significant impact on your ability to obtain any form of financing, such as credit cards and personal loans.

If this is your first time learning about credit scores, don’t panic. We can walk you through the whole process. Continue reading to get all of the information and tips you need!

Why Does My Credit Score Matter?

Lenders use it to assess credit worthiness. Bad credit equals bad loan terms. Want to boost your credit?

Table of Contents

- What is a Credit Score?

- Who Handles Credit Scores in the Philippines?

- What Affects Your Credit Score?

- Credit Score Ranges in the Philippines

- Are Credit Scores Important in the Philippines?

- Where to Check Your Credit Score in the Philippines

- How to Read Your Credit Report

- Common Credit Report Errors and How to Dispute Them

- Tips for Maintaining a Good Credit Score in the Philippines

- FAQs ✨

- How to Boost Your Credit Score with the Tonik Credit Builder Loan

What is a Credit Score?

We’ve briefly touched on what a credit score is, but let’s dive deeper for a better understanding. Simply put, a credit score is a numerical representation of how responsible you are as a borrower. It’s calculated based on information in your credit report.

A credit report is a document that includes details like your credit history, current outstanding debts, and payment history.

Who Handles Credit Scores in the Philippines?

Your credit score isn’t pulled out of thin air – it’s compiled by the Credit Information Corporation (CIC) and its accredited credit bureaus: CIBI, TransUnion, CRIF, and Compuscan. These guys collect and analyze your financial data to see how well you’ve been managing your credit.

What Affects Your Credit Score?

Your score is more than just a number – it’s a reflection of your financial habits. Here’s what goes into the mix:

💸 Payment History (most important!) – Always paying on time? That’s a gold star. Missed payments? Not so great.

💳 Credit Utilization Ratio – Keep your credit card balances low compared to your limits.

🕒 Length of Credit History – The longer your track record, the better your score can be.

🧩 Types of Credit Used – A mix of loans and credit cards shows you can handle different types of credit.

🕵️ Recent Credit Inquiries – Applying for too many loans or cards in a short time can make lenders raise an eyebrow.

Credit Score Ranges in the Philippines

Credit scores in the Philippines usually range from 300-850 – with higher being better (think of it like your financial report card!).

Here’s a quick breakdown:

Score Range | Rating | What It Means |

|---|---|---|

300–579 | Poor 😬 | High risk for lenders; may struggle to get approved. |

580–669 | Fair 😕 | Some lenders might approve, but rates may be higher. |

670–739 | Good 🙂 | Generally reliable borrower — decent approval odds. |

740–799 | Very Good 😎 | Strong credit behavior; likely to get better terms. |

800–850 | Excellent 💖 | Top-tier borrower status — best rates and offers! |

Are Credit Scores Important in the Philippines?

The short answer is yes. No matter where you go, your credit score is very important. That’s because lenders use your credit report and score as a basis to determine your eligibility for loans and other forms of credit. It may also affect the interest rates that you are offered.

But wait, your credit score isn’t just about loans and credit cards, luv – it can actually affect more parts of your life than you’d think!

💼 Job hunting in finance or security-sensitive roles? Some employers check your credit score to see how responsible you are with money.

🏠 Looking to rent a place? Landlords may review your score before handing over the keys.

📱 Eyeing that postpaid plan? Telcos can use your score to decide if you’re good for it (and maybe even offer better deals!).

Checking your score at least once a year is a good habit – especially before applying for big loans (like a car or home loan) or new credit cards. And don’t worry, checking your own score won’t affect it! ✅

Everything clear so far, luv? Great! Now, let’s learn how to check your credit score in the Philippines!

Where to Check Your Credit Score in the Philippines

Now that you know why your credit score matters, let’s talk about where to check it! 💅

In the Philippines, you can get your official credit report from the Credit Information Corporation (CIC) or any of its accredited credit bureaus. Each one has its own process, fees, and turnaround times — so here’s the lowdown to help you pick what works best for you:

CIC (Credit Information Corporation)

As the national credit registry, CIC collects data from banks, lenders, and financial institutions. You can request your CIC Credit Report through their online service or during their CIC Credit Report Online Appointment System (CROS) process.

💸 Fee: Around ₱200–₱250

⏱ Turnaround Time: 1-3 business days after verification

💻 Access Method: Online application + video call verification

💡 Pro Tip: Your first request each year might be free during CIC’s annual promo period — keep an eye out!

CIC-Accredited Credit Bureaus

These private credit bureaus partner with CIC to make credit-checking faster and more accessible:

Credit Bureau | Turnaround Time | Fee | Access Method | Report Includes |

|---|---|---|---|---|

CIBI Information, Inc. | Within 1–2 days | ₱235 | Online via CIBIApp | Credit score, payment history, and account summary |

TransUnion Philippines | 1–3 days | ₱200–₱300 | Online or via partner banks | Comprehensive credit score, open accounts, inquiries |

CRIF Philippines | 2–4 days | ₱250+ | Online portal | Full credit score, trade lines, credit behavior patterns |

Compuscan Philippines | 3–5 days | ₱250 | Online request form | Credit report summary and score range |

How to Read Your Credit Report

When you receive your credit report from Credit Information Corporation (CIC) or one of its accredited bureaus, it might look dense at first – but don’t worry, luv! We’ll walk you through it step-by-step so you know exactly what you’re reading.

You can find a sample CIC Credit Report here for your reference.

Personal Information

At the top, you’ll find your basic profile details: your full name, birthdate, government-ID numbers (such as TIN, SSS/GSIS), address, contact info, and employer information. This section is your “header page” – double-check everything is spelled and dated correctly. Mistakes here can cascade into bigger issues.

Credit Accounts and Status

This section lists all the loan and credit accounts tied to your record: credit cards, personal loans, auto loans, etc. You’ll see data like account type, original credit limit or loan amount, current balance, status (active, closed, overdue), and date opened/closed.

💡 Tonik tip: If you see accounts you didn’t open or balances that look wrong – note them down for dispute!

Payment History

This is the make-or-break area. Lenders check how consistently you pay on time, how many days you’re past due, and how often you fall behind. There might be a chart or table showing delinquency history, how many payments were missed, or how late they were.

Good news: Clean payment history = strong score

Bad news: Late or missed payments drag your score down.

Public Records & Other Alerts

At the bottom (or in a dedicated section), you’ll find public and legal records, like court judgements, bankruptcies, lawsuits, or collection cases. These carry serious weight because they signal high risk to lenders. If you spot something here, it’s a big alert. 🚨

Common Credit Report Errors and How to Dispute Them

Even credit reports can have their “oops” moments – and that’s totally fixable. Errors in your report can drag down your credit score and mess with your chances of getting approved for loans or credit cards. So let’s go over what to watch out for and how to fix it like a pro. 💪

Here are the usual suspects you might find in your report:

- Wrong account status ❌ – Like an account marked “active” even if you’ve already closed it, or one tagged “delinquent” when you’ve been paying on time.

- Outdated debt 🕰️ – Debts that should’ve been cleared or expired are still showing up as unpaid.

- Mistaken identity 🧍♀️ – Another person’s credit info (with a similar name or ID number) somehow ends up on your report.

- Duplicate accounts 💳 – One loan or credit card appears twice, making your debt look bigger than it actually is.

- Incorrect personal details 📅 – Wrong birthdate, address, or employer info that can cause confusion or mismatched data.

If you find an error, don’t panic! Disputing it is totally doable. Here’s your step-by-step guide to getting things sorted with the Credit Information Corporation (CIC) or your accredited credit bureau:

- Get your latest credit report. You can get it from CIC or any accredited bureau (CIBI, TransUnion, CRIF, or Compuscan). Review every section carefully.

- Spot and document the error. Highlight the wrong entry and gather supporting documents – receipts, statements, clearance letters, or screenshots that prove your case.

- Fill out a Dispute Form. CIC provides a Data Correction Form (DCF) you can download from their website. You can also file directly with your credit bureau’s online dispute form. More information on this process with CIC can be found here.

- Submit your dispute.

- 🖥️ Online: Upload your form and documents through the CIC or bureau’s portal.

- 🏢 In person: Submit your printed form at the CIC office or authorized partner location.

- Wait for verification and updates. The CIC or bureau will coordinate with your lender (a.k.a. the data provider) to investigate. Expect feedback within 15-30 working days depending on complexity.

- Receive your corrected report. Once verified, your report gets updated, and you’ll receive a notification confirming the correction.

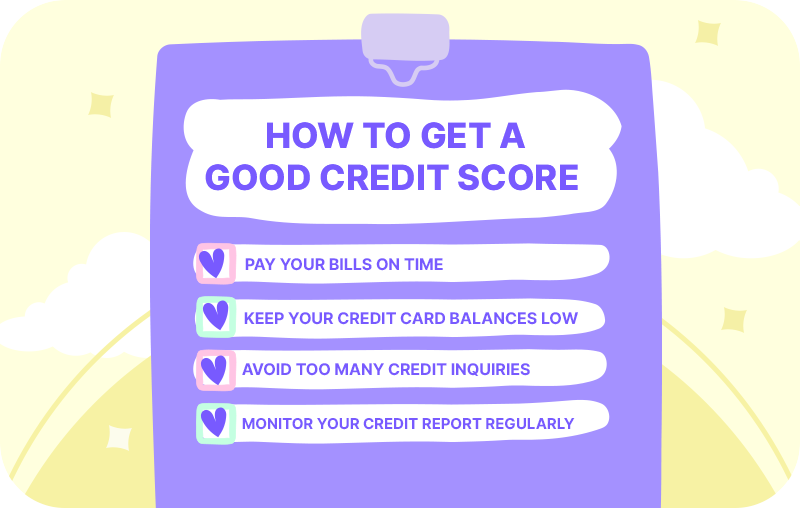

Tips for Maintaining a Good Credit Score in the Philippines

So you’ve checked your credit score – now the goal is to keep it glowing (and maybe even level it up). Building and maintaining a good score takes consistency, a few smart money moves, and a dash of Tonik discipline. 💜 Here’s how to stay on the right track:

Pay On Time, Every Time. Nothing affects your score more than your payment history. Even one missed due date can leave a mark!

👉 Pro move: Set up auto-pay or calendar reminders so your bills get paid on time without you having to think twice. It’s like giving your credit score a permanent “on-time” badge.

Consider Debt Consolidation. If you’re juggling multiple loans or credit cards, debt consolidation can make life way easier. It’s basically combining all your debts into one single loan with a lower interest rate – so you only have to manage one payment instead of five.

Bonus: fewer missed payments = less stress + a stronger score over time.

Use Tonik’s Credit Builder Loan. No credit history yet? Don’t worry, luv – we got you. A credit builder loan is a great way to show lenders you can borrow responsibly.

Here’s how it works: you borrow a small amount, make regular payments on time, and build your credit score along the way. It’s basically credit gym training – you start small but get stronger each month.

Keep Your Credit Utilization Low. If you have a credit card, try not to max it out. Keep your usage below 30% of your limit to show lenders you’re in control.

Example: Got a ₱10,000 limit? Keep your balance under ₱3,000.

- Review Your Credit Report Regularly. Make it a habit to check your credit report at least once a year. Spot errors early and dispute them before they snowball. Remember – no one’s going to care about your credit health more than you.

Want to see real improvement in just three months? Here’s your Tonik 90-Day Credit Improvement Action Plan – easy, doable, and totally worth it.

Timeframe | Action Step | Goal |

|---|---|---|

Days 1–30 | Get your latest credit report and spot any errors. | Build awareness + eliminate red flags. |

Days 31–60 | Open a small Credit Builder Loan (hello, Tonik! 😊). | Start creating consistent positive payment history. |

Days 61–90 | Continue paying on time. | Strengthen your score and prove long-term reliability. |

Remember, improving your credit score isn’t about perfection – it’s about progress. Every on-time payment, every reduced balance, and every smart choice counts. Stay consistent, check in often, and let your credit score glow. 🌈

FAQs ✨

Q: Is checking my own credit score free?

A: Yes – in most cases, you can check your credit report for free once a year through the Credit Information Corporation (CIC) or during their promo periods. Some accredited credit bureaus like CIBI or TransUnion may also offer free reports through limited-time campaigns. Outside that, you’ll usually pay around ₱200–₱300 per report.

Tonik Tip: Bookmark your bureau’s site and set a yearly reminder – it’s like your annual credit health checkup! 🩺

Q: How often should I check my credit score?

A: Once or twice a year is perfect! But if you’re planning to apply for a loan, credit card, or housing rental, check it a few months in advance. That way, you’ll have time to fix any issues before lenders take a peek.

Q: Does checking my own score lower it?

A: Nope! Checking your own score is what’s called a “soft inquiry,” and it does not affect your credit rating. Only “hard inquiries” – like when a lender checks your score after you apply for credit – can make a tiny temporary dip.

In short: Curiosity doesn’t kill your credit score, luv. 🕵️♀️💅

Q: How long do negative records stay in my report?

A: Most negative info – like missed payments or past-due accounts – stays on your credit report for about three to five years from the date it was settled or closed. Serious issues like court judgements or defaults may stay a bit longer.

The good news? Time (and consistent good behavior) heals all credit wounds. 💜

Q: Can unpaid utility bills affect my score?

A: Yup, they can – if your provider reports them to the credit bureaus or sends them to collections. Missed payments on electricity, water, or telco bills can show up as red flags. Stay on top of these just like you would a loan payment.

Pro move: Set all your essentials on auto-pay to never miss a due date again.

Q: Will paying in cash help my score?

A: Not really, luv. While paying in cash is great for avoiding debt, it doesn’t get reported to credit bureaus – so it doesn’t help build your score.

If you want to actively grow your credit reputation, use small, manageable credit (like a Tonik Credit Builder Loan) and pay on time. 💪

How to Boost Your Credit Score with the Tonik Credit Builder Loan

Got a thin credit history or a few past hiccups with loans? Don’t stress, luv – you can bounce back! The Tonik Credit Builder Loan is here to help you glow up your credit score while building better financial habits along the way. 🌟

Designed especially for Filipinos who want to build or repair their credit profile, it lets you borrow up to ₱50,000 straight from your Tonik App — and you can get approved in as fast as two days.

Here’s why this loan packs a serious punch for your credit standing:

- Reports to Credit Bureaus 📈 – Every on-time payment you make is reported to the Credit Information Corporation (CIC) and its accredited bureaus, boosting your payment history (a.k.a. the most important part of your credit score).

- Shows Responsible Credit Use 💳 – Making small but consistent repayments tells lenders, “Hey, I can handle credit like a boss.”

- Helps Avoid Overspending 🚫 – Your loan amount is locked until you’ve fully repaid it, which means no splurging temptations — just pure, focused credit-building.

Clueless where to begin? Don’t worry – we have the cheat sheet right here:

- Apply via the Tonik App. Choose a loan amount and repayment term that fits your budget — no stress, no surprises.

- Set up Auto-Pay. Link your payments to your Tonik account or preferred channel so you never miss a due date.

- Pay on Time, Every Time. Your consistency is what makes your score shine — think of each payment as another gold star on your financial report card.

- Complete the Term. Once you’ve finished your loan, the funds are released to you — and your positive credit history gets recorded. Win-win!

- Check Your Progress. After 3-6 months, request your latest credit report from the CIC and see how far your score’s come. (Spoiler: You’ll like what you see!)

Wanna boost your score faster? Combine your Credit Builder Loan with Tonik-approved money habits:

- Keep credit card usage under 30% of your limit.

- Always pay on time.

- Avoid applying for too many loans at once.

Do all that, and you’ll be flexing a very healthy credit score in no time, luv. 💅