So you and your luv finally got the home of your dreams. Whether it’s a condo in the city or a house in the province, you’re both head over heels for it. Imagine, a place where you can stay together forever!

Not so fast, luv. Let’s bring you back down to earth for a sec and remind you that a home needs appliances and furniture, and these essentials don’t come cheap.

Don’t want to dip into your savings or get multiple jobs just to build your dream home? There’s a faster, easier way: get an appliance loan!

By getting an appliance loan, you won’t have to pay for appliances and furniture upfront. You can buy now, then pay later in small, manageable amounts.

If this is your first time hearing about appliance loans, don’t worry – read this blog and learn all you need to know!

Table of Contents

- When to Choose Appliance & Furniture Loans

- Types of Appliance & Furniture Loans

- Eligibility Requirements

- Step-by-Step Application Process

- How to Get an Appliance Loan from Tonik Bank?

- Interest Rates, Fees, and Repayment Terms

- Tips for Appliance Loan Approval

- Risks and Considerations

- Build Your Dream Home with an Appliance Loan from Tonik

When to Choose Appliance & Furniture Loans

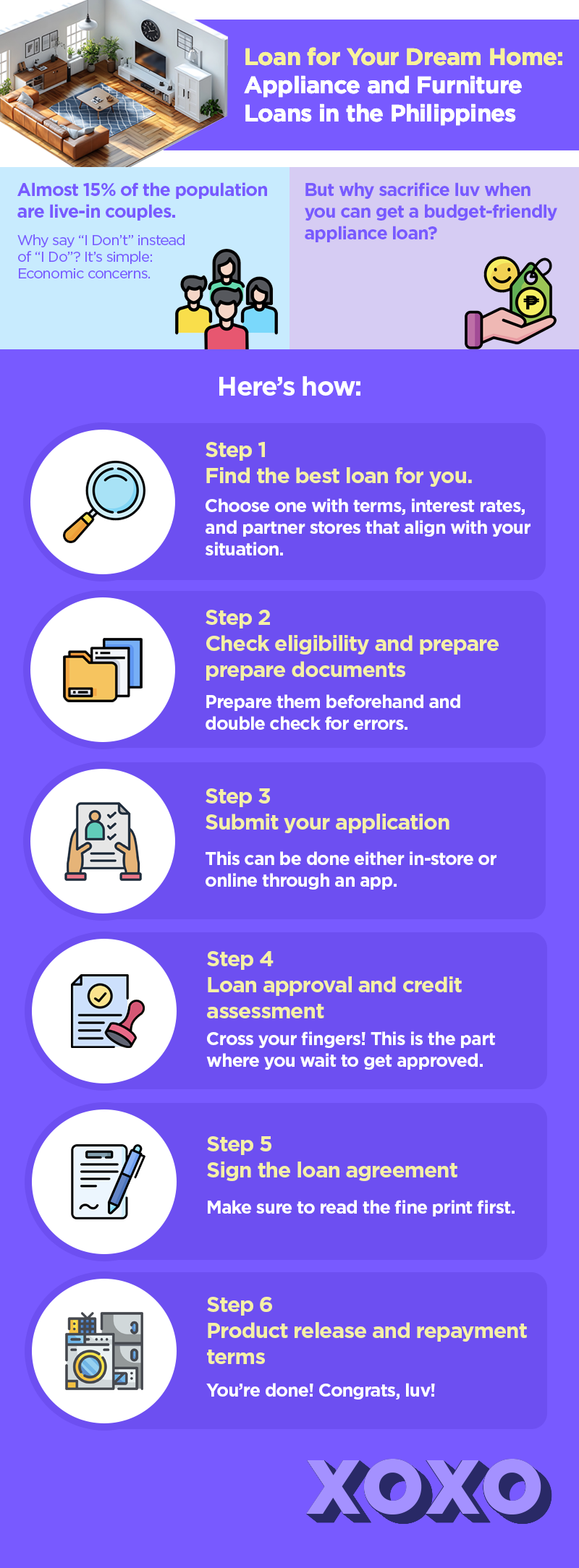

Fun fact: live-in couples in the Philippines now make up nearly 15% of the population. Many choose to cohabitate instead of getting married because of economic concerns, which shouldn’t be a surprise with inflation on the rise. Still, there should still be careful consideration before choosing to take out an appliance or furniture loan.

We’ll make it easier for you. Take out an appliance loan only if:

- You need essential appliances or furniture but lack upfront cash

- The loan offers low or zero-interest installment plans

- The monthly payments fit within your budget

- The financing terms are better than using a credit card

- You qualify for promotions or discounts through financing

Types of Appliance & Furniture Loans

- In-House Financing by Retailers: This is a type loan that retailers directly offer to customers for purchasing products. Pay for items over time, often with little to no interest, depending on the terms.

- Bank Consumer Loans: Personal loans provided by commercial banks to finance purchases. Purchases may include furniture, appliances, and gadgets. These often come with competitive interest rates and budget-friendly repayment terms. Quick plug – I mean – example: The Tonik Credit Builder Loan! Borrow up to P20K and build credit with payment holidays and flexible terms!

- Lending Companies & Microfinance Institutions: Quick, short-term loans typically offered by non-bank financial institutions, ideal for those who may not qualify for traditional bank loans.

- Buy Now, Pay Later (BNPL) Services: Flexible payment plans that allow you to purchase products now and pay for them in installments over a short period, often with no interest.

- Credit Card Installment Plans: Convert large purchases made with your credit card into manageable installment payments with interest applied based on the plan offered by your card issuer.

Eligibility Requirements

- Age and Citizenship Requirements: Must be of legal age (usually 21 or older) and a citizen or legal resident of the country to qualify for a product loan.

- Proof of Income and Employment Status: Proof of income (e.g., payslips, bank statements) to verify your ability to repay the loan. Employment status (whether you’re employed or self-employed) may also be considered.

- Credit Score: Your credit score is used to assess your financial reliability. A higher score improves your chances of loan approval and may result in better loan terms.

- Other Documents (valid IDs, proof of billing, etc.): Additional documents like government-issued IDs, proof of address (e.g., utility bill), and sometimes a co-signer, depending on the loan type.

Step-by-Step Application Process

Research and compare loan options: Don’t go for the first application loan you see. Do your research – visit the lender’s website, check online reviews, and ask friends and family. Once you’ve got all the information you need, assess if it’s the right one for you.

Check eligibility and prepare documents: Preparing the requirements before you apply. A checklist can surely help!

Submit application (online or in-store): The big day! Show up with requirements, and make sure you know everything you need to know about the product loan.

Loan approval and credit assessment: This might be the hardest part of the process because you may have to wait. Be patient, luv!

Sign the loan agreement: If you reach this stage, it means you’ve been approved! However, don’t get too excited – make sure to read the contract first before you sign.

Product release and repayment terms: You finally get to go home with your product. Remember to pay on time!

How to Get an Appliance Loan from Tonik Bank?

Step 1: Download the Tonik App: Complete the onboarding process. Be ready with a valid ID.

Step 2: Visit a partner store: Tap “Loans” on your Tonik App and select “Shop Installment Loan.” Then, visit a partner store (such as Home Along and FC Home Center) and approach a Purple Pro. Don’t worry, they don’t bite!

Step 3: Scan the QR code: They’ll present a QR code to you. Scan it to see your loan summary.

Step 4: Complete the Loan Application: Provide the required information and documents. Follow all on-screen instructions.

Step 5: Accept the Offer: Double check your loan details, accept the offer if you agree, and virtually sign the necessary documents.

Step 6: Finalize Your Purchase: Complete the transaction and get the confirmation code from the cashier, then enter it on the app. Finally, wait for the cashier to confirm your purchase!

Interest Rates, Fees, and Repayment Terms

- Interest Rates: The interest rate is the additional amount you’ll pay on top of your monthly installment. It’s essentially the cost for borrowing money. Interest rates can vary depending on the lender, so it's important to choose one that aligns with your financial situation.

- Additional charges: Some lenders may charge you with additional fees. They’ll sneak that in through the Terms and Conditions. Again, make sure to read everything before you sign anything! For full transparency, Shop Installment Loan only requires a 10% minimum downpayment – no processing fees!

- Repayment period and monthly installment calculations: Remember that you’ll have to repay that product loan in the coming month/s. Make sure the one you get has monthly installments that you can manage!

Tips for Appliance Loan Approval

Keep your credit score up: Lenders use your credit score to assess your reliability as a borrower. A good credit score increases your chances of getting approved for a loan and helps you secure better interest rates.

Choose a Loan That Fits Your Financial Capacity: The loan you apply for should match your ability to repay. Consider your monthly income and existing financial obligations before committing to a loan.

Avoid Common Application Mistakes: Double-check everything for errors. These may include misspelled names, wrong details, or missing documents. These small mistakes can delay your approval process or even lead to a rejection.

Understanding Hidden Fees and Charges: There may be additional costs associated with the loan, like processing fees or late payment penalties.

Risks and Considerations

High interest rates and hidden fees: Some sketchy lenders like to sneak in hidden fees, or trick you into loaning with high interest rates. Remember to read the fine print and understand the full cost of the loan before committing.

Late payment penalties and potential legal action: Missing payments can result in late fees or even legal action. Defaulting on a loan may also damage your credit score, making it harder to secure future loans.

Long-term financial impact of multiple installment plans: While spreading out payments can make purchases more affordable in the short term, accumulating multiple loans can increase your overall debt. The total amount you pay over time may end up being higher due to interest and fees.

Appliance and furniture loan alternatives: You can save up for the item you want over time. You can also opt for secondhand items as a cheaper alternative.

Build Your Dream Home with an Appliance Loan from Tonik

While there are many things to consider before taking out an appliance or furniture loan, don’t let that stop you. It’s perfectly fine to take out a loan to build your dream home – just make sure you remember the important factors and tips laid out in this blog before you do so.

Don’t know where to start? You can take out a Tonik Shop Installment Loan! Visit a partner store today and approach a friendly Purple Pro. You can borrow up to P100,000 for 3, 6, 9, or 12 months!

Ready? Download the Tonik App and apply today.