Start paying off your loans like a boss.

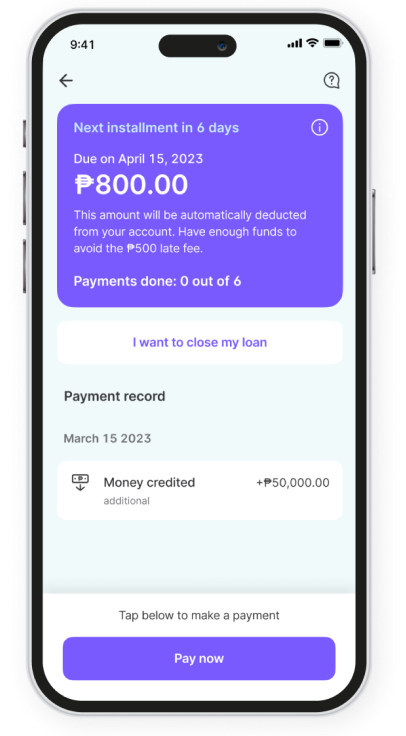

Triple check all the important information about your loan, like your monthly installment and your due date.

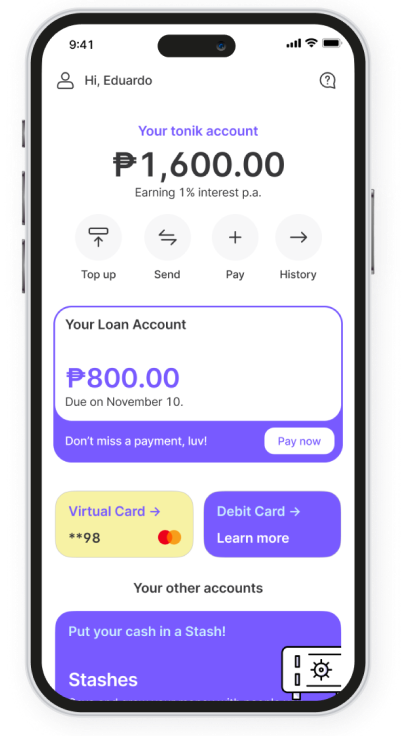

Just tap Pay Now on the Tonik App Dashboard and select "Tonik Account" as your payment option.

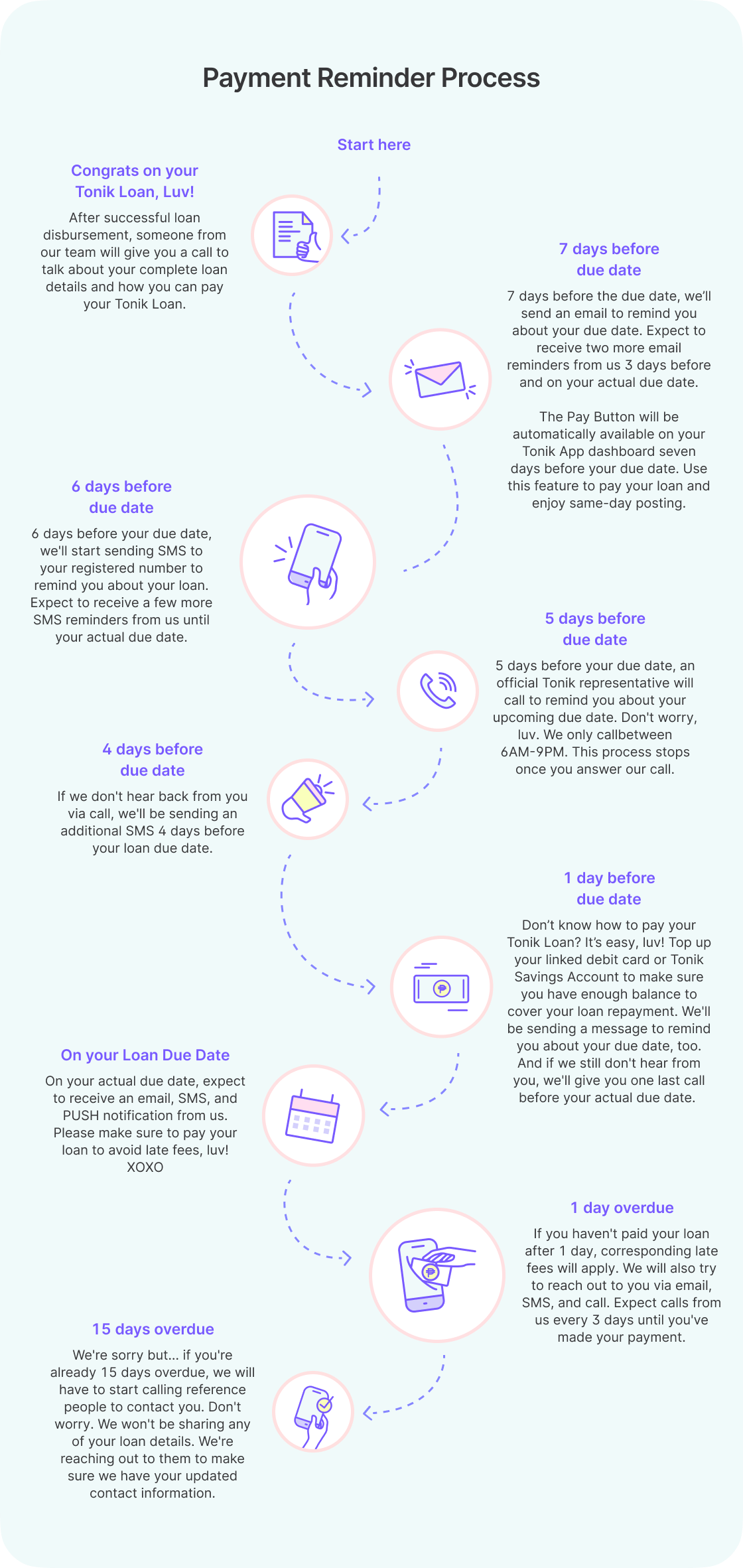

Note: The Pay Button will appear 7 days before your due date. If you want to secure your loan payment earlier, you may top-up instead.

Learn more about the Pay Button here.

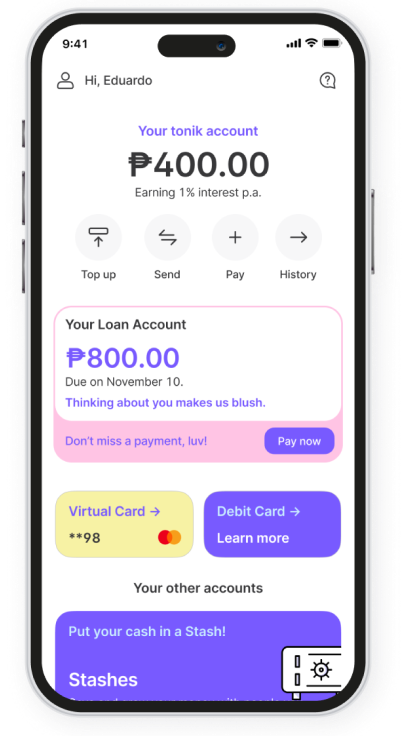

If you don't have enough balance in your linked debit card or Tonik Account, then all you need is to top-up enough funds on or before your due date to avoid fees.(Note: The funds will be debited from your Tonik Account at 10PM on your chosen due date.)

Enhanced Creditworthiness

Paying your loan on time is a surefire way to boost your creditworthiness. Timely loan repayments show that you are a responsible borrower, which will help you build a positive credit score.

Access to Additional Financing

Paying your loan on time can increase your chances of obtaining additional financing when needed. It's easier to extend credit to someone who has a proven track record of timely payments.

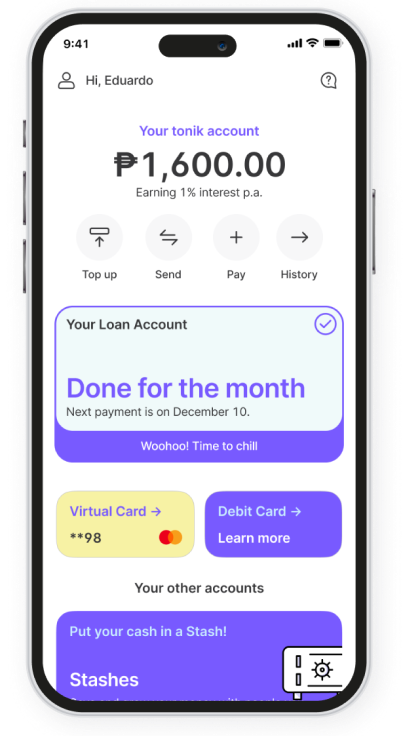

Financial Freedom and Peace of Mind

Taking on debt is a big responsibility. And it can get pretty stressful if you're not up to date on payments, luv. So, be sure to pay on time for your peace of mind.

Increased Debt Burden

Paying your loan late can result in an increased debt. Late payment fees and penalties can quickly add up! Avoid falling into the debt trap by making sure you pay on time, hun.

Damage to Credit History

Late loan payments can tarnish your credit history. This means it might be harder for you to take out a loan, even when you badly need it.

Legal Consequences

If you keep missing payments, lenders may take legal action against you. Lenders may also tap the help of third-party agencies to recover the debt, which can cause further stress.