Blog

Latest Blog

Most Popular

Joining a club is super awesome because it makes one feel like they belong. The right one comes with perks and benefits. A cooperative kind of works the same way. Find out what a coop is and how you can get a loan through one!

Credit cooperatives may not be the first thing that comes to mind when you’re in need of a loan. Because we’re so used to traditional banks and online loan companies, these tend to be brushed over, especially by the younger generation.

A nice thing about cooperatives is that profit isn’t their main goal. They aren’t here to make money, but to…

If you happen to be someone working in a regular Philippine company, you’re likely to be paying taxes as well as contributions to local organizations like PhilHealth, SSS, and Pag-IBIG. But most of the time, we’re unaware of the benefits we can get from being active members and contributors to these corporations. For example: did you know that you could claim sick benefits from SSS if you missed work due to COVID-19? Yep, you totally could.

Another benefit for employees contributing to SSS happens to be a salary loan! We’ve discussed it in our…

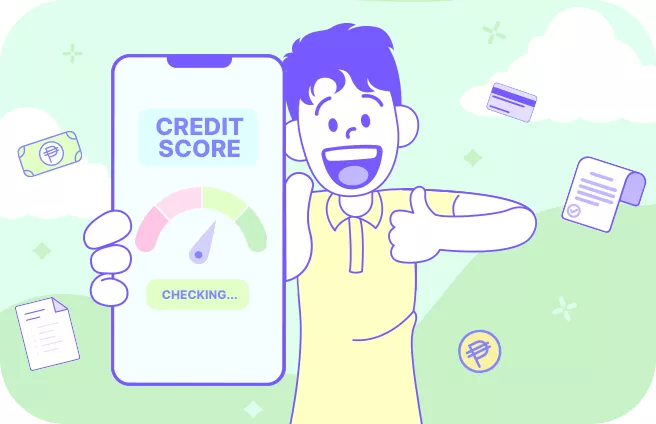

Quick Take: How to Check Your Credit Score in the Philippines

Wanna flex a strong credit score? Here’s how you can check yours like a pro 👇

Step 1: Head over to the Credit Information Corporation (CIC) or any legit credit bureau – like CIBI, TransUnion, CRIF, or Compuscan.

Step 2: Fill out the online form, book a video call for verification, and settle the small fee. Easy peasy! ✅

Step 3…

Quick Take: What makes a good credit score in the Philippines?

Credit scores in the Philippines range from 300 to 850, with 850 being the best. A score between 700-759 is considered good, 650-699 is fair, and 600-649 is poor. Scores below 600 are classified as bad.

Learn all about how credit scoring works in the Philippines and how Tonik is pushing boundaries with its new products!

Picture this: you’re super excited about a shiny new gadget you want to buy! A new laptop, perhaps, to help you work better? While you don’t have enough…

Fintech

Luv, let’s be real—banking has gone 100% digital, and we’re here for it! With platforms like BPI Online, GCash, Maya, and UnionBank, Filipinos can pay bills, transfer funds, and shop online in just a few taps. But while digital banking is ultra-convenient, it also comes with risks—think phishing scams, data breaches, and fraudsters trying to sneak into your account.

In fact, BusinessWorld reported that the suspected retail digital fraud rate in the…

Vlogging, online selling, and starting a virtual tutorial service… These are just some of the most popular online businesses started by Filipinos in recent years. The convenience, flexibility, and vast market reach offered by online platforms have inspired many entrepreneurs to embark on their digital ventures. Plus, the increase in online shopping activity among Filipinos during the pandemic has convinced many of us to start a business online.

Although, there is one crucial aspect that often determines the sustained success of any business—whether it’s a brick-and-…

Did you know? There are over a million small and medium enterprises in the Philippines as of 2021. And a recent study also noted that 4 out of 5 Filipinos are interested in entrepreneurship. This clearly shows that Filipinos have a strong entrepreneurial spirit. Many of us know that doing business can not only help…

Savings

Quick Take: How to Deal with Job Loss

Lost your job or dealing with a pay cut? You’re not alone. 💜 Knowing how to deal with job loss financially can help you stay calm, stretch your money, and bounce back faster. With the right mindset, smart budgeting, and a little help from Tonik, you’ve got this. 💪

Quick Take: Where Should You Keep Your Emergency Savings?

Your emergency fund deserves a home that’s safe, easy to reach, and smart enough to grow. For most Filipinos, the sweet spot is a mix of digital banks, traditional savings accounts, and a small amount in e-wallets—so you’re always ready when life throws a surprise your way. ⚡

Quick take: How much are time deposit interest rates in the Philippines?

It depends on the bank, luv! If you want to save and earn big with a Time Deposit, choose Tonik. Earn up to 6% interest p.a. Just make sure to maintain an average daily balance (ADB) of PHP10,000! Never heard of an ADB before? Learn more here.

Quick Take: How much should you have in your emergency fund?

We recommend saving three to six months' living expenses, but this varies based on your situation. Consider your job stability, family needs, and existing debts when determining the right amount.

Loan

Lifestyle

Every International Women’s Month, I find myself thinking back to a time when I was still figuring things out financially.

Let’s talk about something we’re all guilty of at some point—spending habits that secretly sabotage our finances. We work hard for our money, so it’s only fair that we enjoy it, right?

Summer’s here, and it’s time to turn up the cool factor! ☀️ But, before you break a sweat trying to survive the heat, let's talk about getting you the perfect air conditioner without breaking the bank.

Online scams are a lot like bad relationships. At the beginning, you think you’re in for something great. They promise you all these things that could change your life for the better, like: Get rich quick! Get approved for a loan instantly!