Losing a job can be an unexpected and challenging experience, especially when it comes to debt management.

It's a time when financial stability feels like a distant memory, and handling existing debts might seem overwhelming.

Despite the hardships, you should know that managing debts and getting out of your situation is not impossible.

To help you navigate this time of uncertainty, here’s a handy survival guide with tips, strategies, and options to consider that will effectively help you with your personal debt management!

Table of Contents

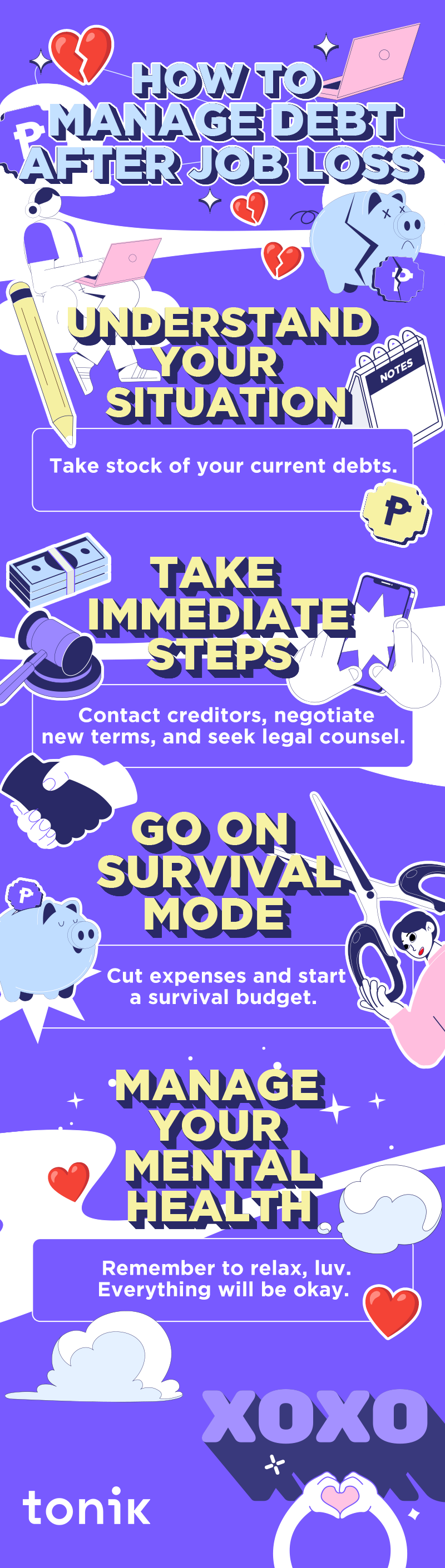

Understanding Your Debt Situation

When facing a job loss, various types of debts may come into focus, such as personal loans, credit card balances, and mortgage payments.

Each has different terms and impacts on your financial situation, so don’t get overwhelmed. Remember to track the various debts, their interest rates, and the terms and conditions attached to them.

Prioritizing debts based on interest rates, outstanding balances, or creditor terms can also help you strategize and manage your financial obligations effectively during this challenging period.

TOCImmediate Steps to Take After Job Loss

The very first step here is to not panic, but we bet you already knew that! Take a few deep breaths, find your zen, don’t let anyone fool you into taking on deals and seemingly easy but expensive “life-saving loans”, and follow these steps:

Step 1: Contact Creditors

Inform your creditors promptly about your job loss. Explain the situation honestly and discuss potential options for managing your debt during this period of financial hardship.

Step 2: Negotiate New Terms

Request more favorable repayment terms or inquire about grace periods. Some creditors may offer temporary relief, such as reduced payments, forbearance, or deferred payment options, to help ease the immediate burden.

Step 3: Seek Legal Consultation

For substantial debts or if negotiations with creditors become challenging, consider seeking legal advice. A legal professional can provide guidance on your rights, debt management strategies, and potential legal ramifications.

TOCCreating a Survival Budget

A survival budget is exactly what it sounds like. This is a bare-bones financial plan that prioritizes essential spending to cover basic needs during a financially challenging period. Here are a few tips to do this:

- Eliminate Non-Essential Spending - Start by identifying and eliminating unnecessary expenses. This might involve cutting down on subscription services, dining out, or non-essential shopping.

- Negotiate Bills and Services - Contact service providers such as utilities, internet, or insurance companies to negotiate lower rates or temporary payment arrangements.

- Find Alternative Cost-Saving Measures - For example, opt for free or lower-cost entertainment options, reduce energy consumption to lower utility bills, or carpool to save on transportation expenses.

- Use Budgeting Tools and Apps - These resources can help with debt management and other aspects of your finances. On top of that, they can help you master debt management and the way you handle your finances in general.

Alternative Income Sources

While you’re cutting down on expenses, you can also start taking on side hustles and start other alternative income sources.

If you have special skills, you can look for freelance work online through websites like Upwork and Fiver. Do you have things at home that you don’t use anymore? You can sell them online via platforms like Facebook Marketplace and Carousell. That way, you’ll be able to declutter your home while earning extra cash!

TOCGovernment and NGO Support Programs

There are several government and NGO support programs that offer support for unemployed Filipinos. One of them is The Assistance to Youth and Unemployed for Development and Advancement (AYUDA) program. This is a government initiative that aims to address unemployment by hiring unemployed youth and those who have lost their jobs during the COVID-19 pandemic.

You may also consider the TUPAD #BKBK program (Tulong Panghanapbuhay sa Ating Disadvantaged/Displaced Workers) by the Department of Labor and Employment (DOLE). They provide emergency employment and welfare assistance to mitigate the impact of job displacement due to various crises.

TOCManaging Mental and Emotional Health

Aside from the obvious effects on your finances, losing a job can cause stress and emotional impact as well. Keep your chin up, luv, and follow these four tips to help you cope during this tough time:

- Maintain a Routine – Establishing a daily routine can provide structure and stability, easing anxiety caused by uncertainty.

- Focus on Self-Care – Forget about debt management for a while and engage in activities that promote relaxation and well-being, such as exercise, meditation, or hobbies. Taking care of yourself physically can positively impact mental health.

- Stay Positive and Seek Perspective - Try to maintain a positive outlook and remember that challenges are temporary. Seeking perspective by focusing on potential opportunities ahead can be helpful.

- Seek Emotional Support - Don't hesitate to seek support from friends, family, or professionals. Speaking to someone can provide emotional relief and guidance during this challenging period.

Long-Term Strategies for Financial Recovery

Before we let you go on your journey to re-employment, we'll leave you with suggested long-term strategies for financial recovery!

- Set Realistic Debt Repayment Goals - Start by creating a structured plan to pay off debts gradually. Prioritize high-interest debts and consider debt consolidation or negotiation with creditors to ease the burden.

- Rebuild Savings - Once employed again, focus on rebuilding your savings. Start by setting up an emergency fund, then gradually increase savings contributions for your future financial security.

- Learn from the Experience - Reflect on the lessons learned from the job loss, adopt better financial practices, and rise above!

- Consider Debt Consolidation - Debt consolidation – in which you get a new loan with favorable terms to pay off your existing loans – can be a great strategy for financial recovery.

Remember, financial setbacks can be overcome with patience, discipline, and a well-thought-out debt management plan. You got this, luv, we’re rooting for you! XOXO