What’s so interesting about loan interest rates? Oh, nothing much, really – except for the fact that it can shape your entire loan experience!

You may think at first that it’s no biggie, but when you start paying interest on top of your loan amount per month, it’s certainly going to hurt your wallet.

Don’t stress just yet, though, because we’re here to give you the ways in which you can get low loan interest rates. Let’s get right to it!

Table of Contents

What is an Interest Rate?

An interest rate, in the context of loans, represents the fee charged by the lender for allowing you to use their money. Think of it as the cost of borrowing or the price you pay for getting a loan. These rates have a big impact on how much you'll ultimately repay when you borrow money.

Interest rates can be categorized into two primary types: fixed interest rate and variable interest rate. Fixed interest rates remain constant throughout the loan term, ensuring predictable monthly payments. On the other hand, having a variable interest rate means your rate fluctuates based on market conditions, potentially resulting in varying monthly payments.

There are different factors that can affect loan interest rates. Let’s take a quick look at each one below:

- Market Conditions – Loan interest rates aren’t immune to the effects of our ever-evolving financial landscape. When the economy is robust, interest rates often rise, and during economic downturns, they tend to decrease. That’s why timing is super important when taking out a loan!

- Lender Policies - Factors such as the lender's cost of funds, risk exposure, and operational expenses play a crucial role in determining the interest rate they extend to borrowers.

- Type of Loan - Different types of loans carry different risk levels for lenders. Secured loans, backed by collateral, usually come with lower loan interest rates due to reduced risk. Unsecured loans, without collateral, often attract higher interest rates since lenders take on more risk. You may also encounter subprime loan offers. A subprime loan is a type of loan with a higher interest rate given to individuals with a low credit score. So be sure to check the type of loan you have to see if you’re getting the best deal.

Understanding Risk-Based Pricing

Before we jump into how you can snag those lower interest rates, let’s take a quick detour and talk about something called risk-based pricing. Ever wonder why two people applying for the same type of loan get offered different interest rates? It boils down to how lenders perceive the risk of lending to each individual. They look at your credit score, your income, and even how you’ve handled debt in the past to decide how big of a risk you are. If they think you’re more likely to pay back the loan without issues, you’ll likely get a lower interest rate. It’s like the financial version of being picked first for the team because you’ve got a good track record. So, understanding this can really help you see the big picture and why improving your financial health is key to getting those rates down.

TOC

How to Get Lower Interest Rates on Loans

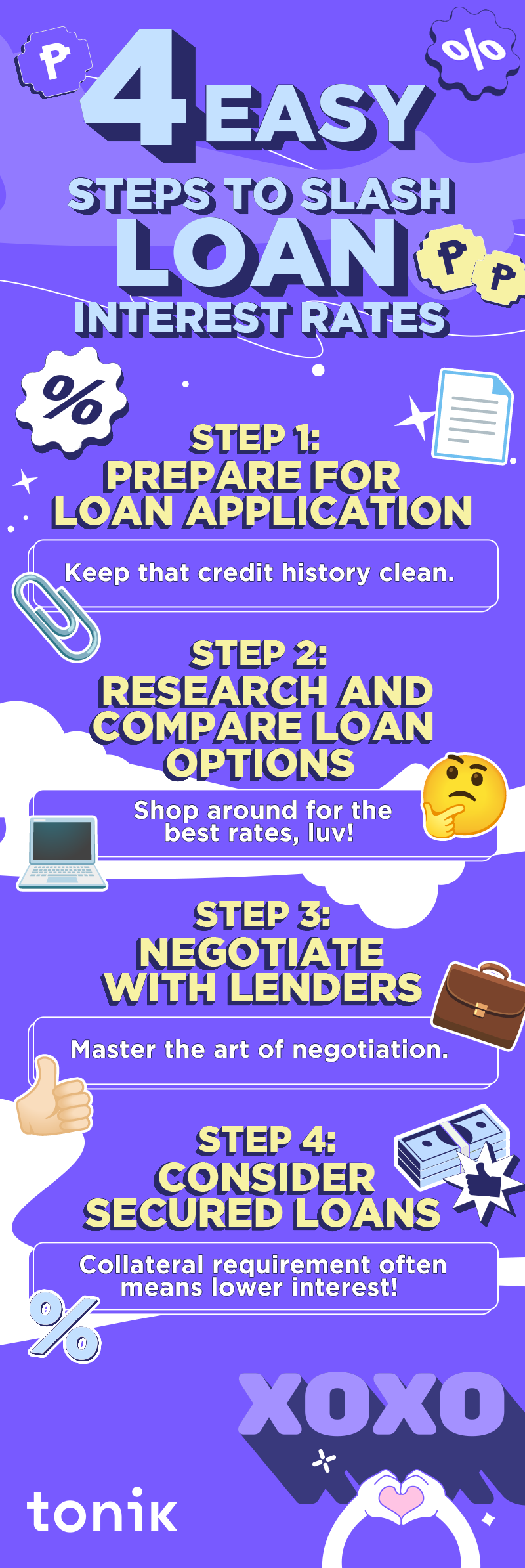

Now it’s time to dig into the juicy part of this blog: the four steps to getting lower loan interest rates!

Step 1: Prepare for Loan Application

Your credit score can greatly affect your chances of loan approval and your loan interest rate. Before the credit investigation process begins, ensure that you been making timely bill payments, reducing outstanding debts, diversifying credit types, and more.

Elevating your score may take time, but it can all be worth it as it can impact loan approval and chances of securing low interest rates!

While preparing for your loan application, make sure that you can demonstrate financial stability. A stable income, reflected through consistent paychecks, assures lenders of your repayment capacity.

The debt-to-income ratio, comparing your debt payments to income, should ideally be lower for a better impression. Additionally, a robust employment history substantiates your stability, highlighting your ability to maintain steady employment, further strengthening your loan application.

Step 2: Research and Compare Loan Options

Grab some coffee and blast your favorite work/study playlist, because your research skills are about to be put to the test!

But before you fire up Google, get to know the three main types of lenders first:

- Banks - Traditional lending institutions that offer a wide array of financial products and services. They have established branches and online platforms and cater to various loan needs.

- Credit Unions - Member-owned financial cooperatives offering similar services to banks, usually with a focus on specific communities or professions. They may provide competitive rates and personalized service due to their non-profit nature.

- Online Lenders - Fintech companies and online platforms providing loans through digital channels. They often offer convenience, speedy processing, and competitive terms compared to traditional lenders.

Take the time to consider all the factors that go into your choice of lender. Think long and hard about your needs and preferences. Once you’ve made up your mind, shop around for the best loan interest rates, then really read and understand their loan terms!

Step 3: Negotiate with Lenders

Negotiating is a delicate art form, luv. But as long as you have a strong credit history, a stable income, and the right collateral (for secured loans), you have nothing to fear. Apply with confidence and get the interest rate you deserve!

We’ll give you two more important techniques to keep in mind:

- Be an Honest Borrower: Be transparent about your financial situation and communicate openly with lenders. This helps foster trust and can potentially lead to more favorable negotiations.

- Use the Lender’s Competitors: Use multiple loan offers to your advantage. By presenting competing offers, you might encourage lenders to match or improve their terms. This strategy can empower you to negotiate more effectively for better rates or favorable loan conditions.

Step 4: Go for Secured Loans

As mentioned earlier, secured loans typically have lower interest rates compared to unsecured loans. That’s because secured loans require you to pledge collateral, making it less risky for lenders. For the same reason, there’s also a better chance of you securing approval and a higher loan amount!

So, if you don’t mind pledging collateral, you should definitely consider taking out a secured loan. Just be wary of the following risks involved:

- Risk of Asset Loss - Defaulting on secured loans may lead to the loss of the pledged asset, such as a house or car, if repayment obligations are not met.

- Potential Over-Leveraging - Access to larger loan amounts might lead to overborrowing, risking financial strain if repayments become unmanageable.

- Impact on Credit Score - Failure to repay secured loans can negatively impact credit scores and financial standing.

Consider Loan Refinancing

Another way to lower interest rates is to refinance a loan. When you refinance a loan, you basically get a new loan with better terms to pay off an existing loan. In other words, you're swapping your current loan for a new one with better terms.

Heads up, though - loan refinancing isn't always a surefire way to lowering interest rates:

- Extended Payment Period - Refinancing could potentially extend the repayment period, resulting in paying more interest over time.

- Upfront Costs - There might be closing costs or fees associated with refinancing, which could offset the potential savings.

- Negative Impact on Credit Score - Applying for new credit may lead to a temporary dip in your credit score due to the hard inquiry made by lenders.

Explore Debt Restructuring

This strategy is particularly relevant if you're facing financial challenges that make it difficult to keep up with your current loan terms. Debt restructuring involves negotiating with your lender to modify the terms of your existing loan, which can include extending the loan period, reducing the interest rate, or even decreasing the principal amount owed.

The goal is to make your debt more manageable and avoid the consequences of default. It's a step worth considering if you're experiencing a financial setback or if your financial situation has changed since you first took out the loan. Keep in mind, while restructuring can provide immediate relief, it's important to carefully consider the long-term implications on your financial health and credit score.

And here’s a pro tip, luv: Before approaching your lender, prepare a detailed plan that outlines your current financial situation and how a modified loan agreement could help you meet your obligations. Transparency and clear communication are key to successful negotiations. Remember, lenders are often more receptive to restructuring proposals that demonstrate a proactive approach to managing your debt responsibly.

TOCMaintaining Financial Health

Whether or not you end up getting the loan interest rates you’ve been hoping for, it’s important to watch out for your financial health. Before we let you go on your merry way, here are a couple of tips to stay financially healthy!

- Regular Credit Monitoring - Consistently monitoring your credit report helps you stay updated on your financial status and enables you to identify and rectify any inaccuracies promptly.

- Avoiding High-Risk Financial Behavior - Steering clear of risky financial practices such as overspending, taking on excessive debt, or missing payments contributes significantly to maintaining a healthy financial profile.

- Continuous Financial Education - Constantly expanding your financial knowledge through resources like workshops, courses, or reliable financial literature aids in making informed financial decisions and improving your financial management skills.

Get the Low Interest Rates You Deserve from Tonik Loans!

Ready to begin your search for low interest rates? We’ll make it a lil’ easier for you, luv. Consider taking out a Tonik Loan!

Get the funds you need ASAP with Tonik Credit Builder Loan.

How about home appliances for the whole family? Apply for a Tonik Shop Installment Loan at any of our partner stores with a fixed monthly interest rate as low as 2%!

Hurry and apply now, luv. Download the Tonik App today!