Are you constantly stressed about money despite having a regular income? Do you ever check your bank account, find it empty, and realize that you have no clue where it all went?

Trust us, luv, you’re not alone.

Many of us face financial challenges that seem insurmountable. The good news? A well-crafted financial plan can help you break this cycle of worry.

In this financial planning guide, we'll help you create a plan and offer a clear path to manage your money wisely. Ready? Let’s dive in!

Table of Contents

TOC

What is a Financial Plan?

A financial plan is a comprehensive document that outlines your current financial situation, goals, and strategies for financial success. It’s your guide for managing your money and your spending, saving, and investing decisions.

Having a financial plan is crucial for several reasons. Firstly, it provides clarity about your financial goals, helping you prioritize and work towards them systematically.

Secondly, it acts as a tool for tracking and managing your income, expenses, and overall financial health.

Additionally, a financial plan can be a safeguard against unexpected challenges, offering you a sense of security and preparedness. Ultimately, it empowers you to make informed financial decisions and lays the foundation for a more stable and prosperous future.

TOCHow to Assess Your Current Financial Situation

Before anything else, you have to assess your current financial situation. Here’s what you need:

- Income Statements - Track and document all sources of income, including salary, side gigs, and investments, to understand your total earnings.

- Expense Tracking - Keep a detailed record of your expenditures to identify patterns, cut unnecessary costs, and allocate resources more efficiently.

- Asset and Liability Statements - Compile a list of your assets (property, investments) and liabilities (debts, loans) to evaluate your net worth.

Understanding your financial health also involves calculating net worth and understanding cash flow.

To calculate net worth, subtract your total liabilities from your assets. This will provide insights into your overall financial position.

To get a clear snapshot of your cash flow, analyze your income and expenses to assess how money moves in and out of your accounts. This helps ensure a balanced and sustainable financial flow.

TOCSetting Financial Goals

Once you have a clear 360-degree view of your financial situation, it’s time to set some goals.

Short-term Goals - These are objectives achievable within a year, such as creating an emergency fund or paying off a small debt.

Medium-term Goals - Aim for accomplishments in the two to five-year range, like saving for a down payment on a home or funding higher education.

Long-term Goals - Look beyond five years with objectives like retirement planning, wealth accumulation, or starting a business.

TOCCreating a Budget

A financial planning guide wouldn’t be complete without a how-to for creating a budget. This involves more than just allocating money to various categories. You have to think long and hard about your needs and wants. To make it easier for you, you can use one of the commonly used strategies below:

- Zero-Based Budgeting - Allocate every dollar, ensuring income minus expenses equals zero.

- 50/30/20 Rule - Dedicate 50% to needs, 30% to wants, and 20% to savings and debt repayment.

- Envelope System - Use cash for discretionary spending, placing allotted amounts in labeled envelopes.

- The 80/20 Rule - Devote 80% of your income to essential expenses, saving the remaining 20%.

Managing Debt

Let’s be real: no one enjoys managing their debts. But this is a financial planning guide, of course we’re going to talk about debts! Don’t worry, luv, we’ll take things slowly, starting with the different types of debt:

- Loans – a financial arrangement wherein you borrow money with the agreement to repay, including interest and fees, within a set period.

- Credit Card Debt – Typically high-interest, revolving debt based on credit card usage.

- Student Loans - Borrowings for educational expenses, often with deferred payments.

- Mortgages - Loans for purchasing homes, secured by the property.

Now that we’ve gotten that out of the way, let’s talk about strategies for debt reduction. Here are two strategies you can try out:

- Snowball Method - Tackle smaller debts first for a motivational boost.

- Avalanche Method - Prioritize high-interest debts to minimize overall interest payments.

Remember to balance debt repayment with savings; allocate a portion of income to an emergency fund while repaying debts.

TOCSaving and Investing

Next up in this financial planning guide: saving and investing. Let’s start with saving!

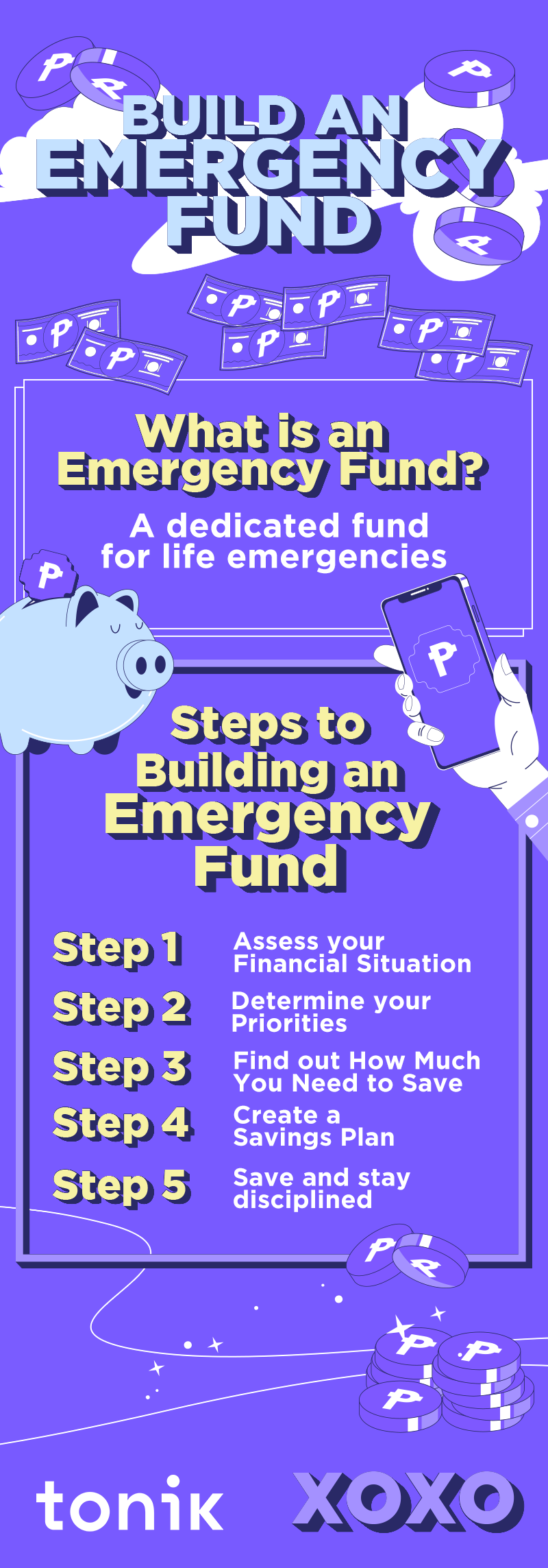

When it comes to saving, it’s best to begin by futureproofing your finances with an emergency fund. You can use emergency funds to cover for unexpected situations like sudden unemployment or medical emergencies. The rule of thumb is to save up enough to cover you for three to six months of living expenses.

Start small, automate contributions, and gradually build it up. Once you’ve got your emergency fund set-up, you can then move on to saving for your other needs and wants.

Investments, on the other hand, are essential for wealth building and financial growth. By putting your money to work in various investment vehicles (i.e. stocks, bonds, and real estate) you have the potential to earn returns that outpace inflation. This can lead to the accumulation of wealth over time, providing financial security, funding future goals, and even supporting your retirement.

Here are the basic concepts you need to know before you start making investments:

- Risk Tolerance and Time Horizon - Assess your comfort with risk and investment duration.

- Diversification - Spread investments across various assets to reduce risk.

- Choosing Investment Vehicles - Explore options like stocks, bonds, mutual funds, and retirement accounts.

Insurance and Risk Management

Insurance is a financial tool that provides protection against the financial impact of risks. Here are the common types of insurance available:

- Health Insurance - Covers medical expenses, ensuring you receive necessary healthcare without significant financial burden.

- Life Insurance - Offers financial protection to your dependents in case of your death, providing a lump sum or periodic payments.

- Property Insurance - Protects your property (home, belongings) against damage or loss from unforeseen events like fire or theft.

When evaluating your insurance needs, start by considering your lifestyle,dependents, and financial goals. Ask yourself questions like: What are your current financial obligations? Do you have dependents relying on your income? What is your overall health status?

So how does insurance fit into your financial planning? Insurance safeguards your finances and assets, helping you to stay financially afloat even during cases of unforeseen and unfortunate circumstances.

TOCRetirement Planning

We know that you’re still years – maybe even decades – away from retirement, but just like emergencies, it’s crucial that you prepare as early as possible.

When creating a financial plan for your sunset years, consider factors like your desired lifestyle, expected healthcare costs, and the age at which you plan to retire.

By understanding these elements, you can calculate the amount required to maintain a comfortable and fulfilling retirement.

There are various retirement savings plans to choose from, each offering unique advantages:

Pag-IBIG MP2 (Modified Pag-IBIG 2) - A government-backed savings program offering higher dividends than regular savings accounts.

SSS Pension - The Social Security System (SSS) provides a pension plan for members contributing regularly.

Personal Equity and Retirement Account (PERA) - A voluntary retirement account with tax incentives, allowing individuals to invest in various instruments.

When planning for retirement, consider the following investment strategies:

- Diversification - Spread investments across different asset classes to manage risk.

- Regular Contributions - Consistently contribute to retirement accounts, benefiting from compounding over time.

- Adjusting Risk - As retirement approaches, gradually shift investments towards lower-risk options to protect your savings.

- Professional Advice - Consult with a financial advisor to tailor your investment strategy based on your unique goals.

- Emergency Fund - Maintain an emergency fund to cover unforeseen expenses, preventing the need to dip into retirement savings.

Tax Planning

Here’s another aspect of adulting that we can’t forget about: taxes. Fitting taxes into your financial plan helps you maximize savings, ensure compliance to avoid penalties, and minimize unwanted surprises during tax season. Here are three strategies for tax efficiency:

- Income Diversification - Spread income across various sources, optimizing for lower tax rates and exemptions.

- Tax-Advantaged Investments - Explore investment options with tax benefits, such as the Personal Equity and Retirement Account (PERA) in the Philippines.

- Strategic Deductions - Leverage tax-deductible expenses like health insurance premiums or contributions to government-backed savings programs.

Need tips to plan for your tax obligations? We’ve got you, luv:

- Record Keeping - Maintain meticulous records of income, expenses, and investments for accurate tax filing.

- Consult Professionals - Seek advice from tax experts to navigate complex tax codes and identify potential deductions.

- Regular Updates - Stay informed about changes in tax laws and regulations to adapt your financial strategy accordingly.

Estate Planning

Estate planning seems like a grim topic to follow retirement and taxes. Still, we have to talk about it for your financial plan. We’re just watching out for you, luv! Here’s what you need to know:

- Wills and Trusts - These legal instruments outline how your assets are distributed upon your passing. Wills are more straightforward and typically cover a broad range of assets, while trusts offer more flexibility, allowing you to specify conditions for asset distribution.

- Beneficiary Designations - This involves specifying individuals who will receive particular assets, such as life insurance policies or retirement accounts, upon your death. Ensuring up-to-date and accurate beneficiary designations is crucial for the efficient transfer of assets and avoiding potential disputes.

Regular Review and Adjustments

Regular reviews of your financial plan are crucial to ensure it stays aligned with your evolving life circumstances. Life changes, such as marriage, the birth of a child, a career shift, or unexpected financial challenges, can significantly impact your financial landscape.

Keep track of changes in your income, expenses, and overall financial goals so you can adapt your plan accordingly. When necessary, adjust your financial plan in response to life changes. This ensures that it remains a dynamic and effective tool in guiding your financial journey.

Congrats, luv – you've reached the end of this financial planning guide! Remember to invest ample time in crafting and regularly reviewing a well-rounded financial plan. Don’t rush and don’t take shortcuts on your journey to financial stability!