If you happen to be someone working in a regular Philippine company, you’re likely to be paying taxes as well as contributions to local organizations like PhilHealth, SSS, and Pag-IBIG. But most of the time, we’re unaware of the benefits we can get from being active members and contributors to these corporations. For example: did you know that you could claim sick benefits from SSS if you missed work due to COVID-19? Yep, you totally could.

Another benefit for employees contributing to SSS happens to be a salary loan! We’ve discussed it in our loans pillar blog earlier on, but to refresh your memory, a salary loan is an unsecured loan that you can get from different organizations, including your employer, allowing you to solve short-term financial needs. Loan disbursement usually depends on the amount of your salary.

If you want to be a part of the 47.1% Filipino adult population who has borrowed money but don’t know where to get a loan yet, then perhaps an SSS Salary Loan is the one for you if you happen to be a contributing member! And if it is, then go ahead and use your member benefits to the fullest! Here’s everything you need to know about it.

Always Getting Rejected for Loans?

You just need a better credit score. Start building with Tonik Credit Builder Loan!

Table of Contents

- What is an SSS Salary Loan?

- SSS Salary Loan Requirements & Eligibility

- How to Apply for SSS Salary Loan

- What is an SSS Salary Loan?

- How to Claim SSS Salary Loans

- SSS Salary Loan FAQs

- How will I know if I qualify for SSS loan?

- How long is the approval of SSS salary loan?

- How many days does it take to get an SSS loan released?

- What are the repayment terms of SSS salary loans?

- How much is the maximum amount you can borrow from SSS salary loans?

- What are the fees (service fee and penalties) and interest rates of SSS salary loans?

TOC- Table FInd

What is an SSS Salary Loan?

As mentioned on the SSS website, an SSS Salary Loan is a cash loan granted to an employed, currently- paying self-employed or voluntary member. Its purpose is to meet the member's short-term credit or financial needs. Because SSS is a government organization, interest rates are lower than your other loans from private lenders. A salary loan amount from SSS would also depend on your own salary and your contributions to the group.

TOC- Table FInd

SSS Salary Loan Requirements & Eligibility

Wondering if you’re eligible for an SSS Salary Loan? Grab a pen and check the list here:

- You need to be currently employed or self-employed. You must also be an actively contributing member of SSS. This is a no-brainer for sure!

- If you’re employed working under a company, your company needs to be updated with paying its employees’ contributions to SSS. Check your payroll contribution items or ask your friendly HR payroll officer.

- You must have not been granted final benefits by the SSS, such as those benefits for total permanent disability, retirement, and death.

- You have to be under sixty-five (65) years of age at the time of application.

- You have not been disqualified due to fraud committed against the SSS.

If you’re looking at getting a one-month loan, then you need to have thirty-six (36) posted monthly contributions, with six (6) of them having to be within the last twelve (12) months prior to the month of your application filing.

Then, for a two-month loan, you must have seventy-two (72) posted monthly contributions, and again, with six (6) of them having to be within the last twelve (12) months prior to the month of your application filing.

For requirements, make sure you have these:

- An SSS digitized ID or E-6

- Two valid photo IDs. The SSS website has a handy list of valid IDs here.

- An SSS online membership. Register for one if you don’t have it yet!

Got all these checked? Then awesome, because you’re good to go!

TOC- Table FInd

How to Apply for SSS Salary Loan

- Make sure you have all the requirements stated above, as in complete, luv, including an SSS online membership.

- Log in to your SSS online account and then tap on the “E-Services” button.

- When you press “Apply for Salary Loan,” it will prompt you to enroll a disbursement method under their Disbursement Account Enrollment Module. You need to do this first before applying for any loan or benefit. Learn more about this step in the “How to Claim SSS Salary Loans” part below.

- Then when you’ve successfully enrolled your disbursement method of choice, you can now go back to applying. Click “Apply for Salary Loan,” and then you will see the loan amount you can borrow. Do note that you can borrow an amount lower than this.

- Go through the loan application and then read the Terms & Conditions. Tap the “I agree” box and then click Proceed.

- Read your loan disclosure statement and check if everything is good.

- Click “Submit.”

- A confirmation message will pop up after. For future reference, you can either copy the transaction number or go back to the email that’ll be sent to you including more details.

- Wait for the loan to be approved and disbursed. You’ll be receiving notifications on these as well.

TOC- Table FInd

How to Claim SSS Salary Loans

Before you can apply for a loan, you need to decide how you’d want to receive your loan amount. Thankfully, SSS has multiple options for loan disbursement, including online banking via PESONet with your bank of choice, e-wallets, Remittance Transfer Companies (RTC), or Cash Payout Outlets (CPO) accredited by the SSS for the Disbursement Account Enrollment Module or DAEM.

For more information on how you can enroll your preferred method of disbursement, SSS has a super handy YouTube guide right here!

Note that the SSS now requires its members to upload proof of account ownership to enroll a disbursement account on their online portal. More details are also in the video linked above, but to give you a preview—it includes passbooks, bank certificates, or ATM cards for bank accounts, and screenshots of your mobile app account for e-wallets.

Once your loan has been verified and approved, it would take around 3 days for the funds to be disbursed into your account.

TOC- Table FInd

Still reading about loans?

Live it and get a Tonik Loan up to P5M today!

Expand your business with the lowest monthly installments, and achieve your goals with us!

SSS Salary Loan FAQs

TOC- Table FInd

How will I know if I qualify for SSS loan?

We just talked about the requirements above, luv! The basics are that you have to be an employed or self-employed, actively contributing member of SSS. And you need to be under 65 years old! You also have to have a certain number of monthly contributions to qualify for certain SSS Salary Loans. Check the “SSS Salary Loan Requirements & Eligibility” portion that we’ve written down near the top of this blog.

TOC- Table FInd

How long is the approval of SSS salary loan?

Once you hit the submit button, your employer has 3 business days to verify your loan application. Once it has been approved (you can actually check this via your SSS portal. A text message will also be sent to you), it would take around 2-3 working days to be disbursed into your chosen account.

TOC- Table FInd

How many days does it take to get an SSS loan released?

How long ‘til the cash hits your account? Once your SSS Salary Loan gets the green light, it usually takes around 3 to 5 working days for the money to land in your enrolled bank account. Yup, straight to your ATM or online banking—super convenient, right?

But if you want it even smoother and quicker, here are a few pro-tips:

✅ Don’t delay your employer certification—get that done ASAP after applying.

✅ Make sure your disbursement account is properly enrolled and updated in your My.SSS portal (no one likes delays from missing info!).

✅ Lastly, keep an eye on your My.SSS account, email, or SMS for updates so you’re always in the loop. Quick money, no hassle, luv!

TOC- Table FInd

What are the repayment terms of SSS salary loans?

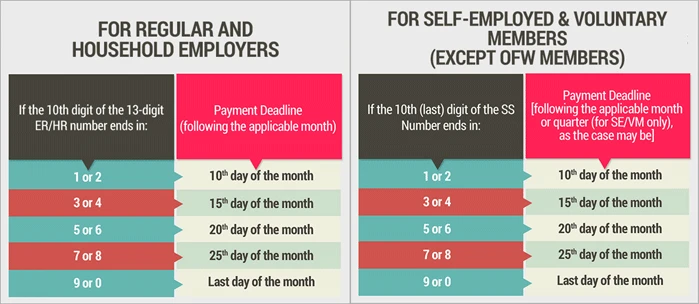

Your SSS Salary Loan is payable in 2 years in 24 monthly installments. Also, monthly amortization begins officially on the 2nd month following the date of the loan. It’s due on or before the payment deadline, which you can see here:

You can pay your loan at any SSS branch with tellering facilities, an SSS-accredited bank, or an SSS-authorized payment center.

TOC- Table FInd

How much is the maximum amount you can borrow from SSS salary loans?

That would depend on your salary, of course, and how much your monthly contributions are to SSS. After all, you’re borrowing from your money and what you’ve paid to the SSS. For a one-month salary loan, it is equivalent to the average of your latest posted 12 Monthly Salary Credits (MSCs), or amount applied for, whichever is lower. In the meantime, a two-month salary loan is equivalent to twice the average of your latest posted 12 MSCs, rounded to the next higher monthly salary credit, or amount applied for, whichever is lower.

Anyway, since the maximum Monthly Salary Credit is currently 25,000, members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month salary loan, and Php 50,000 for a two-month salary loan.

TOC- Table FInd

What are the fees (service fee and penalties) and interest rates of SSS salary loans?

No loan is without interest rates and fees! For SSS salary loans, the interest rate is 10% per annum. If you don’t pay on time, there will be an additional penalty of 1% per month until the loan is fully paid. And then, your service fee: 1% of the loan amount shall be charged and deducted from the proceeds of the loan. Everything clear?

Though getting an SSS salary loan is easy, it may not be the right one for you. If you aren’t sure where to start looking for another loan, why not try out Tonik’s handy loans? We’ve got a couple of good ones in the market so far, including Quick Loan and Shop Installment Loan! Go check ‘em out!

Sources:

- SSS.gov.ph - Salary Loan Overview

- SSS.gov.ph - Salary Loan Details

- SSS Salary Loan Application: Requirements, Interests and More (Moneymax)

- SSS Salary Loan - Easy Step-by-Step Guide On How To Apply (iMoney)

- How to apply for SSS Salary Loan Online 2021 - WhatALife!

- How to Apply for SSS Salary Loan Online (Updated Guide 2022) (NoypiGeek)