Short-Term Loans in the Philippines: Your Guide to Types, Application Process, and Alternatives

Quick Take: How to apply for short-term loans in the Philippines?

A good short-term loan you can apply for is Tonik Credit Builder Loan.With loan terms ranging from 6-12 months, you can borrow up to P20K and start building a solid credit history. Apply today when you download the Tonik App.

Life can sometimes throw unexpected expenses our way – from medical emergencies to urgent repairs – and that's where short-term loans come in to save the day. These can be a real lifesaver when you need quick access to cash. But the question is… which one is right for you?

To help you find the answer, we’re going to walk you through the ins and outs of short-term loans, from the different types available to the application process and even some alternatives you might consider.

Table of Contents

- What Are Short-Term Loans

- Types of Short-Term Loans in the Philippines

- Key Features of Short-Term Loans

- The Application Process

- Pros and Cons of Short-Term Loans

- Essential Tips for Borrowing Short-Term Loans

- Navigating Short-Term Loans: Your Guide to Regulations and Protection

- Alternatives to Short-Term Loans

- Conclusion

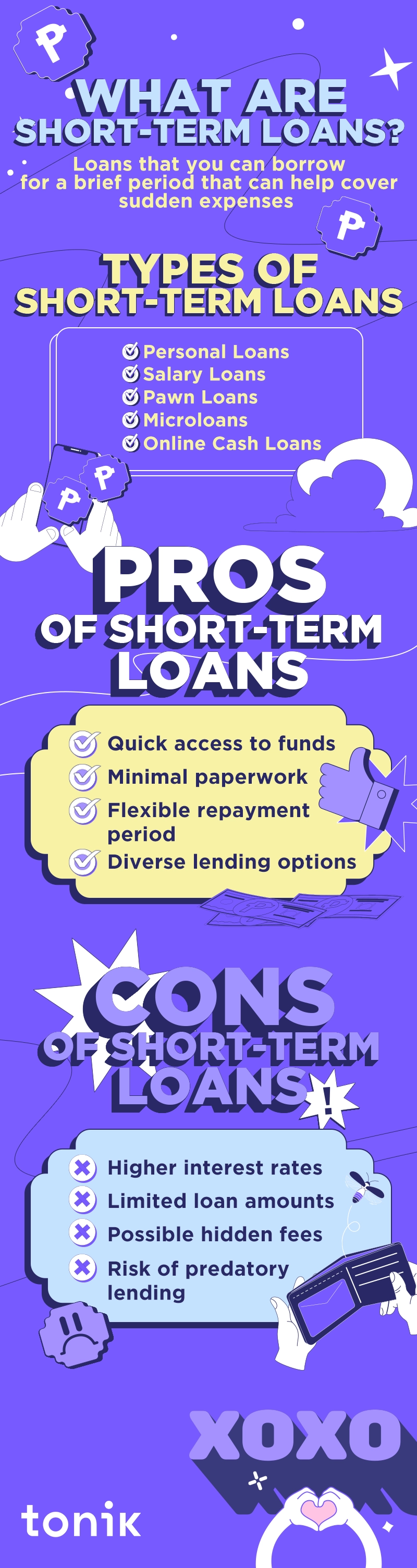

What are short-term loans?

These are loans that you can borrow for a short(er) period (compared to long-term loans), typically ranging from a few weeks to a few months. They're designed to help you cover immediate expenses and bridge financial gaps until your next paycheck or income comes in. In the Philippines, the market for short-term loans is buzzing with activity, and it's not hard to understand why.

Types of Short-Term Loans in the Philippines

There are several types of short-term loans available in the Philippines. Here are some of the most common:

- Personal Loans: These loans are quite versatile and can be used for a variety of purposes, from medical bills to travel expenses. They often come with flexible repayment terms and can provide you with the quick cash you need.

- Salary Loans: If you're employed, you might consider getting a salary loan, luv. It's like an advance on your upcoming paycheck. Think of it as borrowing from your future earnings to cover present needs.

- Pawn Loans: Got something valuable that you're willing to temporarily part with? Then you might be interested in taking out a pawn loan. Pawn loans (also known as sangla) allow you to use your belongings – like jewelry or gadgets – as collateral for a loan. Once you repay the loan, you get your stuff back. Pawn loans have relatively high interest rates, luv. So, you should only consider this as a last resort!

- Microloans from Microfinance Institutions: These short-term loans are often aimed at entrepreneurs and small business owners. They're offered by microfinance institutions and can be a great boost for those looking to grow their businesses.

- Online Cash Loans: The digital age has brought with it online lending platforms that offer convenience and quick approvals. They are convenient and easy to apply for. But fair warning: It's important to read the fine print and understand the terms and conditions before applying for an online cash loan.

Key Features of Short-Term Loans

When considering a short-term loan, it's important to understand the key features, including:

- Interest Rates: Short-term loans in the Philippines have varying interest rates, depending on the type of loan and the lender. Interest rates serve as the fee you pay for taking out a loan.

- Loan Duration and Terms: Short-term loans have a repayment period of weeks to up to a few months.

- Application Fees and Other Charges: Short-term loans may have application fees, processing fees, and other charges. It's important to read the fine print and understand the fees before applying for a loan.

- Secured vs. Unsecured Loans: Some short-term loans, such as pawn loans, are secured by collateral, while others, such as Tonik Quick Loan have none.

The Application Process

The application process for short-term loans varies depending on the type of loan and the lender. But here are the basics:

- Eligibility Criteria: Generally, you'll need to be a Filipino citizen or resident, meet a minimum age requirement, and have a stable source of income to be eligible for a short-term loan.

- Documentation: These documentations typically consist of valid government IDs and proof of income. Some lenders may require other documents before you can take out a short-term loan. So, be sure you’re ready.

- Application Process: The application process can often be done online or in-person at a branch. When transacting online, make sure you’re only applying with a trusted lender. For example, a bank that has a BSP license is a good sign that your lender can be trusted. Otherwise, you might be scammed, luv!

- Processing Time: One of the perks of short-term loans is the quick processing time. You can often get approved within a day or even hours, depending on the lender.

Pros and Cons of Short-Term Loans

Short-term loans have benefits and risks that should be considered before applying. Benefits include quick access to funds and minimal paperwork. Risks and concerns include high-interest rates, potential for debt traps, and predatory lending practices.

Weigh the pros and cons below:

| Benefits | Risks |

|

|

Essential Tips for Borrowing Short-Term Loans

Here are some golden tips to help you breeze through your short-term borrowing journey:

Tip 1: Shop Around and Compare

You know how you don't settle for the first pair of shoes you see? Well, the same goes for loans. When you're on the hunt for a short-term loan, take your time and shop around. Different lenders offer different interest rates, terms, and perks. So, go on a loan-hunting spree and compare your options. You'll be surprised at the range of offers out there.

Tip 2: Unveil the Fine Print

You've probably heard the phrase "the devil is in the details," and that couldn't be truer when it comes to loan agreements. Before you even think about signing on the dotted line, sit down with that fine print and read it like a detective. Understand the interest rates, repayment terms, any hidden fees – everything. If you're unsure about something, don't hesitate to ask questions.

Tip 3: Watch Out for Predators

Predatory lending practices and scams are like those villains in movies – they're out there, lurking in the shadows. Be cautious of lenders promising the moon and stars without any documentation or credit checks. Stick to reputable lenders and institutions with a track record of fairness. If it doesn't feel right, it probably isn't.

Tip 4: Time is of the Essence

Remember that old saying, "Time is money"? Well, in the world of short-term loans, that couldn't be more accurate. Missing a repayment can lead to a domino effect of financial troubles, so set up reminders, mark your calendar – do whatever it takes to ensure you make those payments on time. Your wallet and reputation will thank you.

Suggested Read: From Budgeting to Automation: Top Online Loan Repayment Strategies You Need to Know

Navigating Short-Term Loans: Your Guide to Regulations and Protection

Getting a short-term loan is a serious matter. So, before you start applying for a short-term loan, here are a few things you need to keep in mind:

The Role of The Bangko Sentral ng Pilipinas (BSP)

The Bangko Sentral ng Pilipinas is responsible for overseeing and regulating the financial industry, including short-term loans. They set the rules that lenders must follow to ensure fairness, transparency, and consumer protection.

Legal Safeguards: Laws and Regulations

When it comes to borrowing money, laws are your safety net. The Philippines has specific laws and regulations in place to safeguard borrowers, including the Consumer Act of the Philippines. This pivotal piece of legislation ensures that lenders offer transparency and fairness in all financial transactions.

Under the Consumer Act, lenders are required to provide clear information about interest rates, fees, and terms, empowering you to make informed decisions. These rules make sure that lenders can't spring surprises on you – they're bound by law to ensure you're fully informed before agreeing to your loan terms. The Act supports your right to be fully aware and in control of the financial obligations you undertake, reinforcing the importance of consumer protection in financial transactions.

Where to Seek Help: Complaints and Assistance

If you ever run into problems with a lender, you're not alone. There are avenues for seeking help and voicing your concerns. The BSP operates a Consumer Assistance and Complaints Office (CACO) where you can lodge complaints and get assistance.

Additionally, you can turn to the Securities and Exchange Commission (SEC) or the Anti-Money Laundering Council (AMLC) for specific violations related to financial transactions.

TOCAlternatives to Short-Term Loans

We've covered a lot about short-term loans, but what if we told you that there's more than one path to financial relief? Short-term loans might be a handy tool, but they're not the only tool in the box. Let's dive into some alternatives that might just be a better fit for your situation:

- Savings and Emergency Funds

Picture this: an unexpected expense comes knocking at your door, and you're not caught off guard. That's the magic of having savings and an emergency fund. If you're able to, building up these funds can be a powerful way to avoid borrowing altogether.

- Borrowing from Friends or Family

If you’re facing a temporary setback, reaching out to your close ones might be a solution. But – and this is important – make sure you're transparent about your intentions and work out a clear repayment plan. Mixing money and personal relationships can be tricky, so tread carefully.

- Local Financial Options

The Philippines has a host of local financial options tailor-made for Filipinos. Credit cooperatives, community-based lending programs, and social enterprises are some examples. These institutions often offer more personalized and flexible terms compared to larger lenders.

Wrapping Up

Short-term loans can provide financial relief when you need it the most. However, it's important to understand the different types of loans, their features, and the application process before applying. By following these tips for responsible borrowing and considering alternatives to short-term loans, you can make informed decisions about your finances. The financial world is yours to navigate, and armed with the right knowledge, you can make the best decisions for your situation. Stay savvy and stay financially empowered!

How much do you need?

Max amount ₱50,000

Your monthly installments

Your monthly installments

Actual amount may change

Most Popular