Quick Take: What are the best emergency loans in the Philippines?

You can get personal loans, salary loans, or government loans like the SSS Emergency Loan. You can also use Tonik's Credit Builder Loan so you can also build credit at the same time. Download the Tonik App to apply now!

Picture this: you're cruising through your month, minding your own business, living your best life, when suddenly (OH NO!) your car sputters to a halt in the middle of traffic, a medical bill arrives at your doorstep, and you get a work email saying you’ve been retrenched, all before you’d had your first cup of coffee.

Yeah, we know, these incidents only happen in movies, but sometimes facts are stranger than fiction. The point is, life is extremely unpredictable, and it’s crucial that everyone has a safety net.

This is where emergency loans step in. When faced with urgent and unforeseen expenses, emergency loans emerge as a viable solution that can help you navigate the rough waters.

Whether you’re currently in the thick of it, or if you just want to stay ready, read on to learn all about emergency loans!

Always Getting Rejected for Loans?

You just need a better credit score. Start building with Tonik Credit Builder Loan!

Table of Contents

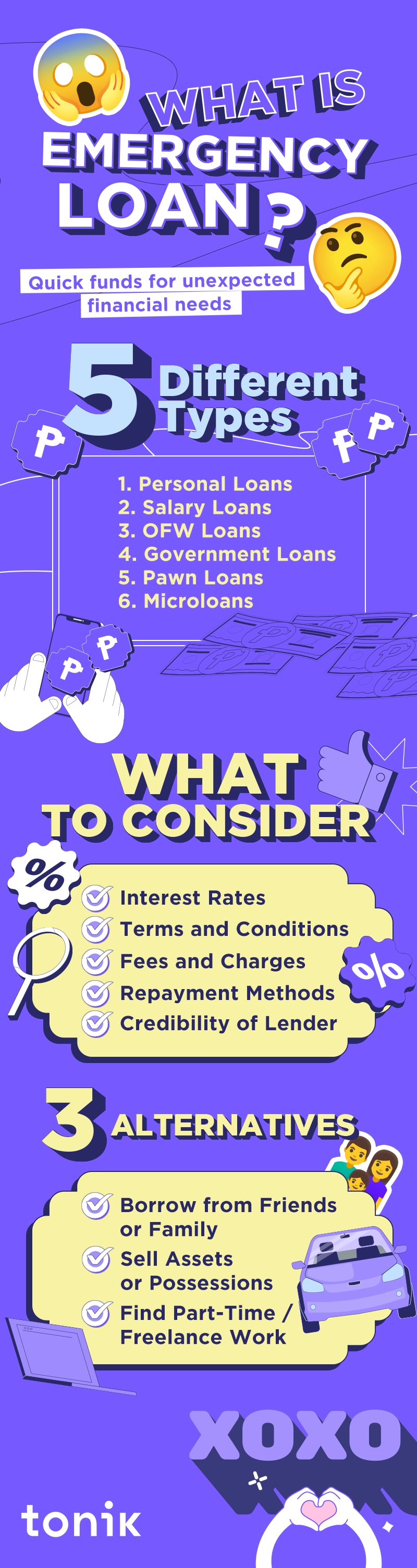

What is an Emergency Loan?

Let’s start with the definition. Emergency loans are financial services designed to provide quick and easy access to funds. Their main purpose is to give you a helping hand when you're grappling with a situation that requires immediate financial attention.

Remember that they’re only intended to bridge the gap between your current situation and your next paycheck or anticipated funds. Use them only for needs, not for wants.

The Different Types of Emergency Loans in the Philippines

Now you know what an emergency loan is, let’s dive into the different types available in the country.

Personal Loans

Personal loans are often offered by banks and lending institutions, providing a valuable resource to navigate unforeseen financial setbacks.

They’re known to be flexible, making them a reliable choice for emergency situations and a good emergency loan source. You can expect competitive interest rates, manageable repayment terms, plus hassle-free application processes online through loan apps.

Eligibility for personal loans may vary from one lender to another, but the usual factors include credit history, income, and overall financial stability. Being a resident of the Philippines is also a common requirement, and the age range for applicants might also have specific limits.

Salary Loans

Salary loans are very similar to personal loans. The main thing that sets them apart is that the maximum limit of salary loans is determined by the borrower’s monthly income. This ensures that repayments remain manageable within the scope of their earnings.

Salary loans have quicker approval processes due to the focus on the borrower's regular income as opposed to credit history. You may be able to secure funds more quickly, easing the financial strain. However, the borrowing amount might be more limited compared to personal loans, depending on your monthly salary.

Additionally, while salary loans offer immediate relief, remember that they still entail interest rates and repayment terms that should be understood fully before committing.

OFW (Overseas Filipino Worker) Loans

These loans are dedicated to Filipinos working abroad, designed to help them manage emergencies back home efficiently.

These loans are versatile and cover a wide variety of needs, including medical expenses, education costs, and home repairs.

Since borrowers are far away from the people they’re trying to aid financially, the application process is streamlined and done remotely online. While required documents may vary, it’s best to prepare requirements like proof of overseas employment, remittance records, and persona identification.

Government Loans

You can also get loans from the Philippine government! Let’s go through them one-by-one.

- SSS (Social Security System) Emergency Loans – These are designed to assist members during calamities or public health crises. While terms and conditions may vary, SSS loans typically offer favorable repayment periods.

- Pag-IBIG Fund Calamity Loan - This loan is for members living in areas declared under a state of calamity. With a simplified application process and reasonable interest rates, this loan strives to alleviate financial pressures during trying times.

- PhilHealth Emergency Loan - PhilHealth, the Philippine Health Insurance Corporation, extends its support beyond healthcare by providing an emergency loan program. This loan aids in covering medical expenses during emergencies, providing a crucial lifeline for individuals facing unexpected health-related costs.

Pawn Loans

Many people like to get pawn loans because it’s super straight-forward. Normally, you pledge an item, and you get money based on the value of said item – no credit history needed. This approach allows individuals with varying credit backgrounds to access funds when required.

Plus, pawn loans tend to involve shorter repayment periods, which can be a plus when looking for a short-term solution. If the borrower is unable to repay the loan and interest within the agreed timeframe, they can opt to forfeit the collateral and end their obligations just like that.

Items that can be pawned vary based on the pawnshop's policies and assessment of value. Jewelry, electronics, musical instruments, watches, and valuable collectibles are the usual suspects you’ll find at a pawnshop.

Microloans from Microfinance Institutions

Microloans are modest amounts of credit often accompanied by lower interest rates and more lenient eligibility criteria than mainstream loans. They can help solve a number of emergencies including vehicle repairs, medical emergencies, and sudden job loss. Definitely another good option to apply for an emergency loan from.

These loans are not only a means to bridge financial gaps. Even without emergencies, you can use these loans to create or expand your businesses, renovate your home, and essentially enhance your overall quality of life.

TOCFactors to Consider Before Applying for Emergency Loans

We know that in emergencies, time is of the essence. We’ll make this quick so you can make a wise decision right away!

- Interest Rates – This is the cost of the privilege of borrowing. That means you should always go for low interest rates. Lower interest rates mean you'll pay less over the loan's lifetime.

- Loan Terms and Duration - Shorter-term loans might have higher monthly payments but lower overall interest costs, while longer-term loans offer lower monthly payments but potentially higher overall expenses due to extended interest accumulation.

- Application Fees and Other Charges – Aside from application fees, you may have to pay processing fees or other charges. Look for lenders with transparent fee structures.

- Repayment Methods - Consider whether the repayment schedule aligns with your financial situation. Automated payments, flexible repayment dates, and the ability to make additional payments can make managing the loan easier.

- Credibility and Reputation of the Lender - Read reviews, check for complaints, and ensure the lender is licensed and compliant with regulations. A reputable lender will provide clear terms, excellent customer service, and reliable support.

Application Process of Emergency Loans

There are several steps when applying for emergency loans. Read about each one so you don’t hit any road bumps during your borrowing experience.

- Know the general requirements – Note that you may have to meet certain criteria, including a minimum age requirement, citizenship or residency status, and stable employment.

- Prepare and submit necessary documents – These often include government-issued IDs to verify your identity, proof of billing to confirm your residence, and a certificate of employment to establish your income and employment status.

- Decide between online or in-person application - Online applications provide the flexibility to apply from the comfort of your home. In-person applications, on the other hand, offer a more personal experience. Going to the branch may also be needed as some lenders require physical document submission.

- Be aware of the estimated processing time - Some lenders offer rapid approval and disbursement processes, ensuring you receive the funds promptly. Clarify the expected timeline to ensure your urgent needs are met without unnecessary delays.

Tips and Recommendations

Of course, we can’t let you apply for emergency loans without learning about these tips and recommendations!

- Compare different loan offers - This empowers you to make an informed decision that aligns with your financial situation and requirements.

- Understand the Fine Print – Don’t just breeze through the Terms and Conditions – read them. Pay close attention to interest rates, repayment terms, and other details that could make or break your borrowing experience.

- Don’t believe too-good-to-be-true offers – If it’s too good, it could be a scam. Research the credibility of the lender and trust your instincts to avoid being a victim!

- Ensure you have a repayment plan - Consider your monthly budget and ensure that you can comfortably meet the repayment obligations. Timely repayments not only maintain your financial health but also reflect positively on your credit profile.

Emergency Loan Alternatives

While emergency loans can be a valuable resource, there are alternative strategies to consider when facing unexpected financial challenges. They may not always be as fast and as easy to get compared to emergency loans, but they’re still worth considering!

- Borrowing from Friends or Family - Seeking assistance from loved ones can be a swift way to secure funds without interest or stringent repayment terms. However, don’t forget the importance of clear communication and honoring the agreement so you can maintain a healthy relationship with your loved ones.

- Selling Assets or Possessions - Consider selling items you no longer need or assets that can be turned into cash. This approach can provide immediate funds to address your emergency. Nowadays, there are countless online platforms and marketplaces to utilize, and you can sell almost anything from vintage video games and clothes to used car parts.

- Finding Part-Time or Freelance Work - Exploring part-time employment or freelancing opportunities can offer a sustainable way to increase your income. This may take some extra time and effort, but it could be fruitful in the end.

Win over any unexpected moment with Tonik Digital Bank

While emergency loans can offer financial relief, remember that you're still borrowing money. You’ll have to pay back that loan eventually.

Before things come to a point where you’ll need to get an emergency loan, try to build a sturdy financial safety net through savings and wise money management.

If you need help in that department, try starting a Stash with us. You can go Solo and earn 4% interest p.a. or earn even more at 4.5% with a Group Stash!

Need an emergency loan now? While they’re not strictly for emergencies, our loans can be just as fast with a maximum amount of up to PHP 250,000 and monthly add-on interest rates that can go as low as 1.7%! As one of the BSP’s licensed digital banks, you can never go wrong with a Tonik Bank Loan that you can conveniently apply and disburse for a loan from all on the Tonik App, wherever you are.

Stay prepared for whatever life throws at you and download the Tonik App today.