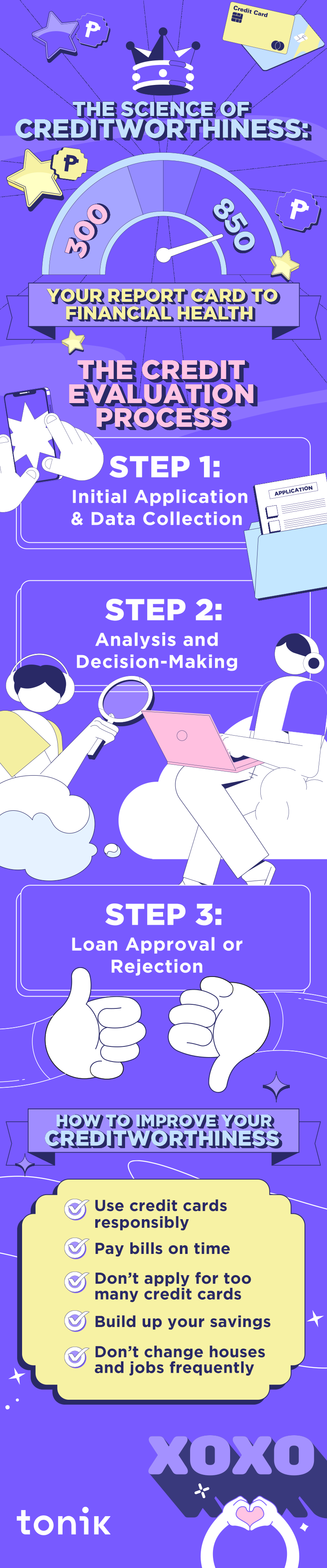

Have you ever wondered how banks determine your creditworthiness, luv? We hope so. You see, creditworthiness is the measure of your financial trustworthiness. It's what banks use to determine if you're a safe bet when it comes to lending money. Think of it as a report card on your financial health.

And in this blog, we'll dive deep into the process, shedding light on the key factors that influence their decision-making. By the end, you'll not only understand the intricate workings of credit evaluation but also discover actionable steps to boost your creditworthiness.

Table of Contents

Importance of Assessing Creditworthiness for Banks

Before we do a deep dive into the credit evaluation process, it's essential to understand why banks care so much about creditworthiness. Simply put, it's all about risk management.

Banks are in the business of lending money, and they want to make sure they get it back. Assessing creditworthiness helps them decide whether you're a low-risk, moderate-risk, or high-risk borrower. This classification plays a pivotal role in determining the terms and conditions of your loan. So, the better your creditworthiness, the sweeter the deal you can score.

TOCThe Credit Evaluation Process

The journey from submitting your loan application to getting the coveted "approved" stamp involves a series of steps. Here's an inside look at the credit evaluation process:

Step 1: Initial Application and Data Collection, and Checking Credit Score

This is where it all begins. When you apply for a loan, you provide the bank with your information. They need this to create a comprehensive profile of your financial situation. Be ready to share details about your income, expenses, employment, and more. The more accurate your input, the better the bank can assess your creditworthiness. To help build your confidence, you can also check your credit score every once in a while. Read about how to check your credit score in the Philippines here.

Step 2: Analysis and Decision-Making

Once your data is in their hands, it's time for the bank to roll up its sleeves. They'll scrutinize your financial history, analyzing every nook and cranny. This phase is where they'll determine how much of a risk you pose.

Step 3: Loan Approval or Rejection

Finally, the moment of truth. After meticulous scrutiny, the bank decides whether to give you the green light or the red flag.

TOCKey Factors Considered by Banks

Now, let's get into the nitty-gritty. What exactly are the banks looking at when evaluating your creditworthiness? Here are the key factors:

Credit Score and History

Your credit score is like your financial report card. It tells banks how good you are at managing credit. A higher score indicates a lower credit risk, while a lower score can raise red flags.

Your credit score isn't plucked out of thin air; it's crafted from a blend of factors, including:

- Your payment history (did you pay your bills on time?)

- Credit utilization (how much of your credit you use)

- Length of credit history (longer is usually better)

- Types of credit (diversity can be good)

- Recent credit inquiries (too many can hurt)

Not all financial actions are created equal. Missing payments or declaring bankruptcy can leave nasty scars on your credit report, making banks skeptical.

Income and Employment Stability

A stable income source is music to the ears of banks. It's a clear indicator that you can make your payments. Your job history is another element in the creditworthiness equation. Banks prefer borrowers with steady, long-term employment. The nature of your employment matters too. Salaried individuals often have an edge over the self-employed because of the perceived stability of a regular paycheck.

Debt-to-Income Ratio (DTI)

Your Debt-to-Income ratio is a vital figure. It's the ratio of your monthly debt payments to your monthly income. A lower DTI means you're managing your debt well. Banks love a low DTI. It tells them that you've got room in your budget to take on more debt responsibly.

Collateral (for Secured Loans)

Secured loans require collateral - an asset that the bank can claim if you don't repay. Your collateral isn't just a safety net; it influences the terms and interest rates on your loan.

Personal Information and History

When banks are looking at your creditworthiness, they check out different aspects of your personal info and history. One important thing they want to know is how stable your living situation is. If you've been living at the same place for a long time, that's a good sign for them. Also, if you've been loyal to a specific bank, that can influence how they see your creditworthiness. And don't forget your references; they're a big deal too, hun! Your references give the bank an idea of what kind of person you are and how financially stable you might be.

TOCOther Considerations in Credit Evaluation

When you're applying for credit, it's not just about the numbers. Banks take a lot more into account when evaluating your creditworthiness. Let's dive into these other important considerations in a more conversational way:

Market Conditions and Economic Factors

- Local and Global Financial Climate: If the economy is booming and stable, it's usually easier to get a loan because people and businesses are more likely to pay back what they borrow. But if the economy is in a downturn, banks tend to get a bit cautious, making it harder to secure credit.

- Industry-Specific Considerations: Some businesses are more affected by economic changes than others. For instance, real estate and construction depend a lot on the local economy. Banks adjust their lending rules based on these industry-specific ups and downs.

Bank's Internal Policies and Risk Appetite

- Risk Appetite: Every bank has its own comfort level with risk. Some banks are pretty conservative and want low-risk loans, while others are okay with taking on a bit more risk for potentially higher rewards. This risk appetite can change depending on how the bank is doing and the rules they need to follow.

- Lending Criteria: Banks set their own rules for lending. These rules include things like minimum credit scores, how much debt you can have compared to your income, and whether you need to put up collateral. Different banks have different standards because they serve different markets and have their own competitive strategies.

External Factors, Such as Regulatory Guidelines

- Regulatory Requirements: Banks must play by the rules set by the government. In the Philippines, these rules are set by the Bangko Sentral ng Pilipinas. These rules are there to keep the financial system stable and honest. These regulations can really affect how banks evaluate credit.

- Compliance Costs: Following these regulations can be expensive for banks. They must keep lots of records and hire people to make sure they're following the rules. These costs can influence how a bank lends money and how much risk they're willing to take.

Technology in Credit Evaluation

So, you know how banks are all about numbers and making sure you're a good bet before they lend you money, right luv? Well, they've gone high-tech with it. Let me explain it more:

Credit Scoring Models and Algorithms

When it comes to evaluating your credit, banks use advanced computer programs. These programs examine a bunch of financial data to calculate your credit score. They look at things like your history of making payments, how much debt you owe, and other financial details to determine if you’ll be a responsible borrower.

Automated Underwriting Systems

Banks use computer systems called automated underwriting systems to make the loan application process smoother. These systems help decide whether your loan should be approved or not. They follow specific criteria and rules to make these decisions quickly and without much human intervention.

While this technology makes things faster and more efficient, it has its limitations. It might not handle special cases or unique situations as well as a human could. So, even though technology is a big part of credit evaluation, human judgment is still needed, especially for complex cases.

TOCHow to Improve Your Creditworthiness

You've got the knowledge; now it's time for action, luv. Here's how you can enhance your creditworthiness:

- Use credit cards responsibly: Having no debt at all doesn't make you more creditworthy. But if you're not good at managing a credit card, cut your credit card limit back. It's also wise to only use it for purchases you know you can afford to repay.

- Pay bills on time: Late payments can negatively impact your credit score. Set up automatic payments or reminders to ensure you pay your bills on time.

- Don't apply for too many credit cards: Applying for multiple credit cards in a short period of time can negatively impact your credit score. Only apply for credit when you need it.

- Build up your savings: Having money set aside for a rainy day assures lenders that you can pay your bills and loans on time.

- Don't change houses and jobs frequently: Lenders want evidence that you're a stable character. They want to see you have staying power - that you're not here one day, gone the next. Put simply, they want evidence of stability so try not to change jobs and addresses too frequently.

Improving your creditworthiness takes time, but by following these tips, you can start to see positive changes in your credit score. Remember to always use credit responsibly and only apply for credit when you need it.

TOCTake Care of Your Credit Score, Luv

Understanding how banks determine your creditworthiness is a crucial step in managing your financial health. By focusing on the key factors discussed in this blog and taking proactive steps to improve your creditworthiness, you'll be better equipped to secure the loans and financial opportunities you desire. In case you still haven’t decided where to loan, we’ve got just the thing: The Tonik Credit Builder Loan! You can get as much as Php 20,000 cash loan in just two days with Credit Builder. Remember, if you are not equipped to increase your creditworthiness at the moment, just maintain your current score and avoid actions that would decrease it.