Quick Take: What’s the best personal loan in the Philippines?

If you plan to get a personal loan, get one that'll help you in the long run. Borrow up to P20K from Tonik Credit Builder Loan to build a strong credit history. That's how you can future-proof your financial standing, luv! Download the Tonik App and apply now.

If you need additional funds to cover unexpected expenses or make big purchases, taking out a personal loan is a good way to do it.

For starters, most personal loans are unsecured loans, meaning you don’t have to use any collateral in order to borrow money from both banks and financing firms. This makes it a convenient and accessible option for many. However, some personal loans may also be secured loans, which require you to “secure” that loan by putting up an asset like your car or something else of value.

There are many types of personal loans available, which is good since this means most personal loans are accessible for most. However, with so many personal loan options available, it can be challenging to know which one is the best for your needs.

Instead of getting overwhelmed by the number of choices out there, check out these tips and factors you need to watch out for when choosing the best personal loan for you in the Philippines!

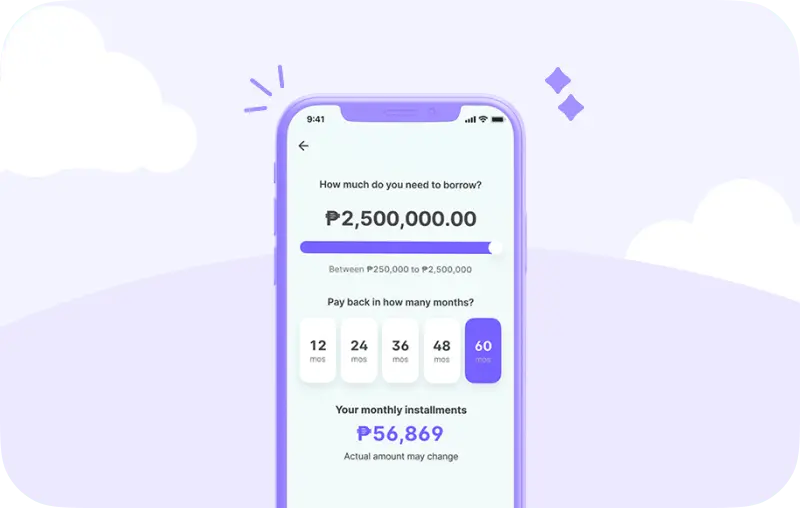

1. Determine your loan amount and the repayment period

The first step in choosing a personal loan is to determine how much money you need to borrow and how long you want to pay it back. This will help you narrow down your options and find a loan that fits your budget.

Most personal loans in the Philippines have a minimum loan amount of PHP 10,000 and a maximum loan amount of PHP 1,000,000. The repayment period for personal loans can vary, but most loans have a term of 6 to 36 months.

If the loan amount you need is much higher than the usual personal loan amount range, you would most likely need to apply for a secured personal loan. Despite having to put up a collateral for this type of loan, it doesn’t always mean it’s more inconvenient. In fact, you can get secured personal loans online.

2. Consider the interest rate and fees

When choosing the best personal loan for you, it's crucial to consider both the interest rate and the associated fees. The interest rate, typically expressed as an annual percentage, significantly impacts the total cost of the loan. It's determined by the lender based on factors like your creditworthiness and market conditions. However, understanding how this interest accumulates on your loan is just as important.

Interest on personal loans can be calculated in two primary ways: simple and compound. Simple interest is calculated on the principal amount of the loan, leading to a straightforward and predictable cost. In contrast, compound interest accumulates on the principal amount plus any interest that has already been accrued, which can increase the total amount you pay back over time.

Additionally, personal loans can come with fixed or variable interest rates. A fixed rate remains the same throughout the loan term, offering stability and predictability in your repayments. A variable rate, however, can fluctuate based on changes in the market, affecting your monthly payments.

Beyond the interest rate, various fees associated with the loan can also affect its overall cost. These may include processing fees, early repayment fees, and late payment fees. Each of these fees can add up, influencing the affordability and convenience of the loan.

Therefore, when evaluating personal loan offers, it's essential to look beyond the headline interest rate. Consider how the interest is calculated—whether it's simple or compound, and whether the rate is fixed or variable. Also, take into account all the associated fees to understand the true cost of the loan. This comprehensive approach will help you find a loan that not only meets your immediate financial needs but also aligns with your long-term financial health.

3. Check your credit score

Your credit score is an important factor in determining your eligibility for a personal loan, and it can also affect the interest rate and fees that you're offered.

A higher credit score typically means that you're seen as a lower risk to the lender, and you may be offered a lower interest rate and more favorable terms. If you need to figure out what your credit score is, you can check it for free with a credit bureau in the Philippines.

Fortunately, you're entitled to one free credit report per year. Use this to see what your credit score is and to check for any errors or inconsistencies that may be impacting your score.

4. Shop around and compare offers

Once you have a good idea of the loan amount, repayment period, and your credit score, it's time to start shopping around and comparing offers.

A quick and easy way to do this is by visiting the websites of banks and other financial institutions to see their personal loan offers. For example, we have 2 loan products with different rates and offers : Credit Builder Loan and Shop Installment Loan.

Take the time to check out those loans on our website and use our loan calculator tool to see what it may look like when you apply for your chosen loan.

Aside from this, consider looking into pre-approved loans. Pre-approved loans are offers made by lenders to potential borrowers who meet certain criteria, indicating a preliminary approval based on their credit profile. This can simplify and speed up the loan application process, as the lender has already assessed your creditworthiness.

Related: Top Online Loan Repayment Strategies

5. Ask friends and family

It’s always a good idea to hear first-hand experiences when it comes to personal loans in the Philippines. For that, don’t hesitate to ask the people you trust the most: friends and family!

Hear them out and get their recommendations or get referred to lenders that they know. At the same time, don’t forget to compare offers. Pay close attention to the interest rate and fees, as well as any additional features or benefits that the loans may have.

Some personal loans in the Philippines offer extra features like flexible repayment terms, the ability to pay in installments, and the option to borrow more money in the future.

6. Read the fine print and understand the terms and conditions

This applies to literally all contracts you sign. It’s basic knowledge at this point, but it’s super important that it’s worth repeating again and again: always read the fine print and understand the terms and conditions before you agree to anything!

Once you've carefully reviewed the terms and conditions of the loan and you're confident that it's the right fit for you, you can go ahead and apply for the loan.

Before applying, understand the process for the loan and what documents and information you'll need to provide to get approved. The lender will then review your application and credit history, and if you're approved, you'll receive the loan funds in your bank account.

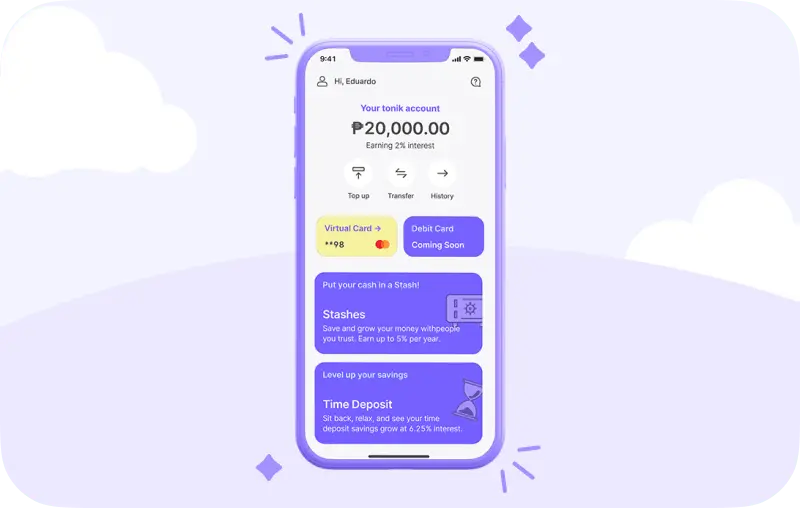

Find the Best Personal Loan in the Philippines at Tonik Digital Bank

Choosing the best personal loan for you in the Philippines can be a challenging task, but with some careful research and comparison, you can find a loan that fits your needs and your budget.

Just a few reminders: Make sure to determine your loan amount and repayment period, consider the interest rate and fees, check your credit score, shop around and compare offers, and read the fine print before you agree to anything. By taking the time to carefully evaluate your options, you can find a personal loan that will help you meet your financial needs.

One way to make it easier for you is to apply for an all-digital loan like the ones we have here at Tonik Digital Bank! With only minimal requirements, you can do it all on the Tonik App. You may not even have to get out of bed to apply. Download our app to get the loan you need today!