Neo Normal Online Loan Application in the Philippines

Say good bye to prehistoric and ridiculous loan applications and say hello to the Neo Normal way of applying for online loans in the Philippines today. We promise you’ll want to hug us at the end of this article!

Adulting: The Reality of Taking Out a Loan

Applying for a loan can be daunting. A quick check on Google Search will present you with pages and pages of available loans in the Philippines, but to even go through each of those will prove to be difficult. Click on the requirements of your preferred traditional bank and you’re presented with strict guidelines, numerous requirements, and processing that takes several banking days. Not to mention the hefty collaterals required by others traditional banks. In flashy letters they call, “Apply Now” but you know the fine print warns, “you shall not pass.”

At the height of the pandemic, Filipinos learned how to embrace the ease of access and peace of mind promised by technology and the internet. Taking advantage of these innovations didn’t just mean convenience, it also meant safety from the outside world and an added layer of security. From payments to weddings, digital played a large part in creating this neo normal and soon, many eventually embraced it.

Taking out a loan online today is as easy as ordering your groceries online, opening a digital bank account, or scheduling a virtual consultation. In fact, some may say it’s even easier than all that. Online loans aren’t the stuff of science fiction. They’ve been around longer than you know. But online lenders have significantly cut down on loan requirements and processing time, promising convenience with the click of a button. Even those who are unbanked or without bank accounts can still apply for an online loan if they have the requirements available.

Still not too keen on taking out a loan online? Let’s dive into what makes them superior. Read on to learn why they’re safe, super fast, convenient, on a league of its own, and just what you need to help you get your Personal Loan today.

All-Digital Loan Application

Though the concept of online lending was around before the pandemic, the processes that online lending institutions offered usually ended after submitting the application. Once submitted, the online loan application would have triggered a manual review and in the span of several banking days, the lender would contact the borrower to verify the documents and information provided. This is usually the part of the process that takes the most amount of time.

Disbursement is usually the part where the online loan process drops offline. This is especially true for those unbanked or those whose bank accounts aren’t digitally linked. In this case, withdrawal of the approved loan amount can be done over the counter at various partners, like remittance centers, convenience stores, pawnshops, and even bills payment centers.

Tonik not only offers online loan applications but promises a 100% digital application process, from start to finish. This means that from application to verification and disbursement, your loan process will be online. Even your loan requirements will be submitted in a digital format, so you can apply for your loan directly in-app whenever, wherever you are.

The approval process will take 15 minutes or less and disbursement is immediate. Once you’re on your Tonik Account, you can opt to transfer your borrowed amount directly to other bank accounts through Instapay, online wallets like GCash, or directly transfer the amount to another Tonik account. If you prefer it, you can still cash-out through Over-the-Counter channels like 7-Eleven or MLhuillier.

Tonik Account Holders with a physical Tonik Debit Card can easily withdraw the amount at any ATM that accepts Mastercard withdrawals or pay for purchases directly in-store. Direct online payments are also available with both your physical and Virtual Tonik Debit Card.

See the Tonik Loan Requirements Below.

- Valid ID

- Philippine Passport

- Philippine Driver’s License

- Unified Multi-Purpose ID (UMID)

- Social Security System (SSS) ID

- Professional Regulation Commission Identification Card (PRC ID)

- Postal ID (card type)

- Payroll Account Bank Statement or Pay Slip (latest 1 month)

Quick and Easy Loan Application

A closer look at why we love online loans can be drilled down to 2 factors: they’re quick and they’re easy. Take out a loan in a few clicks of a button or taps of a finger. Don’t worry, more online lenders don’t require you to be a seasoned borrower, so first-timers are welcome.

In a bind, an online loan can be the speediest and most secure loan option for you when your emergency fund or savings won’t cut it. That’s nothing to be ashamed of. In times as uncertain as this—as we face the new normal of life during and after the pandemic—a helping hand isn’t something to be embarrassed about.

In fact, a study by TransUnion on the effects of COVID-19 on the Philippine Consumer brought to light new information about how Millennials (born 1980-1994) and Gen Xers (born 1965-1979) were financially affected by the pandemic. 66% of respondents reported their household income was negatively impacted by the effects of the pandemic. 23% of Philippine consumers plan to apply for new personal loans, while others will turn to credit cards (16%) and mortgages (16%). 50% of millennials and 52% of Gen Xers surveyed plan to apply for new credit or refinance existing credit within the next year.

For traditional banks, the average loan process, including application, takes 3 to 5 banking days for Personal Loan applications. For other online lenders, the application and verification process can take 24 hours to about 3 days.

The next time you’re in a bind, don’t panic. Your Tonik Quick Loan application will take about 15 minutes from start to finish. Receive your money instantly in your Tonik Account after signing the documents. Get the money when you need it without a hefty collateral, pre-termination fees, and early payment fees. Yep, your Tonik Quick Loan is just a tap away.

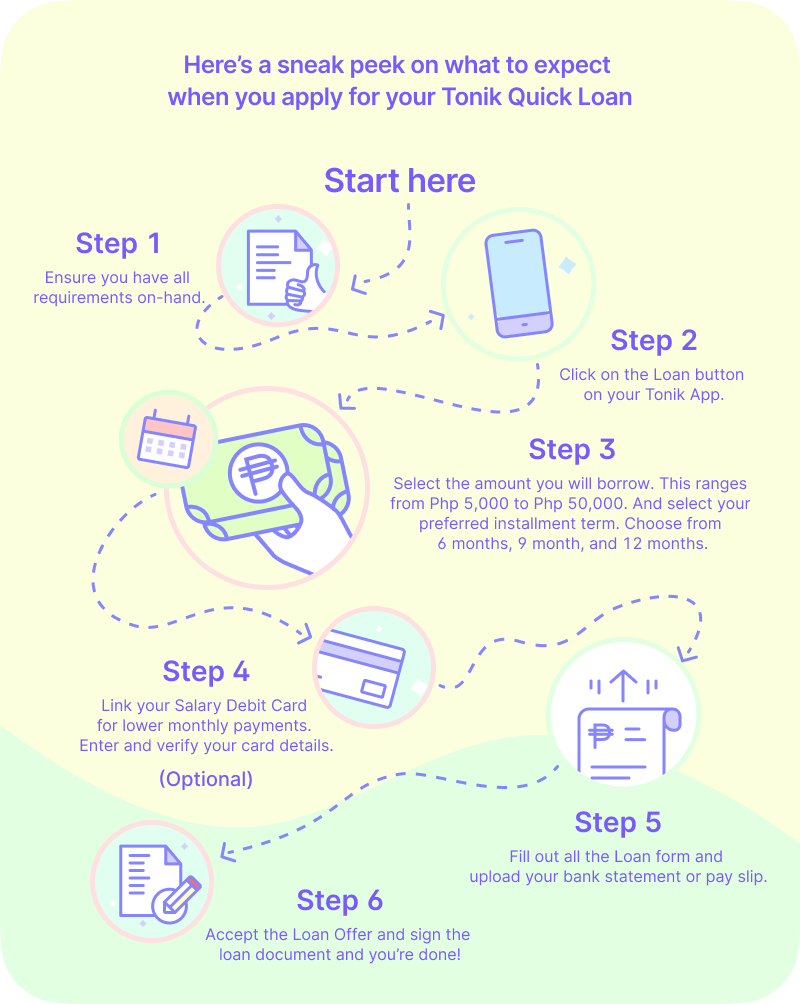

Here’s a sneak peek on what to expect when you apply for your Tonik Quick Loan.

Step 1: Ensure you have all requirements on-hand.

Step 2: Click on the Loan button on your Tonik App.

Step 3: Select the amount you want to borrow. This ranges from Php 20,000 to Php 250,000. And select your preferred installment term. Choose from 6 months, 9 month, 12 months, and 18 months.

Step 4: (Optional) Link your Salary Debit Card for lower monthly payments. Enter and verify your card details.

Step 5: Fill out all the Loan form and upload your bank statement or pay slip.

Step 6: Accept the Loan Offer and sign the loan document and you’re done!

Learn more about Tonik’s Quick Loan product here.

Data Security and Safety

If you ever wondered about just how safe it is to apply for an online loan in the Philippines, all you have to do is check if the lending company is accredited by the Securities and Exchange Commission. If the lender is a bank, then accreditation and licensing is given by the Bangko Sentral ng Pilipinas (BSP), which licenses both traditional and digital banks. As an added level of security, make sure your bank is a member of the Philippine Deposit Insurance Corporation (PDIC). This means that deposits in your account are insured up to Php 500,000. For banks, their accreditation and licensing are displayed on their website or under their about page online. You’ll also find this in their advertising or marketing collaterals.

Another quick check is to ensure that your preferred online lender adheres to the Republic Act 10173 or the Data Privacy Act of 2012. Email subscriptions, submitted forms, and new accounts both online and in-app verify the information provided and inform the account holder that their data is being used for specific purposes, like account creation and marketing efforts.

For digital banking apps like Tonik, permission is required to access certain features on your phone, like your camera and contacts. While the app needs access to these features to function correctly, you may freely toggle these on only as needed. For example, your loan application will access your loan documents through your photos or will require you to take a photo of the physical document using your camera. Learn more about Tonik in-app permissions here.

Above all, be more vigilant. In the same study by TransUnion, 42% of respondents have been targeted by a fraud scheme online but did not become a victim of it. Phishing scams and third-party seller scams on legitimate retail platforms are still prevalent in the country. Thankfully, online lenders in the Philippines have become smarter, maximizing available digital solutions to protect the end user from fraudulent attempts on their accounts.

Licensing, accreditation, and other security measures can easily be checked on your bank or preferred online lending company’s website or app. Here’s a quick security checklist for you to keep on-hand for later. If all else fails, look for reviews. Nothing beats honest to goodness feedback on the internet.

- Is their website secure? You should see ‘https’ on a secure website. The ‘S’ stands for ‘Secure’.

- Are they accredited by the Securities and Exchange Commission or the Bangko Sentral ng Pilipinas?

- If they’re a bank, are they insured by the Philippines Deposit Insurance Corporation?

- Can you access your account or data in your account without a password or PIN lock?

- Is the app requesting access to unnecessary apps, like your messages?

All-Digital Loan Repayment

Not only can you apply for your loan online, but you can repay it online, too For some online lenders, their loan repayments can be treated like regular bills paid through your most convenient channel. This includes payments through e-wallets like GCash or PayMaya. Do keep in mind that your repayment method depends on the lender as different repayment options are given by different lenders.

This should also be a consideration when searching for the best online loan option for you. Look for an online lending company or financial institution that offers convenient monthly repayment terms, as well as your preferred payment method. Remember, a missed payment constitutes late payment fees, so you’ll need to pay for your loan on time, as scheduled.

At Tonik, we’ve thought it through from the perspective of our customers. You can choose to link your salary bank ATM card so your loan repayment will be automatically debited from your card on the day of your choosing. Yup, you can select your preferred repayment date and repay your loan on the same day monthly, regardless of holidays or weekends.

Another repayment option is to pay your loan amount directly from your Tonik Account. Just ensure you have the equivalent of 1 month’s payment in your account on your selected repayment date and your payment will be automatically debited.

Fund your Tonik Loan repayment online through any of the channels below:

- Automatically through your linked 3D-secured salary bank ATM

- Cash-in through PESONet. Just check your bank's mobile app if Tonik Digital Bank, Inc. is already listed.

- Top up from your local bank’s debit card.

- Top up using your e-wallet and digital/online accounts

In conclusion

We’ve established just how much better online loans are—they’re a quick, easy, and secure loan within reach. Literally, because you just need to reach for that mouse or your digital banking app to take out your first Personal Loan.

Get those gears in motion. Plan ahead with the Tonik online loan calculator and learn more about our Personal Loan products today. Got questions? Check out our loans FAQs or read more on our website.

If you aren’t convinced yet, how about we get to busting some Personal Loan myths? you might’ve taken to heart? Know why they’re actually more beneficial and just how to take advantage of the best online loans the Philippines has to offer.

XOXO