Whether you’re a humble start-up or a monster of a tech giant, there’s no denying that running a business is a massive undertaking. You’ve probably got a number of things you need to purchase like equipment, commercial property to rent, an army of people to hire – in other words, you need capital, luv, and lots of it.

The sad (not-so) news is money doesn’t grow on trees. The good news, though, is you can borrow cash instead through business loans!

A business loan is what it sounds like. It’s a loan that companies or individuals can use to borrow funds for business purposes. Just like any other loan, you can pay them back in regular installments with fees and interest rates.

Now, you must be asking, “Why would I put myself in debt even before my business gets off the ground?” Because luv, business loans can help you pace yourself. Paying for everything upfront out of your own pocket could cause you to burn out too early. By getting a loan with monthly installments, you can pay for everything in manageable amounts, lessening the financial weight on your shoulders.

Everything clear so far, luv? Great! Now let’s take a crash course on how to use business loans effectively!

Table of Contents

TOC

Different Types of Business Loans in the Philippines

Term Loans

The most straight-forward of the bunch, term loans work like any other loan. You choose a loan amount, set a repayment period, then you pay it back with interest. Loan amounts for term loans can range from PHP100,000 up to PHP20,000,000, with repayment periods from 5 to 15 years. Most term loans are flexible, and you can use them for short and long-term goals like purchasing equipment or starting a franchise business.

Credit Lines

Credit lines are best for short-term purposes and immediate needs. Kind of like a credit card, you’re given a limit, and you can borrow as much or as little you need within that limit. The best part? You’ll only be charged with interest for the amount that you used! The loan terms are equally flexible, as you can either pay monthly or pay the principal amount as soon as you want to. You can also extend annually when needed.

Secured Business Loans

Secured business loans (or collateral loans) are unique in that you need to pawn property or collateral to borrow. That gives lenders a sense of security (hence the name) that you can pay back your loan, opening the doors to lower interest rates and higher loan amounts. Be careful, though. If you're not able to pay your loan back, the lender has the right to seize the collateral that you pledged.

Unsecured Business Loans

An unsecured business loan (or non-collateral loan) is a type of loan that doesn’t require collateral, but eligibility may be stricter as a result. You have to be more mindful of your creditworthiness when taking out an unsecured loan, and you better be prepared with relatively high interest rates. If you’ve got a good credit score, though, there’s a good chance you’ll be able to negotiate for a lower interest rate. At least you won’t have to risk the ownership of your property, right?

TOC

Effective Uses of Business Loans

Capital Investment

Investing in equipment and infrastructure is a must if you want to maintain the quality of your company's products/services. This not only benefits your customers, but it can keep your employees happy and productive as well. If you want to take your business to the next level, don't skip this!

Inventory Purchases

You need to keep those shelves stocked so you can keep those customers coming back for more. Business loans are great for bulking up that inventory, and you'll need that especially once you start growing and gaining a wider customer base.

Operational Costs (Salaries, Utilities)

As soon as your business opens, you're going to need a way to keep the lights on - literally! That's why business loans can come in handy if you don't have enough capital yet. Borrow cash and use it to pay for various utilities such as internet and electricity. With the same loan, you can also pay your hardworking staff.

Business Expansion

If you think you're ready to step out of your comfort zone but don't want to put too much at risk, perhaps you can dip your toes into expansion with business loans. Open new locations, introduce your company to a new set of customers, and see how it goes.

Marketing and Advertising

Your product/service could be the best in the world, but it will do nothing for your business if no one knows it exists. That's where marketing and advertising come in. Use business loans to invest in targeted ads or hire specialists (either in-house or 3rd party) to craft content no one can resist. These days, you need to always be ahead of the curve when it comes to marketing and advertising, so don't spare a single centavo!

Research and Development

This supports your marketing and advertising efforts. R&D goes a long way to keeping you one step ahead. It lays the groundwork and gives you an idea of what technology to invest in, the talent to hire, and so on, breaking down doors you may not even know were there in the first place.

Debt Consolidation

This allows you to streamline your debts, shrinking them down to a single, manageable payment. You can finally breathe a sigh of relief and say goodbye to the confusion of multiple due dates and interest rates. That way, you can focus fully on your business!

TOC

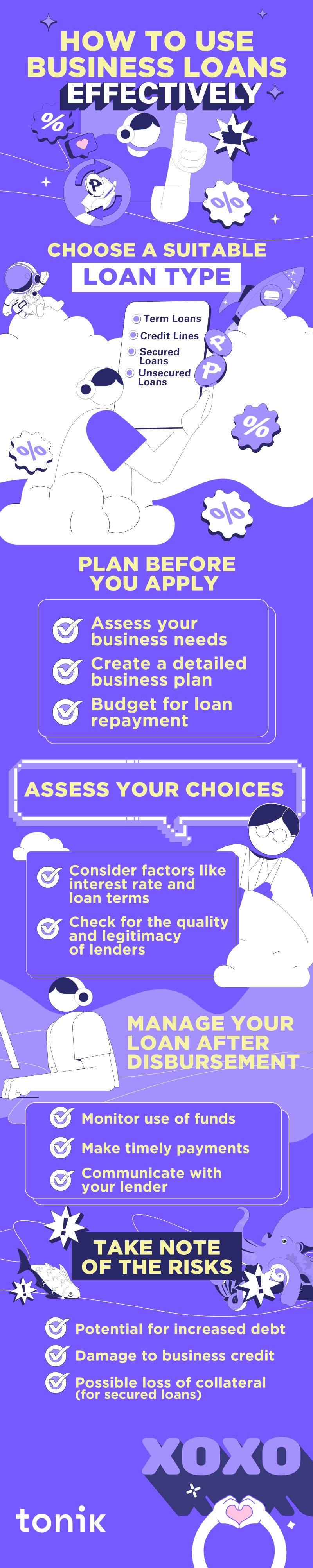

Planning Before Taking Out a Loan

- ✓Assess your business needs and financial situation - This is a crucial step and should not be overlooked. Assess your business needs and financial situation so you can get the loan amount, repayment terms, and type of loan that best align with your business goals. Especially if you're just starting out, you certainly don't want to borrow more than you can handle!

- ✓ Create a detailed business plan - This step is where you outline your business' vision, mission, and goals. You can also detail your target market, the products/services you plan to offer, and marketing strategies you plan to execute. Not only will it show lenders that you have a clear understanding of your business (thus giving you a better chance at approval) but it can also help you utilize business loans in the most efficient ways.

- ✓Budget for loan repayment - Well before it's time for loan repayments every month, allocate a certain amount so your day-to-day operations stay smooth. In addition to making your life easier, staying on track also helps you maintain a positive relationship with your lender, and you'll be able to dodge late payment fees without breaking a sweat.

TOC

Choosing the Right Loan for Your Needs

- ✓Factors to consider (interest rate, term length, etc.) - Business loans help businesses get off the ground, but it’s on you to keep it afloat. Before signing a contract for that loan, make sure that you’ve considered it carefully with important factors in mind. For interest rates, go low so you don’t end up paying significantly more than you borrowed. For loan terms, simply choose the length that you think is most feasible for your business. There’s the loan amount, too, and – we cannot stress this enough – borrow only what you need.

- ✓ The role of lenders in choosing the right loan - Think of your lender as your partner. They're there to help you navigate through the various loan options available and to guide you towards the most suitable financing solutions that they can offer. If they offer digital loans, you should also pay attention to their loan apps. Is their app user-friendly? Is customer support responsive and helpful? Do they have other features that can benefit your business? Remember that you'll be paying back the loan across multiple months, so choose a lender that you'll want to stick with for a long time!

TOC

Managing Your Loan After Disbursement

- Monitor use of funds - Ensure that the borrowed funds are being used effectively through regular financial reporting and expense tracking. With a clear view of how you utilize them, you can spot any discrepancies or deviations and make the necessary adjustments.

- Make timely payments – This is a no-brainer, luv, and we’ve already discussed this above, but let us remind you one more time because this is super, duper, uber-important: don’t forget to pay on time! Allocate the budget for repayment at the start of the month to steer clear of late payment fees.

- Communicate with your lender - Engaging with your lender is key to a successful borrowing experience. This makes sure you're on the same page with regards to repayment dates, interest rates, and any potential changes or modifications to the loan agreement. This will show your lender that you're committed to being fully transparent, and that you're open to alternative solutions when needed.

TOC

Risks of Misusing Business Loans

- Potential for increased debt - Taking on more debt than necessary or using business loans for personal purposes can lead to a never-ending cycle of debt. Needless to say, that's something you don't want to be stuck with. Assess your borrowing needs, create a well-defined repayment plan, and stick with it!

- Damage to business credit – If you fail to make repayments on time, it can damage your credit, which could then make it harder for you to take out another loan in the future. As if that wasn’t bad enough, a bad credit score could also scare off potential investors. Take care of your business credit profile so you don’t sabotage your business’ future!

- Possible loss of collateral (for secured loans) - Just one more reminder before we let you go, luv. If you choose a secured loan for your business, you’ll have to pledge a property of yours as collateral, and you’re giving the lender the right to seize it if you can’t pay for the loan. Make your monthly payments, and you won’t have anything to worry about!

TOC

Strategize for Your Next Big Move

Tying it all together—when getting business loans, it all boils down to strategy. What do you need the loan for? How will it help you achieve your business goals? How will it drive your company forward?

It doesn’t stop there, either, because you need to stay strategic as you manage your loan disbursement with all the risks in mind.

We know – there's a lot to take in, but don’t worry. Take a deep breath and keep this blog handy when you’re ready to make your next big move!