Retirement—a word that conjures images of leisure, travel, and the freedom to pursue passions long put on hold. Yet, for many, the shackles of debt can cast a shadow on this dream. So, if you want your golden years to truly be your golden era, then you need to tackle your debts ASAP, luv!

In this blog, we unravel the importance of effective debt management in retirement planning, helping you pave the way for financial freedom in your golden years.

Table of Contents

- Impact of Debt on Retirement

- How to Assess Your Debt Situation

- Strategic Debt Repayment Plans

- Budgeting for Debt Repayment

- Maximizing Income Sources

- Protecting Retirement Savings

- Seeking Professional Advice

- Considering Mental and Emotional Factors in Retirement Planning

- You Deserve the Best for Your Retirement, Luv!

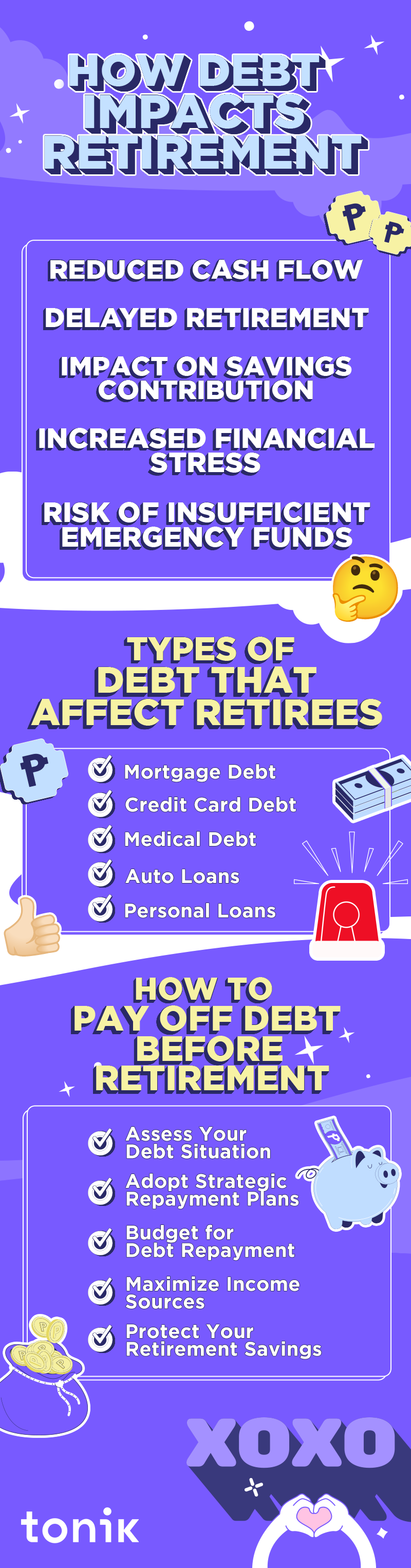

Impact of Debt on Retirement

How Debt Compromises Retirement Goals and Savings

Entering retirement with debt can significantly compromise the dreams and aspirations you've envisioned for your golden years. Let's unravel the ways in which debt poses a threat to your retirement goals and savings.

- Reduced Cash Flow: Debt often translates to monthly payments, reducing your available cash flow. This diminished income stream limits your ability to allocate funds to activities and experiences you've been looking forward to in retirement, such as travel, hobbies, or pursuing personal interests.

- Delayed Retirement: Carrying debt may force you to delay your retirement plans. The financial strain of servicing debts can make it challenging to accumulate the necessary savings for a comfortable retirement, extending the years you must remain in the workforce.

- Impact on Savings Contributions: Debt payments compete with your ability to contribute to retirement savings accounts. Instead of channeling funds into building a nest egg, a significant portion may go toward paying off debts, slowing down the growth of your retirement portfolio.

- Increased Financial Stress: The burden of debt can lead to increased financial stress, negatively affecting your mental and emotional well-being. Stress can further compromise your ability to make sound financial decisions and could potentially impact your physical health.

- Risk of Insufficient Emergency Funds: Paying off debt may leave you with insufficient emergency funds. In retirement, unexpected expenses can arise, such as medical bills or home repairs. Without a sizeable emergency fund, you may be forced to tap into retirement savings, undermining the financial security you've worked hard to build.

Types of Debt that Affect Retirees

- Mortgage Debt: Retirees often carry mortgage debt into their retirement years, impacting monthly expenses and financial flexibility. Ongoing property payments can put a strain in your retirement budget, affecting your overall financial health.

- Credit Card Debt: Accumulated credit card debt poses a significant burden in retirement, particularly due to high-interest rates. It can limit discretionary spending and erode savings intended for other purposes.

- Medical Debt: Unexpected medical expenses, not fully covered by insurance, can lead to medical debt. This type of debt can be especially challenging for retirees on a fixed income, affecting their ability to cover essential living expenses.

- Auto Loans: Car loans that extend into retirement can impact a retiree’s ability to allocate funds to other essential areas. Monthly payments on auto loans can reduce available resources for necessities like healthcare and housing.

- Personal Loans: Outstanding personal loans, whether for home improvements or other purposes, can contribute to financial stress in retirement. Balancing these loans with limited retirement income can be challenging.

Long-term Implications of Carrying Debt into Retirement

- Diminished Quality of Life: Debt payments can affect your available income, leading to a diminished quality of life. The dreams of a carefree retirement filled with travel, leisure, and hobbies may no longer turn into reality, impacting your overall well-being and satisfaction.

- Strained Relationships: Financial stress arising from debt can strain relationships with family and friends. The strain may result from the inability to fulfill shared aspirations or the emotional toll of navigating financial challenges together.

- Limited Leisure and Enjoyment: Retirement is meant to be a time of relaxation and enjoyment, yet carrying debt may limit your ability to indulge in leisure activities. The constant worry about financial obligations can overshadow the joy and fulfillment you hoped to experience.

How to Assess Your Debt Situation

Step 1: Creating a Comprehensive List of All Debts

- Gather Documents: Begin by collecting all relevant documents related to your debts. This includes credit card statements, loan agreements, mortgage details, and any other financial records.

- List Each Debt: Create a comprehensive list that includes every debt you currently owe. Be meticulous, noting the creditor, outstanding balance, monthly payment, and the interest rate for each debt.

- Categorize Debts: Group your debts into categories such as credit cards, loans, mortgages, and medical bills. This categorization provides a clearer picture of your overall financial obligations.

Step 2: Analyzing Interest Rates and Terms

- Identify Interest Rates: Make a note of the interest rates associated with each debt. High-interest debts, such as credit cards, may need special attention in your repayment strategy.

- Understand Terms and Conditions: Review the terms and conditions of each debt. Some debts may have variable interest rates or specific conditions that impact your repayment plan. Understanding these details is crucial for effective debt management.

- Prioritize High-Interest Debts: Identify debts with the highest interest rates. These are often the most costly in the long run. Prioritize these for more aggressive repayment to minimize overall interest payments.

Step 3: Understanding Your Debt-to-Income Ratio

- Calculate Your Monthly Income: Determine your monthly income from all sources, including salary, pensions, and any additional revenue streams.

- Total Up Monthly Debt Payments: Add up all your monthly debt payments, including minimum payments on credit cards, loan installments, and mortgage payments.

- Calculate Debt-to-Income Ratio: Divide your total monthly debt payments by your monthly income and multiply by 100 to get a percentage. This is your debt-to-income ratio. A lower ratio indicates better financial health.

- Interpret the Ratio: Understand the implications of your debt-to-income ratio. A high ratio signals that a significant portion of your income is allocated to debt payments, which may impact your ability to save or handle unexpected expenses.

Strategic Debt Repayment Plans

Debt Snowball vs. Debt Avalanche Methods

The debt snowball method involves tackling the smallest debts first, regardless of interest rates. Once the smallest debt is paid off, the focus shifts to the next smallest. It provides psychological victories early on, boosting motivation.

But this might not be for everyone since it’s not the most cost-effective in terms of interest payments. That’s why you can also consider doing the debt avalanche method. The debt avalanche prioritizes debts based on interest rates, starting with the highest. By paying off high-interest debts first, it minimizes overall interest payments.

Prioritizing High-Interest Debts

High-interest debts accumulate more rapidly, increasing the overall cost of repayment. By prioritizing these debts, you minimize the financial impact over the long term.

Consolidation, Refinancing and Restructuring Options

Debt consolidation means you’re combining multiple debts into a single loan or payment plan. This simplifies repayment with a single monthly payment and may help you secure a lower overall interest rate.

Meanwhile, refinancing means looking for a different lender to take on your debt, often with better terms.

And lastly, you can also try debt restructuring. This strategy involves negotiating directly with creditors to modify the terms of your existing debts. It can lead to adjustments such as lower interest rates, extended repayment periods, or even reductions in the total debt owed.

TOCBudgeting for Debt Repayment

- Adjusting Retirement Budget to Include Debt Payments: Review your retirement budget and allocate a portion specifically for debt payments. Ensure that this allocation is realistic and won't compromise essential living expenses.

- Balancing Debt Repayment with Living Expenses: Strike a balance between debt repayment and essential living expenses. Ensure that your budget remains sustainable, allowing you to meet both financial obligations and daily needs.

Maximizing Income Sources

- Exploring Part-Time Work or Side Gigs: Consider part-time employment or side gigs to supplement your income. The additional funds can accelerate debt repayment and boost your overall financial situation.

- Optimizing Pension and Social Security Benefits: Maximize your pension and Social Security benefits. Explore strategies to ensure you receive the full value of these crucial income sources.

- Asset Liquidation or Downsizing for Debt Relief: Explore the possibility of liquidating assets or downsizing. Using these funds for debt repayment can provide immediate relief.

Protecting Retirement Savings

Strategies to Avoid Tapping into Retirement Funds:

- Build an Emergency Fund: Establish a robust emergency fund to cover unexpected expenses, reducing the temptation to dip into retirement savings during financial challenges.

- Implement a Budget: Craft a detailed budget that prioritizes essential needs. Adhering to a well-structured budget can prevent the need to tap into retirement funds for day-to-day expenses.

- Explore Additional Income Streams: Consider alternative sources of income, such as part-time work or side gigs. Supplementing your income can alleviate financial strain and protect your retirement savings.

Legal Protections for Retirement Accounts

Here are key legal protections for retirement accounts in the Philippines:

- Social Security System (SSS): The SSS provides comprehensive social insurance, including retirement benefits, to private sector employees. Contributions from both employees and employers go into a fund that supports various benefits, including retirement pensions.

- Pag-IBIG Fund: The Home Development Mutual Fund, commonly known as Pag-IBIG Fund, offers a provident savings program for its members. This includes a savings component that can be withdrawn upon retirement.

- Government Service Insurance System (GSIS): GSIS caters to the retirement needs of government employees. It offers a pension fund and other benefits, ensuring financial support for public servants in their retirement years.

- Philippine Veterans Bank Retirement Program: Military veterans can benefit from specific retirement programs provided by institutions like the Philippine Veterans Bank. These programs are designed to meet the unique needs of retired servicemen and women.

- Republic Act No. 7641 (Retirement Pay Law): This law mandates private employers to provide retirement pay to eligible employees upon reaching the age of 60 or after at least 5 years of service.

Seeking Professional Advice

Navigating retirement complexities requires professional insight. Financial advisors offer personalized guidance on investment, debt management, and overall financial planning. Consult them when:

- Approaching retirement age

- Experiencing major life changes

- Receiving windfalls or bonuses

- Facing financial challenges

- Planning for long-term care

Role of Debt Counselors

Debt counselors also play a critical role in retirement planning, especially for those grappling with debt-related challenges. Their responsibilities include:

- Assessing and counseling on debt

- Crafting debt repayment strategies

- Assisting with budgeting

- Providing financial education for long-term well-being

Utilizing Retirement Tools

Retirement planning involves utilizing various tools and resources to make informed decisions. These can include:

- Retirement Calculators

- Investment Platforms

- Budgeting Apps

- Educational Materials

- Retirement Planning Workshops

Considering Mental and Emotional Factors in Retirement Planning:

In the realm of retirement planning, acknowledging and addressing mental and emotional aspects is crucial. After all, it's not merely a financial endeavor; it encompasses your overall well-being.

Managing Stress Amidst Retirement Debt:

Confronting debts during retirement can induce stress. However, strategic approaches can be employed to navigate this challenge. It's important to maintain composure and seek effective solutions for a more gratifying retirement experience. Here are some ways you can manage stress while paying off retirement debt:

- Stay Positive: Cultivating optimism is instrumental in the retirement journey. Despite potential hurdles, maintaining a positive outlook contributes significantly to a fulfilling retirement.

- Build Support Networks: Establishing a reliable support system is an integral part of the process. Engaging in open conversations with friends and family and seeking their counsel can provide invaluable support during the complexities of retirement planning.

You Deserve the Best for Your Retirement, Luv!

In essence, debt compromises the very essence of retirement – a time to enjoy the fruits of your labor, pursue passions, and experience life to the fullest. By acknowledging the impact of debt on your retirement goals and savings, you can take proactive steps to eliminate or manage debt, ensuring a more financially secure and fulfilling retirement journey.