We’ve all needed extra cash for emergencies, business expansions, or just to have a solid credit line you can count on for the many items in your cash outflows, and chances are, you’ve thought of talking to at least two lenders in the Philippines. But in this modern age, the concept of a lender is now a lot more complex than just a relative or that person down the road who lets you borrow money.

So if you want to know more about lenders in the Philippines, you’re in the right place, luv! In this comprehensive guide, we'll simplify the world of lending, helping you make informed decisions for your financial well-being.

Table of Contents

What is a Lender?

Let's start with the basics. A lender is an institution or individual that provides funds to borrowers with the expectation of repayment, typically with interest. This financial exchange powers personal goals, business ventures, and more. There are different kinds of lenders in the Philippines out there. But they normally have a standard process for lending money to people and organizations.

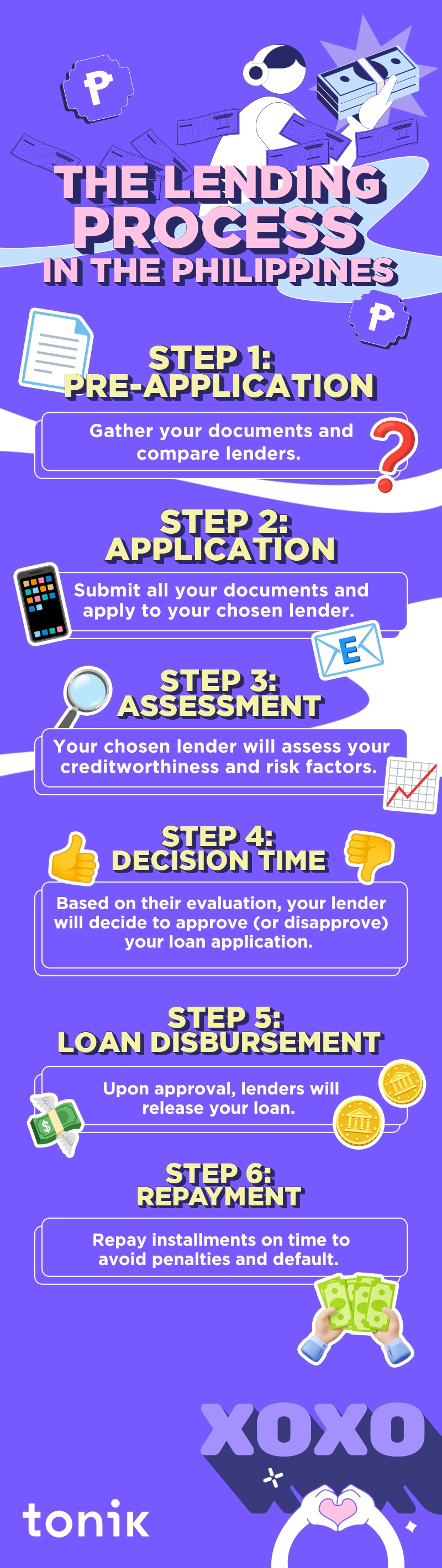

The Lending Process in the Philippines: From Application to Repayment

Understanding the lending process is the first step in making informed financial decisions. Whether you're a first-time borrower or looking to refine your borrowing strategy, this section will guide you through the key steps involved, ensuring you're well-prepared for every stage of your lending journey.

Step 1: Pre-application

As a borrower, your journey begins by gathering the necessary documents that lenders in the Philippines will require. These documents typically include proof of identity, income, employment, residence, and possibly financial statements. Being prepared with these documents will expedite your loan application process.

It's also essential to compare different lenders in the Philippines before applying. Each lender may offer different interest rates, loan terms, and fees. By researching and comparing lenders, you can make an informed choice that aligns with your financial goals.

Step 2: Application - Submission of Documents

Once you've gathered your documents, the next step is submitting your loan application along with these documents. Many lenders in the Philippines offer online application options through their websites or mobile apps, making the process convenient and secure. For in-person applications, ensure that you provide all required documents accurately.

Step 3: Assessment

Lenders in the Philippines, and generally elsewhere will assess your creditworthiness during this phase by reviewing your credit score, financial history, and the documents you've provided. They use established protocols and scoring models to evaluate your application fairly.

Keep in mind that lenders will also consider risk factors. These might include your employment stability, existing debts, and economic conditions that could impact your ability to repay the loan.

Step 4: Decision Time

After their evaluation, lenders will decide whether to approve or disapprove your loan application. If approved, it means they believe in your ability to repay the loan. At this point, lenders will also define the loan terms, including the interest rate, loan amount, repayment schedule, and any associated fees. Make sure you understand and are comfortable with these terms.

If your application is denied, don't be discouraged, luv! Lenders should provide clear reasons and guidance on how to improve your eligibility.

Step 5: Loan Disbursement

Upon loan approval, lenders will efficiently disburse the funds to your designated account or provide you with a check. This is the moment when you gain access to the loan amount for your intended purposes.

Step 6: Repayments

As a borrower, it's crucial to understand your responsibilities during the repayment phase. Lenders in the Philippines expect you to make timely repayments according to the agreed-upon schedule. They often provide options for automated payments and send reminders to help you stay on track.

By familiarizing yourself with these steps in the lending process, you'll be better prepared and empowered to make informed decisions about your loans. Knowledge of the process not only helps you navigate it more effectively but also contributes to your overall financial well-being.

TOCTypes of Lenders in the Philippines

The Philippines offers a diverse landscape of lenders, each with its own advantages and disadvantages. Here, we'll break down the major categories, starting with commercial banks.

1. Commercial Banks

Commercial banks are financial giants that dominate lenders in the Philippines. Here's what you need to know about them:

| Pros | Cons |

|

|

2. Rural and Cooperative Banks

Now, let's explore an alternative option: rural and cooperative banks. Rural and cooperative banks serve specific regions, supporting local development and empowering communities. Here are their pros and cons:

| Pros | Cons |

|

|

3. Microfinance Institutions (MFIs)

Microfinance institutions play a crucial role in promoting entrepreneurship and alleviating poverty in the Philippines. MFIs focus on providing financial services to individuals and small businesses who may not have access to traditional banks. MFIs offer microloans, savings accounts, and financial literacy programs. Here are some of their pros and cons:

| Pros | Cons |

|

|

4. Digital Banks, Online Lenders, and Digital Platforms

In recent years, fintech has transformed the lending landscape in the Philippines. The rise of fintech has made financial services more accessible to Filipinos, revolutionizing the way loans are accessed and managed.

Online lenders offer a quick and convenient way to apply for loans. They leverage technology to streamline the lending process while making it readily available to users via the internet. Know more about them here:

| Pros | Cons |

|

|

Digital banks (like us) offer more than just loans. They typically have everything that a traditional bank has such as savings accounts and time deposits. The biggest difference is that they don’t have physical branches. You can access their final services all through their website or mobile app.

| Pros | Cons |

|

|

5. Peer-to-Peer (P2P) Lenders

P2P lending is another innovative option for borrowers seeking alternative financing. P2P lending platforms connect individual investors with borrowers, eliminating traditional intermediaries like banks. Take a look at some of their pros and cons:

| Pros | Cons |

|

|

6. Informal Lenders

Informal lenders, including "5-6" money lenders, are individuals or groups who provide loans outside the scope of regulated financial institutions. These lenders operate in an unofficial or informal capacity, often within local communities. Find out more about them below:

| Pros | Cons |

|

|

How to Choose the Right Lender

Now that you're familiar with various lending options, it's crucial to know how to choose the right lender for your needs. Selecting the right lender can significantly impact your borrowing experience and financial well-being, luv. In this section, we'll guide you through the process of making an informed choice when it comes to picking a lender.

Factors to Consider

When evaluating potential lenders, it's essential to consider several key factors. These can include:

- Interest Rates: Interest rates can vary significantly between lenders. Lower rates mean you'll pay less over the life of the loan. Compare interest rates from different lenders to find the most competitive option.

- Repayment Terms: Examine the repayment terms offered by each lender. This includes the duration of the loan, the frequency of payments, and any flexibility in case of financial hardship. Choose terms that align with your budget and financial goals.

- Credibility and Reputation: Research the lender's credibility and reputation in the industry. Look for established institutions with a history of reliable service and transparent practices. Customer reviews and ratings can provide valuable insights into a lender's reputation.

- Loan Products: Consider the loan types offered by the lender. Some lenders specialize in specific loan types, such as personal loans, business loans, or mortgages. Ensure that the lender offers the type of loan that suits your needs.

- Fees and Charges: In addition to interest rates, be aware of any additional fees and charges associated with the loan. These can include origination fees, late payment fees, and prepayment penalty. Take note that prepayment penalty is often imposed upon borrowers who pay off their loans ahead of schedule. So be sure to talk to your lender about this, luv!

- Customer Service: Assess the quality of customer service provided by the lender. Will you have easy access to customer support when you have questions or concerns? Responsive and helpful customer service is essential for a positive borrowing experience.

- Loan Approval Criteria: Understand the lender's eligibility criteria. Some lenders have stricter requirements than others. Knowing whether you meet these criteria can save you time and effort in the application process.

Importance of Reading and Understanding Loan Agreements

Once you've chosen a lender, the next critical step is to thoroughly read and understand the loan agreement. Never underestimate the importance of the fine print in loan agreements. Here's why it matters:

- Legal Obligation: The loan agreement is a legally binding contract. By signing it, you agree to specific terms and conditions. Understanding these terms is crucial because you are legally obligated to adhere to them.

- Financial Commitment: The agreement outlines your financial commitment, including the loan amount, interest rate, repayment schedule, and any associated fees. Knowing these details helps you budget effectively and avoid surprises.

- Rights and Responsibilities: The agreement also outlines your rights as a borrower and the lender's responsibilities. Understanding these rights ensures you are treated fairly throughout the loan term.

- Potential Pitfalls: Reading the fine print helps you identify any potential pitfalls, such as hidden fees or onerous clauses. If you have questions or concerns, don't hesitate to seek clarification from the lender before signing.

Consumer Protection: Consumer protection laws play a critical role in safeguarding borrowers by mandating lenders to disclose all key information in a transparent, clear, and understandable manner. This essential requirement is designed to empower you, the consumer, by ensuring you are fully informed about the terms, conditions, and any fees associated with your loan before you agree to it.

A significant part of these protections is underscored by the Consumer Act of the Philippines, which reinforces the rights of consumers to be informed and to make decisions based on complete and accurate information.

By thoroughly reviewing the loan agreement, you can verify that the lender is in compliance with these crucial consumer protection laws. This not only helps in making an informed decision but also provides a recourse in case of disputes. Understanding your rights under the Consumer Act and ensuring lenders' adherence to these regulations is a vital step towards responsible borrowing and financial health.

Tips for Successful Loan Applications

To increase your chances of securing a loan that suits your financial goals and circumstances, consider the following tips:

- Check Your Credit: Review your credit report and credit score before applying for a loan. A good credit score can open doors to better loan terms.

- Shop Around: Don't settle for the first lender you come across. Compare multiple lenders to find the best fit for your needs.

- Prepare Documentation: Gather all necessary documents, including proof of income, identity, and residence, before applying. Having these ready can expedite the application process.

- Borrow Responsibly: Only borrow what you need and can comfortably repay. Avoid taking on excessive debt that could strain your finances.

- Read Carefully: Thoroughly read and understand the loan agreement before signing. If something is unclear, ask for clarification.

- Budget for Repayments: Create a budget that accounts for loan repayments. Ensure that you can make payments comfortably without compromising your other financial obligations.

- Communicate with Lender: If you encounter difficulties making payments, contact your lender promptly. The sooner, the better, hun.

Pick the Best Lender For You

Now that you have a better understanding of the lending landscape in the Philippines, we hope you make a better choice when applying for a loan. Ultimately, the choice is yours to make. The best lender for you would be someone who’s flexible and accessible enough to accommodate your situation and can give you enough funds for your needs.

Most Popular