Have you ever wondered what happens when you're unable to repay a cash loan in the Philippines? If yes, then this is the moment you’ve been waiting for, luv! In this article, we’ll tell you everything you need to know about the process of debt collection in the Philippines.

Understanding the ins and outs of this process is not only crucial for your financial well-being, as taking out a loan is a commitment, but also for protecting your rights as a borrower. So let’s get started, shall we?

Table of Contents

- Understanding Unpaid Cash Loans

- The Impact of Unpaid Cash Loans on Credit Score

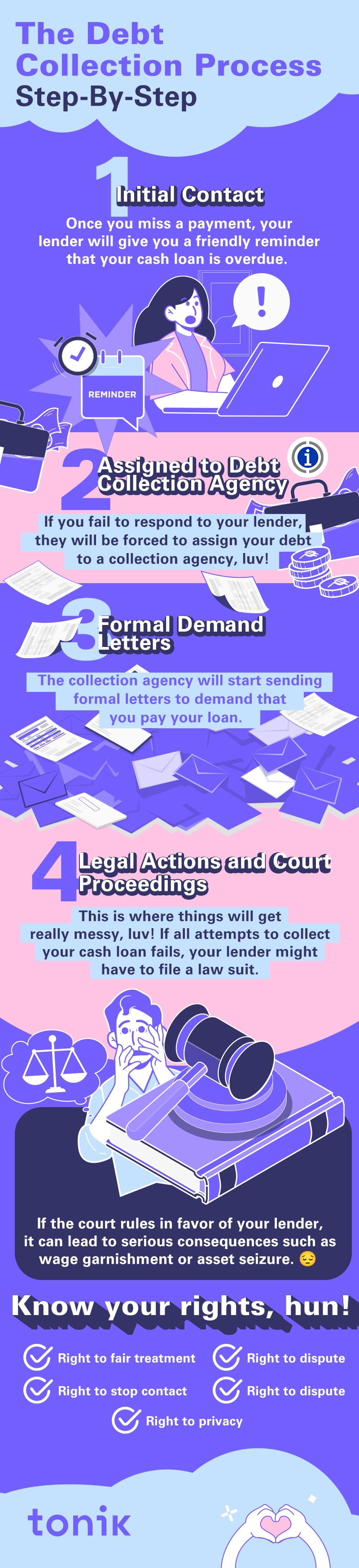

- The Debt Collection Process: Step-by-Step

- The Role of Debt Collection Agencies

- Consumer Rights in Debt Collection

- Legal Implications of Unpaid Cash Loans

- Consequences of a court judgment in favor of the lender

- Prevention and Management of Unpaid Cash Loans

- Conclusion

Understanding Unpaid Cash Loans

Before we get into the nitty-gritty of debt collection, let's define what unpaid cash loans actually are. In simple terms, they refer to loans you've taken from lenders, such as banks or financial institutions, that you haven't been able to repay within the agreed timeframe.

Suggested Read: Understanding Cash Loans in the Philippines: A Comprehensive Introduction

TOCThe Impact of Unpaid Cash Loans on Credit Score

Now, let's take a closer look at how unpaid cash loans can impact your credit score and why it's so important to pay attention to this aspect of your financial life.

Firstly, let's understand what a credit score is. In the Philippines, credit scores are typically generated by credit bureaus based on your credit history and financial behavior. This three-digit number, usually ranging from 300 to 850, provides lenders with a quick assessment of your creditworthiness. The higher your credit score, the more likely you are to be considered a low-risk borrower, making it easier for you to secure loans and obtain favorable interest rates.

Unpaid cash loans can have a detrimental impact on your credit score. Late or missed payments on your loans are recorded on your credit report, indicating a potential risk to lenders. If you consistently fail to make timely payments or default on your cash loans, your credit score will suffer as a result. This negative information can stay on your credit report for several years, making it challenging to obtain future loans or credit. And sometimes, even if you are approved for credit, you may be subject to higher interest rates, which can increase the cost of borrowing over time.

Additionally, a low credit score can impact other aspects of your financial life, such as insurance premiums or rental applications, as some landlords and insurers may check your credit history to assess your reliability.

Rebuilding a damaged credit score takes time and effort. It involves consistently making payments on time, reducing debt, and demonstrating responsible financial behavior.

The Debt Collection Process: Step-by-Step

So, you've found yourself in a situation where you're unable to repay your cash loan in the Philippines. What happens next? Let's take a step-by-step journey through the debt collection process to shed some light on what you can expect.

Step 1: Initial contact and reminders from the lender

Once you miss a payment or fall behind on your loan, the lender will likely reach out to you, luv. This initial contact serves as a friendly reminder that your payment is overdue. They may send you a notification via email, phone call, or even a letter in the mail. The purpose here is to give you an opportunity to address the issue and catch up on your payments.

At this stage, you will also incur late payment fees depending on your loan term.

Step 2: Assignment of debt to a collection department or agency

If you consistently fail to respond or repay your loan on time, your lender may assign your debt to a collection department or agency. This is where things can become a bit more serious, luv. The collection department or agency specializes in debt recovery. They are tasked to recover the unpaid amount on behalf of the lender. This means the collection agency will be the one to talk to you moving forward.

Step 3: Formal demand letters and communications

Once the debt has been assigned to a collection department or agency, you can expect more formal demand letters and communications. These letters will outline the outstanding amount, the consequences of non-payment, and the steps you need to take to resolve the debt. The collection agency will likely contact you through phone calls, letters, and, in some cases, even personal visits to urge you to repay the debt.

Step 4: Legal action and court proceedings, if applicable

This is where things will get really messy, luv! If all attempts to collect the debt fail, the lender or collection agency may decide to take legal action. This is typically the last resort, but it can happen if the debt remains unpaid for an extended period. Legal action can result in court proceedings, where a judgment may be made in favor of the lender. If the court rules in favor of the lender, it can lead to serious consequences, such as wage garnishment or asset seizure.

Do take note that not all cases progress to legal action, as it can be time-consuming and costly for both parties involved. But, it's essential to take debt repayment seriously and explore all possible options to resolve the issue before it reaches this stage.

TOCThe Role of Debt Collection Agencies

Debt collection agencies can sometimes seem like mysterious entities that appear out of nowhere when you're struggling with unpaid cash loans, right? So, let us help you demystify their role and understand how and when they get involved in the debt collection process.

Debt collection agencies are specialized organizations hired by lenders to assist in the recovery of unpaid debts. Think of them as the cavalry that swoops in when the lender decides to outsource the task of debt collection to experts. These agencies have the knowledge, resources, and experience to navigate the often challenging process of debt recovery.

These agencies employ various strategies to communicate with borrowers and encourage repayment. They may contact you through phone calls, letters, or even visit you in person. Their approaches can range from friendly reminders to more assertive efforts to recover the debt. However, it's important to note that debt collectors are bound by specific rules and regulations that govern their conduct.

TOCConsumer Rights in Debt Collection

As a borrower facing debt collection in the Philippines, it's crucial to understand your rights during the process. Philippine law provides certain protections for borrowers to ensure fair treatment and prevent harassment. After all, having unpaid loans doesn’t mean you no longer have rights!

Under Philippine law, you have specific rights when dealing with debt collection. These rights include:

-

✓ The right to fair treatment: Debt collectors must treat borrowers with fairness, respect, and dignity throughout the debt collection process. They definitely cannot engage in abusive, threatening, or harassing behavior.

-

✓ The right to privacy: You have the right to privacy. Debt collectors should not disclose details of the debt or discuss it with third parties. This means they aren’t supposed to talk about your loan with friends, employers, or even your family!

-

✓ The right to dispute: If you think there is an error in the debt amount or other aspects of the debt, you have the right to dispute it. Debt collectors must investigate and provide a response to the dispute within a reasonable timeframe.

-

✓ The right to stop contact: You have the right to request that debt collectors cease communication with you. This can be done by submitting a written request to the debt collector. However, it's important to note that this does not absolve you of your responsibility to repay your cash loan.

Debt collectors have boundaries and limitations defined by Philippine law. Here are three things debt collectors absolutely cannot do:

-

✘ Use abusive, threatening, or offensive language when communicating with you. They are prohibited from engaging in harassment, coercion, or intimidation tactics.

-

✘ Misrepresent themselves or make false statements about the debt. They cannot claim to be the police or mislead you about the legal consequences of non-payment.

-

✘ Publicly shame or disclose details of the debt to third parties, such as friends, family, or employers, except as allowed by law or with your explicit permission.

Understanding these rights and limitations is crucial for borrowers dealing with debt collectors. If you believe that a debt collector has violated your rights or engaged in unfair practices, you have the right to file a complaint with the appropriate regulatory bodies or seek legal assistance to protect your interests.

TOCLegal Implications of Unpaid Cash Loans

When borrowers fail to repay their cash loans, lenders or collection agencies may take certain legal actions to recover the debt. These actions can include:

- Filing a lawsuit: Lenders or collection agencies may choose to file a lawsuit against you to seek a court judgment for your unpaid debt. This is typically a last resort and is pursued when other collection efforts have been unsuccessful.

- Obtaining a court judgment: If the lender or collection agency successfully wins the lawsuit, a court judgment may be issued in their favor. This judgment confirms your obligation to repay the debt and may include additional costs, such as legal fees and interest.

- Garnishment of wages: With a court judgment, the lender or collection agency can seek wage garnishment. This means that a portion of your wages can be withheld by their employer to repay the debt directly.

- Seizure of assets: In some cases, if the debt remains unpaid despite legal actions, the lender or collection agency may seek to seize your assets. This can include properties, vehicles, or other valuable possessions, which may be sold to recover the outstanding debt.

Consequences of a court judgment in favor of the lender

Here’s the thing, luv. You can’t get imprisoned for unpaid debt, there are still some significant consequences when a court rules in favor of your lender. These consequences may include:

-

Damage to credit score: A court judgment will negatively impact your credit score. It will be recorded on their credit report and can make it more challenging to obtain credit in the future or secure favorable interest rates.

-

Continued collection efforts: A court judgment does not automatically guarantee full repayment of the debt. Lenders or collection agencies may continue their collection efforts even after obtaining a judgment, using legal means to enforce the repayment.

-

Legal costs and additional fees: If the court rules in favor of the lender, you may have to pay all legal fees incurred during the proceedings. This means more debt, luv!

It’s important that you understand the potential legal implications of unpaid cash loans. But of course, it’s better if you can address your debt issue before it escalates to legal action, luv. Seek professional help or just talk to your lender to avoid all this trouble.

TOCPrevention and Management of Unpaid Cash Loans

Preventing loan default and effectively managing your cash loans in the Philippines is essential for maintaining financial stability. Let's explore some valuable tips to help you avoid loan default and manage your loans responsibly.

- ✓ Budgeting and financial planning:Create a budget to track your income and expenses. Allocate funds specifically for loan repayments to ensure they are prioritized.

- ✓ Timely communication with lenders: If you anticipate difficulties in repaying your cash loan, it's crucial to communicate with your lender promptly. Contact them as soon as possible to discuss your situation and explore potential solutions.

- ✓ Regular review of loan terms and conditions: Familiarize yourself with the terms and conditions of your loan agreement. Understand the repayment schedule, interest rates, and any penalties or fees associated with late payments.

- ✓ Establish an emergency fund: Building an emergency fund can serve as a financial safety net. Set aside a portion of your income regularly to create a fund that can be used to cover unexpected expenses or temporary financial setbacks. Having this buffer can help prevent the need for relying on additional loans or falling behind on existing ones.

- ✓ Seek financial counseling or advice: If you find yourself struggling with debt or unable to manage your cash loans effectively, consider seeking professional financial counseling. Financial experts can provide guidance on debt management, budgeting, and developing a personalized plan to regain control of your finances.

- ✓ Explore debt consolidation or restructuring options: If you have multiple loans with varying interest rates and repayment terms, consolidating your debts or exploring loan restructuring options may be good for you, luv. This can simplify your repayment process and potentially reduce your overall monthly payments.

TOC

Navigating the world of unpaid cash loans and debt collection can be daunting, luv. But it's essential to understand the implications and your rights as a borrower in the Philippines. Failing to repay cash loans can negatively impact your credit score, making it harder to obtain credit in the future and potentially leading to legal actions. It's crucial to communicate with your lender, explore repayment options, and seek financial advice if needed.

By practicing responsible financial management, budgeting, and timely communication, you can prevent loan default and work towards a healthier financial future. Remember, taking proactive steps today can save you from potential difficulties tomorrow. Stay informed, be proactive, and take control of your financial well-being. We know you can do it!