Unlocking Financial Freedom: A Guide to Loan Restructuring & Loan Refinancing in the Philippines

One of the biggest reasons why some people don’t like taking out loans is getting buried under a mountain of debt. After all, no matter how prepared or organized you may be, you might encounter a sudden financial setback or emergency that could cause you to fall behind on payments. But let me tell you this, luv: you actually have two options that can help you avoid the so-called debt trap. The answer lies in loan restructuring and loan refinancing and in asking how!

In this blog, we’ll take a closer look into the intricacies of loan restructuring and refinancing in the Philippines to ease your worries about taking out a loan.

Table of Contents

- What is Loan Restructuring?

- What is Loan Refinancing?

- Interest Calculation in Loan Restructuring and Refinancing

- The Influence of Risk-Based Pricing on Loan Terms

- Loan Restructuring & Loan Refinancing Eligibility and Criteria

- Restructuring vs. Refinancing

- Navigating the Risks: A Simple Guide to Avoiding Debt Traps

- Conclusion

What is Loan Restructuring?

Loan restructuring or debt restructuring, in essence, is a financial strategy that allows borrowers to adjust the terms of their existing loans to make repayments more manageable. This typically involves modifying interest rates, extending loan tenures, or even temporarily suspending payments in cases of financial crisis.

Common Reasons for Loan Restructuring in the Philippines

Let's break down the common reasons why loan restructuring is so essential in the Philippines, and how it can be your lifeline in tough times.

- Economic Downturns: Imagine the economy slowing down, jobs becoming scarce, and money getting tight. During these instances, many people struggle to pay off their loans. Debt restructuring steps in to help. It lets you change your loan terms to make them more affordable. For example, you can ask for lower interest rates or extend the time to pay back, giving you some breathing room to survive the economic storm.

- Personal Financial Crises: Life can throw all sorts of curveballs your way – like losing your job, sudden family emergencies, or even a global pandemic! When these hit, it's tough to keep up with loan payments. Debt restructuring acts like a financial safety rope. It allows you to temporarily ease your loan burden. You can request a break from payments or extend your loan period until things stabilize.

- Medical Emergencies: Healthcare bills can be a real headache, especially without good medical insurance. When you face a sudden health crisis, the bills can pile up fast. That’s where loan restructuring can come in. It lets you adjust your loan terms to handle these unexpected expenses.

Your Financial Allies: Where to Seek Loan Help in the Philippines

In the Philippines, you have some trusted allies when it comes to loan restructuring and loan refinancing. These include:

- Banks: Banks are like the big players in the lending game. They're your traditional banks, commercial banks, and digital banks, like us. When it comes to loan restructuring and refinancing, we’ve got your back. We offer a wide range of options, from adjusting your interest rates to extending your loan terms. Banks are known for their reliability, making them a top choice for borrowers.

- Credit Cooperatives: Think of credit cooperatives as your friendly neighborhood lending clubs. These are community-based organizations where people pool their money to provide loans to members. Credit cooperatives often offer flexible terms and personalized solutions for loan restructuring and refinancing.

- Government Agencies: The government cares about your financial well-being too. Some government agencies, like SSS and PAG-IBIG, have special programs to assist borrowers facing financial difficulties. These programs often come with favorable terms and conditions. Don't hesitate to reach out to them when you need a helping hand.

Unlocking the Benefits: How Loan Restructuring Saves the Day

- Reduced Monthly Payments: When you’re struggling to make ends meet every month because of high loan payments, loan restructuring can help. It's like finding extra money in your pocket. You can use that cash for groceries, bills, or just breathing easier.

- Lower Interest Rates: High-interest rates can be a real budget buster. Loan restructuring can come to the rescue by lowering those rates. With lower interest rates, you pay less over time, which means more money in your pocket.

- Extended Loan Tenures: Sometimes, you just need more time to repay your loan without feeling the pinch. Loan restructuring can extend your loan period, spreading out the payments over a more extended period. This means you won't have to tighten your belt too much every month.

- Immediate Relief: Loan restructuring eases the pressure and gives you time to get back on your feet.

- Avoiding Loan Default: Defaulting wrecks your creditworthiness and makes future borrowing difficult. Loan restructuring helps you avoid this nightmare. It keeps you on track with manageable payments, ensuring your financial reputation stays intact.

Suggested Read: Mastering Loan Agreements: Your Roadmap to Financial Trust

Behind the Scenes: How Loan Restructuring Impacts Lenders

Wondering what happens to lenders when they offer loan restructuring programs? Don’t worry. Here are two ways such programs impact lenders:

- Temporary Cash Flow Disruptions: When borrowers request loan restructuring, it can create a temporary hiccup in a lender's cash flow. Think of it like a speed bump on the financial highway. Lenders might receive lower payments or must wait a bit longer to recoup their funds. But take note that this is a short-term inconvenience.

- Long-Term Benefits Outweigh Short-Term Challenges: Here's the big picture – lenders understand that helping borrowers regain financial stability is a win-win situation. Yes, there might be some minor cash flow disruptions initially, but in the long run, everyone benefits. When borrowers can manage their loans better, they're more likely to repay them, avoiding defaults. This means lenders ultimately get their money back, and borrowers stay financially afloat.

In simple terms, lenders might face a tiny bump in the road when borrowers opt for loan restructuring, but it's worth it. Helping borrowers get back on their feet ensures a healthier financial future for everyone involved. It's a smart move that keeps the financial ecosystem running smoothly in the Philippines.

What is Loan Refinancing?

Loan refinancing involves replacing an existing loan with a new one, usually from a different lender, with better terms. This can include lower interest rates, extended loan terms, or reduced monthly payments. Refinancing provides borrowers with an opportunity to secure more favorable loan terms than their original agreement.

Loan Refinancing: Your Ticket to Financial Savings

Let's break down the amazing benefits of refinancing your loan in the Philippines.

- Lower Total Loan Cost: Imagine you're shopping, and you find the same item for a lower price. That's what refinancing does for your loan. It secures lower interest rates and better terms, reducing the total cost of your loan.

- Easier Monthly Payments: Loan refinancing can make those payments more manageable. It's like rearranging your monthly expenses so you have more room for other essential things, like groceries, bills, or savings.

- Extended Loan Terms: Sometimes, you need a little more time to repay your loan without feeling the pinch. Refinancing can extend your loan terms, too. With this, you'll have more manageable monthly payments, so you can cover other essential expenses without stress.

When you refinance, you're not just making minor tweaks – you're giving your loan a complete makeover. By securing lower interest rates and extending loan terms, it’s important to understand that refinancing significantly impacts the total cost of your loan.

TOCInterest Calculation in Loan Restructuring and Refinancing

Now that we've unpacked the essentials of loan restructuring and refinancing, let's delve into a critical component that often determines the success of these strategies: interest calculation. Understanding how interest is recalculated in the context of restructuring and refinancing is akin to knowing the fuel efficiency of your car. It directly influences how far your financial decisions will take you and at what cost.

Interest Calculation in Loan Restructuring

When you opt for loan restructuring, your lender recalculates your loan's interest based on the new terms. This could mean adjusting the interest rate, which directly affects your overall payment amount. For instance, if your lender agrees to lower your interest rate as part of the restructuring plan, the interest calculation will reflect this change, potentially reducing your total repayment amount over time. However, if the restructuring extends the loan term, you must understand how this longer period affects the total interest you'll pay. While your monthly payments may decrease, the total interest paid over the extended term could increase.

Interest Calculation in Loan Refinancing

Refinancing introduces a new loan with its own set of terms, including potentially different interest rates. The interest calculation for this new loan will consider the current market rates, your creditworthiness, and other factors at the time of refinancing. Lowering your interest rate through refinancing can significantly reduce the amount of interest you pay over the life of the loan. However, it's essential to consider any fees associated with refinancing, as these can impact the overall savings.

Both restructuring and refinancing offer pathways to more manageable loan terms, but the key to making an informed decision lies in understanding how interest calculation affects each option. By carefully considering the impact of new interest rates and terms on your total loan cost, you can choose the strategy that best aligns with your financial goals and situation.

TOCThe Influence of Risk-Based Pricing on Loan Terms

Before we dive into the nuts and bolts of interest calculation, it’s essential to understand a key factor influencing your loan’s terms: risk-based pricing. This concept plays a pivotal role in determining the conditions under which banks and lenders offer restructuring or refinancing options.

Risk-based pricing is a strategy lenders use to tailor loan terms based on the borrower's risk profile. Factors such as your credit history, income stability, existing debts, and even the economic climate can influence your perceived risk level. Essentially, the higher the risk you pose of not repaying the loan, the less favorable your loan terms might be, including higher interest rates.

This pricing model ensures that lenders manage their risk effectively by adjusting terms to match the borrower's financial health. For borrowers, it highlights the importance of maintaining a good credit score and a stable financial status. Improving your risk profile can lead to better loan terms, whether you’re seeking to restructure or refinance.

Understanding this principle is crucial as you explore loan restructuring and refinancing. It underscores the need for a robust financial foundation and informs your strategies for securing more favorable loan terms. Now, let's move on to how interest is calculated in these scenarios, keeping in mind how risk-based pricing might have already shaped the options available to you.

TOC

Loan Restructuring & Loan Refinancing Eligibility and Criteria

Requirements for Loan Restructuring and Loan Refinancing in the Philippines

Eligibility for loan restructuring and refinancing in the Philippines often depends on one’s financial circumstances. Here are some factors that lenders consider when offering loan restructuring or loan refinancing programs:

- Credit score: Lenders will consider the borrower's credit score to determine their creditworthiness. The higher your credit score, the higher your chances of getting approved for loan restructuring or loan refinancing.

- Payment history: Lenders will also look at the borrower's payment history to determine if they have a history of on-time payments.

- Current financial standing: Lenders will consider your current financial standing to determine if you have the ability to repay the loan.

- Debt-to-income ratio: Lenders will calculate your debt-to-income ratio to determine if you have too much debt relative to their income. If your loans far exceed your capacity to pay, then you might not get approved for loan refinancing or restructuring.

- Collateral: If the loan is secured by collateral, such as a home or car, lenders will consider the value of the collateral to determine the loan amount and interest rate.

- Loan purpose: Lenders may also consider the purpose of the loan, such as whether it is for debt consolidation or home improvement.

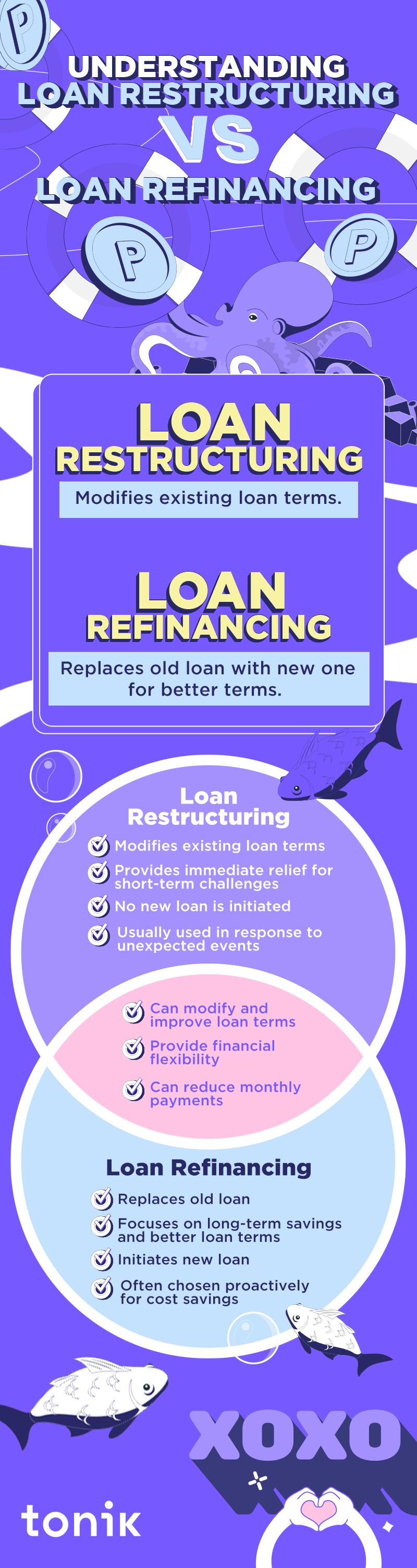

Restructuring vs. Refinancing

Loan restructuring and loan refinancing might sound similar. But in truth, they aren’t exactly the same. Here’s a diagram to illustrate the similarities and differences of loan restructuring and loan refinancing.

Now, let's explore when each option comes to the rescue:

Restructuring: When Life Throws Curveballs

Loan restructuring serves as your financial first-aid kit for unexpected emergencies. It proves invaluable when confronting short-term financial challenges, offering the flexibility needed to adapt to current circumstances and avoid potential financial crises.

Refinancing: For Long-Term Savings and Comfort

Loan refinancing acts as your long-term financial strategist. It's the ideal choice when your goal is to reduce overall loan costs over its lifespan and enhance the comfort of your monthly payments. It's setting the stage for a more financially secure future.

In summary, loan restructuring and refinancing in the Philippines are like to two distinct financial superheroes, each with its unique superpowers. Restructuring provides immediate relief during tough times, while refinancing positions you for long-term financial success with improved terms. Knowing when to call upon each hero equips you with the knowledge needed to make informed financial decisions and attain financial empowerment in the Philippines.

Navigating the Risks: A Simple Guide to Avoiding Debt Traps

Now, let's talk about the possible pitfalls of loan restructuring and refinancing in the Philippines. We'll break it down so you can avoid these financial potholes without breaking a sweat.

- Extending Loan Tenures: Imagine you have a loan, and you decide to extend the time you have to pay it back. Sounds good, right? Well, here's the catch: when you extend the loan term, you might end up paying more interest over time. It's like stretching a rubber band – it becomes longer, but it also gets thinner. So, while your monthly payments may be lower, you're shelling out more money in the long run. It's crucial to weigh the immediate relief against the long-term cost.

- The Risk of Falling into a Debt Cycle: This is the big one, hun. If you're not careful, loan restructuring and refinancing can be like quicksand – they provide temporary relief but can suck you into a cycle of debt. Here's how it happens: you refinance or restructure your loan to make it more manageable, but if you don't change your financial habits, you might end up with even more debt. It's like using a band-aid on a cut without cleaning the wound – it might help temporarily, but the problem lingers. To avoid this trap, you need a clear plan. It's like having a roadmap to get out of the woods. You must use restructuring or refinancing as a stepping stone toward regaining financial stability, not as a crutch for overspending.

Your Path to Financial Empowerment

Loan restructuring and loan refinancing are valuable financial tools that can provide relief and empowerment to borrowers facing economic challenges in the Philippines. These strategies offer the potential for lower interest rates, extended loan terms, and reduced monthly payments, making it easier to navigate financial hardships.

However, it's crucial to approach them with caution. While loan restructuring and refinancing are powerful tools, they come with their own set of risks. Be careful about extending loan terms, as it can cost you more in the long run. And always, always be vigilant about the risk of falling into a cycle of debt.

With the right information and a clear financial plan, you can use loan restructuring and refinancing to regain control of your financial future and achieve lasting financial freedom.