Are you tired of feeling powerless and vulnerable when it comes to securing cash loans in the Philippines? Do you find yourself trapped in unfavorable loan terms, paying exorbitant interest rates, and burdened with excessive fees? If so, it's high time to break free from all of this, luv!

In this comprehensive guide, we will dive deep into the world of negotiating cash loan terms, equipping you with the knowledge, strategies, and confidence to take control of your financial destiny. So, fasten your seatbelt luvs and get ready to unlock the secrets of securing better loan terms that can pave the way to a brighter financial future.

Table of Contents

Understanding Cash Loan Terms

Before we jump into negotiation techniques, let's first get familiar with the key terms associated with cash loans. These terms hold the key to understanding the true cost and impact of your loan.

-

Interest Rates: Interest rates are the percentage of the cash loan amount that you will be charged for borrowing the money. This is essentially the cost of borrowing, luv. A higher interest rate means you'll end up paying more in interest over the loan term, resulting in a higher total cost. Conversely, a lower interest rate can significantly reduce the overall cost of the loan.

-

Loan Tenure: Loan tenure refers to the duration of the loan, or how long you have to repay it. The longer the tenure, the more time you'll have to distribute your repayments, potentially resulting in lower monthly installments. But here’s the thing, luv: A longer tenure also means paying more in interest over time, increasing the total cost of the loan. On the other hand, a shorter tenure may have higher monthly payments but can save you money in the long run.

-

Fees: Cash loans often come with various fees, such as processing fees, late payment fees, and prepayment fees. These fees can significantly impact the overall cost of your loan.

-

Penalties: Penalties are charges imposed when you fail to meet certain cash loan obligations. They can include late payment penalties, bounced check penalties, or penalties for early loan repayment. Penalties can quickly add up and inflate the total cost of your loan. So be sure to pay your cash loan on time!

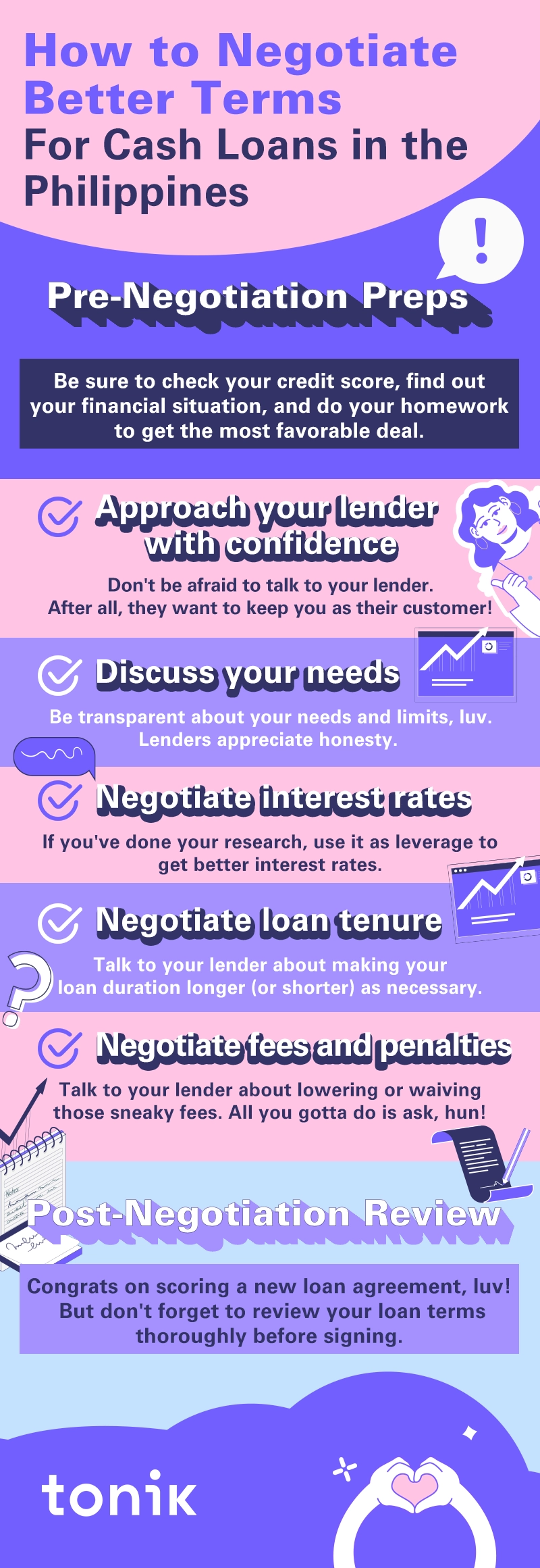

Preparation Before Negotiation

Negotiation is all about preparation, luv! To set yourself up for success, here are three things you need to do before diving into negotiations.

- Take a good look at your credit history and credit score. Lenders love borrowers with a solid credit track record, so ensure yours is in good shape.

- Get a clear picture of your financial situation. What's your income? What are your monthly expenses? Understanding your capacity to repay will help you craft a realistic negotiation strategy.

- Don't forget to do your homework, hun! Research market rates and terms for similar loans, so you know what's fair and reasonable.

Effective Negotiation Strategies

Now that you're armed with knowledge and preparation, it's time to get down to business and negotiate those loan terms. Here are some tried-and-true strategies to help you make a compelling case:

-

✓ Approach your lender with confidence: Don’t be afraid to start a dialogue with your lender, expressing your desire to negotiate terms. Remember, they want to keep you as a customer, so they may be more willing to work with you than you think.

-

✓ Discuss your needs and financial situation: Be transparent about your needs and limitations. Share your financial situation, emphasizing your commitment to repay the loan. Lenders appreciate honesty and may be more inclined to offer better terms if they see you're serious about meeting your obligations.

-

✓ Negotiate interest rates: Interest rates can make or break your loan. If you've done your research and found lower rates elsewhere, use that as leverage to negotiate a better rate.

-

✓ Negotiate loan tenure: The loan tenure affects the duration of your repayment and the monthly installments. If you need more time to repay or prefer shorter cash loan tenure, discuss it with your lender. Find a balance that suits your financial situation while keeping the total cost manageable.

-

✓ Negotiate fees and penalties: Those sneaky fees and penalties can add up quickly, luv. Negotiate for lower fees or ask for certain penalties to be waived. It’s possible, hun. You just have to ask.

The Role of a Loan Officer or Broker

Feeling overwhelmed by the negotiation process? Consider enlisting the help of a loan officer or broker. These professionals are experts in the lending industry and can guide you through the negotiation process. Here are three good reasons why it might be best to get a loan officer’s help to negotiate your cash loan:

Reason #1: They have access to exclusive offers

Due to their relationships with lenders, loan officers and brokers may have access to exclusive offers or preferential terms that may not be readily available to individual borrowers like you. Leveraging their connections, they can present you with opportunities to secure more advantageous loan terms that you may not have been able to access on your own.

Reason #2: They can provide you with industry insights

The lending landscape is constantly evolving, with interest rates, fees, and loan products subject to change. Loan officers and brokers stay abreast of these changes and possess up-to-date knowledge of market trends. By working with them, you gain access to their insights, ensuring that you are well-informed about the current lending environment and can make informed decisions when negotiating your loan terms.

Reason #3: They are expert negotiators

Loan officers and brokers possess exceptional negotiation skills honed through their experience in the industry. They understand the dynamics of loan negotiations, know how to leverage their relationships with lenders, and have a track record of securing favorable terms for their clients. By entrusting them with your loan negotiation, you benefit from their expertise and increase your chances of obtaining more favorable loan terms.

If you don’t have time or you simply don’t have the confidence to negotiate your cash loan terms, then you’re going to be better off getting help from loan officers or brokers.

TOCPost-Negotiation: Reviewing the Loan Agreement

If you’ve reached this point then let us be the first to congratulate you, luv! We know it’s not easy to get better cash loan terms with your lender. But before celebrating, it's crucial to understand the importance of thoroughly reviewing and comprehending the loan agreement before affixing your signature. Why? Because a loan agreement is a legally binding contract that outlines the terms and conditions of your borrowing arrangement.

By carefully reviewing the agreement, you ensure that you fully understand your rights and responsibilities as a borrower. Failing to grasp crucial details could result in unforeseen financial and legal consequences or potential disputes in the future.

Here are key points to consider when reviewing your loan agreement:

-

Interest Rates and Charges: Examine the loan agreement to understand the precise interest rate applied to your loan, whether it is fixed or variable interest rate, and how it will affect your overall repayment amount. Take note that when your interest rate is fixed, it doesn’t change during the entire loan term. Meanwhile, with a variable interest rate, your rate changes depending on prevailing market conditions.

Additionally, be attentive to any additional charges or fees associated with your cash loan. Understanding these financial implications helps you assess the true cost of borrowing and make informed financial decisions.

-

Repayment Terms and Schedule: Review the repayment terms outlined in the agreement, including the duration of the loan, the frequency of payments, and the due dates. Ensure that these terms align with your financial capabilities and that you can comfortably meet the repayment obligations without straining your budget. Pay attention to any provisions related to early repayment or loan refinancing, as they may impact your repayment strategy.

-

Collateral or Security Requirements: If your loan is secured by collateral, carefully examine the agreement to understand the details of the collateral requirements, including its valuation, maintenance responsibilities, and potential consequences in case of default. Understanding the collateral terms is essential to protect your assets and comprehend the risks involved in the borrowing arrangement.

-

Dispute Resolution and Default Provisions: Loan agreements often include provisions for dispute resolution and outline the consequences of defaulting on the loan. Take the time to understand the steps involved in resolving potential disputes and familiarize yourself with the penalties or legal actions that may be taken in case of default. Being aware of these provisions helps you anticipate and mitigate potential risks.

-

Prepayment Penalty and Early Termination Fee: If you anticipate the possibility of repaying the loan before the agreed-upon term, review the agreement for any prepayment penalty or early termination provisions. Understand any fees or penalties associated with early repayment and assess whether such provisions align with your financial goals and flexibility requirements.

Suggested Post: The Process of Debt Collection for Unpaid Cash Loans in the Philippines

TOCAlternatives to Negotiation

If negotiation isn't yielding the desired results, don't lose hope. luv! There are alternatives you can explore. These include:

-

Refinancing options: Consider refinancing your cash loan with another lending firm offering better terms. This can help you secure a lower interest rate or more favorable conditions.

-

Debt consolidation loans: If you have multiple cash loans with varying terms and interest rates, consolidating them into a single loan can simplify your finances and potentially reduce your overall cost.

Debt Restructuring Options In the event that negotiation efforts fall short or you find yourself on the verge of insolvency, debt restructuring emerges as a critical strategy for regaining financial stability. This process involves renegotiating the terms of your existing loans with your creditors to achieve more manageable repayment conditions. It can be an essential step for individuals facing financial distress, offering a lifeline to those struggling with high interest rates, onerous fees, and challenging repayment schedules.

Debt restructuring can involve various adjustments, including but not limited to extending the loan tenure, reducing the interest rate, and sometimes even decreasing the principal amount owed. The goal is to lower the monthly payment to a level that is sustainable for the borrower, thereby preventing default and the potential long-term damage to one’s credit score.

TOC

Negotiation is a powerful tool that can unlock better terms for your cash loans in the Philippines. By understanding loan terms, preparing diligently, and employing effective negotiation strategies, you can take control of your financial journey, luv. Remember, it's not about luck; it's about knowledge, confidence, and communication. So go forth, negotiate like a pro, and pave the way to financial success. Your wallet will thank you!