Me: Financing my lifestyle is made so much easier through my access to various credit accounts!

Also me: But I have to make sure I’m managing my credit accounts well.

You might not be aware of it, but you may already be using various credit accounts for your finances, which makes all sorts of finances convenient, or so we think!

Understanding credit accounts is essential for anyone looking to build a solid financial foundation. These accounts not only facilitate purchases and investments but are also crucial tools for establishing and enhancing your credit history.

So where do you start? How do you become a master of credit accounts? Before your journey to building good credit begins, take the time to read this blog and become a master of credit accounts!

Table of Contents

TOC

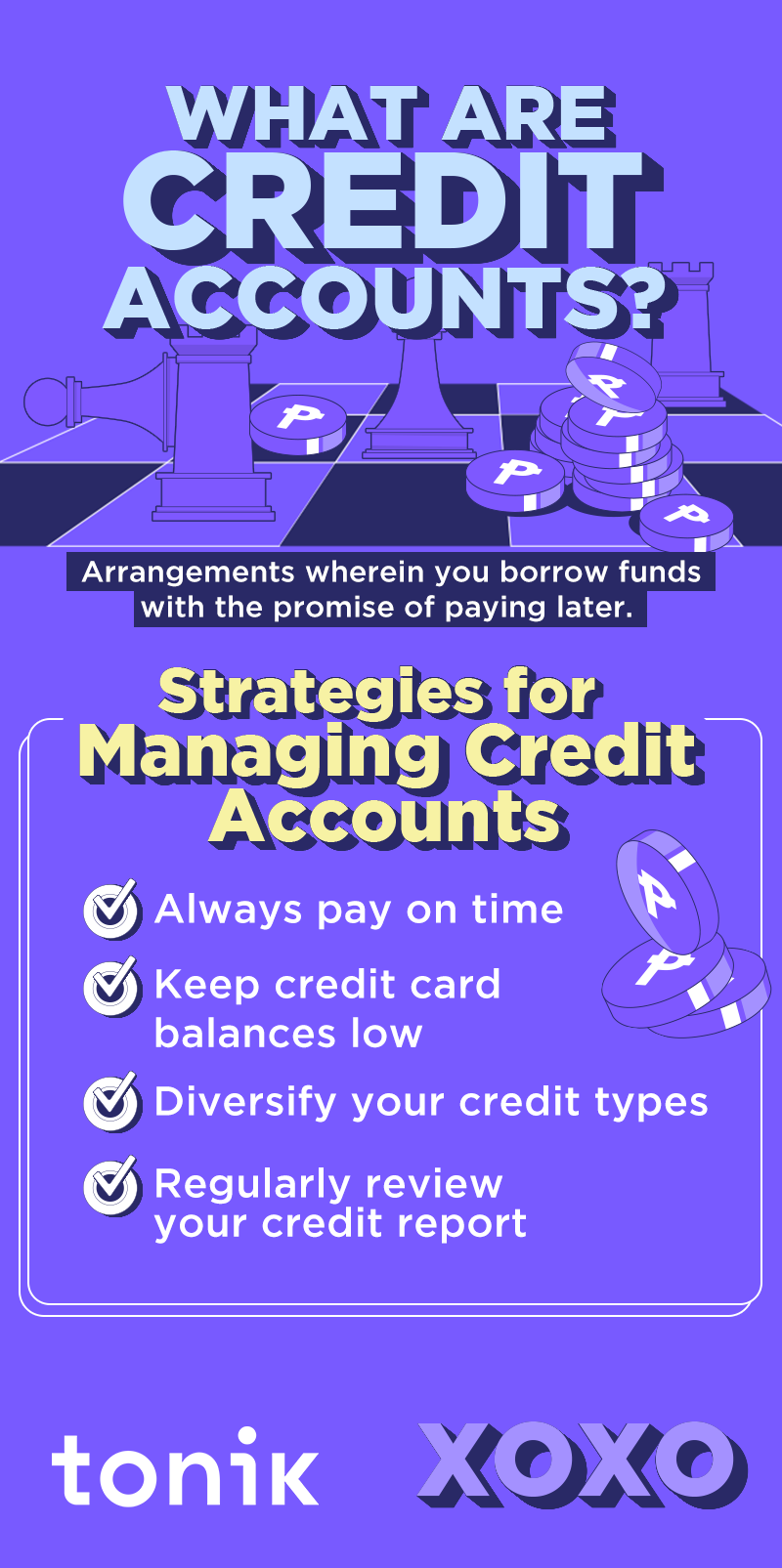

What Are Credit Accounts?

Credit accounts are arrangements wherein you borrow funds or access goods and services under the agreement that the borrower will pay them back. These include everything from credit cards to loans.

The Role of Credit Accounts in Your Credit Score

Credit accounts directly influence your credit score through payment history, debt levels, and the diversity of credit, known as credit mix. Effectively managing these accounts is key to maintaining and improving your creditworthiness. If you’d like to know how to check your credit score, read our blog here.

TOC

Types of Credit Accounts

Let's look at the various types of credit accounts that can impact your financial health:

- Credit Builders

- Credit Cards

- Personal Loans

- Auto Loans

- Mortgages

Some of them you probably already know or have, while some might be completely new to you. Don’t worry, luv, let’s go each one of them together!

TOC

Credit Cards

How they work: Credit cards provide you with a line of credit that you can use repeatedly for purchases, cash advances, and balance transfers, up to a specified limit.

Secured vs. Unsecured Credit Cards: Secured credit cards require a security deposit which typically sets the credit limit. Unsecured credit cards, on the other hand, do not require a deposit, and the limit is based on your creditworthiness.

Impact on Credit Health: Responsible usage, including timely payments and keeping balances low, boosts your credit score, while missed payments can cause significant damage.

TOC

Personal Loans

How they work: Personal loans are typically installment loans with fixed interest rates and monthly payments over a predetermined period.

Secured vs. Unsecured Personal Loans: Secured loans are backed by collateral, which is a piece of property (can be a house, a vehicle, etc.) which the lender can claim if you default. Meanwhile, unsecured loans are given largely based on creditworthiness, without requiring collateral.

Impact on Credit Health: Effectively managing personal loans by making consistent, on-time payments can significantly enhance your credit profile. Make sure to be a responsible borrower to keep that credit score up!

TOC

Auto Loans

How they work: Auto loans are secured by the vehicle you purchase, which means the lender can repossess the vehicle if payments are not made as agreed.

Its Role in Credit Building: Regularly paying your auto loan on time can positively impact your credit score, demonstrating financial reliability to potential lenders.

TOC

Mortgages

The Process of Obtaining a Mortgage: Getting a mortgage involves a detailed credit check, proof of income, and often a down payment. It's typically the largest debt most consumers will take on.

Its Long-Term Impact on Credit: Mortgages can greatly improve your credit score over time if managed properly, thanks to the significant loan amount and extended repayment period.

TOC

Strategies for Managing Credit Accounts

Here are some quick tips for using and balancing various credit accounts:

- Always pay on time

- Keep credit card balances low

- Diversify your credit types

- Regularly review your credit report

PRO TIP: Optimize your credit cards. Choose the best credit card providers that offer the best features and promotions that best suit you and cut the rest to ensure you are able to manage credit card debt and repayments.

TOC

Become the Master of Your Financial Fate

Achieving optimal credit health is crucial for a safe and secure financial future. In order to do that, you’re going to have to be the master of managing different types of credit accounts. And you know a great place to start your loan journey and built credit? With the Tonik Credit Builder Loan, of course! You can get approved within just two days.

It may seem intimidating now, luv, but don’t worry. Just have this blog handy to understand how each account affects your credit score. Learn the best practices and tips by heart, and stay financially responsible. You’ll be a credit accounts guru in no time!