Quick Take: What are the best online loans with monthly payments in the Philippines?

These days, luv, personal loans with monthly installment options are easier to get than ever—thanks to the rise of online lenders in the Philippines! Whether it’s for emergency expenses or a little extra cushion for life’s big purchases, you can now borrow anywhere from PHP 5,000 to PHP 100,000, with flexible repayment terms that usually range from 3 to 24 months depending on your chosen lender and eligibility.

But if you’re after a loan that’s not just easy but also smart, Tonik Bank’s Credit Builder Loan is a total standout. Fully regulated by the BSP and available right inside the Tonik App, this digital loan comes with fixed monthly payments, flexible terms, and a super simple application process. Just 1 valid ID and a Tonik account—no complicated paperwork, no stressful credit score checks.

Plus, Tonik reports your repayments to credit bureaus, meaning you’re not just managing payments—you’re actively working to build or improve your credit history too. Convenient, affordable, and future-friendly? That’s a triple win!

Quick and flexible financial options are key to solving the ever-evolving needs of Filipino families. This includes unexpected medical bills, day-to-day expenses, home improvement plans, maybe even existing debts that need to be consolidated.

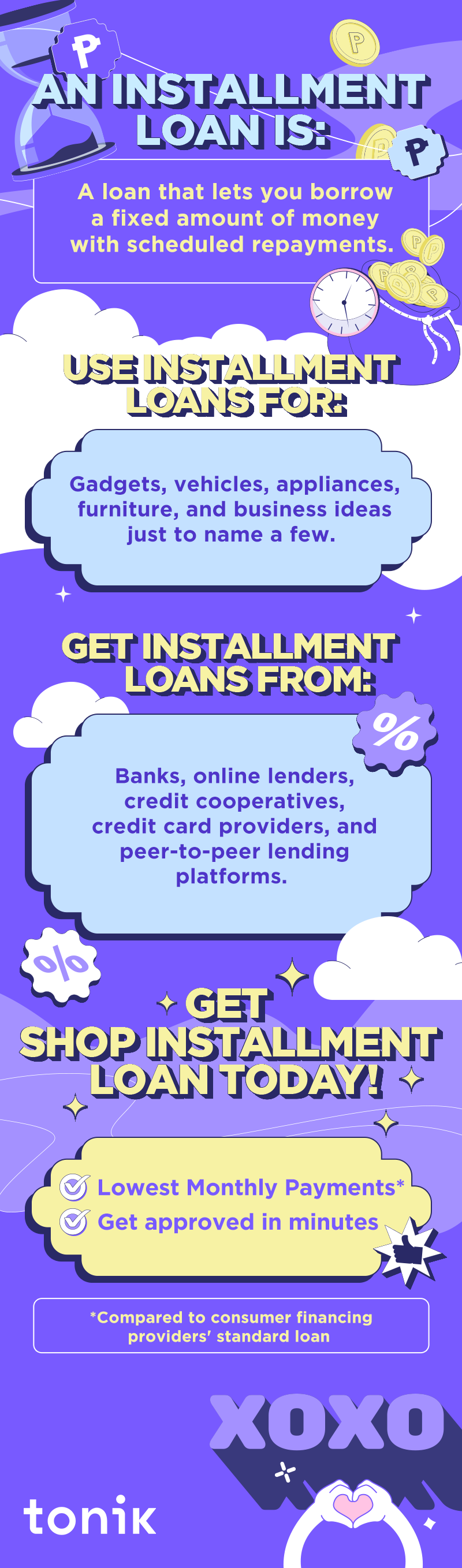

One such option is the installment loan, a financial solution that’s been growing in popularity as of late because of how easy-to-use and accessible it is. In this blog, we’ll guide you through the different types, purposes, loan providers, and the various interest rates available in the Philippines.

Get ready, luv – here's everything you need to know about installment loans!

Table of Contents

TOC

Types of Installment Loans

Let’s start off with the different types of installment loans. Check out each one below and learn about their specific purposes!

- Personal Installment Loans –They can be used for various purposes like debt consolidation, medical expenses, or home improvements. They typically offer fixed monthly payments and competitive interest rates. Plus, unsecured personal loans don’t require collateral, making it easier for you to apply!

- Auto Loans - As the name suggests, these loans are for purchasing new vehicles, allowing you to spread the cost over several months or years. They often come with lower interest rates compared to other loan types.

- Home Renovation Loans - This type of loan can provide the funds needed for your home remodeling project. It's an excellent choice for homeowners looking to enhance their living spaces.

- Education Loans - These can help cover educational expenses like tuition fees and books. They often offer favorable terms and repayment options for students and their families.

- Business Installment Loans – Got a business idea? You can benefit from business installment loans to finance startup costs, purchase equipment, or expand your ventures. These loans are typically tailored for small and medium-sized enterprises (SMEs).

- Emergency Loans - These loans provide quick access to funds. They are designed to help you bridge the gap until your next paycheck or until you resolve urgent financial crises.

- Appliance and Gadget Loans – This type is for those looking to upgrade their home appliances or electronics. They’re a convenient way to make these purchases and pay for them gradually.

- Buy Now Pay Later Apps - These apps allow you to make immediate purchases and pay for them in installments, often with zero or low-interest rates. They have gained popularity for online shopping and retail purchases. Interested? We bet you are! Try out the Tonik Shop Installment Loan to get any appliance you need with flexible terms. It’s the perfect example of a Pay Later method for an easy product loan.

- Credit Card Installments - Credit cards often offer the option to convert larger purchases into manageable monthly installments. This can help you spread the cost and avoid high credit card interest rates.

TOC

What Can I Use an Installment Loan For?

There are many ways that you can use an installment loan. One of them is for gadgets and electronics. You can stay up-to-date with the latest tech trends without breaking the bank all at once.

Another is for online purchases so you can shop with convenience and financial ease. That doesn't end with items like clothing and accessories, but for travel bookings as well.

Are your bills and expenses getting you down? Installment loans can help as financial cushions so you can cover medical bills, emergency repairs, and other unforeseen costs for the time being.

Lastly, installment loans can also help you with large purchases such as furniture and appliances. Tonik Shop Installment Loan is perfect for this very purpose as it’s currently available in select partner stores in Metro Manila and nearby provinces. We have the lowest monthly installments (compared to consumer financing providers' standard loan) and you can get approved in minutes!

TOC

Where to Get Installment Loans in the Philippines

Just like the types, there are different places where you can get an installment loan in the Philippines. Learn about them below so you can choose the one that best suits your needs!

- Banks - Traditional banks in the Philippines offer a wide range of installment loan products, including personal loans, auto loans, and home renovation loans. You can get them from neobanks too, like Tonik! Just make sure the bank is legit, and you’re good to go.

- Online Lenders - Many reputable online lenders in the Philippines offer installment loans with quick approval processes. You can apply from the comfort of your home, and funds are often disbursed directly to your bank account. Quick tip here: do your research to ensure that your online lender of choice is indeed licensed by the DTI or the SEC.

- Credit Cooperatives - Also known as "co-ops," these are member-based organizations that offer financial services, including installment loans, to their members. These institutions focus on community and often provide competitive rates.

- Credit Card Providers – Here's where you can get those credit card installments we’ve talked about. If you have a credit card, you can inquire about converting large purchases into installment payments.

- Peer-to-Peer Lending Platforms - Peer-to-peer lending platforms connect individual borrowers with lenders, cutting out traditional financial intermediaries. They may offer installment loans with competitive terms, but it's essential to research and choose a reputable platform.

TOC

How Much are the Interest Rates for Installment Loans in the Philippines?

Interest rates for installment loans can fluctuate over time, so make sure to do plenty of research and compare before committing to one.

Pro-tip: aim for the lowest rate possible. A lower interest rate can save you money in the long run and make your loan more affordable.

So, whether you're looking for a personal loan or any other type of installment loan, do your due diligence, and choose the option that best fits your financial needs and budget.

TOC

How to Apply for Tonik’s Shop Installment Loan?

Are you convinced that an installment loan is for you? Then look no further than your neobanking lover, Tonik Digital Bank!

Our Tonik Shop Installment Loan makes in-store shopping better than ever. As mentioned, we have the lowest monthly payments compared to consumer financing providers' standard loans, and you can get approved within minutes.

If this will be your first time applying for a loan, don’t worry. Just visit one of our partner stores, and our Purple Pros will be there to help. They’re the kind folks wearing purple, you won’t miss them!

Ready to get a Shop Installment Loan, luv? Download the Tonik App below and see you at your nearest partner store today!