Cash loans play a crucial role in the lives of many Filipinos, providing financial assistance when it's needed the most. Whether you're facing an unexpected medical expense, planning a dream vacation, or need some extra cash to cover your monthly bills, cash loans can be a reliable solution.

In this comprehensive guide, we will explore everything you need to know about cash loans, from understanding the different types of loans to managing repayments and maintaining a good credit score.

Table of Contents

- What is a Cash Loan?

- Types of Cash Loans in the Philippines

- Eligibility Criteria for Cash Loans in the Philippines

- The Benefit of Having a Co-Signer

- How to Apply for a Cash Loan

- Choosing the Right Cash Loan

- Popular cash loan providers in the Philippines

- Understanding Interest Rates and Fees for Cash Loans in the Philippines

- The Impact of Cash Loans on Credit Score

- The Importance of Maintaining a Good Credit Score in the Philippines

- Managing and Repaying Your Cash Loan

- Legalities of Cash Loans in the Philippines

- Alternatives to Cash Loans

- Tips for Negotiating Lower Interest Rates on Cash Loans

- How to Improve Your Chances of Approval for a Cash Loan

What is a Cash Loan?

Before we dive into the details, let's start with a brief explanation of what cash loans are. In simple terms, a cash loan is a borrowing arrangement where a lender provides you with a specific amount of money that you repay over time, typically with interest. These loans are designed to be accessible and flexible, offering a quick solution for your financial needs.

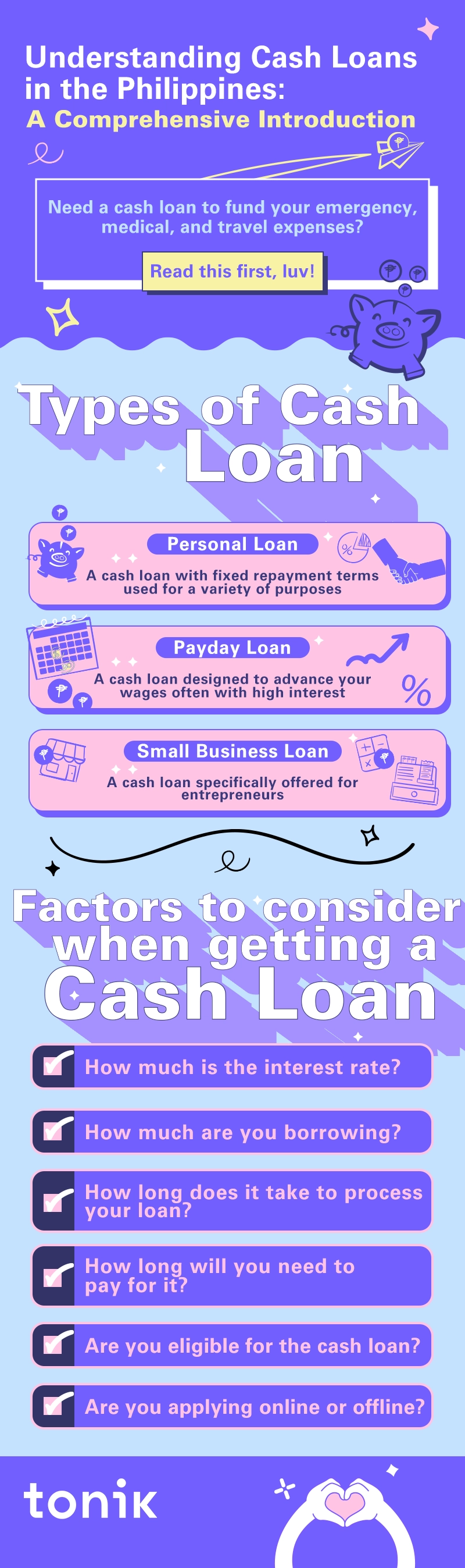

Types of Cash Loans in the Philippines

- Personal Loan: These cash loans are often offered by banks and other financial institutions. They can serve a variety of purposes such as home renovations, debt consolidation, or medical expenses. Loan amounts range from thousands to hundreds of thousands of pesos, with fixed repayment terms

- Payday Loan: Payday loans are cash loans designed to advance your wages. These are usually used when there are unexpected expenses that you need to cover before your next cutoff. However, they are often considered predatory debt because most of them have short repayment terms and high interest rates.

- Small Business Loan: These types of cash loans are specifically offered to those who want to start a small business or need extra cash for their business expansion plans.

Eligibility Criteria for Cash Loans in the Philippines

When applying for a cash loan in the Philippines, there are common eligibility criteria that lenders typically require. While specific requirements may vary among different lenders, here are some common criteria you should be prepared to meet:

-

Age: Borrowers are typically required to be at least 21 years old. Some lenders may have varied minimum age requirements, such as 18, 23, or 25 years old.

-

Citizenship and Residency: Philippine lenders usually require borrowers to be Filipino citizens to be eligible for a cash loan. You may be asked to provide proof of citizenship or residency, such as a valid government-issued ID or a residence certificate.

-

Employment or Income Stability: To ensure that you have the means to repay the loan, lenders often require proof of a stable source of income. You may be asked to provide documents such as payslips, employment contracts, or income tax returns.

-

Minimum Income: Most lenders set a minimum income requirement to assess your repayment capacity. This can vary depending on the bank and the loan amount you're applying for.

-

Credit History: While some lenders may be more lenient with credit history, most reputable institutions consider this an important factor. So be sure your credit history is good before applying for a cash loan, luv!

-

Valid Identification Documents: You will need to provide valid identification documents to verify your identity. This can include a government-issued ID, such as a driver's license, passport, or Social Security System (SSS) ID. Make sure the identification documents you submit are current and not expired.

The Benefit of Having a Co-Signer

Securing a cash loan in the Philippines can be smoother with a co-signer. This is someone who agrees to back your loan application, promising to pay if you can’t, thereby enhancing your chances of approval and possibly earning you better loan terms. Ideal co-signers have a robust credit history and a reliable income, often being close family or trusted friends.

Opting for a co-signer can be a strategic move, especially for those with limited credit history, aiming for loans with favorable conditions. Remember, this choice involves significant financial trust and responsibility. So be sure to choose someone you actually trust.

TOC

How to Apply for a Cash Loan

Are you ready to unlock the secrets of applying for a cash loan in the Philippines? Let's walk through the step-by-step process and explore the options of online and offline applications.

Step 1: Plan Your Approach

Before diving into the world of cash loan applications, it’s essential to get ready, luv. Take some time to research different lenders and compare their terms, interest rates, and repayment options. This way, you’ll be equipped with the knowledge to make an informed decision.

Step 2: Gather Your Documents

To make a successful loan application, gather the necessary documents, like valid IDs and proof of income. Having these documents ready will help streamline the application process.

Step 3: Choose your Lender (Offline vs Online Approach)

Now comes the decision-making time: online or offline application? With online loans, you can conveniently submit your information and upload documents through the lender's website or mobile app. It saves you time and allows for a smoother process.

On the other hand, if you prefer a more traditional approach, you can visit your bank’s physical branch, interact with their staff, and submit your documents in person. The choice depends on your preferences and convenience.

TOCChoosing the Right Cash Loan

Factors to consider when choosing a cash loan

When choosing a cash loan in the Philippines, there are several factors to consider to ensure you make the right decision for your financial needs. Here are some key factors to keep in mind:

-

Interest Rates: Interest rates play a significant role in determining the total cost of your loan. Compare the interest rates offered by different lenders to find the most competitive option. Lower interest rates can save you money in the long run. But be mindful of any additional fees or charges associated with the loan, hun!

-

Loan Amount: Assess your financial needs and determine the appropriate loan amount. Some lenders may have minimum and maximum loan limits, so choose a lender that can accommodate your desired loan amount.

-

Repayment Terms: Consider the repayment terms offered by different lenders. Look at the duration of the loan and the frequency of repayments. Longer repayment terms may result in lower monthly payments but may also mean paying more in interest over time.

-

Eligibility Criteria: Review the eligibility requirements set by the lenders. Ensure that you meet the minimum age, income, and credit score requirements to increase your chances of getting approved!

-

Loan Processing Time: If you need funds urgently, consider the loan processing time of different lenders. Some lenders offer quick approvals and disburse funds within a short period, while others may have a longer processing time. Assess your urgency and choose a lender that can meet your time requirements.

Popular cash loan providers in the Philippines

![]()

When it comes to cash loans in the Philippines, it's important to choose reputable lenders who prioritize transparency, fair practices, and customer satisfaction. While there are numerous lenders in the market, here are a few reputable cash loan providers in the country:

- Traditional Banks: Traditional banks are banks regulated by the Bangko Sentral ng Pilipinas that have brick and mortar branches. The downside? Because of their processes, it usually takes them a while to disburse cash loans and they’re pretty selective with their clientele, too.

- Digital Banks: Digital banks are another type of banks regulated by the BSP. There are only 7 licensed digital banks in the country (us included). Digital banks offer banking transactions purely online, making them a more convenient choice for getting a cash loan.

- Online Lending Platforms: Digital banks aren’t the only ones who can offer cash loans online. There are also online lending platforms that have a wide range of loan products for Filipinos. Just be sure you’re applying to a reputable lender to avoid scams.

- Cooperatives and Credit Unions: Cooperatives and credit unions are community-based financial institutions that also cash loans. These institutions often prioritize the welfare of their members and operate with fair and reasonable terms.

Understanding Interest Rates and Fees for Cash Loans in the Philippines

Interest Rates: The Crucial Numbers

Interest rates determine how much you’ll be paying on top of the borrowed amount. In the Philippines, interest rates for cash loans can vary depending on several factors, such as the lender, loan amount, repayment term, and your creditworthiness.

Generally, you can either have a fixed or a variable interest rate. Fixed rates remain the same throughout the loan term, providing stability and predictability in your monthly payments. Having a variable interest rate, on the other hand, means your interest rate may change over time based on prevailing market conditions. It’s important to understand the terms and conditions of the loan to determine which type of interest rate suits your financial goals, luv!

Fees and Charges: The Extra Costs

Beyond interest rates, there are other fees and charges that can sneak their way into cash loans. These additional costs can impact the overall affordability of the loan. Here are some common fees and charges you might encounter:

-

Processing Fee: This fee covers the administrative costs associated with processing your loan application. It is usually a percentage of the loan amount and is charged upfront.

-

Late Payment Fee: Missed a payment? That’s not good! Late payment fees are charged when you fail to make your loan repayments on time. They serve as a reminder to stick to your repayment schedule.

-

Prepayment Penalty: If you're eager to repay your loan ahead of schedule, be aware that some lenders impose prepayment penalties, hun! It's always good to check the terms and conditions regarding prepayment penalties before committing to a loan.

-

Insurance Premium: Certain lenders may require you to have insurance coverage for your loan. This premium helps protect you and the lender in case of unforeseen circumstances, such as disability, death, or loss of income.

The Impact of Cash Loans on Credit Score

Taking out a cash loan is just like doing any other financial transaction that gets recorded. Yes, hun, your cash loan becomes part of your credit history, which shows your borrowing and repayment activities. How you manage your loan can have both positive and negative impacts on your credit score.

Here's how it works:

1. Payment History

Your payment history plays a significant role in your credit score. Making timely loan payments demonstrates responsible borrowing behavior and can improve your credit score. On the flip side, late or missed payments can lower your score and raise red flags for future lenders.

2. Credit Utilization

Cash loans can affect your credit utilization ratio, which is the percentage of your available credit that you're currently using. If you have a high loan balance in proportion to your credit limit, it may indicate a higher risk to lenders and potentially lower your credit score. It's best to keep your credit utilization ratio low to maintain a healthy credit score.

3. Credit Mix

Having a diverse credit mix, including both installment loans (like cash loans) and revolving credit (like credit cards), can positively impact your credit score. It shows that you can handle different types of credit responsibly. However, it's important not to take on excessive debt, as it can have adverse effects on your credit score!

TOCThe Importance of Maintaining a Good Credit Score in the Philippines

Having a good credit score is essential for various financial endeavors. It can:

-

✓ Improve your chances of getting future loan approval

-

✓ Grant you better interest rates and repayment terms

-

✓ Open doors to other financial opportunities

So make sure you keep your credit score positive to take advantage of many awesome benefits for your financial health, luv!

Pro tip: Why not build on your credit history and maintain a high credit score? You never know when this will come in handy in the future!

Suggested Post: The Truth about Credit Scoring in the Philippines

TOCManaging and Repaying Your Cash Loan

Strategies for successfully managing loan repayments(and keep a high credit score)

Now that you know how crucial it is to manage your loan repayments, here are a few moves to keep in mind to make sure to keep payments in order:

-

Budget like a boss: Take a close look at your income and expenses to create a solid budget. By knowing where your hard-earned cash is going, you can allocate enough funds for loan repayments without sacrificing your basic needs.

-

Prioritize payments: Make your loan repayments a top priority, luv! Consider setting up automatic payments or reminders to ensure you never miss a beat. Stay on top of your due dates and show that loan who's boss!

-

Communicate with your lender: Life can throw unexpected curveballs, and sometimes meeting repayments becomes challenging. If you find yourself in a tight spot, reach out to your lender. They might offer flexible solutions to help you stay on track and avoid unnecessary stress.

Here’s the thing: If you miss payments, you don’t just accumulate late fees or get a deduction on your credit score… it can also be stressful! Consistently missing loan installments might trigger your lender to take more serious action to recover their funds. This can involve collection agencies, and legal proceedings. Best to avoid opening that can of worms!

TOCLegalities of Cash Loans in the Philippines

Laws and regulations governing cash loans

Cash loans are governed by various laws and regulations to ensure fair practices and protect consumers. Some important laws to know include:

- The Truth in Lending Act (Republic Act No. 3765): This law requires lenders to disclose all the necessary information about the loan, such as interest rates, fees, and charges. It ensures transparency and helps borrowers make informed decisions.

- The Consumer Act of the Philippines (Republic Act No. 7394): This act safeguards the rights of consumers in various transactions, including cash loans. It prohibits unfair practices and provides remedies for consumers who experience deceptive or abusive practices.

- The Usury Law (Presidential Decree No. 116): This law sets limits on the interest rates that lenders can charge. It protects borrowers from exorbitant interest rates and promotes fair lending practices.

Consumer rights and protection

As a borrower, you have rights and protections to ensure a fair lending experience. Here are a few key points to keep in mind:

- ✓ Right to accurate and transparent information: Lenders should provide clear and accurate information about the loan terms, including interest rates, fees, and charges. This allows you to make informed decisions and prevents hidden surprises down the road.

- ✓ Protection against unfair practices: The law prohibits lenders from engaging in deceptive advertising, hidden charges, or harassment. If you encounter any of these practices, you have the right to report them and seek appropriate action, luv!

- ✓ Right to privacy and data protection: Lenders must handle your personal and financial information with care and confidentiality. They should comply with data privacy laws to ensure the security of your personal data.

- ✓ Access to dispute resolution mechanisms: If you encounter issues or disputes with your lender, you have the right to seek resolution through appropriate channels. This can include filing complaints with regulatory authorities or seeking assistance from consumer protection agencies.

Remember, knowledge is power! Familiarize yourself with the laws and regulations surrounding cash loans in the Philippines. By understanding your rights and protections as a borrower, you can navigate the lending landscape with confidence and ensure a fair and transparent borrowing experience.

TOCAlternatives to Cash Loans

Sometimes, borrowing money isn't the only solution, and there are other financial options to consider. These can include:

-

Personal Savings: If you have money set aside for emergencies or future plans, consider using it instead of borrowing. The good thing is that there is no interest to pay and no need to worry about repayment. But this will deplete your savings, so think carefully before dipping into that rainy-day fund

-

Family and Friends: Sometimes, the best support comes from our loved ones. Consider reaching out to family or friends who may be willing to lend you money. The pros? Usually flexible terms, little to no interest, and a supportive relationship. The cons? It can strain relationships if not handled carefully.

-

Salary Advances: Some employers offer salary advances or emergency loans to their employees. It's worth checking if your company provides such benefits.

-

Peer-to-Peer Lending: In the digital age, peer-to-peer lending platforms have gained popularity. These platforms connect borrowers directly with individual lenders.

Tips for Negotiating Lower Interest Rates on Cash Loans

Let's dive into some tips that can help you tilt the scales in your favor and secure a better deal. Get ready to channel your inner negotiator and save some hard-earned pesos!

- Research and Compare: Knowledge is power, luv! Before approaching any lender, do your homework. Research different lenders and compare their interest rates and terms. This will give you an idea of the prevailing rates in the market and help you identify potential lenders who offer more favorable terms.

- Improve Your Creditworthiness: Lenders often consider your creditworthiness when determining interest rates. Boost your credit score by paying bills on time, reducing outstanding debt, and maintaining a healthy credit history. A good credit score can enhance your bargaining power and increase your chances of negotiating lower interest rates.

- Negotiate Based on Market Conditions: Stay updated on the current economic climate and interest rate trends. If interest rates are falling or competition among lenders is high, use this information to negotiate better terms. Lenders may be more inclined to offer lower interest rates to attract borrowers in a competitive market.

- Leverage Existing Relationships: If you have an existing relationship with a bank or financial institution, such as a savings account or credit card, leverage that relationship. Sometimes, loyal customers are offered preferential interest rates. Reach out to your bank and inquire about any special promotions or offers available to you.

Remember, negotiation is an art, and it's worth putting in the effort to secure a better interest rate on your cash loan, hun. Be confident, persistent, and prepared to walk away if the terms don't meet your expectations. By applying these tips, you'll be well-equipped to negotiate like a pro and potentially save yourself some pesos in the process.

TOCHow to Improve Your Chances of Approval for a Cash Loan

Want to boost your chances of getting approved for a cash loan? Here are a few things you should keep in mind:

-

Understand the Requirements: Before applying for a cash loan, familiarize yourself with the lender's eligibility criteria. Read through the requirements carefully and ensure that you meet them.

-

Check and Improve Your Credit Score: Your credit score plays a significant role in loan approval decisions. Request a copy of your credit report and review it for any errors or discrepancies. If you spot any issues, work on resolving them promptly

-

Build a Stable Employment History: Lenders prefer borrowers with a stable employment history as it reflects financial stability and repayment capacity. If you're self-employed, ensure you have documentation to demonstrate a consistent income source.

-

Apply with Multiple Lenders: Casting a wider net can increase your chances of approval. Consider applying with multiple lenders. But do so responsibly to avoid negatively impacting your credit score.

-

Consider a Co-Borrower or Guarantor: If you're facing challenges in meeting the lender's eligibility criteria, consider adding a co-borrower or obtaining a guarantor. A co-borrower shares the responsibility of loan repayment, while a guarantor provides an additional layer of assurance for the lender. Make sure your co-borrower or guarantor understands the obligations and risks involved.

In conclusion, cash loans in the Philippines provide a lifeline for many individuals in times of financial need. Whether it's a personal loan for home renovations, a payday loan to bridge the gap between paychecks, or a small business loan to fuel entrepreneurial dreams, cash loans offer flexibility and convenience. Remember to choose a reputable lender, understand the terms and fees, and manage your repayments responsibly.

By staying informed and making wise financial decisions, you can navigate the world of cash loans with confidence. So go ahead, seize those opportunities and conquer your financial goals, luv!