Loan underwriting. It's a term that might not come up in casual conversations about borrowing money, yet it plays a starring role in the entire lending saga. This behind-the-scenes hero of the financial world is the key to unlocking the doors to your dreams, be it a new home, a business venture, or that long-awaited car. Understanding loan underwriting is like having a secret map to a treasure trove. It’s where numbers, analysis, and your financial story converge, determining not just if you get the loan, but also how it’s structured.

So, let's embark on a journey to understand this crucial, yet often overlooked, process, luv. By the end of this blog, 'loan underwriting' won’t just be another financial jargon for you, but a powerful concept that could shape your borrowing experience.

Table of Contents

- What is Loan Underwriting?

- Loan Underwriting Process in the Philippines

- Key Elements in Loan Underwriting

- Types of Underwriting

- Risk Analysis in Loan Underwriting

- Risk Mitigation Techniques

- Regulatory Framework in the Philippines

- Specific Compliance Requirements in Underwriting

- Ready to Apply for a Loan, Luv?

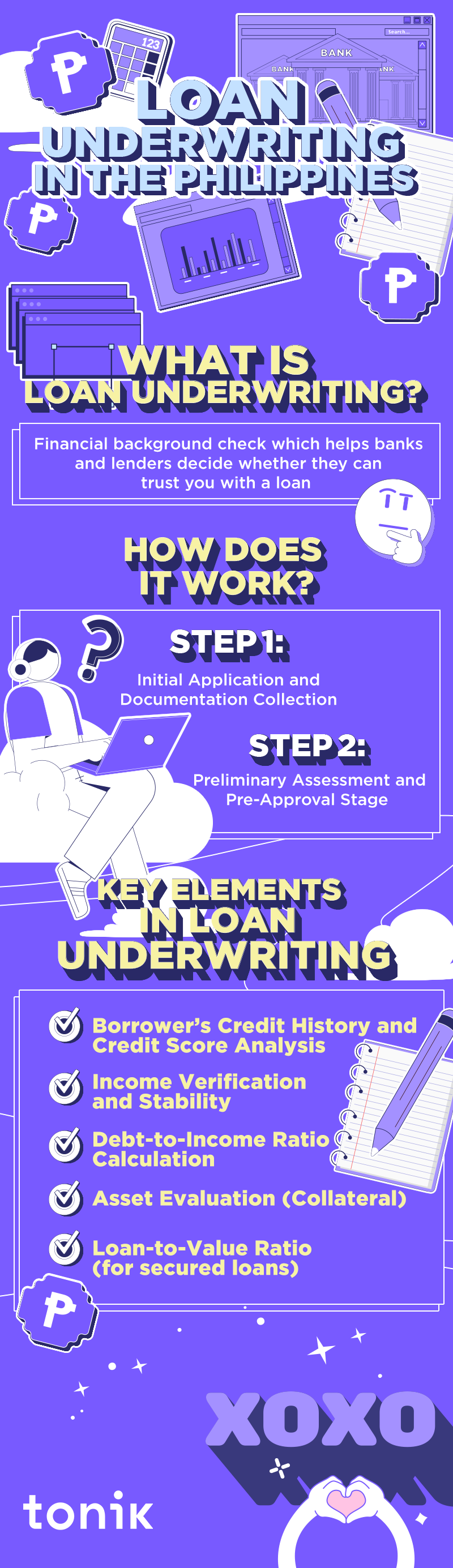

What is Loan Underwriting?

Loan underwriting is basically how banks and lenders decide whether they can trust you with a loan. They take a deep dive into your financial life - think of it as a financial background check. They look at your credit history, how much you earn, your existing debts, and what you own that can back up the loan, like your house or car. All of this helps them figure out how likely you are to pay them back without any hiccups.

TOCLoan Underwriting Process in the Philippines

Step 1: Initial Application and Documentation Collection

This is your first impression. You fill out an application, providing personal and financial details. The documentation—like income proof, employment history, and existing debts—is your arsenal. It's like preparing for a fiesta; you need to have everything ready and appealing.

Step 2: Preliminary Assessment and Pre-Approval Stage

Here, lenders scrutinize your application. They check for red flags, verify your details, and assess your financial health. If you pass, they'll give you a pre-approval, kind of like a 'Save the Date' for your loan.

TOCKey Elements in Loan Underwriting

- Borrower’s Credit History and Credit Score Analysis: Your credit history and score are like your financial reputation. They show how well you've managed debts in the past. A high score means you're a star borrower; a low score, and you might need to woo the lenders a bit more.

- Income Verification and Stability: Lenders want to know you can pay back the loan. They'll look at your income sources, job stability, and career prospects. It's like proving you're a dependable suitor in the world of finance.

- Debt-to-Income Ratio Calculation: This ratio compares your monthly debt payments to your income. It's like a financial waistline—the lower it is, the fitter you appear to lenders.

- Asset Evaluation (Collateral): Assets, like property or investments, can act as collateral. They're a safety net for the lender, like a backup plan in case things don't go as expected.

- Loan-to-Value Ratio (for secured loans): This is all about how much loan you're getting against the value of the collateral. A lower ratio means less risk for the lender, and possibly better terms for you.

Types of Underwriting

- Manual Underwriting: This is the traditional way where a human underwriter assesses everything. It's more flexible and can be better for complex cases.

- Automated Underwriting Systems (AUS): AUS uses algorithms to evaluate your application. It's faster and more consistent, but less personalized.

Risk Analysis in Loan Underwriting

Assessing Credit Risk

In the heart of loan underwriting lies credit risk assessment. Lenders become financial detectives, piecing together your credit history, repayment habits, and financial behaviors. They scrutinize your past dealings with credit, looking at how punctually you've paid bills or repaid previous loans. Think of it as a credit version of a background check, luv – the cleaner your history, the more trustworthy you appear.

Setting Loan Terms Based on Risk Assessment

Based on their findings, lenders tailor the terms of your loan. This customization includes determining the interest rates, loan amounts, and repayment periods. If you're deemed a low-risk borrower, congratulations! You might enjoy lower interest rates and more favorable terms. On the flip side, a higher perceived risk might lead to steeper interest rates or a reduced loan amount. It's a delicate balancing act, akin to setting just the right spice level in adobo – too little and it's bland, too much and it's overpowering.

TOCRisk Mitigation Techniques

- Risk Management and Compliance: Risk management in loan underwriting is a bit like preparing for a typhoon – it's all about having robust strategies in place. Lenders incorporate compliance into every step, ensuring they adhere to the regulatory framework set by entities like the Bangko Sentral ng Pilipinas (BSP) and the Securities and Exchange Commission (SEC).

- Risk Assessment Methods in Compliance with Philippine Regulations: Compliance with Philippine regulations is non-negotiable. Lenders employ various risk assessment methods that align with local laws, such as rigorous credit evaluations, regular monitoring of loan portfolios, and adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

- Balancing Risk and Compliance in Loan Approval Decisions: Lenders walk a tightrope, balancing the need to manage risk with the necessity to comply with regulations. They use statistical models, historical data, and market analysis to inform their decisions. It's a dynamic process, requiring constant adjustment and fine-tuning, much like adjusting a recipe based on taste and customer feedback.

- Strategies for Effective Risk Mitigation: Effective risk mitigation strategies in loan underwriting include:

- Diversification of Loan Portfolio: Just like a balanced diet, lenders avoid putting all their eggs in one basket. They spread out their risks across different types of loans and borrowers.

- Use of Collateral: Lenders often require collateral for loans, providing a safety net in case of defaults. It's like having a security deposit.

- Insurance Products: Some lenders use insurance to protect against loan defaults. Think of it as an umbrella on a rainy day – it won't stop the rain, but it'll keep you dry.

- Staying Current with Market Trends: Staying informed about economic conditions helps lenders anticipate and prepare for potential risks.

- Regular Review and Adjustment of Credit Policies: Lenders don’t just set policies and forget them. They regularly review and adjust credit policies based on current economic conditions and portfolio performance, much like a captain adjusting the sails to the changing wind.

Regulatory Framework in the Philippines

Key Financial Regulatory Bodies

- Bangko Sentral ng Pilipinas (BSP): As the central bank of the Philippines, the BSP plays a pivotal role in regulating and supervising the banking industry. Its main goals include maintaining monetary stability, preserving the stability and efficiency of the financial system, and ensuring a safe and reliable payments system.

- Securities and Exchange Commission (SEC): The SEC oversees the securities market, ensuring fair play and transparency. It regulates corporate entities and protects investor interests, playing a crucial role in maintaining the integrity of financial transactions and corporate governance.

Overview of Relevant Laws and Regulations

- General Banking Law: This law provides the framework for the regulation and supervision of the banking industry by the BSP. It outlines the standards for bank operations, solvency, and examinations.

- Lending Company Regulation Act: This act specifically regulates lending companies, focusing on licensing, operational requirements, and compliance standards to protect borrowers from unfair practices.

Specific Compliance Requirements in Underwriting

Anti-Money Laundering (AML) Regulations

The AML regulations require financial institutions to monitor and report suspicious activities and transactions. This includes identifying the source of funds, monitoring large and unusual transactions, and maintaining records. These regulations are crucial in preventing the financial system from being used for money laundering and terrorist financing.

Know Your Customer (KYC) Standards

KYC standards are designed to ensure financial institutions know and verify the identities of their clients. This process includes verifying personal identification, understanding the nature of the client’s activities, and assessing money laundering risks associated with the client. It's essential for preventing identity theft, financial fraud, and other illegal activities.

Credit Information System Act (CISA) and Credit Reporting

CISA establishes the legal and regulatory framework for credit information sharing and credit reporting in the Philippines. It mandates the creation of a centralized credit information system to improve the availability of credit data, enhance the credit decision-making process, and reduce the risk of non-performing loans.

Consumer Protection and Fair Lending Practices

These practices are designed to protect consumers from predatory lending and discriminatory practices. Financial institutions are required to provide clear, accurate information about loan products and to treat all loan applicants fairly. This includes not discriminating based on race, religion, gender, age, or other non-financial factors.

TOCReady to Apply for a Loan, Luv?

As we wrap up our exploration of loan underwriting in the Philippines, it's clear that this process is more than just a set of procedures and regulations. It's the gateway to your financial goals, be it a new home, a business venture, or a personal project. Understanding the intricacies of loan underwriting means you're not just a bystander in your financial journey, but an informed participant, luv!