Ever watched a game show and wondered why one contestant walks away with the grand prize while another leaves empty-handed? Securing a loan can sometimes feel just as suspenseful. You're in the hot seat, and the lender is the host with the power to make or break your financial goals. But unlike a game of chance, getting approved for a loan isn’t just about luck, luv. It’s a calculated decision based on a process known as credit risk assessment.

So, what sets the winners apart from the rest? It's not a secret handshake or a magic word. It’s about who ticks the right boxes on the lender’s checklist. From your credit score to the stability of your income, each step in your financial history choreographs your application's outcome.

In this tell-all, we’re spilling the details on why some people hear a resounding “Yes!” and others a disheartening “Nope” when they apply for loans. By decoding the lender's playbook, we’ll reveal what factors into that crucial decision. Ready to find out? Let's dive into the nitty-gritty of credit risk assessment and turn those buzzers into bells of approval!

Table of Contents

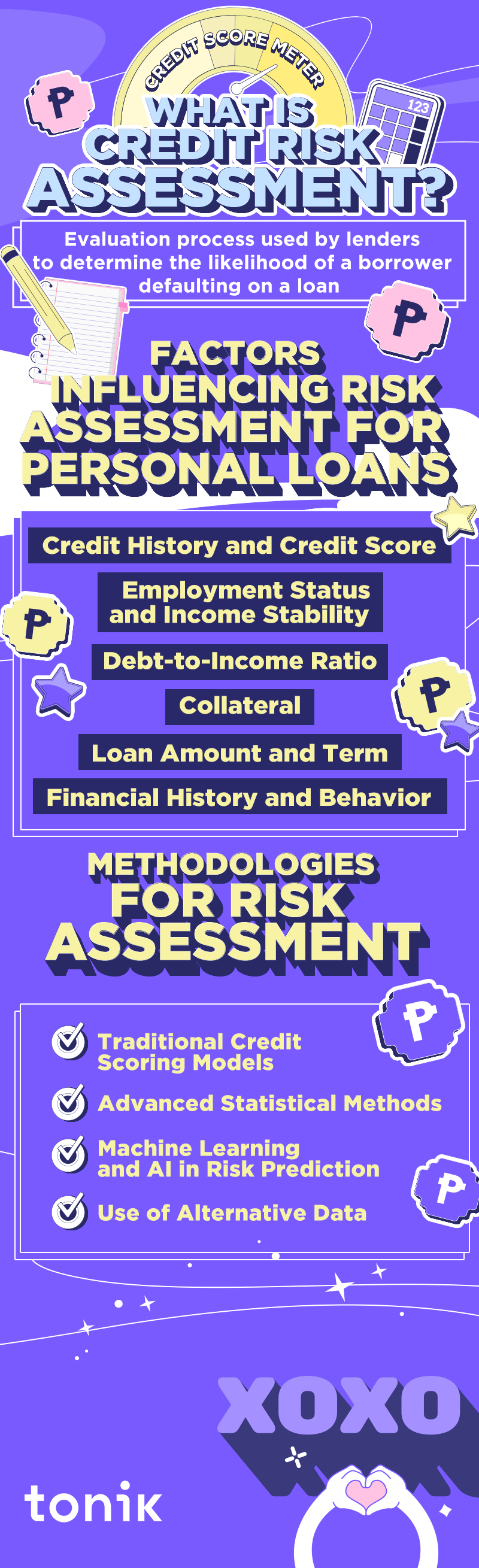

What Exactly is Credit Risk Assessment?

It's the financial version of a detective series where lenders look for clues in your financial behavior to gauge how much of a risk you pose. They examine your credit history, scrutinizing every loan, credit card payment, and even your promptness in paying your phone bill. They're not just being nosy – they're calculating how likely you are to repay a loan, and on time.

A thorough credit risk assessment does two things: It protects the lender against potential losses (think of it as financial insurance), and it ensures that loans are given out fairly and responsibly (a bit like the financial version of justice).

TOCFactors Influencing Risk Assessment for Personal Loans

- Credit History and Credit Score: Lenders use your credit history to gauge your reliability in repaying debts. A high credit score reflects a history of timely payments and responsible credit management. This score is derived from your credit reports, which include details of past and current debts, your repayment history, the length of your credit history, and the types of credit you've used.

- Employment Status and Income Stability: A consistent work history and steady income are critical to lenders, luv. They typically request proof of income through pay slips, tax returns, or employer verification to ensure you have the means to fulfill your loan obligations.

- Debt-to-Income Ratio (DTI): This ratio measures your monthly debt payments against your gross monthly income. A lower DTI ratio shows you have a good balance between debt and income. In contrast, a higher DTI ratio might indicate you are over-leveraged, and additional loan obligations could overextend your finances.

- Collateral: In secured loans, collateral — such as a home for a mortgage or a car for an auto loan — secures the loan. If the borrower defaults, the lender has the right to seize the asset, which mitigates their risk. The value and stability of the collateral are assessed to ensure it covers the loan amount.

- Loan Amount and Term: The size of the loan and the repayment period influence the lender's risk. Larger loan amounts increase the lender's exposure, and longer repayment terms mean the lender's money is at risk for a more extended period. Both factors can affect the interest rate and loan terms offered to the borrower.

- Borrower’s Financial History and Behavior: Beyond credit scores, lenders may look at your savings and checking account histories, investment assets, and even your history of cash management to get a sense of your financial behavior.

Positive factors include a history of saving money, minimal instances of overdraft fees, and a track record of increasing asset accumulation. Negative factors might include frequent late fees, payday loans, or patterns of maxed-out credit cards.

Methodologies for Risk Assessment

- Traditional Credit Scoring Models

Traditional credit scoring models primarily focus on a borrower's credit history and credit score. These scores are calculated based on factors including payment history, the amount owed, length of credit history, new credit, and types of credit used. While these models provide a standardized way to evaluate creditworthiness, they can sometimes miss the broader context of an individual's financial health. For instance, a person with a short credit history might have a low score despite being financially responsible.

- Advanced Statistical Methods

Advanced statistical methods, including logistic regression and decision trees, take a more detailed approach to risk assessment. Logistic regression, for instance, predicts the probability of a certain event (like loan default) by analyzing previous data on defaults and non-defaults. It considers various borrower attributes as independent variables to make this prediction.

Decision trees, on the other hand, create a model that predicts the value of a target variable based on several input variables. This method splits data into subsets based on the value of those input variables, making it useful in identifying specific risk patterns that might not be evident in traditional models.

- Machine Learning and AI in Risk Prediction

Machine learning and AI are revolutionizing risk assessment in loan applications. These technologies can analyze vast datasets, including non-traditional data, to uncover patterns that might indicate risk. For example, machine learning models can process data from a borrower's transaction history, social media activity, and even how they interact with a lender's website. These systems get better over time as they are exposed to more data, allowing for more dynamic risk assessment.

- Role of Alternative Data in Risk Assessment

The use of alternative data in risk assessment is particularly beneficial for individuals who might not have extensive credit histories. This is useful if you’re a recent immigrant, someone who has avoided traditional credit or if you’ve never ever taken out a loan before.

This data can include rent payments, utility bill payments, and even certain types of public records. By incorporating this information, lenders can get a more complete picture of a borrower's financial behavior. For example, consistent utility and rent payments can demonstrate a person's reliability in meeting regular financial obligations, offering a different dimension of creditworthiness.

We’ve seen this risk assessment factor in most fintech companies in the business of providing cash loans and it has been a game changer in strengthening financial inclusion especially in countries like the Philippines, Vietnam, and Indonesia. If you lack the requirements for a traditional financing company luv, you might want to head in the direction of financing firms with this type of credit scoring or credit risk assessment.

Pro tip: Always be ready to read in-between the lines of the eligibility and requirements that your shortlisted financing firms have. Alternative Data in credit risk assessments will scour as much data they can get to make up for more vetted data points and it's best that such data shows not just your credit worthiness but your responsibility rating in your transactions.

Don’t Be Afraid to Apply for that Loan, Luv!

And that, luv, is your crash course in the art of risk assessment for loan applications. Remember, it's not just about how much you earn, but how you handle what you've got. Stay savvy and maybe, just maybe, you'll charm those lenders into saying "yes."