Getting approved for a Credit Builder Loan can be tricky. There's a multitude of documents, requirements, interest fees, and more to consider.

Before you dive into all that, focus on the one thing that can get your foot in the door: prequalification.

Don’t know anything about Credit Builder Loan prequalification? Chill, luv, that’s what this blog is for! We’ll cover everything from A to Z, ensuring you’re well-equipped with the knowledge to embark on this financial journey.

Table of Contents

- What is Prequalification for Credit Builder Loan

- Benefits of Prequalifying for a Loan

- Eligibility Criteria for Credit Builder Loan Prequalification

- Basic Eligibility Requirements

- Employment and Income Thresholds

- Credit History and Credit Score Considerations

- Documents and Information Required

- The Prequalification Process

- Digital Banks

- Brick-and-Mortar Banks

- Credit History and Credit Score Considerations

- Choosing the Right Lender

- Impact of Prequalification on Credit Score

- Common Mistakes to Avoid

- Next Steps after Prequalification

- FAQs

Read on, and let’s get you prequalified ASAP!

TOC

What is Prequalification for Credit Builder Loan

The word “prequalification” may have made you think of another word, “pre-approval.” Don’t get confused, hun, these are two completely different things!

PREQUALIFICATION is the initial step in the loan application process. It’s akin to a financial snapshot, giving lenders a quick glance at your creditworthiness without a deep dive into your credit history. Should you get messages about being “prequalified” for a loan offer, calm down and read the fine print, luv.

PRE-APPROVAL, on the other hand, is a more rigorous assessment. Pre-approval provides a more concrete offer, detailing the loan amount, interest rate, and terms you qualify for, subject to verification of your financial documents.

TOC

Benefits of Prequalifying for a Loan

Prequalifying for a Credit Builder Loan illuminates your financial landscape, offering several benefits:

- Understanding Borrowing Limits: It reveals the maximum loan amount you might be eligible for, helping to set realistic expectations.

- Financial Planning: Knowing your potential borrowing limit and estimated interest rates enables more accurate budgeting and financial planning.

- Comparing Offers: Prequalification allows you to shop around and compare offers from different lenders without committing to any terms or impacting your credit score.

- Time-Saving: It streamlines the loan application process by identifying the loans you're more likely to be approved for, saving you time on applications likely to be rejected.

Eligibility Criteria for Credit Builder Loan Prequalification

TOCBasic Eligibility Requirements

- Age: The typical age requirement for loans are ages 21-65. Age requirements ensure that borrowers have the legal capacity to enter into a contract and are within the working age range.

- Citizenship and Residency: Filipino citizenship is typically required, along with proof of residency. Foreign residents may need a valid visa and work permits.

- Permanent Address: A verifiable residential address or business address (for self-employed individuals) is crucial to establish your locality and stability.

Employment and Income Thresholds

- Employment Status: A minimum tenure of at least one year with your current employer or two years of employment history is often required. This is used to gauge job stability and reliability of income.

- Income: Lenders have varying income thresholds, but a common requirement is a minimum monthly income that demonstrates your capability to repay the loan. This amount can differ based on whether you live in Metro Manila or outside it, reflecting the cost of living differences.

- For Self-Employed: Business owners or freelance professionals need to show proof of stable income through business permits, income tax returns (ITR), and financial statements for the last two years.

Credit History and Credit Score Considerations

- Credit History: This includes your record of borrowing and repaying loans, credit card payments, and other debts. A positive history can enhance your loan terms. Not confident about your credit history yet? A credit builder might help!

- Credit Score: Banks and lenders increasingly utilize credit scores to evaluate loan applications. A higher score can improve your chances of prequalification and secure better loan terms.

Documents and Information Required

Ensuring that these documents are accurate and readily available not only smoothes your path to loan approval but also positions you as a reliable borrower in the eyes of lenders.

- Government-Issued IDs: Valid identification (such as a Passport, Driver’s License, or UMID) is required to verify your identity and prevent fraud.

- Proof of Income: This includes your latest payslips and/or bank statements, offering lenders a glimpse into your financial capacity to repay the loan.

- Employment Verification: For employed individuals, a certificate of employment or latest Income Tax Return (ITR) confirms your employment status and income stability.

- For Self-Employed Applicants: Aside from ITRs, submit business registration documents and financial statements to prove the existence and profitability of your business.

- Proof of Residence: Utility bills or barangay certification can validate your current residential address, ensuring you have a stable living situation.

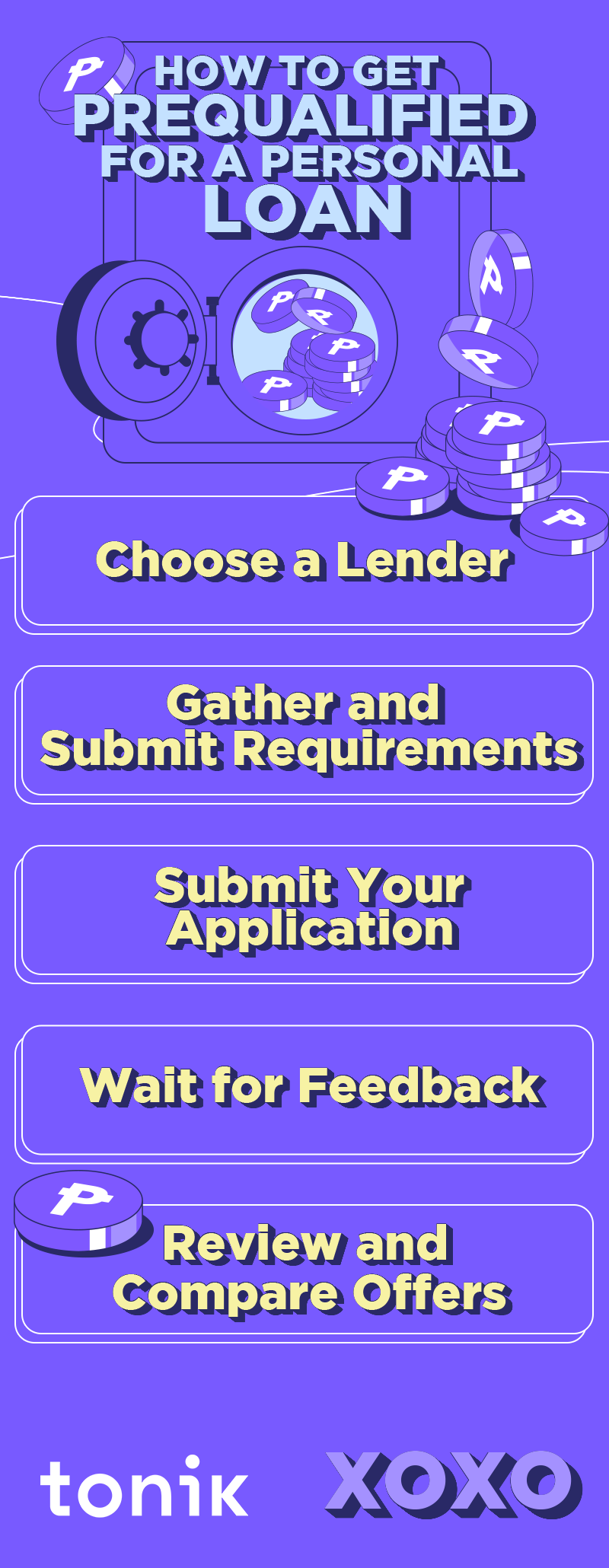

The Prequalification Process

You can either be prequalified for Credit Builder Loan from digital banks or traditional brick-and-mortar banks. Check out the process of each option below.

TOC

Digital Banks

For digital banks, the process can take anywhere from 24 hours to a few days.

- Online Application Submission: A prequalification form that you can find on the digital bank’s website or app. This usually requires basic personal and financial information.

- Document Upload: Upload the necessary digital copies of your documents directly through the platform.

- Instant Assessment: Digital banks leverage algorithms to assess your application quickly, often providing feedback in as little as 24 hours.

- Offer Review: If prequalified, you’ll receive an offer outlining potential loan amounts, rates, and terms.

- Final Verification: Some banks may require a final verification call or an additional document submission.

TOC

Brick-and-Mortar Banks

For traditional banks, the process can take anywhere from a few days to several weeks.

- Visit a Branch: Visit a local branch and fill out a prequalification form. Submit a physical copy of your documents.

- Manual Review: Your application will undergo a manual review process, which may involve background checks and a more in-depth financial analysis.

- Interview or Verification Call: You might be required to attend an in-person interview or a verification call to discuss your financial status and needs.

- Offer Receipt: If prequalified, you’ll receive a loan offer that details the terms and conditions.

TOC

Choosing the Right Lender

When selecting a lender for your Credit Builder Loan in the Philippines, it's crucial to make an informed decision. Here's a quick guide:

- Traditional Banks: Some people favor them for their personalized services and physical branches. They’re known for having competitive rates and flexible terms, but slightly higher interest rates compared to other options

- Digital Banks: Digital banks such as yours truly provide convenient online processes with attractive interest rates. They leverage technology to streamline the application process, resulting in faster approval times and lower fees compared to traditional banks

- Online Lenders: These mainly offer quick access to loans. However, stay cautious and ensure legitimacy before borrowing to avoid falling victim to scams or predatory lending practices. Interest rates and fees may vary widely, so carefully compare offers before committing to a loan.

Whichever lender you choose, always remember to read the fine print. Read and understand all terms, including hidden fees and restrictions. Seek clarification if needed before committing to any agreement!

TOC

Impact of Prequalification on Credit Score

Prequalifying for a Credit Builder Loan involves an assessment of your creditworthiness either through a soft inquiry or a hard inquiry. Read about the differences of each one, and how they affect your credit score:

- Soft Inquiries: These are checks made by lenders for prequalification purposes and do not appear on your credit report to other lenders. They’re usually not associated with an actual loan application, so they don’t impact your credit score.

- Hard Inquiries: This type of inquiry occurs when a lender makes a thorough review of your credit history as part of a loan application approval process. Hard inquiries can slightly lower your credit score and may remain on your credit report for up to two years.

TOC

Common Mistakes to Avoid

Here are some common missteps when getting prequalification for Credit Builder Loan, and how to steer clear of them:

- Overapplying for Multiple Loans: Overapplying for Credit Builder Loan can be seen as a red flag, suggesting financial distress. Focus on lenders that best match your needs and circumstances.

- Misrepresenting Financial Information: Accuracy is key; providing false or inaccurate information can lead to application denial and affect future loan applications.

- Not Considering the Full Cost of the Loan: Look beyond the principal amount and understand all associated costs, including interest rates and late fees, to ensure the loan is affordable and suits your financial plan.

TOC

Next Steps after Prequalification

After successfully prequalifying for a Credit Builder Loan, the journey towards securing your financial boost enters a crucial phase. Here’s how to navigate the subsequent steps with confidence:

- How to Proceed Once Prequalified: Review the prequalification offer carefully, paying close attention to the terms, interest rates, and repayment period. This is the time to ask questions or seek clarifications from the lender.

- Finalizing the Loan Application: Complete any outstanding requirements, submit necessary documents, and provide additional information if requested by the lender to move from prequalification to approval.

- Preparing for Potential Approval or Denial: Organize your finances to accommodate the forthcoming loan payments. If your application is denied, seek feedback from the lender to understand the reasons and explore ways to improve your creditworthiness or find alternative solutions.

After covering all that, you probably still have a bunch of questions swimming around in your head. Don’t worry, luv, here are a couple frequently asked questions!

TOC

FAQs

What does it mean to prequalify for a loan?

Prequalifying for a loan means a lender has done a basic review of your creditworthiness to estimate how much you might be able to borrow, at what rate, and under what terms, without a detailed investigation.

Is prequalifying for a loan the same as applying for one?

No, prequalifying is an initial step that indicates potential loan terms based on a superficial review of your finances, while applying for a loan involves a comprehensive check and leads to a final decision.

Does prequalifying for a loan affect my credit score?

Prequalifying usually involves a soft credit check, which does not impact your credit score, making it a risk-free step to understand your loan eligibility.

What information do I need to provide to prequalify for a loan?

You'll typically need to provide personal information, income details, employment history, and the amount you wish to borrow to prequalify for a loan.

How accurate is the loan estimate given during prequalification?

The loan estimate given during prequalification is a good faith estimate based on your provided information. It’s fairly accurate but subject to change upon a full review of your application.

Can I prequalify for a loan with bad credit?

Yes, you can prequalify for a loan with bad credit. Some lenders specialize in bad credit loans, but the terms might be less favorable.

How long does the prequalification process take?

The prequalification process can be quick, often taking just a few minutes to a few hours, depending on the lender's procedures and your readiness with the required information.

Is a prequalification binding or can I choose not to proceed with the loan?

A prequalification is not binding. You can choose not to proceed with the loan if the terms do not meet your needs or if you find a better offer.

Can I prequalify with multiple lenders?

Yes, you can and should prequalify with multiple lenders to compare loan terms and ensure you’re getting the best deal possible.

What should I do after I prequalify for a loan?

After prequalifying, review and compare the offers, consider the terms carefully, and decide whether to proceed with a formal loan application with the lender offering the best terms for you.

Are there any fees associated with prequalifying for a loan?

Typically, there are no fees to prequalify for a loan. It’s a free process intended to give you an idea of what you might qualify for.

How can I improve my chances of prequalifying for a good loan offer?

Improving your credit score, reducing debt, and increasing your income can enhance your chances of receiving a favorable loan offer during prequalification.