Hey there, luv! If you've been dreaming of teaming up for that big purchase or venture, a joint loan in the Philippines might just be the magic wand you need. Whether it's for that cozy home you've been eyeing with your significant other or a business idea you and your partner are eager to launch, understanding the path to a joint loan can make all the difference.

And guess what? We're here to guide you through it all! Buckle up, luv, as we embark on this enlightening journey together.

Table of Contents

- What are Joint Loans?

- Eligibility Criteria for Joint Loans in the Philippines

- Types of Joint Loans Available in the Philippines

- Advantages of Joint Loans

- Risks and Considerations

- Joint Loan Application Process

- Documentation Required

- Steps in the Application Process

- Tips for a Successful Application

- How to Compare Different Loan Offers

- How Banks Assess Joint Loan Applications

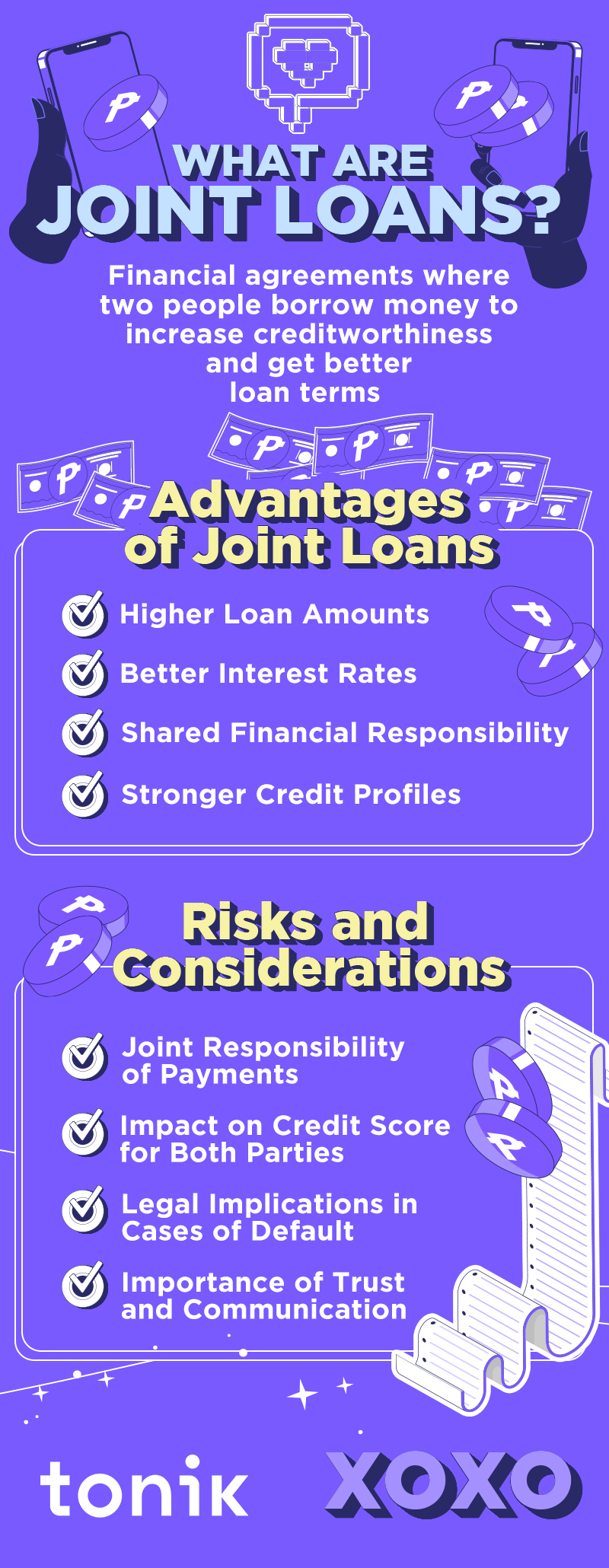

What are Joint Loans?

Imagine joining forces with someone close to you to achieve a financial goal that seems just out of reach on your own. That's the essence of a joint loan. It's like teaming up in a marathon where both of you run side by side, committed to crossing the finish line together. This partnership in borrowing doesn’t just spread the load but also amplifies your borrowing power, thanks to the combined financial strength you bring to the table.

TOC

TOC

Eligibility Criteria for Joint Loans in the Philippines

Securing a joint loan is like entering a pact, and there are a few rules of the game:

- General Eligibility Requirements: Besides being of legal age and a citizen or a permanent resident, lenders might also peek into your residency status and if you have a stable place you call home.

- Credit Report and Financial History Considerations: Think of your credit score as your financial report card. Lenders use it to gauge how reliably you and your partner have managed debts in the past. A better score can be a ticket to better loan conditions.

Quick Pro-Tip: You can borrow extra cash and boost your credit at the same time using a credit builder loan!

- Employment and Income Requirements: Here’s where you show you can pay back the loan. Steady jobs and regular income for both applicants are must-haves. Lenders often look for a certain minimum income level to ensure you can comfortably handle your repayment obligations.

- Relationship between the Co-borrowers: The nature of your relationship with your co-borrower can influence your application. While any two individuals can apply, certain relationships, like spouses or long-term partners, might be viewed as more stable by lenders.

Types of Joint Loans Available in the Philippines

- Personal Loans: Ideal for consolidating debt, funding a major purchase, or covering unexpected expenses. The flexibility here is a big plus.

- Home Loans: Buying a home is a big step, and a joint home loan can make this dream more accessible by pooling resources for a larger loan amount or better terms.

- Auto Loans: Vehicles can be pricey, and an auto loan taken out jointly can ease the financial burden, making that dream car more attainable.

- Business Loans: For entrepreneurs, a joint business loan can provide the essential capital needed to start or expand your venture, leveraging the combined financial strength and expertise of the partners.

Advantages of Joint Loans

- Higher Loan Amounts: Two applicants mean more income, which often translates to qualifying for a larger loan than you might on your own.

- Better Interest Rates: Combined financial stability and lower risk for lenders can lead to more favorable interest rates and terms.

- Shared Financial Responsibility: Sharing the repayment responsibility means less pressure on each individual, making the financial journey smoother.

- Strengthening of Credit Profiles: On-time repayments can improve both borrowers’ credit scores, opening doors to better financial opportunities in the future.

Risks and Considerations

- Joint Responsibility for Repayments: If one borrower struggles, the other must cover the full payment, which can strain both finances and relationships.

- Impact on Credit Score for Both Parties: Missed payments affect both borrowers' credit scores, potentially harming your ability to borrow in the future. If you're concerned about the strength of your credit history, you might want to consider building it up with a credit builder loan first.

- Legal Implications in Case of Default: Defaulting on the loan can lead to legal actions against both borrowers, not just the one who might have financial difficulties.

- Importance of Trust and Communication: A joint loan is a partnership that thrives on trust and open communication. Regular check-ins on financial health and responsibilities can prevent misunderstandings and conflicts.

TOC

Joint Loan Application Process

Documentation Required

The first step in your joint loan application is gathering all necessary documentation. This includes:

- Valid IDs: Government-issued IDs for both applicants are a must to verify identities.

- Proof of Income: Lenders will want to see payslips, bank statements, or even tax returns to assess your income stability and ability to repay the loan.

- Lender-specific Documents: Some lenders may require additional paperwork, such as proof of residence, marriage certificates for spouses, or business registration documents for entrepreneurs.

Steps in the Application Process

- Research: Begin by exploring your options. Each lender offers unique advantages, and what works best for one pair may not suit another. Look into various banks and financial institutions, understanding their loan products.

- Compare Offers: Look beyond surface-level terms and delve into the details of loan offers. Consider the APR (Annual Percentage Rate), which includes both the interest rate and any associated fees, to understand the true cost of the loan.

- Apply Together: When you're ready, fill out the application forms together. This might be done online or in-person at a bank branch. Ensure all provided information is accurate and reflects your current financial situation.

Tips for a Successful Application

- Honesty is the Best Policy: Be truthful in every detail you provide. Inaccuracies, even if unintentional, can lead to delays or denials.

- Full Disclosure: Include all sources of income and debts. A comprehensive financial picture can work in your favor.

- Check and Double-Check: Before submitting, review your application for any errors or missing information. This can save you a headache later on.

How to Compare Different Loan Offers

- Interest Rates: While important, they don't tell the whole story. A loan with a lower interest rate but high fees might end up costing more overall.

- Fees and Penalties: Understand all possible fees, including loan origination fees, late payment penalties, and charges for early repayment.

- Repayment Flexibility: Some loans offer more flexibility in repayment terms, which can be crucial if your financial situation changes.

- Customer Service: Consider the lender's reputation for customer service. Reading reviews and asking for recommendations can provide insights into what it's like to be their customer.

How Banks Assess Joint Loan Applications

- Financial Health: Banks look at income, employment stability, debt-to-income ratio, and credit reports.

- Relationship Stability: For personal joint loans, the nature of your relationship might be considered as an indicator of the loan's stability.

- Loan Purpose: Whether it's for buying a home, a car, or funding a business, banks evaluate how the loan aligns with your goals and financial situation.

- Meeting Criteria: Each bank has its own set of criteria. Understanding these can help tailor your application to increase your chances of approval.

Wrapping it Up

Embarking on the path to securing a joint loan in the Philippines with someone important in your life can bring you closer to your shared dreams. While there are significant benefits to be reaped, such as higher loan amounts and potentially better terms, it’s crucial to approach this journey with open eyes, understanding the responsibilities and risks involved.

Communication, trust, and a solid understanding of each other's financial habits and goals are the bedrock of a successful joint loan application. Remember, the goal is to support each other in achieving a mutual financial milestone, whether that’s buying a home, a car, or starting a new business venture.

As we wrap up this detailed guide, remember that every journey starts with a single step. With the right preparation and partnership, securing a joint loan in the Philippines can be a smooth and rewarding process. Cheers to a brighter financial future together, luv!