There’s definitely nothing “micro” about the financial support that microfinance loans can provide.

Is this your first time hearing about microfinance loans? Want to know more, luv? Don’t worry, that’s what this blog is for!

In this comprehensive guide, we’ll explore the variety of available options, their application processes, the risks involved, and many more. Now, let’s get things going with the basics!

Table of Contents

- What is Microfinance?

- Types of Microfinance Loans in the Philippines

- Top Microfinance Institutions (MFIs) in the Philippines

- Eligibility and Application Process

- Interest Rates and Repayment Terms

- Impact of Microfinance on Local Communities

- Challenges and Risks in Microfinance

- Regulatory Framework and Government Policies

- Technological Advancements and Microfinance

What is Microfinance?

Microfinance is a financial service provided to individuals, usually from low-income segments, who have limited access to traditional banking services. These can include small loans, savings accounts, insurance, and other basic financial services.

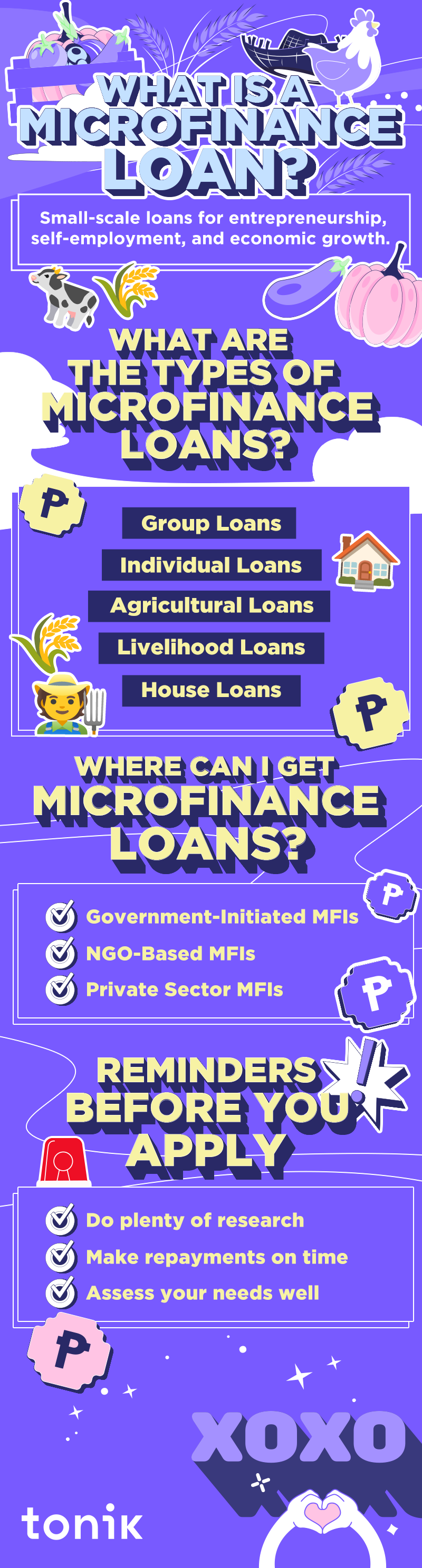

To make things more specific, microfinance loans are small-scale loans designed to support entrepreneurship, self-employment, and economic growth within communities that may not have access to traditional banking. These loans often have lower requirements for collateral and focus on aiding the underbanked.

TOCTypes of Microfinance Loans in the Philippines

Microfinance in the Philippines offers various loan types tailored to the specific needs of different demographics and business sectors:

- Group Loans - Loans for groups where each member shares the responsibility for repayment.

- Individual Loans - Loans for individuals based on their personal capacity and creditworthiness.

- Agricultural Loans - Loans specifically for farmers and agriculture-related businesses. These funds can support crop cultivation, livestock, and other farm-related activities.

- Livelihood Loans - Loans for small businesses and micro-entrepreneurs.

- Housing Loans - Loans dedicated to supporting the construction, renovation, or purchase of residential properties for low-income families.

Top Microfinance Institutions (MFIs) in the Philippines

Fortunately, in the Philippines, there are several significant microfinance institutions (MFIs) you can choose from to get your microfinance loans. Here are the three main types:

- Government-Initiated MFIs - Government-backed institutions such as the Development Bank of the Philippines (DBP) focus on providing financial support and credit assistance to marginalized sectors.

- NGO-Based MFIs - Institutions like ASA Philippines Foundation operate as non-governmental organizations, offering microfinance services, including microfinance loans, primarily directed towards women and underserved communities.

- Private Sector MFIs - Some privately-operated entities, like Alalay sa Kaunlaran, Inc. (ASKI), provide financial services tailored for micro-entrepreneurs and small businesses.

Eligibility and Application Process

To save yourself time, make sure you meet the common eligibility requirements of microfinance loans before you apply. Take note of the following:

- Age - Applicants should be at least 18 years old.

- Residency - Filipino citizenship or permanent residency is often required.

- Income - Proof of a stable income source is necessary.

- Credit History - Some MFIs may request a credit history or score.

- Business Registration (if applicable) - For business loans, proof of business existence may be required.

- Collateral - Collateral might be requested by certain MFIs.

While the application process may slightly vary across different Microfinance Institutions (MFIs) in the Philippines, there are general steps you have to follow:

Step 1: Research and Select an MFI

Choose based on your financial needs, loan products, interest rates, and repayment terms. Ensure it aligns with your business or personal goals.

Step 2: Contact the MFI

Gather information about their loan products, eligibility criteria, and required documents. You can visit their branch offices, contact them via phone, or explore their official website.

Step 3: Submit Required Documents

Prepare the necessary documents. These may include valid identification, proof of income, residence proof, and any additional paperwork. You may also have to complete and submit their application form.

Step 4: Assessment and Evaluation

Wait for the MFI to assess your application, review your financial capability, and conduct credit checks. They’ll analyze your creditworthiness and repayment capacity.

Step 5: Loan Approval and Disbursement

Upon successful evaluation and approval of your application, the MFI will notify you of your loan approval. Once the terms are agreed upon, the loan amount will be disbursed. After this, make sure to always figure in loan repayments into your monthly budget. That’s it, luv!

TOCInterest Rates and Repayment Terms

Microfinance loans usually come with interest rates and fees tailored for small-scale borrowers. Unfortunately, the interest rates can be relatively higher compared to traditional bank loans. They may also charge fees like processing or service charges, impacting the overall borrowing cost.

On the bright side, repayment schedules for microfinance loans are usually flexible and vary from weekly to monthly options. Plus, the loan terms differ based on the borrower's needs and the microfinance institution's policies.

TOCImpact of Microfinance on Local Communities

Microfinance continues to impact local communities in the country in a positive way. Here are the three ways how:

- Economic Empowerment - Microfinance helps alleviate poverty and boosts economic development through financial services for underserved populations. They enable individuals to start or expand businesses, generate income, and improve their living standards.

- Community Development - Microfinance initiatives foster community development by offering financial resources for small-scale businesses, agriculture, and other income-generating activities.

- Empowering the Underserved - Ultimately, microfinance institutions extend financial inclusion to marginalized groups, empowering them with access to savings, insurance, and microfinance loans.

Challenges and Risks in Microfinance

While microfinance loans and microfinance in general seem like the answer to all our financial problems, it should be noted that they come with risks and challenges.

Borrowers of microfinance loans may have a hard time with repayments due to high-interest rates. Over-borrowing is a common problem as well and may lead to loan defaults.

To avoid these challenges, you can follow these tips:

- Educate yourself with financial literacy content like this blog and many of our other articles

- Take note of responsible lending practices like making timely repayments and borrowing only what you need

- Think long and hard before you decide to get microfinance loans. Taking out a loan is a big responsibility, luv, so don’t get one just for the heck of it!

Regulatory Framework and Government Policies

The microfinance sector in the Philippines benefits from a robust regulatory framework and supportive government policies, ensuring that both banks with microfinance operations and NGO-based Microfinance Institutions (MFIs) operate effectively and responsibly. Banks involved in microfinance are regulated and supervised by the Bangko Sentral ng Pilipinas (BSP), ensuring they adhere to policies that promote financial stability and responsible lending. On the other hand, NGO-based MFIs fall under the regulatory purview of the Securities and Exchange Commission (SEC), which mandates compliance with consumer protection laws, including those outlined in the Consumer Act of the Philippines.

This act further strengthens the regulatory framework by ensuring transparency, fairness, and the protection of consumers, vital aspects for the microfinance sector. It requires all financial institutions to provide clear information about their services, ensuring consumers are well-informed and protected in their financial transactions.

Moreover, the sector is supported by various laws and policies tailored to the unique needs of different types of MFIs, based on their organizational structures and objectives. Government initiatives, such as the People’s Credit and Finance Corporation (PCFC), play a significant role in bolstering the sector by providing funds to MFIs. This enables them to continue their crucial work of offering financial assistance to those in need, including micro-entrepreneurs and small-scale businesses.

These comprehensive policies and initiatives have a significant impact, facilitating increased financial access and opportunities at the grassroots level, leading to economic empowerment and growth. Through the combined efforts of regulatory bodies, the incorporation of laws like the Consumer Act, and supportive government policies, the microfinance sector in the Philippines stands as a model of responsible and inclusive financial practice.

TOC

Technological Advancements and Microfinance

Microfinance has evolved over the years through rapid technological advancements. Digital banking and payment systems, for example, may have been unimaginable a decade ago, but now you’d be hard-pressed to find someone who wasn’t using some sort of digital bank or e-wallet.

These advancements enable easier access to financial services for previously underserved populations, streamlining transactions and reducing operational costs for microfinance institutions.

Things don’t end there, though. You can expect further digital transformation in the future with increased adoption of fintech solutions, expansion of mobile-based financial services, and the integration of artificial intelligence and big data analytics.

Who knows where microfinance will be in the coming years? We can’t answer that question right now. What we can do is support your journey into the world of microfinance loans. Bookmark this blog and pull it up any time you need some refreshing.

That’s all, luv. Now go get that microfinance loan. You’ve got this!