Quick Take: What are the best loan programs for OFWs?

The best loan programs for OFWs include personal loans for covering personal expenses, business loans for entrepreneurial ventures, and housing and car loans for purchasing property or vehicles. Additionally, emergency or multi-purpose loans provide crucial support during unexpected financial needs.

Working miles away from home can be both daunting and emotionally exhausting. That’s why we think OFWs (or Overseas Filipino Workers) everywhere are super awesome at what they do to support their loved ones!

To help them out, we prepared this quick, informative blog about OFW loans! These are loans that can provide a great deal of comfort and peace of mind for our Filipino heroes abroad.

Sit back, relax, and learn all about OFW loans!

Always Getting Rejected for Loans?

You just need a better credit score. Start building with Tonik Credit Builder Loan!

Table of Contents

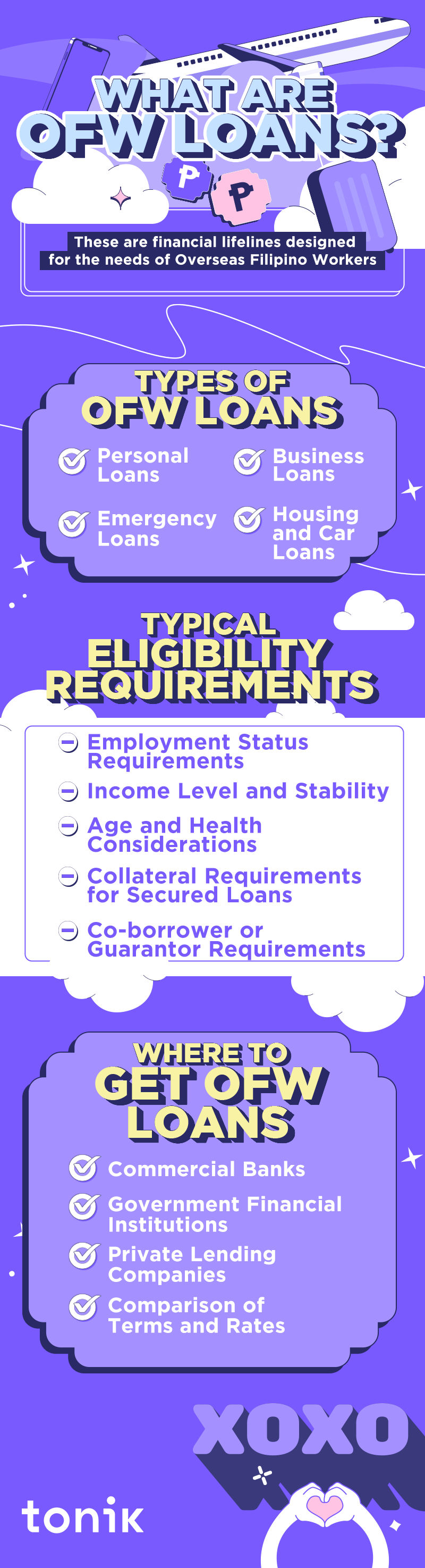

What are OFW Loans?

Before we embark on this journey, let's get the basics out of the way. What exactly are OFW Loans? These are financial solutions designed specifically for Overseas Filipino Workers. They enable them to address various needs back home in the Philippines while working abroad. They can be used for personal expenses, investments, housing, education, emergencies, and more!

TOCTypes of OFW Loans

There are different types of OFW loans available. Read about each one carefully so you can decide which one is the best for you.

- Secured vs. Unsecured Loans – In short, secured loans are loans that require collateral. Unsecured loans, on the other hand, don’t, but they may have more stringent eligibility requirements.

- Personal Loans for OFWs - Need some extra funds for personal expenses? Personal loans might just be for you.

- Business Loans for Entrepreneurial OFWs – These are OFW loans that can help you fund your business goals while abroad!

- Housing and Car Loans – As the name suggests, these OFW loans can help you purchase the house and car of your dreams.

- Emergency or Multi-purpose Loans - Life's storms can hit unexpectedly. These loans can help keep you and your loved ones afloat during turbulent times.

- Joint Loans for OFWs: A Joint Loan allows OFWs to partner with a spouse, relative, or close friend to apply for a loan together. This can be particularly beneficial for larger expenses or investments back home, as combining financial resources and credit scores may improve loan terms and increase the likelihood of approval. Both applicants are equally responsible for the joint loan, offering a shared approach to financial management while abroad.

Eligibility Criteria for OFW Loans

The eligibility criteria for OFW loans vary from lender to lender. Here are some that you will commonly find. Make sure to be prepared before you apply for a smooth and speedy loan journey.

- Employment Status Requirements – You may need to provide essential documentation verifying stable employment. This can be a work contract indicating duration, salary, and job stability.

- Income Level and Stability - Demonstrating a consistent and adequate income source is a must. This can be verified through pay stubs, bank statements, or remittance records.

- Age and Health Considerations - Age restrictions and health prerequisites may influence your loan eligibility. Make sure to check with your lender for the specifics.

- Collateral Requirements for Secured Loans – Collateral is any property (can be a vehicle or a house, just to name a few) that you pledge to the lender in order to secure your loan.

- Co-borrower or Guarantor Requirements - Involving a co-borrower or guarantor with good credit or financial stability can strengthen your loan application.

Enhancing Your Loan Application with a Co-signer

For some OFWs, meeting the strict eligibility criteria for loans can be challenging. Whether it's due to fluctuating income levels or insufficient collateral, there's an alternative path to strengthening your loan application: enlisting a co-signer. A co-signer is someone who agrees to take on the responsibility of your loan should you be unable to make payments. This person essentially pledges to the lender that they will uphold the loan obligations, providing an additional layer of security.

Having a co-signer with a solid financial background and a strong credit score can significantly increase your chances of loan approval. This is particularly valuable for OFWs who might be facing hurdles in their loan applications due to the nature of their employment or credit history.

By combining your financial profiles, a co-signer can help you access better loan terms or higher loan amounts, making it easier to achieve your financial goals. Remember, choosing a co-signer is a major decision that requires mutual trust and understanding, as it involves financial risks for both parties.

TOC

How to Get OFW Loans

Now that you have a good idea about the eligibility requirements of OFW loans, let’s dive right into the necessary steps!

Step 1: Prepare the Documentation Needed

Gather essential documents for a successful loan application journey. Keep everything organized, luv!

Step 2: Apply for the Loan

Fill the forms, submit the documents, and cross your fingers as you wait for approval. Want this to be super fast and easy? Consider getting a loan from a lovely neobank like us!

Step 3: Disbursement of Funds

Now for the fun part – receive the funds! Woohoo! Make sure you pay consistently and on time to maintain a squeaky clean credit history.

Role of Agencies and Banks in the Application Process

Agencies and banks in the Philippines act as navigators in steering your loan application journey. They conduct assessments, verify documents, and ultimately play a pivotal role in approving and disbursing the sanctioned funds. Learning about their responsibilities to ensure a smoother and more informed loan application experience is certainly essential when getting OFW loans.

TOCThe Pros and Cons of OFW Loans

Are you sure that OFW loans are for you? If you still have some doubts, you can read the pros and cons below to help you make an informed decision!

Pros of OFW Loans:

- Financial Support for Diverse Needs - OFW loans offer essential financial aid tailored to various needs. This makes it so much easier for OFWs to support their families despite the geographical distance.

- Facilitating Investments - OFW loans provide opportunities to invest in businesses or properties in the Philippines. Such investments can yield long-term financial benefits.

Family Support and Security - OFW loans play a crucial role in supporting families left behind by overseas workers. They enable families to access funds for essential needs, ensuring their well-being and security in the absence of the primary breadwinner.

Cons of OFW Loans:

- High-Interest Rates and Additional Fees - OFW loans often come with higher interest rates and additional fees, impacting the overall cost of borrowing. Make sure to do your research and look for a loan that offers low interest rates.

- Risk of Over-Indebtedness - Access to loans might tempt borrowers to take on more debt than they can manage. Borrow only the amount that you can pay back later on to avoid the vicious cycle of debt.

- Potential for Scams and Predatory Lending - There is a risk of falling victim to scams or engaging with predatory lenders who exploit the vulnerability of OFWs. Look for the lenders’ credentials before trusting any of them to ensure their legitimacy.

Financial Institutions Offering OFW Loans

Now, you must be wondering: Where can I get these OFW loans? There are actually a number of institutions that you can turn to. Check out the list below and take your pick!

- Commercial Banks – Commercial and traditional banks are prominent providers of OFW loans. Plus – since they’ve been around probably before you were born – you can count on them for being legit. They provide comprehensive services, including personal, business, housing, and emergency loans.

- Government Financial Institutions (e.g., OWWA, PAG-IBIG) - Government financial institutions like the Overseas Workers Welfare Administration (OWWA) and the Home Development Mutual Fund (Pag-IBIG Fund) cater specifically to OFWs.

- Private Lending Companies – You can choose from diverse loan products from these companies, often focusing on specific financial needs such as personal loans, emergency funding, or investment opportunities.

Quick Pro-Tip: Before signing that loan contract, make sure that you’ve reviewed the terms and conditions. If there’s anything you don’t understand, don’t be shy: seek clarification from your lender or a financial advisor!

TOCAlternatives to OFW Loans

Do you think OFW loans aren’t for you? That’s alright, luv. There are more options that you can explore!

- Non-Governmental Organization Support - Non-Governmental Organizations (NGOs for short) dedicated to supporting OFWs provide services such as legal assistance, financial education, counseling, and advocacy. You can get resources and guidance from these organizations without the burden of debt.

- Community Savings Programs and Cooperatives - Community-based savings programs and cooperatives offer alternatives to traditional banking. These programs encourage saving, offer micro-loans, and provide access to community funds that cater to specific financial needs without the formalities of conventional loans.

- Personal Savings and Investment - Leveraging personal savings and investments can serve as a practical alternative to borrowing. This may feel heavy on your wallet, but you may thank yourself later if you go this route since you won’t have to think about repaying a debt.

Best Practices for OFW Loan Management

Before we say goodbye and send you on your merry way, we’re giving you one last bit of knowledge about OFW loans: the best ways of managing them! Take these words by heart, luv, and you’ll be a-ok!

Financial Planning and Budgeting - This involves creating a realistic budget, tracking expenses, and aligning financial goals to ensure loan repayment while maintaining other financial obligations.

Understanding the Full Cost of Loans - Understanding the complete cost of the loan. This includes interest rates, fees, and any additional charges. Being aware will allow informed decision-making, preventing surprises in repayment.

Avoiding Over-Indebtedness - Exercise caution to prevent over-borrowing or accumulating more debt than can be comfortably managed. Again, borrow only what you need and within manageable repayment limits to avoid financial strain.

Seeking Financial Advice - Professional advice assists in making informed decisions, managing loans effectively, and ensuring long-term financial stability. That’s all, luv, now go get that OFW loan!