Sometimes you’re there at the right time. You get accepted into your dream university. Your barkada comes up with a brilliant business idea. You find the house you’ll raise your future kids in.

But what if you’re not in the right place financially? When you’re thousands of pesos short, do you resign yourself to sighing about The Opportunity That Got Away (aka TOTGA)?

Well, not anymore. There’s no room for TOTGA with Tonik Quick Loan, easy online loans that give the cash you need in as fast as 30 minutes.

Table of Contents

No TOTGA with Tonik

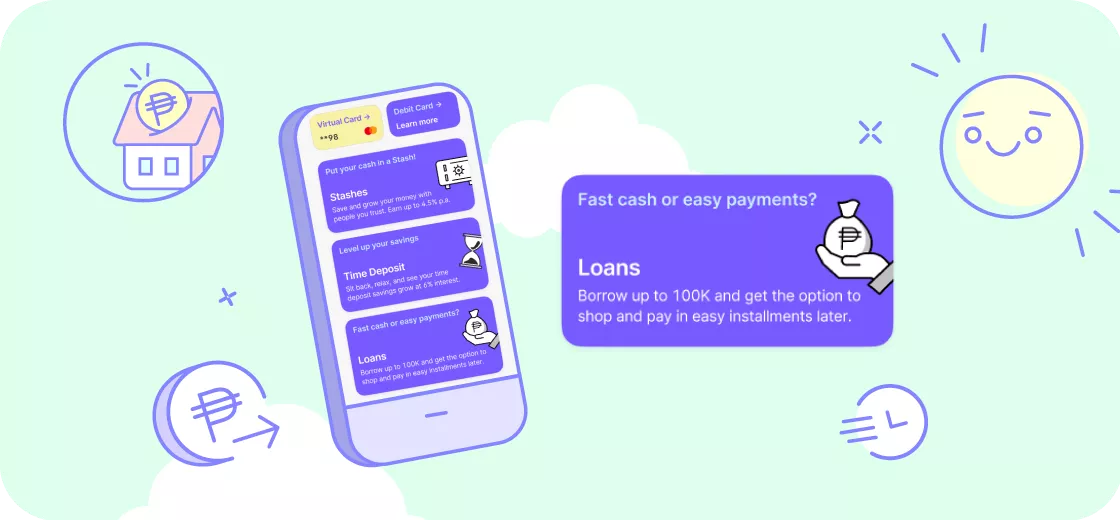

Tonik isn’t a fan of TOTGA and other financial regrets. As the Philippine’s first ever neobank or digital-only bank, we’re all about making banking as secure, easy, and fast as possible --including loans.

No need to visit a branch. No need to submit paperwork. No need to prove your credit score (a Philippine first, but more on that later). All banking transactions are done in one money management app.

We're the real deal too. Tonik holds the first private digital bank license from the Bangko Sentral ng Pilipinas (BSP). Our deposits are insured by the Philippine Deposit Insurance Commission (PDIC). Our cloud-based banking system is powered by global financial technology leaders like Mastercard, Amazon Web Services and Finastra. Our app is certified by international mobile security experts, and equipped with biometrics and military-grade encryption.

So don’t let those opportunities get away. Here’s the lowdown on Tonik Quick Loan.

TOC- Table FInd1. Easy online loan in as fast as 30 minutes

Tonik understands that sometimes, you just need the money right NOW. So we’re not going to make you wait. With a few taps on the app, you can apply for a 5,000 PHP to 50,000 PHP loan and get approval in as fast as 30 minutes.

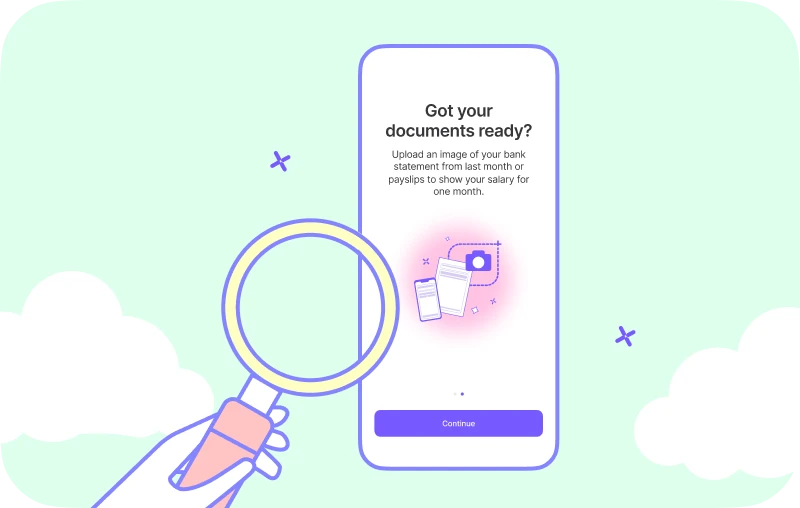

You can forget about digging up your financial records and IDs. You only need 2 things to apply: 1 valid government ID from this list and your most recent payslip for the month OR bank statement. (That’s just how a neobank works.)

The best part? Once your loan is approved, you’ll see the amount immediately in your savings account/Tonik Account, ready to use. (Plus, Tonik helps you earn more with our savings interest and products.)

Apply. Approved. Disbursed. All in one money management app.

TOC- Table FInd2. No credit history needed

We’re not here to judge your (credit) history. Most banks in the Philippines use credit scores to gauge a client’s ability to pay off a loan, and that’s usually based on how regularly they repay debts, how their credit card is used, the kind of loans they’ve taken out before, and more.

But of course, that requires a long credit history that not everyone may have. With Tonik Quick Loan, you don’t need to worry about all that. For the first time, everyone has a shot at getting loan approval, even with a very thin or non-existent credit history.

Tonik Quick Loan uses an AI-based algorithm and other world-class alternative credit scoring tech to give you an accurate, fast, and easy online loan assessment. As a neobank, we believe that everyone deserves a fair credit score in the Philippines.

TOC- Table FInd3. No collateral, lots of flexibility

If you’re wondering at this point what the catch is...relax. We’re not going to demand absurdly high collaterals from you. In fact, you don’t need to pledge any collateral

All you need to do is repay on time. And if you think applying for an online loan sounds easy, well we’re making repaying it even easier.

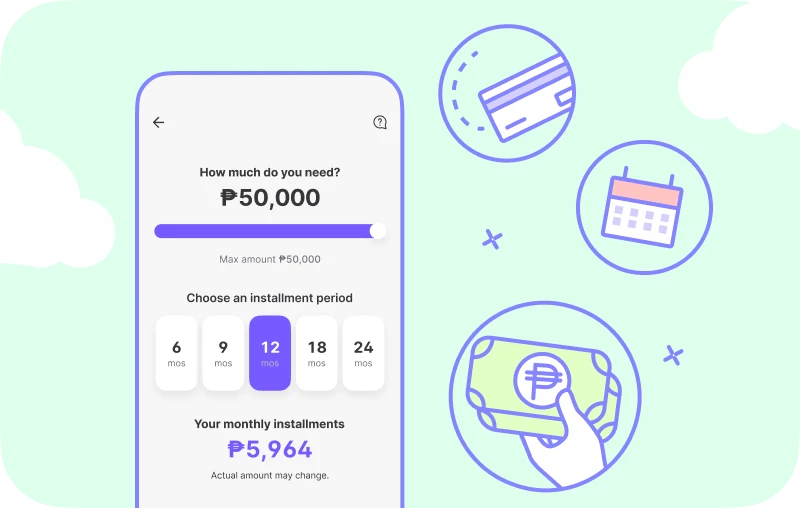

Your Tonik Quick Loan has a fixed monthly interest rate of 7 percent. (But if you link your salary payroll ATM card, we can bring it down to 5.42 percent.) You can repay it in installments of 6, 9, or 12 months. You can use our handy calculator to pick which repayment term is best for you.

You get to set your repayment date too. It could be your preferred salary payout date (just a suggestion), and we can automatically debit the amount from your Tonik Account. And there won’t be any surprises. Your Tonik app has a repayment tracker that keeps you updated on the deadline and your loan status.

If you decide to pay your loan in full early, well, congrats. We’re happy that you’re taking initiative. No early payment or pre-termination fees to worry about here.

After all, repaying your loan on time is a huge boost to your Philippine credit score, and that means more opportunities for you in the long run.

Say goodbye to TOTGA and let’s create opportunities together. Download the Tonik App today.