Starting your debt repayment journey isn’t easy. But if you’re serious about taking control of your finances and being debt-free, you need to learn how to master personal budgeting. And we all know that budgeting isn’t really a walk in the park.

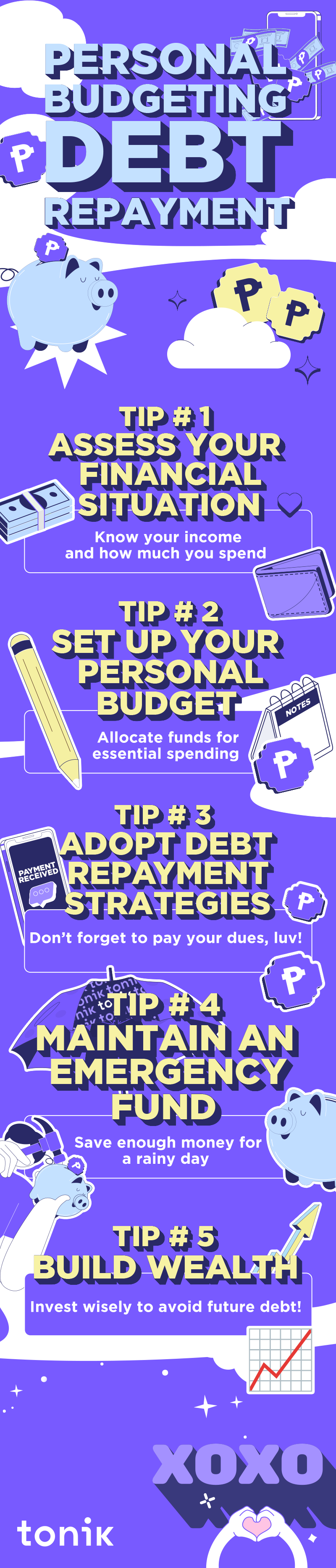

So today, we’ll share various strategies and techniques for creating a personal budget that focuses on debt repayment, providing actionable tips and insights to help you manage your finances effectively.

Table of Contents

- What is Personal Budgeting?

- Financial Audit: Assessing Your Financial Situation

- How to Set Up a Personal Budget

- Strategies for Debt Repayment

- Expense Management and Cost Reduction

- Savings and Emergency Funds

- Tracking and Adjusting Your Budget

- Overcoming Challenges in Debt Repayment

- Long-term Financial Planning Post Debt Repayment

- Budget Wisely and Be Debt-Free!

What is Personal Budgeting?

Personal budgeting isn't just about tracking expenses, luv. It's a strategic tool for conquering debt. By understanding where your money goes, you gain the power to allocate funds efficiently, making debt repayment a tangible goal.

Before diving into the budgeting intricacies, let's grasp the basics of debt repayment. We'll discuss the significance of a financial audit and the role it plays in creating a robust repayment plan.

TOCFinancial Audit: Assessing Your Financial Situation

- Listing All Debts

- Calculating Total Monthly Income

- Understanding Your Monthly Expenses

- Fixed Expenses: This includes rent or mortgage payments, insurance premiums, loan repayments, and any other recurring bills.

- Variable Expenses: These include groceries, entertainment, dining out, and other discretionary spending.

Start by facing the numbers. List down all your debts, including credit cards, loans, and other financial obligations. Specify the amounts owed, the interest rates attached to each debt, and their respective due dates. This detailed snapshot forms the bedrock of your debt repayment strategy, allowing you to prioritize and strategize effectively.

Know your financial starting point by calculating your total monthly income. This includes your salary, bonuses, freelance income, or any other sources of money you receive regularly. Understanding your monthly earning power provides a clear baseline for crafting a realistic and actionable budget.

To get to know your monthly expenses, list them down into these two categories:

How to Set Up a Personal Budget

The Concept of a Zero-Based Budget

A zero-based budget is a financial approach where every peso you earn has a designated purpose, leaving no room for unallocated funds. This method ensures that your income minus your expenses equals zero, helping you track and control your spending effectively.

Allocating Funds to Essential Expenses

Before tackling debts, prioritize essential expenses like housing, utilities, and groceries. Allocating funds to these foundational needs ensures stability and sets the stage for effective debt repayment.

Prioritizing Debt Payments

Not all debts are created equal. Prioritize debts by considering interest rates and outstanding balances. Allocate extra funds to high-interest debts first, accelerating your journey towards financial freedom.

Tips for Realistic Budgeting

Crafting a realistic budget is not about restriction; it's about aligning your financial goals with your lifestyle. Here are practical tips to create a budget that you can stick to without feeling overwhelmed:

- Be Honest About Your Spending Habits: Track your expenses for a month to identify patterns and areas where you might be overspending. This self-awareness forms the foundation for a realistic budget that reflects your actual financial behavior.

- Set Achievable Goals: Break down your larger objectives into smaller, manageable milestones. This not only makes your budget more attainable but also provides a sense of accomplishment as you reach each goal.

- Embrace Flexibility: Life is unpredictable, and so should your budget be. Leave room for flexibility to accommodate unexpected expenses or opportunities. A rigid budget is more likely to fail, whereas a flexible one can adapt to changing circumstances without causing financial stress.

- Use Technology to Your Advantage: Take advantage of budgeting apps and tools available today. These tools can automate expense tracking, categorize spending, and provide insights into your financial habits. They make budgeting more convenient and accessible.

- Be Realistic About Income: When budgeting, use a realistic estimate of your income. Avoid counting on windfalls or irregular bonuses as a steady source of income. A conservative approach to income ensures you can meet your financial obligations consistently.

Strategies for Debt Repayment

Now that you’ve got the basics of personal budgeting down, let’s talk about debt repayment. Here are a couple of strategies you can apply so you can pay your debts faster.

The Debt Snowball Method

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation. As each small debt is cleared, the momentum builds, empowering you to tackle larger debts with increased confidence.

The Debt Avalanche Method

Conquer high-interest debts strategically with the debt avalanche method. This approach targets debts with the highest interest rates, saving you money in the long run by minimizing interest payments.

Debt Consolidation and Refinancing Options

Explore options to simplify your debts. Consolidation combines multiple debts into a single payment, while refinancing may lower interest rates. Understand these options to choose the one that best fits your financial situation.

Negotiating with Creditors

Learn the art of negotiating with creditors to explore possibilities of lower interest rates or flexible payment terms, making debt repayment more manageable.

Exploring Debt Restructuring for Financial Relief

Debt restructuring involves negotiating directly with your creditors to modify the terms of your debts. This can include reducing the interest rate, extending the repayment period, or even reducing the principal amount owed. Such adjustments make your debt obligations more manageable, especially if you're facing financial hardship.

Engaging in debt restructuring requires a good understanding of your financial situation and clear communication with your creditors. It's an opportunity to work out a more feasible repayment plan, ensuring that you can meet your obligations without sacrificing essential living expenses.

TOCExpense Management and Cost Reduction

Here are a few ways to manage costs to help your debt repayment efforts:

- Identify and Reduce Non-Essential Expenses: Trimming unnecessary expenses doesn't mean sacrificing joy. Learn how you can reduce non-essentials in a realistic way. You don’t have to compromise your lifestyle to do this, luv!

- Be a Smart Shopper: Learn the art of smart shopping, utilizing discounts, promotions, and loyalty programs to stretch your budget further.

- Cutting Down Utility and Recurring Costs: Explore practical ways to reduce your monthly bills. From energy-saving tips to negotiating service fees, every peso saved contributes to your debt repayment journey.

Savings and Emergency Funds

An emergency fund acts as a financial cushion during unexpected challenges, providing peace of mind and ensuring that you don't have to resort to accumulating more debt.

Balancing Debt Repayment with Saving

Navigating the delicate balance between debt repayment and saving requires strategic financial planning. While eliminating debt is a priority, neglecting savings can leave you vulnerable to future uncertainties. Here are three saving strategies you can do while on your debt repayment journey:

- Automated Savings Contributions: Set up automated transfers to your savings account each time you receive your paycheck. Even a small percentage, like 5% or 10%, can accumulate over time. This "pay yourself first" approach ensures that saving becomes a non-negotiable part of your financial routine, regardless of your debt obligations.

- Create a Contingency Fund within Your Budget: Allocate a specific portion of your monthly budget exclusively for savings. Treat savings as a non-negotiable expense, just like rent or utilities. By incorporating savings directly into your budget, you create a structured plan that accommodates both debt repayment and savings without sacrificing one for the other.

- Explore High-Yield Savings Accounts: Maximize the impact of your savings by exploring high-yield savings accounts. While in debt, every bit of interest earned matters. High-yield savings accounts (like our Time Deposit) offer more competitive interest rates compared to traditional savings accounts, allowing your money to work harder for you.

Tracking and Adjusting Your Budget

Methods for Tracking Expenses and Payments

Stick to your budget and track expenses properly by following any of these three methods:

- Envelope System: Simplify tracking with physical envelopes for budgeted categories, using cash for purchases.

- Spreadsheet Tracking: Utilize Excel or Google Sheets for a customizable and detailed digital tracking method that you can save and review.

- Mobile Expense Apps: Stay on-the-go with mobile expense apps for easy transaction input and insightful reports. This is the easiest way to track expenses and payments.

Overcoming Challenges in Debt Repayment

Dealing with Unexpected Expenses

Whether it's creating an emergency fund or developing contingency plans, having a proactive approach to unexpected costs ensures you stay on track with your debt-free journey, even in the face of financial surprises.

Staying Motivated and Managing Financial Stress

The path to becoming debt-free can be challenging, but staying motivated is essential. Learn to embrace the journey, celebrate small victories, and keep your eyes on the long-term goal. Managing financial stress is crucial for maintaining commitment to your debt-free future. By cultivating a positive mindset and focusing on the progress you've made, you can navigate the challenges with resilience and determination.

Seeking Professional Financial Advice

Financial experts can provide tailored guidance, steering you towards optimal financial health. Whether you're navigating complex financial decisions or need assistance in refining your debt repayment strategy, seeking professional advice adds a valuable layer of expertise to your debt repayment journey.

TOCLong-term Financial Planning Post Debt Repayment

Strategies for Avoiding Future Debt

Learn from the past to secure your financial future. Here are three ways you can avoid future debt:

- Establish a Robust Emergency Fund: Having a reserve for unexpected expenses prevents reliance on credit for emergencies, reducing the risk of accumulating debt in the face of unforeseen challenges.

- Adopt a Mindful Spending Approach: Before making a purchase, assess whether it aligns with your financial goals and if it's a necessary expense. This approach helps control impulsive spending, preventing unnecessary debt from accumulating.

- Create and Stick to a Realistic Budget: Craft a realistic budget that aligns with your income and financial goals. Regularly review and adjust your budget to accommodate changes in your financial situation, ensuring that your spending remains within your means and preventing the need for additional debt.

Investing and Wealth Building Post-Debt

Building wealth post-debt involves strategic financial planning and disciplined actions. Develop a well-diversified investment portfolio that aligns with your financial goals and risk tolerance. Consider a mix of stocks, bonds, real estate, and other investment vehicles. Diversification helps spread risk and optimize returns over the long term.

TOCBudget Wisely and Be Debt-Free!

Remember, the road to debt freedom is a marathon, not a sprint. Celebrate small victories along the way and stay committed to your budgeting goals. Be flexible, adapt to changes, and most importantly, be kind to yourself throughout the process. It's not just about eliminating debt… it's about cultivating a healthy and sustainable relationship with your money. Your dedication today will pave the way for financial peace tomorrow.

Happy budgeting, luv!