Borrowing is a tool used globally and locally to achieve financial flexibility. But if you’re looking to start your lending journey luv, there are two types of borrowing that you need to seriously read up on. These are short-term and long-term borrowing. It’s crucial to understand the differences between short-term and long-term borrowing before making a choice that aligns with your financial goals.

In this blog, we'll explore these two borrowing options, discussing their definitions, characteristics, pros, and cons. By the end, you'll be equipped with the knowledge to make informed decisions about your financial future. Let’s get started!

Table of Contents

Short-Term Borrowing

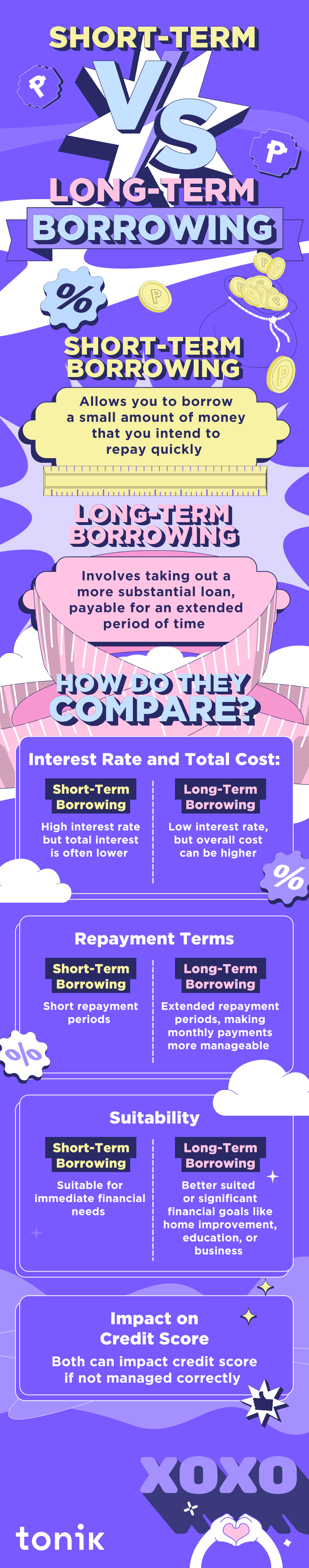

Short-term borrowing is a financial strategy where you borrow a relatively small amount of money that you intend to repay quickly, typically within a year. This type of borrowing is often used to cover immediate expenses, emergencies, or short-term projects.

| Pros | Cons |

|

|

Common Short-Term Loan Types in the Philippines

- Payday Loans: These are small, short-term loans intended to cover immediate expenses until your next payday.

- Microloans: Offered by various lenders and institutions, microloans cater to small borrowing needs with a brief repayment period.

- Credit Line: A revolving credit line allows you to borrow up to a predetermined limit and make regular payments, like a credit card.

Long-Term Borrowing

Long-term borrowing involves taking out a more substantial loan, often with a repayment period exceeding a year. These loans are typically used for significant expenses like buying a house or car, investing in education, or growing a business.

| Pros | Cons |

|

|

Common Long-Term Loan Types in the Philippines

- Mortgages: These are long-term loans used to finance the purchase of a home. They typically come with repayment periods spanning 15 to 30 years.

- Car Loans: If you're looking to purchase a vehicle, car loans offer a way to spread the cost over several years.

- Personal Loans: Personal loans can be used for various purposes, such as education, debt consolidation, or home improvement. They usually have longer repayment terms than short-term loans.

Comparative Analysis: Short-Term Borrowing vs Long-Term Borrowing

Now that we've explored the characteristics, pros, and cons of short-term and long-term borrowing, let's dive into a comparative analysis to help you make an informed decision.

| Criteria | Short-Term Borrowing | Long-Term Borrowing |

May have higher interest rates, but the total interest paid is often lower due to shorter repayment periods. |

Feature lower interest rates, but the overall cost (total interest paid) can be higher due to the extended repayment period. |

|

Repayment Terms and Flexibility |

Provides flexibility by allowing quick debt clearance. Frequent payments may pose budget challenges. |

Offers extended repayment periods, making monthly payments more manageable, but ties you to a prolonged financial commitment. |

Suitability for Different Financial Needs |

Suitable for immediate financial needs, such as covering emergencies or short-term projects. |

Better suited for significant financial goals like buying or renovating a home, financing education, or growing a business. |

Impact on Credit Score |

Both types can impact your credit score. Timely repayments boost your creditworthiness, but missed payments or defaulting can harm your credit score. | |

Which Type of Borrowing is Better For You?

In the realm of personal finance, choosing between short-term and long-term borrowing is a decision that should align with your financial goals, current needs, and future aspirations. Short-term borrowing offers quick access to funds but may come with higher interest rates. Long-term borrowing, while more affordable in terms of interest rates, involves more extended repayment periods and potential collateral requirements.

Consider your unique circumstances and objectives when deciding which type of borrowing is right for you. Whichever path you choose, responsible borrowing and timely repayments are key to maintaining a healthy financial profile. You can do it, luv!

Most Popular