Ah, debt. It's like that friend who's always there for you, especially when you want to buy something you can't quite afford or invest in your dreams… but also reminds you of its presence at the most inconvenient times.

For many Filipinos, debt is a part of life's financial journey, a companion on the road to achieving personal milestones or business growth. Whether it's for swiping your credit card for those shoes you've been eyeing, taking out a loan for your dream home, or even getting a little help to pay for school, debt is a tool that, when used wisely, can help pave the way to your goals, luv.

But, as with any powerful tool, it's all about how you manage it. This guide is designed to walk you through the types of debt in the Philippines, from the dizzying highs of getting that loan approval to the challenging lows of managing repayments. Let’s get started, shall we?

Table of Contents

TOC

What is Debt, Anyway?

Debt is money that you borrow and are expected to pay back, often with interest. It's like a boomerang; it always comes back, most of the times with a few extra pesos attached.

TOC

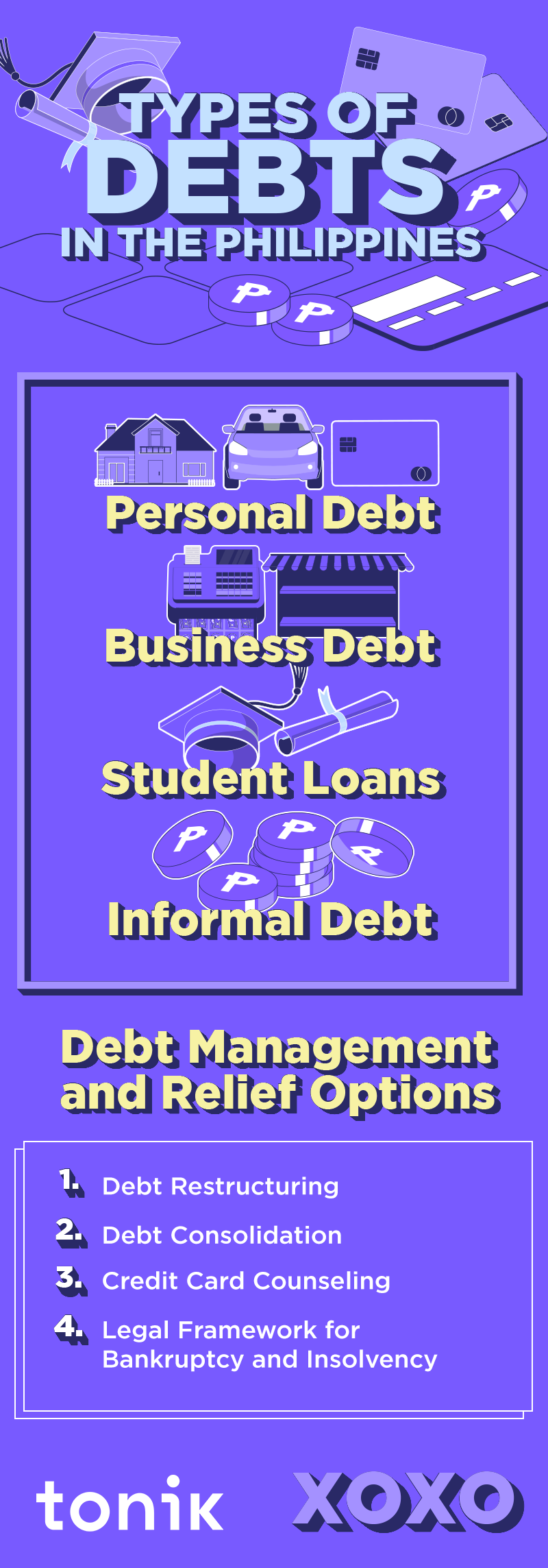

Different Types of Debt in the Philippines

- Personal Debt

- Credit Card Debt: Credit cards are fantastic for cashless transactions, but boy, do they love to accumulate interest! The risk? Spiraling into a shopping spree. The benefit? Reward points and the occasional "treat yourself" moment.

- Personal Loans: There are two kinds of personal loans. You have secured loans and unsecured loans. Unsecured Loans don’t need collateral. It’s based on your promise to pay back. Secured loans, on the other hand, requires you to give something valuable as collateral. And if you can’t pay your loan bank, the lender would have the right to take your collateral away.

Now, another popular personal loan is a payday loan. If you need quick cash, you can get a payday loan. But be warned, luv! Payday loans often have high interest. They are convenient but not exactly healthy for your wallet. - Mortgage Loans: Mortgage loans, also known as property loans, are a type of personal debt to specifically finance a property. Mortgage loans can be categorized either as home loans or real estate financing. If you need funding to buy or renovate your home, then home loan is your best bet. But if you need help purchasing a property for other purposes such as investments, then real estate financing will suit you better.

- Auto Loans: Auto loans are a type of personal debt that helps you purchase a vehicle. Whether you want a car for personal needs or a vehicle to help your business operations, you can take out this kind of loan. Usually, auto loans have long-term commitments. So be sure you’re ready for it.

- Business Debt

- Corporate Bonds: Corporate bonds are a type of debt issued by companies to raise capital. Investors lend money to the company in exchange for periodic interest payments and the return of your capital when the bond matures. When investing in corporate bonds, consider the bond's yield, the issuer's credit rating, and the bond's maturity date. Higher yields often come with higher risks, and the credit rating indicates the issuer's ability to repay the debt.

- Bank Loans for Businesses: Business bank loans can be grouped into the following:

- Short-term Loans: The entrepreneurial equivalent of "I just need a little to get through the month." These are loans provided to businesses to cover immediate financial needs, such as inventory purchase or working capital. They usually have a repayment period of less than a year.

- Long-term Loans: Long-term loans provide businesses with funding for major investments, such as purchasing equipment or real estate. These loans have a longer repayment period, often several years, and are typically secured by the assets purchased with the loan.

- Microfinance Loans: Microfinance loans are designed to support small businesses and entrepreneurs who might not have access to traditional banking services. These loans aim to empower economically disadvantaged individuals by providing them with the capital to start or grow their businesses. This, in turn, can contribute to poverty reduction and economic development in underserved communities.

- Student Loans: Student loans are financial aids that help students cover their education costs. In the Philippines, these types of debts are available from different sources including the government, private banks, and financial institutions. They aim to make higher education accessible to everyone, regardless of their financial situation. Student loans in the Philippines can be categorized under the following types:

- Government Loans: These loans are provided by government agencies such as CHED or GSIS and are intended for their members' children.

- Private Loans: Offered by private banks and financial institutions, these loans have various terms and interest rates.

- University Loans: Some universities offer their own loan programs to help students with their tuition and other fees.

Informal Debt: Informal debt refers to loans taken from non-institutional lenders like family, friends, or local money lenders. While accessible, these loans may carry high interest rates and lack formal repayment terms.

Some examples of informal debt are private lending and the 5-6 lending system. Private lending involves borrowing from lenders not associated with banks or traditional financial institutions. This option can be useful for those unable to meet the stringent requirements of banks, though it often comes with higher interest rates. Meanwhile, the "5-6" system is an informal lending practice where the borrower pays a 20% interest rate. It's a quick source of cash but can lead to financial strain due to its high interest rates.

TOC

Debt Management and Relief

Think of debt management and relief as your financial stress-reliever, luv. It's all about finding strategies to manage your debt more effectively or getting some relief if it's becoming too much to handle. Whether it’s tweaking your budget, negotiating better terms with creditors, or finding a program that can lighten your debt load, the goal is to make your debt more manageable and less of a headache. Here are some ways you can manage your debt:

- Debt Restructuring: Debt restructuring is like giving your debt a makeover. If you're struggling to keep up with payments, restructuring can change the terms of your debt—think lower interest rates, extended payment periods, or even reducing the total amount owed. It's a way to make your debt fit better with your current financial situation, so you can keep up without sacrificing your essentials.

- Debt Consolidation: Imagine rounding up all your debts—credit cards, loans, that money you owe your friend—and combining them into one. That's debt consolidation. Instead of juggling multiple payments with various interest rates, you get one loan to pay them all off, leaving you with just one payment to manage. It can simplify your life and often reduce the amount you're paying in interest. Just make sure you're not jumping into a higher interest rate in the process.

- Credit Counseling Services: Credit counseling services are like having a personal trainer, but for your finances. These services offer advice on managing your debt, creating budgets, and making a plan to pay off your loans. They can also negotiate with creditors on your behalf to secure lower interest rates or enroll you in a debt management plan. It’s a helpful resource if you’re feeling overwhelmed and need some expert guidance to get back on track.

- Legal Framework for Bankruptcy and Insolvency: The legal framework for bankruptcy and insolvency is your financial safety net. When debts become completely unmanageable, these legal processes can offer a way out. Bankruptcy can help discharge some or all of your debts, while insolvency procedures can provide protection as you figure out how to pay creditors. It’s a complex path with serious implications for your credit score and financial future, so it’s usually seen as a last resort, luv. But knowing it’s there can provide some peace of mind when you’re navigating tough financial waters.

TOC

Don’t Be Afraid of Debt, Luv

As we wrap up this exploration of debt, it's clear that managing and relieving debt is crucial for financial well-being. From the various types of debts available in the Philippines to the strategies for managing it, the journey through understanding debt is filled with opportunities to learn and grow. Remember luv: While debt can be a powerful tool for achieving personal and business goals, it comes with responsibilities. Approach it wisely, consider your options, and seek professional advice when needed. Don’t be afraid of debt, luv. But be sure to take it seriously, too!