From Personal to Business: A Complete Guide to Online Loan Types & Alternatives

Are you tired of the long lines, endless paperwork, and frustrating wait times involved in getting a traditional loan? Look no further than online loans! With just a few clicks, you can apply for and receive funds in no time!

But hold it right there, luv! Before you jump in headfirst, read on to learn about the different types of online loans available in the Philippines. We’ll also share some important factors to consider before making your choice. Plus, we’ll even throw in some alternative loan options for those who want to explore outside the online loan world. Let’s get started!

Table of Contents

TOC

How do online loans differ from traditional loans?

The main difference between an online loan and a traditional loan is the way in which they are obtained. Traditional loans involve a trip to the bank, paperwork, and often require collateral and a credit check. Approval can take weeks and sometimes even months! Once approved, funds are disbursed via check or deposit.

Online loans, on the other hand, are applied for and processed entirely online. The application is quick and easy, and funds can be deposited within minutes, hours, or days. Digital banks and other lending institutions that offer online loans can choose to require collateral or not for their online loan products. However, online loans may come with higher rates and fees.

TOC

What types of online loans are available in the Philippines?

There are now tons of online loan offerings currently available for Filipino borrowers. But today, let’s talk about three of the most popular online loan types in the Philippines. Read on to find out more about them:

1. Quick Loans

Need a loan approved within minutes? This is where quick loans come in. Usually, these online loans are not backed by any collateral, such as a car or home. They are often called "quick loans" because they are designed to be processed and approved quickly, with funds typically disbursed within a few days or even hours. Because it’s easy to apply, get approved, and receive your loan, quick loans often have smaller loan amounts than other types of online loans.

Need a quick loan that is fast and reliable? Then our Quick Loan is right for you! Our Quick loan allows you to borrow up to PHP 20,000 without any collateral or credit check. You can also choose to pay us back within 6 to 12 months. All you need is one valid ID to get started.

Our Quick Loan is perfect for sudden expenses where you need a fast loan to save you from unnecessary disaster. Think of sudden medical or even educational expenses that don’t fit the budget (or exceeds your Emergency Stash). We’ve got you covered!

2. Personal Loans

If you need a larger amount of money than a quick loan can offer you, then personal loans are your best friend! Personal loans are loans you can use for a variety of purposes, like sprucing up your home, indulging in some sweet revenge travel, or tackling big expenses.

3. Business Loans

Need to purchase new equipment? Looking to scale and hire new employees? Need short-term cash to cover unexpected business expenses? Then a business loan is perfect for you! Business loans are a type of online loan designed specifically for entrepreneurs. They are often used to finance long-term investments of businesses; hence they have bigger loan amounts than other loan types.

TOC

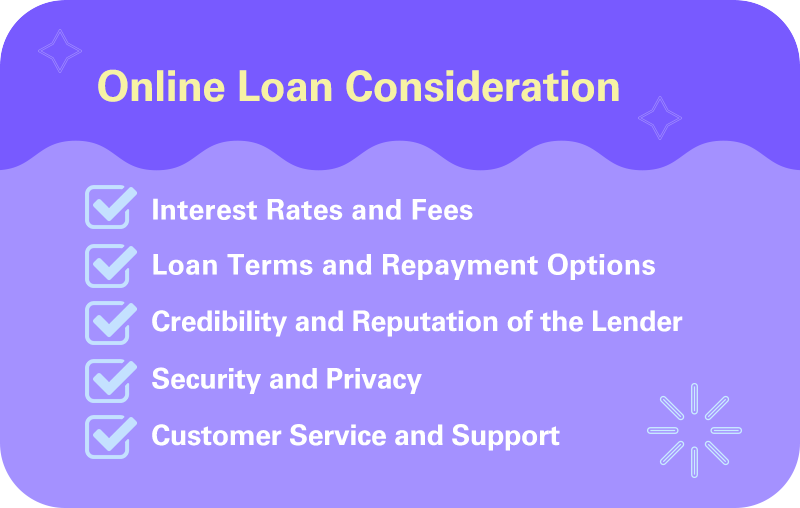

What should I consider before choosing an online loan?

Applying for an online loan is definitely quick and easy. But deciding where and how much to loan should never be done in haste! Here are five things you need to keep in mind before signing on the dotted line:

1. Interest rates and fees

Don't get played by lenders with sneaky fees and high rates. Look for someone with transparent fees and competitive rates -- and watch out for any hidden charges that could blow up your bill.

2. Loan terms and repayment options

Make sure you pick a loan term and repayment plan that works for your wallet. And if you're feeling ambitious and want to pay it off early, watch out for pesky penalties.

3. Credibility and reputation of the lender

Don't get catfished by shady lenders. Do your research and read reviews from other borrowers to make sure you're dealing with a legit lender. Legit lenders are those licensed either by the Bangko Sentral ng Pilipinas or the SEC.

4. Security and privacy

Keep your info safe and sound by choosing a lender that takes security and privacy seriously. Make sure they're using top-notch tech to protect your deets -- and be aware of any potential risks when sharing sensitive info online.

5. Customer service and support

Nobody got time for bad customer service, luv. Better look for a lender with responsive and helpful support. And be sure to read the fine print to make sure that you know what's what.

TOC

What are some popular online loan alternative options?

Just in case you’re looking for other ways to get money… we gotchu, luv. Here are five popular online loan alternatives just for you:

1. Credit Unions

Credit unions are member-owned financial cooperatives who offer low-cost loans and other services, with more flexible lending criteria and lower interest rates than traditional banks.

2. Microfinance Institutions

Microfinance institutions provide small loans and support to entrepreneurs and low-income folks who may not qualify for online loans. They may also offer training and rowers build their businesses.

3. Government Programs

If you’re looking to borrow money, you can’t forget about the big guys, luv. The Philippine government has various programs that offer loans and financial assistance to small businesses and individuals. From the SSS Salary Loan program to the PAGIBIG Multi-purpose Loan, there are plenty of options out there for your funding needs.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with investors who are willing to lend money. Some P2P lending platforms may offer lower interest rates compared to online loans. But let me warn you: P2P lending platforms might require you to also have a good credit history to qualify.

5. Personal Savings

Online loans are awesome. But if you can’t qualify for them yet, then it’s probably best if you save money first. Good thing you can stash your savings in our Stashes and see your hard-earned money grow by 4% per annum.

Online loans can provide a quick and easy solution to your financial needs. But it's important to choose the right loan product that fits your situation. Understanding the differences between online loans and traditional loans, as well as the types of online loans available to you, is essential to making an informed decision. Also consider other important factors such as interest rates and loan terms before signing the dotted line. We know it's tempting but resist the urge to borrow more than you need, luv. Don’t do anything you’ll regret later on.