Quick Take: What’s the best online lending app in the Philippines?

That depends on what you're looking for, luv. We recommend going for legit BSP-licesned digital banks instead, like us. Download the Tonik App today!

Say “sayonara” to face-to-face loan applications and strict requirements. Online loans are all about ease and convenience. Are they the ones for you? Check out all the information you need about them here.

A benefit of banking and doing finance in the modern age is the convenience of technology. During the past 10 years, fintech companies, as well as digital banks, have been on the rise. Some of the upsides of digital banking and finance include all your errands and needs being on the cloud, like transfers, deposits, customer service, and of course, applying for a loan!

Loans may be a huge ordeal to a lot of people due to the stress of just applying for one. Online loans and lending platforms were made for the borrower in search of comfort and leisure. If you want to get money the easiest way possible, try an online loan!

But wait, what is an online loan anyway and what do I need to know about it before applying for one? We've got the answers for you here.

Table of Contents

- What are Online Loans?

- Online Loans vs. Traditional Loans

- Types of Online Loans available in the Philippines

- Credit Builder Loan

- OFW Loans

- Salary Loans

- Small Business Loans

- Buy Now, Pay Later (BNPL)

- P2P Lending

- Pros and Cons of Online Loans in the Philippines

- How to Apply for Online Loans in the Philippines

- How to Find Safe Online Lending Platforms and Apps

- Tips on How to Get Your Online Loan Application Approved

- Online Loans FAQs

- What are the typical requirements for online loans in the Philippines?

- How much is the maximum amount you can borrow from online lending platforms?

- Is it safe to get online loans in the Philippines?

- How long does an online loan take to process?

TOC- Table FInd

What are Online Loans?

Online loans are loans you can get from online lending platforms, fintech apps, digital banks, or digital arms of more traditional banks or companies. They are typically unsecured loans, though there are some online platforms that have multiple types of loans that involve collateral or bigger monetary amounts.

These loans normally have super quick processes, with application and disbursement happening in a matter of minutes (at Tonik, it takes about 30 minutes in total to get a Credit Builder Loan, for example!) due to more automated systems in place.

Lots of online lenders are gaining more and more traction in the Philippines. Examples include Tonik (duh!), Cashalo, Moneycat.ph, Tala, Home Credit, Robocash, Digido, Juanhand, and loads more.

TOC- Table FInd

Online Loans vs. Traditional Loans

As of April 2023, as much as 47.1% of the Filipino adult population have borrowed money. And such loans could be classified into online and traditional loans. If you’re still new to the world of loans, you may be wondering what’s the big difference between online and traditional anyway?

- No more face-to-face – Since everything is online, you no longer need to talk to a banker or representative about your loan. If you have questions, all matters would have to be settled over the internet or via call since these online lenders or digital banks usually do not have their own physical branches. Whether this is a pro or a con is up to you.

- Super-fast processing – Again, online lenders and digital fintechs incorporate automated processes to help quicken the application process for their loans. This is how you can get your loan disbursed in an hour or even way less! They may partner up with other suppliers and programs online to verify your information so that no other third-party will be involved. Traditional loans take a lot longer to process.

- Not much cross-selling – Traditional banks may offer lower interest rates since they might urge you to take more of their products, like a savings account. You don’t have to deal with this much when it comes to online lenders.

TOC- Table FInd

Types of Online Loans available in the Philippines

Thinking of getting an online loan? Look for the best type for you.

- Credit builder loans – These are the quickest loans you can get and they’re normally unsecure (no collateral) with low amounts that can be borrowed. Their terms are shorter too. Disbursement happens in minutes and there are lots of legit platforms and apps online to choose from. Examples are apps or lenders like Tala, Cashalo, and Tonik!

- OFW loans – OFW loans are loans that allow Overseas Filipino Loans with families in need to borrow money for different purposes, whether it’s for buying a loan, starting a small business, etc. These are especially for OFWs.

- Salary loans – These are short term loans that can be paid in full or in installments when you get your next salary or payout. SSS is one of the most popular organizations that give salary loans—you can apply for this online too!

- Small Business Loans – As mentioned by its namesake, these loans are meant for borrowers to kickstart their small business venture and lay its foundations. Traditional banks give out small business loans, but so do some online lenders like First Circle and Grab.

- Buy Now, Pay Later (BNPL) - These loans, more known as BNPL programs, help customers buy appliances, furniture, or other items online or in-store and allow them to pay on a later date or in installments—hence the name “buy now, pay later.” This lets consumers purchase things instantly should they need them but not have enough funds to do so. Home Credit is among the most popular companies that offer BNPL loans. Tonik also has one called Shop Installment Loan, with presence in stores such as Home Along.

- P2P Lending - This is short for “Peer to peer” lending, meaning you loan from actual individuals and peers instead of a financial institution, like a bank. You get the loans from a pool of money from investors (sometimes, even just one investor). An example of a P2P lending platform is Blend.ph, where you can both borrow or invest. It’s a little like how a mutual fund works.

TOC- Table FInd

Pros and Cons of Online Loans in the Philippines

Pros of Online Loans

- Convenient, easy application – As mentioned earlier, application is fuss-free and these companies only require minimal documents. This, however, would vary per lending company. Make sure to check the requirements of the online loan you choose to get!

- Fast disbursement – If the application takes a day or even less, then disbursement is even faster! Tonik, for example, disburses the loan instantly to your Tonik Savings Account after the 30 minutes that it takes you to apply (this is for Credit Builder Loan, FYI).

- Apply anytime, anywhere – Because these platforms operate digitally, you can apply at whatever time you want and anywhere! Just open your app or website of choice. No more lining up at banks or submitting documents personally. It’s the age of tech, baby!

- No need for collateral – No collateral? No problem! You normally don’t need to give up something valuable such as property, car, jewelry, or anything similar to get an online loan. These loans are typically unsecure.

Cons of Online Loans

- Short terms – Since you can borrow very low amounts of money at a time from these apps (Tala offers loans as low at Php 1000), terms are also normally shorter as well, with some that last only a month or so. For Tonik, the shortest loan duration for Credit Builder Loan is 6 months.

- High interest rates – Because you don’t need credit history or many requirements, plus application is a breeze, interest rates are normally higher than what you’d see from traditional loans. These are typically unsecured loans without collateral, so it’d be more expensive to pay back.

- Possibility of scam – Because it’s online and you may not get to meet anyone in real life for your loans, there’s always the possibility of getting scammed out of your money. Make sure to only borrow from verified online lending companies that have reviews from actual people. Do your research and stay vigilant when dealing with finance digitally. Lots of scammers might even claim to be associated with legit companies—remember that you do online loans by yourself and with no third parties!

- Lower maximum amount – If you’re in need of big money, you might not be able to cover everything with an online loan. They’re normally smaller amounts only since they’re unsecured and easy to get.

TOC- Table FInd

How to Apply for Online Loans in the Philippines

Applying for an online loan is definitely a lot easier than applying for a traditional bank loan. One reason, as mentioned earlier, is because everything is digital and that you can do it right in the palm of your hand, especially when the online lending platform you’ve chosen has its own app. You usually begin by researching the app or platform that’s good for you, then you download the app and begin applying through there.

A great option is Tonik, where you can get a loan within 30 minutes or even less! Here’s some steps on how to do it.

- Download the Tonik App onto your mobile phone and sign up for an account. This involves taking face biometrics and uploading a valid government ID to the platform. To know more about creating a Tonik Account, just follow the steps on our handy onboarding video.

- Once you have a Tonik Account, go to your app dashboard and click on the “Loans” tile.

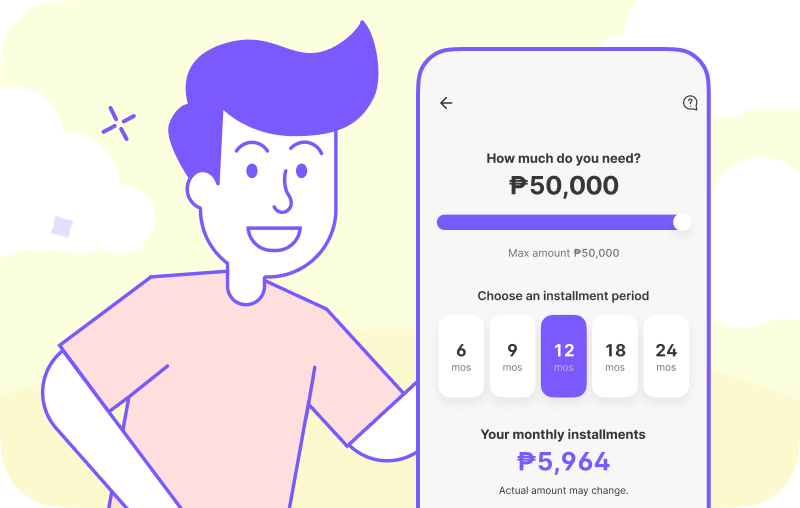

- Choose the loan that is best for you. Currently, Tonik has 2 that you can pick from—Credit Builder Loan (personal loan) and Shop Installment Loan (BNPL loan).

- Input how much money you need and your desired payment terms.

- Fill up your information on the app and upload income documents (such as your latest pay slips or bank statement).

- Wait a few minutes for approval. If you get approved (WOOHOO!), sign all the necessary forms, like the Promissory Note, Disclosure Statement, and the Amortization Statement.

- Check your Tonik App again to see your loan amount disbursed there. Yass!

Can you believe that all this would take less than an hour and all from the safety and comfort of your home? Technology is amazing!

TOC- Table FInd

How to Find Safe Online Lending Platforms and Apps

If you’ve been reading this article from the start, then you understand that part of the risk of getting an online loan is the possibility of being scammed over the internet. Prevent this from happening and take precautions through these steps:

- Find reviews online – The easiest way to check if a company is legit? Reviews! Scroll through the internet for reviews, from all their social media sites to Google. Yes, reviews may either be biased or faked, but it doesn’t hurt to read them to research further and inform your judgment whether the platform is the real deal or a potential scam.

- Search for a physical address - Okay, so digital platforms may operate online, but the legitimate ones still have a physical address displayed on their website. For example, Tonik’s office is located somewhere in Metro Manila. This information is easily accessible through a quick Google search.

- Check the website – You can easily enter the domain on whois.com to know who owns and runs the site as well as how long it’s been around. This’ll give you an idea of whether the lending company is legit or not.

TOC- Table FInd

Tips on how to get your loan application approved

- Borrow only what you need – We know it's super tempting to just go for the biggest amount, don’t forget, this is a commitment. You’ll need to pay it back eventually. So, think about it: how much do you really need to borrow? If you're looking at an amount that’s too huge and lenders see that you don’t really have the capacity to pay back your dues, then your application will most likely be rejected. Only loan what you can afford.

- Find the lender suited to your situation – First time borrower with no credit score? Then a traditional bank loan won’t be for you; try online lenders instead, since they’re more lenient with applications. Are you a student on the hunt for a student loan? Try the government loan from CHED! When hunting for a loan, you must make sure the lender’s terms are suited to your situation and your needs. Are you employed or not? Are you looking for an emergency loan? Do you want to buy a gadget? These are questions you need to ask yourself because there are loans and lenders out there that cater to what you need. All you’ve got to do is assess and search.

- Have a steady source of income – Most of the time, financial organizations that offer loans will ask you for proof of income. If you’re a salaried employee, then that’s a good step in ensuring an approved loan. Lending institutions will usually ask for your most recent pay slips to make sure you can pay off debts.

- Keep a good balance in your bank – In relation to the last bit, private online lenders might ask you to submit one or the other: your latest pay slip or your latest bank statement. To prove your financial capacity, have enough savings in your bank and make sure you regularly place funds there.

- Prepare all documents needed – If you loan from online lenders or digital banks like Tonik, you’ll only need a valid government ID. For that, ensure that your ID isn’t expired at the very least!

- Make sure all information is accurate – When you’re putting in your information while applying for an online loan, triple check your information because you may be declined should your details be erroneous. Your information should add up to all of your supporting documents so look at your application thoroughly before passing it to your desired lender.

TOC- Table FInd

Online Loan FAQs

What are the typical requirements for online loans in the Philippines?

Not much, actually! A pro of online loans is how easy the application process is and how minimal the requirements are. You’d really only need a valid government ID and an income document to show that you’re capable of paying the loan back, like a bank statement or recent pay slips. Of course, you’d have to make the qualifications as well to get an online loan, like to be of a certain age (usually around 21-60 years old), a Filipino residing in the Philippines, employed, etc. This is a lot less than the requirements and document needed by traditional finance companies or banks! Tonik’s requirements can be found here (Credit Builder Loan) and here (Shop Installment Loan).

How much is the maximum amount you can borrow from online lending platforms?

Because online lending is supposed to be quick and easy, the payment terms are shorter (around 2 years at most) and the amount you can borrow is less. This would depend on the lending platform you choose, but the usual maximum amount for Credit Builder online loans would be around PHP 20,000-PHP 100,000. Tonik’s Shop Installment Loan has a maximum lendable amount of PHP 100,000. It’s also coming out with bigger loan amounts, so you can stay tuned for that!

Is it safe to get online loans in the Philippines?

As long as you go to the verified, legitimate platforms that are regulated by the Bangko Sentral ng Pilipinas, then yes, it is super safe to get online loans in the Philippines! Just make sure you research about the platform you’re choosing before applying for any loan. As mentioned earlier in this article, the possibility of being scammed is always present since no face-to-face interactions are involved when it comes to these.

How long does an online loan take to process?

Again, online loans are supposed to be fast and easy. It takes less than a day to process and have your loan disbursed, or even just a few minutes involving everything—application, approval, and disbursement. Tonik’s entire loan process just takes 30 minutes long.

Because online loans are among the most accessible in the country at the moment, why not try one right now if you’re in need of quick cash? Tonik’s loans are among the easiest you can get. All you need to know is right here. Doesn’t hurt to check something out, so go for it, luv!

Sources:

Conclusion

Want to make life easier? Just choose the perfect loan for you. They provide a convenient, fast, and accessible option for those in need of financial assistance. We offer streamlined application processes, quick approval times, and flexible terms as opposed to traditional banks. But don't forget! You must carefully consider the terms, interest rates, and your ability to repay to avoid those annoying financial strains. Just remember to be responsible, since online tools can be your best friend for managing unexpected expenses or funding important purchases. Ready to apply for an online loan? Download the Tonik App today!