So you’ve decided that you’re getting a loan. That’s great, luv! When handled responsibly, (that means borrowing only what you need and paying on time!) a loan can be an excellent solution to your financial woes.

But before you apply, you must first make an important decision that will largely affect your borrowing experience: are you taking out an online loan or a bank loan?

It’s a little bit more complicated than choosing between applying at home and applying in a bank, hun. No worries! In this blog, we’ll give you the deets you need to make a well-informed decision!

Table of Contents

What are Online Loans?

Online loans are financial lifelines that you can access using your smartphone and a stable internet connection. They come in different forms, including mobile lending apps, online lending platforms, and peer-to-peer lending communities. In short, they’re loans that provide quick and convenient ways to secure funds for unexpected expenses!

Pros of Online Loans

- Speedy Approval - Online loans offer lightning-fast approval, often within minutes, making them ideal for urgent financial needs.

- Convenience - You can apply for online loans from the comfort of your home. No need to dress up for the bank!

- Accessibility - Online loans may be more accessible to individuals with varying credit histories, offering a wider pool of potential borrowers.

Cons of Online Loans

- Higher Interest Rates - Some online loans come with higher interest rates compared to traditional bank loans, potentially costing you more in the long run.

- Fees and Hidden Costs - Be wary of additional fees and hidden costs that can eat into the loan amount you receive.

- Privacy Concerns - Providing personal information online can be a security risk, so it's crucial to ensure you're dealing with a reputable lender.

What are Bank Loans?

Bank loans are financial products you'll encounter in traditional brick-and-mortar banks. These loans are your go-to for more formal borrowing needs.

Pros of Bank Loans

- Lower Interest Rates - Bank loans usually come with lower interest rates, potentially saving you money over time.

- Established Reputation – Traditional banks have a long-standing reputation for reliability and trustworthiness, making them a good choice for those who get cold feet when they hear the word “online.”

- Variety of Loan Types - Banks offer a wide range of loan products, including personal, business, and even auto loans, catering to various needs.

Cons of Bank Loans

- Lengthy Approval Process - Bank loans often involve a more time-consuming and paperwork-intensive application and approval process, which may not be ideal if there’s an emergency.

- Strict Requirements - Banks may have stricter criteria for approval, which can be challenging for borrowers with not-so-great credit histories.

- Limited Accessibility - Traditional banks may have limited operating hours and locations. This can be a problem especially for those living in remote and rural areas.

Comparative Analysis: Online Loans vs. Bank Loans

Now, let’s get down to the nitty-gritty. Let’s see online loans and bank loans go head-to-head in this quick comparative analysis!

- Interest Rates and Fees - Online loans may come with higher interest rates, but they make up for it with their lightning-fast approval process. Traditional bank loans offer lower rates, but you'll be filling out a ton of paperwork!

- Loan Amounts and Terms – Many online loans have smaller loan amounts and shorter terms compared to bank loans. Bank loans, on the other hand, tend to be more generous, but you might have to pledge collateral to get the funds you need.

- Application and Approval Process - Online loans are a breeze. You can apply in your pajamas while eating breakfast or binge-watching your favorite K-drama. It’s that easy! Bank loans might ask for your entire life history, including your first pet's name and your third-grade teacher's favorite color (okay, not really, but you get the picture).

- Customer Service and Support - Online lenders are available 24/7, and if you reach out to customer care agents like ours, you’re sure to get top-tier service. Traditional banks, however, follow regular office hours.

- Security and Privacy Aspects - Online lenders have state-of-the-art security, but you may get targeted ads afterwards which – let’s face it – can get annoying sometimes. Banks have that vault-like security, but your banker will probably recognize you at the grocery store (awkward!).

Suitability for Different Borrowers

Still scratching your head, wondering which one is more suitable for you? It all boils down to your needs, preferences, and which would give you the best deal based on the first two. Here are a few more things to consider to help you say “yay” or “nay”!

- Personal vs. Business Loans - Online loans are great for personal endeavors. Banks are more your go-to for business endeavors. However, that’s not to say that there aren’t any online loans that can help you achieve your business goals.

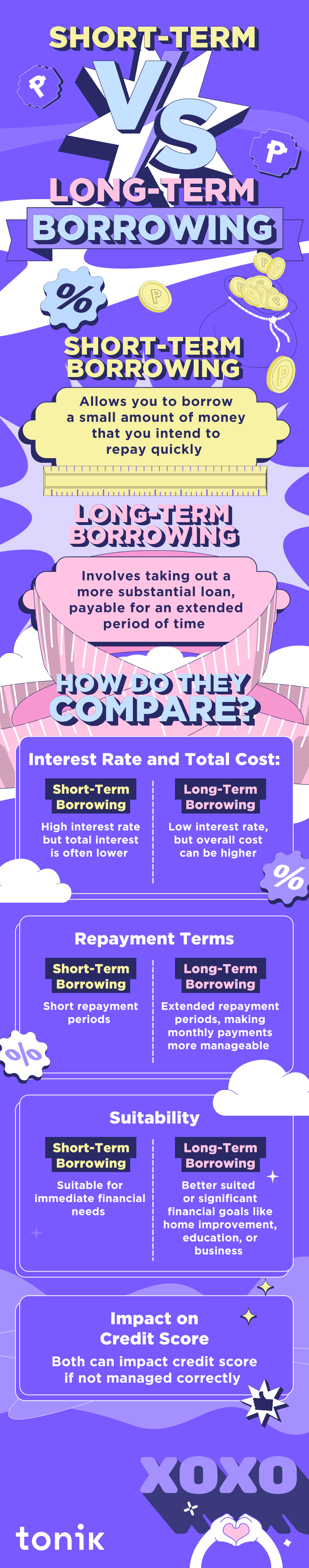

- Short-Term vs. Long-Term Financial Needs - Need money for a spontaneous trip? How about an emergency that may cost a fortune? Online loans have your back. Buying a house? Better suit up for a bank loan then!

- Borrower’s Credit History and Financial Stability - Online loans might be more forgiving to those with a rocky financial past. There’s even a type of online loan called bad credit loans that are specifically designed for individuals with – you guessed it – bad credit. Traditional banks prefer customers with a squeaky-clean history, so make sure you’ve been paying your debts consistently and on time if the traditional bank loan is what you’re after!

How to Decide What’s Best for Your Financial Needs

In the end, it comes down to your individual financial situation, your goals, and how quickly you need those funds. If you need to make an urgent loan, Tonik Bank offers loans you can get within two days. Download the Tonik App to kickstart your journey with us!

Whether you choose the digital path or the traditional route, make sure to weigh your options and pick the one that suits your needs best. And remember, it's all part of the adventure of adulting and being financially responsible.

Don’t stress too much, luv. Just remember what we taught you, and you’ll be okay. You got this!