Quick Take: What’s the best loan app in the Philippines?

It's the Tonik App, luv, but we're not just a loan app – we're a neobank, too! You can use the Tonik App to borrow up to P20K, pay your bills, shop with our virtual or physical debit card, and save with Stashes and Time Deposits! Download the Tonik App today.

Adulting brings the harsh reality that money doesn’t come easy. No more allowances, it’s time to work hard to earn cash. And, for most people, the pressure to earn never lets up. Your income may increase as you gain more experience, but the responsibilities start to stack up too.

Fortunately, you don’t have to rely solely on your paychecks to pay for the life you want. Enter loan Apps, the solution to funding your aspirations without waiting for years to save up! Since you can easily download and access them through a phone, almost everyone is welcome, no matter what stage of adulting you’re in.

In this blog, we’ll guide you as you choose the right app, with advice on how to use it safely and effectively!

Tired of High-Interest Loans?

A solid credit history can unlock better loan terms. Start building with Tonik Credit Builder Loan!

Table of Contents

TOC

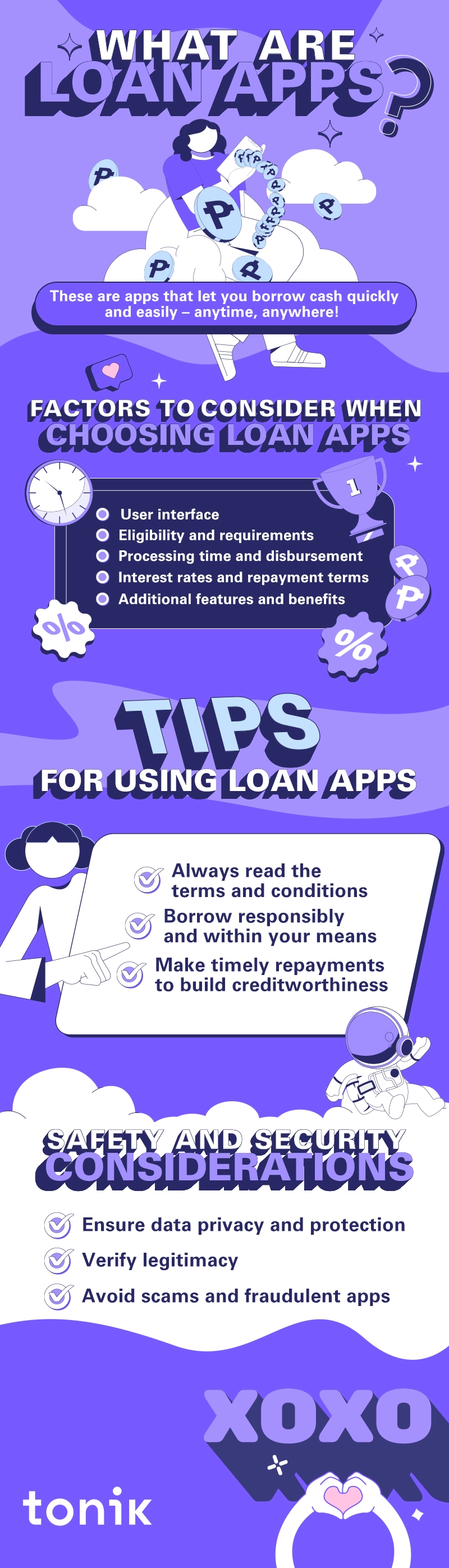

What Are Loan Apps?

Loan apps are apps that allow you to borrow money conveniently and quickly. Typically, you'll only need a phone and an internet connection to access them. This takes out the need for countless visits to the bank just to get a loan - you can do it all anywhere you want!

You don't have to be an expert in loans or banking to understand how to use them either, because lenders make sure their apps are as simple and user-friendly as possible. But, to quote Spiderman's late Uncle Ben, with great convenience comes a buttload of responsibility (or, at least that's what we think he said).

Having a loan app will sometimes feel like having a genie in your pocket. Resist the urge to treat it like one, because unlike genies, you'll have to punctually repay your loans with interest. So be a responsible borrower and borrow only what you need and what you can repay!

TOC

Factors to Consider When Choosing Loan Apps

We know a nicely designed logo and a memorable name can go a long way, but those aren’t the only factors you should consider when choosing the best loan app suitable for you. Here are five important factors you should look out for!

- User interface and ease of navigation - The loan app you choose should be easy to navigate. Even the most tech-challenged grandparents should be able to use it! If you find yourself using a loan app that feels more like a Rubik’s Cube, it’s time to say “Thank You, Next.”

- Loan eligibility criteria and requirements - Loan apps may be tech-savvy Gen Z versions of traditional lenders, but they still need old-school requirements. You typically have to be employed and/or of a certain age in order to get a loan. These loan apps may also ask you for documents like proof of income and a government-issued I.D.

- Loan processing time and disbursement - There are loan apps that will need some time to process your application. Others (*cough* Tonik Quick Loan *cough*) will only take a matter of minutes as long as you have complete and accurate requirements. Some will need extra steps before you can get to your loan amount, while others (*cough* literally all Tonik Loans *cough*) can disburse it in the same app you’re using to get a loan. It all depends on when and how you want to get that loan amount, so make sure you do some research before applying!

- Interest rates and repayment terms – Oh snap! Here we go again... A loan interest rate is the fee you pay for the privilege of borrowing money. Repayment terms are the number of months that you can choose to pay back the loan. Look for a loan app that gives you flexibility, so you won’t have too much of a hard time paying back your loan!

- Additional features and benefits offered by the app - Some loan apps don't just offer loan products. They also include cool features like savings accounts, multiple time deposits, quick digital payments, sometimes even financial education resources. That can give you an all-in-one experience when managing your finances!

Need New Appliances?

We've got the lowest monthly payments for you.

Visit our partner stores and shop with Tonik Shop Installment Loan today!

TOC

Some of the Best Loan Apps in the Philippines

Tonik App

You can do everything you would normally do with a bank through the Tonik App. You have your most basic feature, which is the Savings Account. This lets you earn 1% interest p.a. You can also Top up, Send cash, and pay your bills. We have a Virtual Debit Card, but you can also get a physical version if you want to give your wallet a hint of purple.

If a basic Savings account is too vanilla for you, we also have Stashes which you can create and customize on your own or with friends (Group Stashes) to earn 4% interest p.a. For the patient ones out there, there’s a Time Deposit that you can use to save up to P100,000 and earn up to 6% interest p.a. for up to 6 months. Each Tonik user is eligible to one time deposit with that special rate..

For loans, we have non-collateral loans like Quick Loan (up to PHP20,000) and Shop Installment Loan (up to PHP100,000). Quick Loan – as the name suggests – is a lightning-fast loan that you can apply for all through the Tonik App. The Shop Installment Loan, on the other hand, is an in-store loan that makes shopping for home appliances effortless at our partner stores.

CIMB

Frequent GCash users will surely find CIMB a convenient choice. It offers a GSave Account that you can manage through the GCash App. The base interest rate for GSave, however, is relatively low at 2.60% annually. They also provide an Upsave Account, allowing you to grow your savings while earning 2.5% p.a. Additionally, you'll enjoy free life insurance coverage of up to PHP250,000. The catch is that you need to maintain a minimum average daily balance of PHP5,000. Lastly, for seamless payments, you can use their virtual debit card or order a physical one.

Now, let's talk about their lending product! CIMB offers a Personal Loan, a fully-digital loan that you can apply for in just 10 minutes, enabling you to borrow up to PHP1,000,000. Please note that disbursement may take 1-2 banking days. Some noteworthy eligibility requirements they have are: you must have a minimum gross monthly income of PHP15,000 and you must be tentured for at least 6 months if employed or be continuously employed for 1 year. For required documents, you just need to submit 1 valid I.D.

Loan App | Product | Max. Amount | Lowest Monthly Interest Rate | Loan Terms | App Store Rating | Google Play Store Rating |

|---|---|---|---|---|---|---|

Tonik Digital Bank | Quick Loan | PHP20,000 | 4.24% | 6-12 months | 4.5 | 4.5 |

Shop Installment Loan | PHP100,000 | 4.50% | 3-12 months | |||

CIMB | Personal Loan | PHP1,000,000 | 1.12% | 12-60 months | 4.1 | 3.8 |

Overall, the Tonik App has the most loan products to offer, giving you plenty of customization and flexibility. Monthly interest rates are also kept at manageable levels, from 0.58% to 4.50%. Plus, the extra features make the app an all-around neobank in your pocket.

CIMB, on the other hand, emphasizes convenience with its GCash integration. Through their Personal Loan, it offers a relatively generous loan amount at PHP1,000,000 and an enticing interest rate at 1.12%. The requirements, though, may be too much for some customers.

Right now, you're probably starting to get a clearer idea of which app is most suitable for your needs. Before you say "I do" to any of them, read through some tips to help you use loan apps effectively, including a number of safety and security considerations you should be aware of.

TOC

Tips for Using Loan Apps Effectively

- Read and understand the terms and conditions - That part that you usually scroll through just to tick a tiny checkbox is actually very important. That's because you might miss crucial details about interest rates and hidden fees. So, unless you want to unknowingly agree to anything you don't want to, strap yourself in with a grande coffee pronto and read through those Terms and Conditions!

- Borrow responsibly and within your means - Remember when you were a kid, and you ate too much candy, and you ended up with a tummy ache? The same can happen with loans - just replace "candy" with "loans," and "tummy ache" with "massive debt." Always borrow an amount that won't leave you overstuffed with repayments so you can avoid those nasty tummy aches!

- Make timely repayments to build creditworthiness - Set reminders on your phone, ask a friend for help, slap sticky notes everywhere at home—do whatever it takes so that you always remember to pay on time. Late repayments may negatively affect your credit score, and you want it to stay in the green if you ever plan to take out a loan again in the future. Plus, paying back on time will help you dodge those pesky late fees!

TOC

Safety and Security Considerations

- Ensure data privacy and protection - Like a good lover, loan apps should be able to protect you and keep you safe. They should have robust encryption to safeguard your personal information, and their servers should be airtight for secure transactions. You can also check out if they've partnered with trusted financial institutions and/or payment gateways. Finally, don't forget to read their Privacy Policy. You can't be too careful these days, especially when it comes to apps and what they do with your data!

- Verify the legitimacy of the loan apps and lenders - You can start by checking if the loan app is registered and licensed. You can easily find this information on their website. Afterward, you can look up reviews from top-ranking loan aggregator sites like Moneymax, iMoney and the like, and ratings for loan apps. If you want to go a step further, you can even test their customer support! Many loan apps have in-app chat features that let you speak with agents. Give them their burning questions and see if they respond well.

- Avoid scams and fraudulent loan apps - Just research thoroughly and follow the tips we’ve provided here carefully, and you should be able to avoid those scammy loan apps. Trust your gut as well! If you see a loan app and you think it’s sketchy as heck, then it probably is. Oh, and one more thing: if it seems too good to be true, it probably is!

TOC

You’re On Your Loan, Kid!

Just like every innovation now available at our fingertips, loan apps are meant to make our lives a whole lot easier. But remember, that doesn’t mean we can use them irresponsibly, and security should always be your top priority, especially when it comes to your money and sensitive personal information.

Remember to choose a loan app wisely with these important factors in mind. And once you do decide on which one you want to go for, make sure to make the most out of it.

But who are you kidding? You know you want to take us with you on your loan journey. So, make sure to download the Tonik App on your smartphone to get the best kind of loan for you!

That’s all, luv. Stay safe, and loan responsibly!