You think you’re an adult and you’re done with school, you don’t have to worry about grades anymore? Think again, luv!

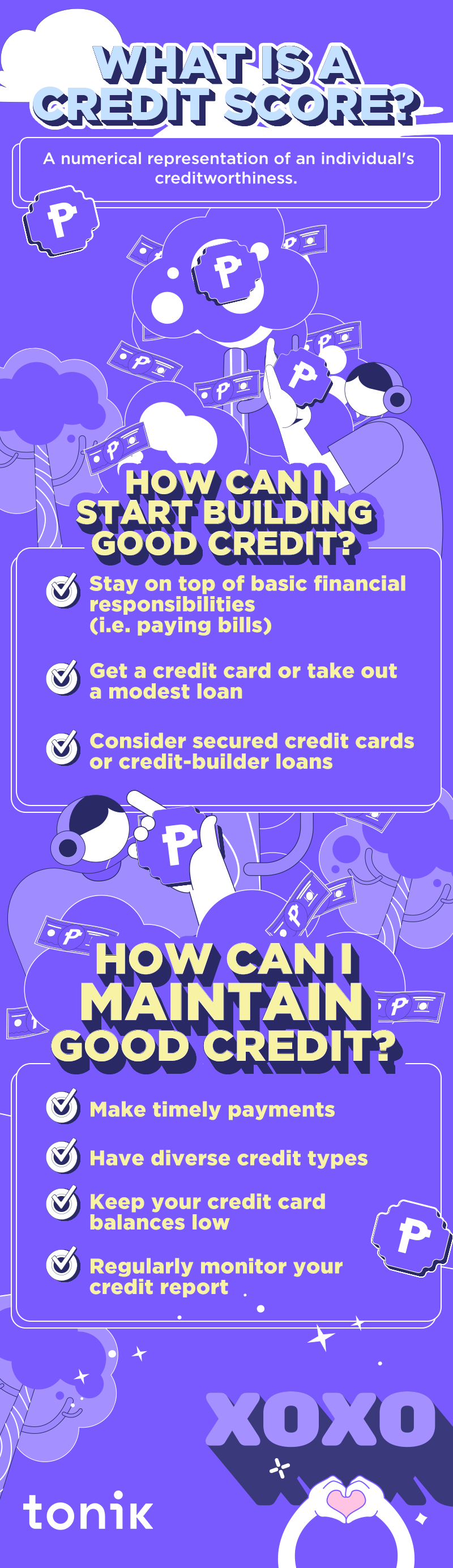

In the financial and #adulting world, you have to worry about this little thing called a credit score.

What is a credit score? We’ll get into the specifics in a second. What you need to know now is that a good credit score acts as your plane ticket to the beautiful land of financial opportunities.

Read this blog and find out all their is to know about building and maintaining good credit!

Table of Contents

- Understanding Credit Scores

- Starting to Build Credit

- Using Credit Cards Wisely

- Managing Loans and Debts

- Paying Bills on Time

- Credit Utilization Ratio

- Regular Credit Report Checks

- Limiting Hard Inquiries

- Handling Joint Accounts and Co-Signing

- Dealing with Financial Setbacks

- Maintaining Good Credit Long-Term

- Start Building Credit with Us

Understanding Credit Scores

In finance, credit score is key. It influences your eligibility for loans, credit cards, and more. How is this magical number concocted? It's a complex mix of various financial elements, from your payment history and credit utilization to the length of your credit history.

In the Philippines, key credit bureaus and agencies meticulously gather and assess this data to provide you with a numerical representation of your financial health. The major players in this game are the Credit Information Corporation (CIC), CIBI Information, Inc., and TransUnion Philippines.

These institutions diligently compile your credit history, creating a comprehensive snapshot that lenders use to gauge your reliability.

TOCStarting to Build Credit

For those taking their first steps to building credit, we salute you. Let’s talk about how it’s done!

Building credit from scratch is not as hard as it may seem. First, you have to establish a foundation through basic financial activities. These include regularly paying bills (i.e. utilities and rent) and demonstrating financial responsibility.

Once you get the hang of that and you’re ready to level up, you can obtain your inaugural credit card or taking out a modest loan to give your credit history a significant boost. Don’t go trigger happy with your debts, though! Start small and ensure you can comfortably manage repayments.

If the traditional routes seem challenging, consider secured credit cards or credit-builder loans. Secured cards require a cash deposit as collateral, making them more accessible for those without an established credit history.

Meanwhile, credit-builder loans provide a structured approach, allowing you to borrow a small amount held in a savings account until the loan is repaid. Start with whatever works best for you – there's no right or wrong way as long as it helps you in maintaining good credit!

TOCUsing Credit Cards Wisely

It’s easy to lose control when you’ve got a magic plastic card that can buy you seemingly anything at a whim. Be extra careful though, because that can lead to over-indebtedness. Steer clear of that potential dilemma and follow these tips:

- Select the right credit card - Choose a credit card that aligns with your spending habits and financial goals. Consider factors like rewards programs, annual fees, and interest rates.

- Understand credit card terms - Familiarize yourself with the card's interest rates, fees, and credit limits. Know all penalties or charges for late payments or exceeding your credit limit.

- Always check your statements - Regularly monitor your credit card statements for accuracy and unauthorized charges.

- Pay in full each month - If you can, pay your balance in full each month to avoid accruing interest. You can set up automatic payments or reminders to ensure timely payments.

- Practice self-discipline - Keep your credit utilization low by using only a small portion of your available credit.

Managing Loans and Debts

There are a couple of strategies you can us for managing debts and maintaining good credit. Read through each one and find the best one that best suits you!

- Debt Repayment Plan - Prioritize high-interest debts and create a systematic repayment plan to tackle them strategically.

- Consolidation - Explore debt consolidation options to combine multiple debts into a single, more manageable payment, potentially with a lower interest rate.

- Refinancing - Consider refinancing high-interest loans to secure more favorable terms, reducing the overall cost of repayment.

- Snowball Method - Start by paying off the smallest debts first, gaining momentum to tackle larger ones progressively.

- Seek Professional Advice - Consult with financial advisors or credit counselors for personalized guidance on debt management strategies.

Paying Bills on Time

A big chunk of your credit score is based on your payment history. That’s because it reflects your reliability in meeting financial obligations. How can you make that payment history squeaky clean in the eyes of financial institutions? Make timely payments! That’s a great way to demonstrate your financial responsibility.

In cases of late payments, don’t panic. Communicate with creditors, especially during unexpected financial hardships. They may offer grace periods or flexible arrangements, which can help manage late payments without severely affecting your credit score.

TOCCredit Utilization Ratio

The credit utilization ratio represents the proportion of your credit limit that you've used. Keeping this ratio low is crucial for a healthy credit profile. It’s best to use only a small percentage of your available credit, as high utilization can negatively impact credit scores.

Maintaining good credit utilization ratio demonstrates responsible , credit management and positively influences credit scores. Additionally, balancing multiple credit accounts responsibly contributes to a well-rounded credit history, further strengthening your creditworthiness.

TOCRegular Credit Report Checks

Regularly checking your credit report is a crucial habit for maintaining good credit health. It allows you to monitor your financial standing, detect any inaccuracies, and address issues ASAP. Here’s how you can get your credit report:

- Choose a Credit Bureau - Select a reputable credit bureau such as CIBI Information, Inc., CRIF Philippines, or TransUnion Philippines.

- Request Your Report - Submit a request for your credit report through the chosen credit bureau's official website or other designated channels.

- Provide Necessary Information - Furnish the required personal details and documentation to verify your identity.

- Review Thoroughly - Once you receive your credit report, scrutinize it thoroughly to ensure accuracy in the information provided.

- Spot and Correct Errors - If you identify any errors or discrepancies, promptly contact the credit bureau to rectify the information.

Limiting Hard Inquiries

Time to talk about the cold, hard truth about hard inquiries.

Hard inquiries occur when a lender checks your credit report in response to a credit application. Although a single hard inquiry may have a minor impact, don’t get too comfortable because multiple inquiries within a short period can potentially lower your credit score.

When considering new credit applications, it's essential to be strategic. Apply for credit when you genuinely need it and avoid excessive or unnecessary applications. Each hard inquiry typically stays on your credit report for about two years.

Here are some helpful tips to avoid those worrisome hard inquiries:

- Be mindful of your financial needs and planning

- Prioritize credit applications based on needs, not wants

- Avoid applying for multiple lines of credit simultaneously

Handling Joint Accounts and Co-Signing

Opening joint accounts and co-signing loans with the luvs of your life have advantages and drawbacks. Here’s a quick breakdown:

Benefits

- Enhanced Qualification - Joint accounts can improve your chances of qualifying for loans or credit cards, especially if your co-applicant has a strong credit history.

- Shared Responsibility - Joint account holders share responsibility for managing and repaying the account, fostering financial collaboration.

- Establishing Credit - Co-signing for someone with a limited credit history can help them access credit and begin building their credit profile.

Risks

- Credit Impact - Both positive and negative actions on joint accounts affect the credit histories of all account holders.

- Financial Liability - Co-signers are legally responsible for the debt, and missed payments can lead to financial and credit consequences.

- Relationship Strain - Financial disagreements or issues can strain relationships with joint account holders.

Dealing with Financial Setbacks

Navigating financial hardships like sudden unemployment or medical emergencies is a challenging but vital aspect of maintaing good credit.

In these situations, negotiate with creditors and seek professional advice pronto. Let us explain in more detail:

- Negotiating with Creditors - When facing financial challenges, consider reaching out to your creditors. Many are willing to negotiate payment plans, temporary relief, or debt settlement arrangements. Communicating proactively can prevent negative entries on your credit report.

- Seek Financial Advice - In challenging times, seeking professional financial advice can provide valuable insights. Financial advisors can help create a realistic budget, prioritize debts, and explore options for debt relief, ensuring a strategic approach to financial recovery.

Maintaining Good Credit Long-Term

You can’t go YOLO without the dough, luv. Always remember that maintaining consistent financial habits is not just about the present; it's an investment in your future financial well-being.

Before we let you go, here are our final reminders and tips that you can bring on your journey to maintaining good credit.

- Timely Payments - Consistently pay bills and loans on time to build a solid payment history.

- Credit Utilization - Keep credit card balances low to maintain a healthy credit utilization ratio.

- Diverse Credit Mix - Maintain a mix of credit types, such as credit cards, loans, and mortgages.

- Regular Monitoring - Monitor your credit report regularly for errors and unauthorized activities.

- Long-Term Perspective - Avoid closing old credit accounts, as the length of your credit history influences your score.

Start Building Credit with Us

Start building good credit with your favorite neobank with a Tonik Quick Loan! Borrow up to P250,000 with a monthly add-on interest rate as low as 1.7% for up to 18 months.

You only need to submit minimal requirements, and the application takes only a few minutes of your time through the Tonik App!

Download the Tonik App now and fall in love with building good credit and achieving your goals with us!