Online lending apps are becoming more prevalent in the Philippines. They’ve become just as commonplace in a person’s phone these days as their favorite social media app and streaming platform. There’s no big secret why: online lending apps are fast, easy and convenient. Which mortal with a long list of needs can say no to that?

However, it's important to navigate this online lending age with caution. The thing is, not all lending apps are cut from the same legitimate cloth. This is where the Securities and Exchange Commission (SEC) comes in, helping to ensure that online lending apps meet certain standards and keep your financial interests protected.

In this blog, we'll dive into the realm of online lending in the Philippines, shedding light on the reputable and SEC-registered lending apps that are contributing to a more inclusive and secure financial landscape!

Table of Contents

The Landscape of Online Lending in the Philippines

Growing up, you probably learned about loans through traditional lending. We’re guessing you’ve also heard your parents complain about the long queues and piles of paperwork they had to endure just to borrow some cash. Seemed more like a recipe for frustration than a solution to financial woes, right?

Nowadays, we’ve got online lending apps. This exciting innovation rewrites the script with simplicity and speed. These apps make queues feel shorter, almost non-existent, with paperwork largely diminished to just a couple of fields you can digitally fill-up. Suddenly, you can gain access to cash for your business, tuition fees, and other urgent matters you have to pay for.

As we proceed, we'll explore apps that prioritize your experience, operating within the SEC's guidelines for a secure and respectful borrowing journey.

TOCWhy Choose SEC-Registered Lending Apps?

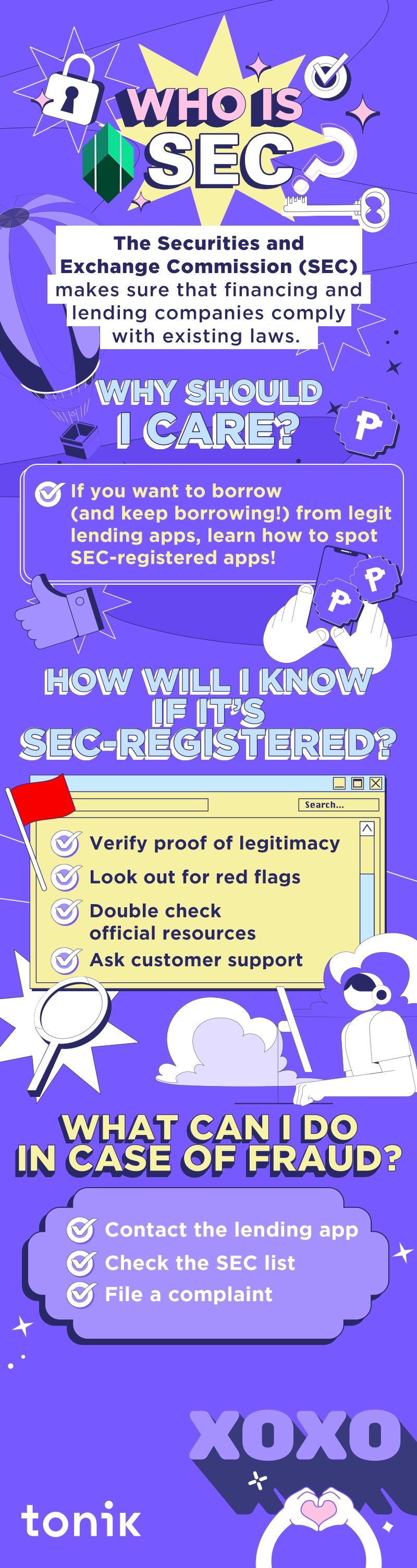

Think of the Securities and Exchange Commission (SEC) as your financial watchdogs, making sure that lending companies play fair and look out for your interests.

When an online lending app is SEC-registered, it's like a seal of approval that guarantees it's passed some serious quality tests. This gives you peace of mind and ensures that you have a smooth borrowing journey ahead. With SEC-registered apps, you're not just trusting blindly – there's real verification behind it.

Another thing, SEC-registered apps are sure to keep things transparent. They make sure that companies spell out terms, interest rates, and fees, leaving no room for hidden surprises. Plus, they're all about fairness, sticking to reasonable interest rates and terms that won't leave you feeling trapped.

TOC3 SEC-Registered Online Lending Apps

Looking for SEC-registered online lending apps can eat away your time. To cut your search short, here are some good ones you should check out!

The Tonik App

In case you haven’t heard, luv, the Tonik App’s not just for high-interest Time Deposits and Stashes. We’ve got two loan products as well! First is Credit Builder Loan. With Credit Builder Loan, you can borrow up to P20,000 with minimal requirements. You can get approved quickly and conveniently from your Tonik App.

Then, there's Shop Installment Loan. It's a Buy Now, Pay Later product that let's you enjoy the lowest monthly payments on your dream appliances in any of our partner stores.

BillEase

This lending app promises “Blissful Shopping” and “Easy Billing.” Looks like they’re delivering on this promise with a PHP40,000 maximum loan amount for 2-6 months for new customers. Existing customers can get an even better deal with the same amount but for 2-24 months at an interest rate of 11.90%. They only ask for minimal requirements including a valid ID, proof of income, and proof of billing. The amount will be disbursed straight into your BillEase app in as quick as one day!

Tala

Lastly, we have Tala. Offering a “fast, flexible, and secure way” to borrow cash, you can get their loan up to PHP25,000 with an interest rate of 14.74%. They certainly deliver on flexibility with loan terms ranging from 1 to 61 days. Plus, their application process typically takes 10 minutes only!

How to Ensure You're Using a SEC-Registered App

Finding out if an app is SEC-registered can be tricky. Take these necessary steps to make sure you’re using online lending apps you can trust!

-

✓Verify proof of legitimacy - Check the app's official website or download page for clear information about SEC registration.

-

✓Look out for red flags - Watch out for apps pressuring you, having unclear terms, or asking for upfront fees – red flags for possible scams.

-

✓Double check official resources - Visit the SEC's official website for a list of registered lending companies.

-

✓Ask customer support - Reach out to the app's customer service to confirm their SEC registration and address any doubts.

Benefits of Online Lending Apps for Filipinos

If you’re reading this, then you’re probably already aware of digital banks. If not, don’t worry – it’s not too late to make the move! Here are three benefits to help you make the switch from traditional to online lending!

Convenience and Accessibility

No longer bound by the limitations of physical bank branches, online lending apps provide a digital avenue for accessing credit. Whether you're nestled in the mountains or residing in the heart of a bustling city, all you need is an internet connection and a smartphone to tap into financial opportunities that might have previously seemed out of reach.

Specific to digital banks, they’re quicker and more convenient compared to your average traditional bank and comparing them against the very many other online lending apps out there, they would be more credible as they are licensed and regulated by the Bangko Sentral ng Pilipinas (BSP).

Speed and Efficiency

Online lending apps have mastered the art of swift loan processing. No more hours spent queuing up, only to be handed a stack of forms. With just a few taps or clicks, your loan application is submitted, and approval processes that used to take days have been condensed into mere hours. This efficiency not only meets the demands of modern life but also caters to the urgent financial needs that can arise unexpectedly.

Digital Record-Keeping

Online lending apps offer the gift of digital record-keeping, ensuring that all your financial details are organized, secure, and accessible at your fingertips. This not only simplifies the management of your loans but also contributes to a more environmentally friendly approach by reducing paper waste. Whether you need to review your repayment plan or access transaction history, it's all neatly stored within the app, ready to assist you in staying on top of your financial commitments.

TOCPotential Pitfalls and How to Avoid Them

Online lending apps may have a ton of benefits, but they’re not without their cons. Be aware of these pitfalls before you go all in on online lending!

-

✓Borrow only what you need - It might be tempting to borrow more than necessary but remember that loans come with interest. Borrowing only what you truly require can prevent unnecessary debt.

-

✓Understand the terms - Before clicking "Accept," carefully read and understand the loan terms, including interest rates, repayment schedules, and fees. Clear terms prevent surprises down the road.

-

✓Get one loan at a time - While the ease of online lending is fantastic, refrain from taking out multiple loans simultaneously. Each loan comes with commitments, and managing too many can become overwhelming.

-

✓Set a repayment plan - Plan how you'll repay the loan before borrowing. Factor the repayments into your budget to ensure you can meet your financial obligations. If you don’t know how to repay your Tonik Digital Bank Loans yet, here's how!

In case of fraudulent activity, follow these steps straight away:

-

✓Contact the app: Reach out to the customer support of these online lending apps to address your concerns and seek solutions.

-

✓Check the SEC List: Verify if the app is registered with the SEC. If not, it might be a red flag.

-

✓File a complaint: If you believe you've been scammed or treated unfairly, file a complaint with the relevant authorities, such as the National Privacy Commission or the National Consumer Affairs Council.

Loan right with this SEC-Registered Online Lending App!

Where else are you getting your much-needed cash loan than your neobanking lover, Tonik Digital Bank! If you need cash fast, borrow as much as PHP 20,000 with Tonik Credit Builder Loan!

What are you waiting for, luv? Download the Tonik App to apply now!