When it comes to borrowing money in the Philippines, understanding interest rates is super important. After all, it determines how much we must pay to be able to loan a particular amount. But these days, interest rates can be described in so many terms that most of us end up confused and dizzy.

The good news is… it doesn’t have to be this way, luv!

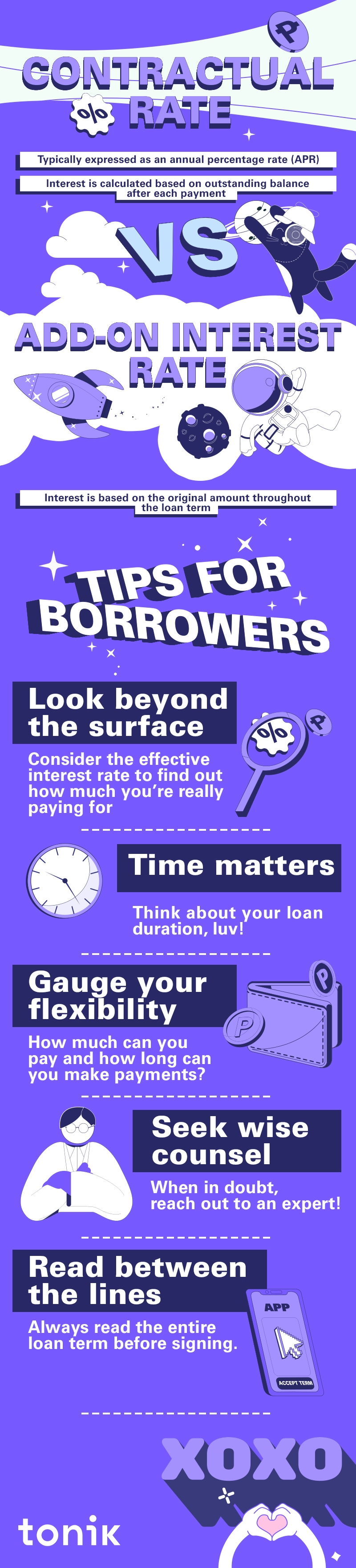

In this article, we'll unravel the differences between two common types of bank interest rates: contractual and add-on rates. We'll explain how they work, their advantages and disadvantages, and help you make informed decisions when it comes to applying for cash loans in the Philippines. So, let's dive in and demystify these interest rate terms!

Table of Contents

Interest Calculation Basics

Before talking about the nuances between contractual and add-on interest rate, let's pause for a moment to dive a bit deeper into the nuts and bolts of how interest on loans is generally calculated.

When you take out a loan, the interest calculation determines how much extra you'll pay over the loan's life, on top of the principal amount. The two main methods for this are simple and compound interest. Simple interest is calculated only on the principal amount, making it straightforward but less common for long-term loans. Compound interest, however, adds interest to the principal, including previously accumulated interest, which means it can add up more quickly over time.

This distinction is essential when comparing different loan offers. Contractual interest rates often involve a form of reducing balance interest calculation, which can be seen as a type of compound interest but calculated in a way that benefits you as the borrower, as you're paying interest on a decreasing principal amount. In contrast, add-on interest rates simplify the calculation but may end up costing more over the loan term since the interest is calculated upfront on the total loan amount and doesn't decrease as you pay down the principal.

TOCUnderstanding Contractual Interest Rates

When you borrow money, the bank or lender charges you something extra called interest. It's like a fee for borrowing the money. Now, there are different types of interest rates. Contractual interest rates are one of them. To understand how this works, let’s use an example.

Let's say you got a loan worth P10,000 from the bank. The bank tells you that you have to pay 10% interest. That means you have to give back an extra 10% of the money you borrowed. But here's the interesting part!

With contractual interest rates, the bank doesn't charge interest on the whole P10,000 all the time. Instead, they only charge interest on the smaller amount that you still owe after each payment. So, if after the first month you paid back P500 and you now owe P9,500, the bank only charges interest on the P9,500. That means you pay less interest each month as you give back the money you borrowed.

Given this example, here’s how your repayments would look like:

| Month | Outstanding Balance | Monthly Interest Payment |

| 1 | P9,500 | P79.17 |

| 2 | P8,900 | P74.17 |

| 3 | P8,300 | P69.17 |

| 4 | P7,700 | P64.17 |

| 5 | P7,100 | P59.17 |

| 6 | P6,500 | P54.17 |

| 7 | P5,900 | P49.17 |

| 8 | P5,300 | P44.17 |

| 9 | P4,700 | P39.17 |

| 10 | P4,100 | P34.17 |

| 11 | P3,500 | P29.17 |

| 12 | P2,900 | P24.17 |

So, with contractual interest rates, you get to pay less and less interest over time as you give back the money you borrowed. That's good news because it means you get to keep more of your money!

TOCExploring Add-On Interest Rates

Add-on interest rates work in a different way, luv. But it’s the standard used in the local lending market. So it would definitely be good to understand what it means.

When you borrow money with add-on interest rates, the interest is calculated in a special way. The bank or lender looks at the original amount you borrowed and keeps the interest the same throughout the whole time you have the loan. This means that no matter how much you've paid back, the interest stays constant.

For example, let's use the same situation. Imagine you borrowed P10,000 with a 10% add-on interest rate for one year. The bank calculates the interest based on the ₱10,000 you borrowed, not the amount you still owe. This means your interest payments stay the same every month, no matter how much you've already paid off.

So, if you have to pay P1,000 extra on top of your installments every month with a 10% add-on rate, it will stay that way until the end of your loan period. In other words, the interest you have to pay stays the same, even if you've paid back some of the money you borrowed.

Suggested Read: The Good, The Bad, and The Ugly Truth About Philippine Interest Rates

TOCImportant Tips for Borrowers

Add-on interest rates work in a different way, luv. But it’s the standard used in the local lending market. So it would definitely be good to understand what it means.

- Know the Math: Take a moment to understand how add-on and contractual rates are calculated, luv. Add-on rates have a fixed interest repayment every month. While contractual rates mean your interest gets lower as you continue to make loan payments. Knowing this will help you make sense of the numbers and make a smart choice.

- Look Beyond the Surface: Don't be fooled by the nominal interest rate or the actual number advertised by banks and lenders! It's essential to consider the effective interest rate, which includes all the extra costs associated with the loan. This way, you'll have a clearer picture of the total amount you'll end up paying.

- Time Matters: Think about the duration of your loan. Add-on rates might be fine for short-term needs with predictable monthly payments. But for longer-term loans, contractual rates often save you more in the long run. So, consider the length of your borrowing adventure, luv!

- Gauge Your Flexibility: Assess your own financial flexibility and situation. Add-on rates come with consistent monthly payments, making it easier to plan your budget. On the other hand, contractual rates give you the benefit of decreasing interest payments over time. Decide which option matches your financial style.

- Seek Wise Counsel: When in doubt, don't hesitate to reach out to financial experts. They can provide personalized advice based on your specific circumstances. Getting some professional guidance will help you make a well-informed decision.

- Read Between the Lines: Before signing any loan agreement, give it a thorough read. Make sure you understand all the terms and conditions, including any hidden fees or penalties. You want to be fully aware of what you're getting into, so there are no surprises down the road!

- Explore Your Options: Don't settle for the first loan offer that comes your way, especially if it's a subprime loan with higher interest rates. Take the time to explore and compare multiple loan offers from different lenders. This includes looking beyond just the interest rates and considering other factors like repayment terms, customer reviews, and overall loan features. It's important to be particularly cautious with subprime loans, as they can be more costly and riskier due to their higher interest rates and less favorable terms.

Final Words

Let’s be real, luv. The thing is… most banks and lending companies in the Philippines communicate monthly add-on interest rates for their loan products. But as you now know, there is more to your interest than your nominal rate.

Understanding the differences between contractual and add-on interest rates empowers you to make better borrowing decisions. So, remember, always compare multiple loan offers, consider your individual financial situation, and seek expert advice if you have to. By arming yourself with knowledge, you'll be able to make borrowing choices that align with your financial goals and pave the way to a brighter financial future!