Loans sound like a great quick fix to fund dreams and solve financial problems. Still, a loan is a commitment. You may not be making a vow in front of a priest or a judge, but you’re promising the lender that you’ll pay back what you owe in a few months or years, no matter what.

Like every commitment, you have to know what you’re signing up for. Especially since now, you have a fair chance at getting approval with Tonik Quick Loan, our game-changing loan in Philippine digital banking.

Typically, Philippine banks use credit scores to gauge your ability to repay a loan based on your history of repaying previous loans, credit cards, and more. But where does that leave first-time borrowers and those with a very short credit history?

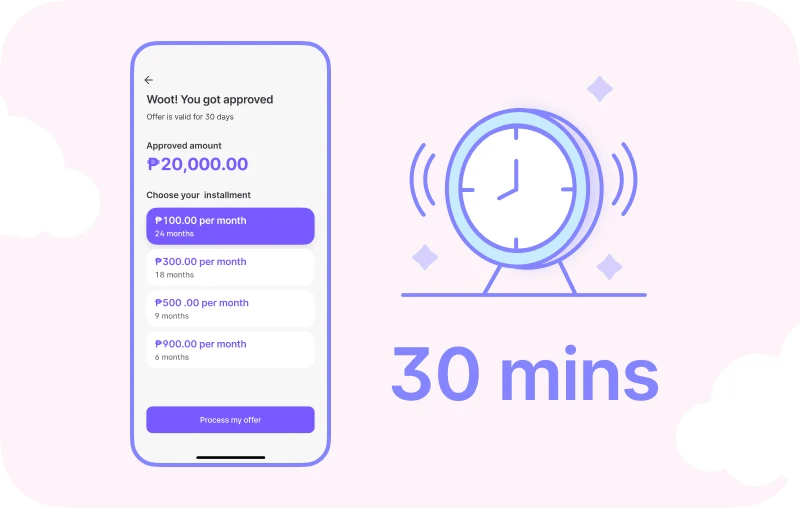

As the country’s first neobank (digital-only bank), Tonik believes that everyone deserves quick and easy access to loans. So with just a valid government ID, a month’s payslip, and a few taps on our money management app, you can apply and get approval in as fast as 30 minutes. No need for multiple visits. No need to show financial records. No need for experience in your credit score (a Philippine first!).

Sounds good, right? But before you sign “I do”, ask these 3 questions.

Table of Contents

1. How much can I afford to borrow?

With Tonik Quick Loan, you can access a higher loan amount than most lenders in Philippine digital banking. We offer up to PHP 250,000. (But if you link your salary payroll ATM card, that rate goes down to 5.42 percent.) You can repay us in installments of 6, 9, 12, and 18--whichever works for you.

While it’s tempting to just go for the biggest amount, don’t forget, this is a commitment. You’ll need to pay it back eventually. So think about it: how much do you really need to borrow?

If you’re using your loan to pay for your sibling’s schooling, total the cost of their tuition fee, laptop, wi-fi, and more to support learning from home. Once it’s clear to you, you can borrow just enough.

Remember, your loan repayment will be among the expenses you’ll need to cover in the coming months. Use the calculator below and see what that may mean for you.

Pro Tip: Before you say "I do" to any loan, understanding how the interest on your loan is calculated is crucial. It’s like knowing the recipe to your favorite dish—you might not be the one cooking, but knowing what goes into it makes you appreciate it even more (or helps you decide if it's really what you want).

here are generally two types of interest calculations used in the banking world: simple interest and compound interest.

- Simple Interest works by calculating interest solely on the principal amount—that initial sum you borrow. It's straightforward and predictable, making it easier to calculate your total repayments over time.

- Compound Interest, on the other hand, calculates interest on the principal amount plus any accumulated interest. This means the interest can "compound" over time, leading to higher total repayments if not managed carefully.

Understanding the interest calculation on your loan is like having a map in a new city; it helps you navigate your financial journey with confidence. So, before you commit, take a moment to crunch those numbers and ensure you’re making a decision that fits your budget and future plans.

TOC- Table FInd

TOC- Table FInd

2. When will I get my loan?

Remember when we said loan application and approval can be done in as fast as 30 minutes? Here’s even better news: once your loan is approved, you’re free to access the cash in your Tonik Account.

You don’t need to wait at all. As a neobank, all of Tonik’s transactions are housed in one money management app. Loan application, approval, and disbursement happen with just a few taps.

We understand that you need to act fast these days, so we’re making sure that Philippine digital banking keeps up.

TOC- Table FInd

TOC- Table FInd

3. How can I repay my loan?

If you have little to no experience borrowing, Tonik Quick Loan may just be your starting point to building a strong Philippine credit score. The trick is paying on time.

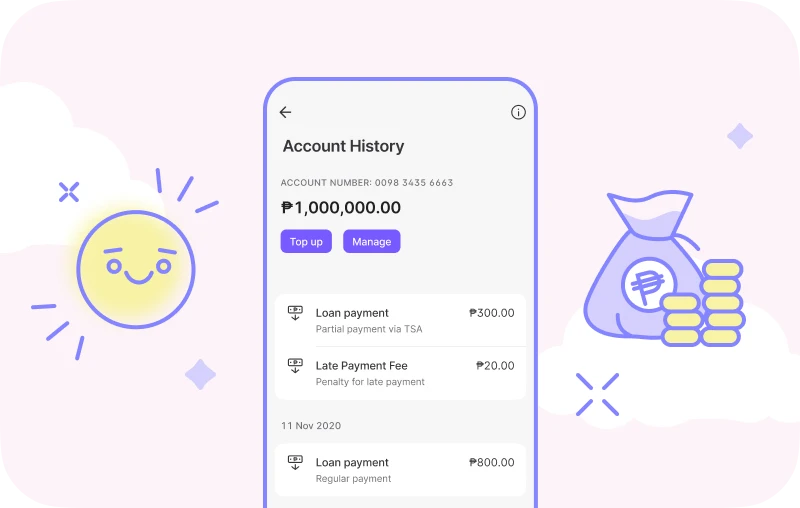

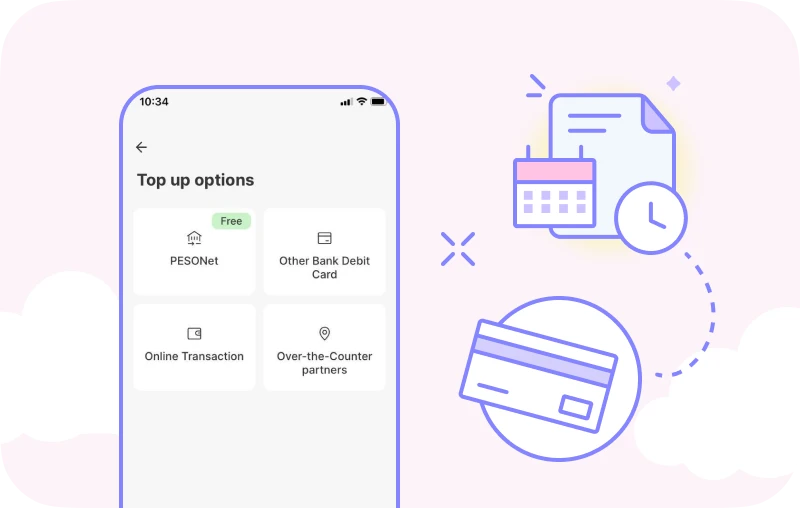

You can set your preferred payment date and we can auto-debit the amount from your savings account/Tonik Account (which earns 1 percent interest per annum, btw). You just need to make sure you’ve topped up your account before the date.

We’ll remind you too. Our money management app has a repayment tracker that updates you every day on your loan status and deadlines. If you pay your loan early and in full, well, we’re happy for you! You don’t need to worry about early payment or pre-termination fees.

If you’re committed to paying on time, well, we’re committed to helping you succeed.

Does all that sound like a sure go for you? If it does, say “I do” to the Tonik app and hit download.