Imagine this: You're embarking on a thrilling adventure, mapping out your financial journey. What do you need to ensure you stay on course and loan responsibly? The answer: a loan agreement. It's not just a piece of paper, luv. It's your trusty co-pilot, guiding you through the twists and turns of your financial path.

This binding document spells out the who, what, when, and how of your loan, ensuring everyone involved is on the same page. But more than that, it's a symbol of trust, forging a transparent partnership between you and your lender. In moments of uncertainty or disputes, this humble agreement becomes your shield. So, fasten your seatbelts, and let's explore the world of loan agreements together!

Table of Contents

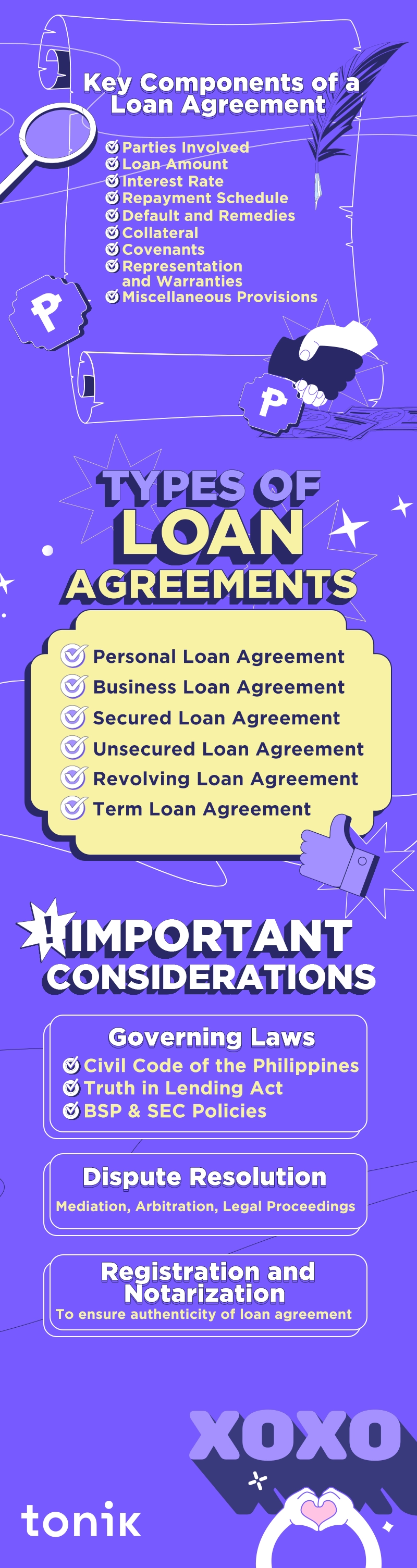

Key Components of a Loan Agreement

The heart of any loan agreement lies in its key components. Let's dive deeper into these crucial elements, making sure you understand each one like a seasoned pro:

- Parties Involved: Think of this as the cast of characters in your financial story. You've got the borrower (that's you) and the lender, each with their roles and responsibilities clearly defined.

- Loan Amount: This is the meat of your loan agreement. How much money are you borrowing, luv? Make sure you've got this figure down pat, as it's the cornerstone of your financial arrangement.

- Interest Rate: The interest rate determines the extra amount you'll pay on top of your principal loan. It's crucial to grasp this concept, as it directly affects your overall repayment.

- Repayment Schedule: It tells you when you need to pay, how much to pay, and how often. Stick to this schedule like a seasoned traveler, and you'll reach your financial destination smoothly.

- Default and Remedies: No one likes to ponder the what ifs… but what if you can't repay the loan, hun? This part of the agreement lays out the consequences and the steps to remedy the situation. It's your safety net in case of financial trouble.

- Collateral: Sometimes, loans require a security deposit. Think of collateral as your financial insurance policy – it's only at risk if you can't fulfill your end of the bargain.

- Covenants: These are the terms and conditions, the do's and don'ts, of your loan. Pay close attention to them to avoid any unintentional missteps.

- Representations and Warranties: Consider these the promises both you and your lender make. If these assurances are broken, there can be consequences, so it's best to be crystal clear from the outset.

- Miscellaneous Provisions: The fine print, the "just in case" section. Here, you'll find everything from dispute resolution mechanisms to the lender's rights and responsibilities. Don't skim through it. Give it the attention it deserves.

Types of Loan Agreements

Personal Loan Agreement

Personal loan agreements are your go-to solution for a wide range of personal financial needs. Whether it's funding a dream vacation, covering unexpected medical expenses, or purchasing that shiny new gadget you've had your eye on, a personal loan provides the flexibility to fulfill your individual desires.

Typically, personal loans are unsecured, meaning they don't require collateral. They're often based on your creditworthiness and income, with fixed interest rates and structured repayment plans.

Business Loan Agreement

If you're an entrepreneur with aspirations to expand your business, launch a startup, or simply secure working capital, a business loan agreement is your ticket to realizing those ambitions. It provides the necessary financial backing to help your business thrive.

Business loans can vary widely, from short-term working capital loans to long-term financing for substantial investments. They often come with specific purposes and requirements, such as providing business plans or demonstrating revenue projections.

Secured Loan Agreement

Secured loan agreements are an excellent choice when you need a substantial amount of money for significant purchases like a car or a home. By pledging an asset (e.g., the vehicle or property) as collateral, you can secure lower interest rates compared to unsecured loans.

The collateral mitigates the lender's risk, resulting in more favorable terms for borrowers. However, it's essential to understand that if you default on the loan, the lender has the right to take possession of the pledged asset.

Unsecured Loan Agreement

Unsecured loans are ideal for individuals who lack significant assets to use as collateral. These loans rely primarily on your creditworthiness, making them suitable for various purposes, such as debt consolidation or funding smaller projects.

As there's no collateral involved, unsecured loans typically come with higher interest rates to compensate for the increased risk for lenders. Your credit score and financial history play a pivotal role in determining eligibility and terms.

Revolving Loan Agreement

Think of revolving loan agreements as a financial safety net. They provide flexibility and ongoing access to funds, like having a credit card. Revolving credit can be invaluable for managing unpredictable expenses or cash flow gaps.

You can use and repay the loan repeatedly, up to a predetermined credit limit. Interest is charged only on the amount you've borrowed, and you have the flexibility to manage your payments as long as you meet the minimum requirements.

Term Loan Agreement

Term loans are perfect for projects or investments that have fixed timelines and budgets. Whether you're financing a home renovation, purchasing equipment for your business, or investing in education, term loans offer structured payments.

Term loans come with a specific repayment schedule, including fixed interest rates and a predetermined term. They allow you to budget and plan for payments over time, making them suitable for projects with clear start and end dates.

TOCLeveraging a Co-signer for Your Loan Agreement

Embarking on a loan journey? A co-signer might be your ace in the hole. This trusted ally signs the loan with you, pledging to take over payments if you're unable to continue. Ideal for those with thinner credit files or looking to sweeten the loan terms, a co-signer can bolster your bargaining position with lenders. It's a partnership built on trust, enhancing your application with their creditworthiness. But tread carefully, luv. It's a shared commitment with significant responsibilities for both parties.

TOCLegal Considerations

Governing Law

Laws and regulations are important when making and accepting loans because they protect both the lender and borrower. In the Philippines, these laws include:

- Civil Code of the Philippines: This law explains everything about loans, from what creditors and borrowers can do to their rights and responsibilities.

- Truth in Lending Act: This law makes lenders tell borrowers all the details about a loan, like interest rates and payment terms, before they agree to it.

- BSP & SEC Policies: The Bangko Sentral ng Pilipinas and the Securities and Exchange Commission are government groups that oversee banks and online lenders. They make rules that these institutions must follow.

Dispute Resolution

When there are disagreements in loan terms, you can start dispute resolution to settle them. This helps prevent expensive and long court battles.

Typically, you can use mediation, arbitration, or go to court. It's important to pick the method that both sides like, as it can impact how quickly the dispute gets resolved.

Registration and Notarization

For certain loan agreements, you might need to register them with the government or have a certified notary public make them official. This step makes sure the agreement is real and keeps a clear record of what happened.

TOCTips for Negotiating a Loan Agreement

Tips for Successful Negotiation

- Do Your Homework and Research the Terms: Before entering negotiations, take the time to thoroughly understand the loan agreement's terms. This includes interest rates, repayment schedules, and any associated fees. Knowledge is your greatest bargaining tool.

- Don't Be Afraid to Ask Questions and Seek Clarity: If something isn't clear or you have doubts about a particular term, don't hesitate to ask, luv. A transparent and open dialogue with the lender can lead to a better understanding of the agreement.

- Negotiate the Interest Rate: The interest rate is often negotiable, more so than you might initially think. Lenders may be willing to adjust the rate based on your creditworthiness, financial stability, or the competitive landscape. Explore your options and aim for the most favorable rate possible.

- Understand the Consequences of Default: It's crucial to comprehend the potential repercussions of defaulting on the loan. These consequences may include additional fees, damage to your credit score, or even legal actions. Knowing what's at stake can motivate you to meet your obligations.

- Get Legal Advice if Needed: If the loan agreement is complex, involves substantial amounts, or includes terms you're not entirely comfortable with, consider seeking legal advice. A lawyer experienced in financial agreements can provide valuable insights and ensure your interests are protected.

Suggested Read: Unpaid Loans in the Philippines: Understanding Your Rights, Remedies, and Responsibilities

Common Negotiation Pitfalls

- Rushing Through the Process: Impatience can lead to hastily accepting terms that aren't in your best interest. Take the time needed to understand every facet of the agreement and negotiate thoughtfully.

- Ignoring the Fine Print: The devil is in the details. Neglecting to read and understand the fine print can result in unpleasant surprises down the road. Pay attention to every clause, no matter how minor it may seem.

- Not Considering Your Long-Term Financial Capacity: It's easy to focus solely on your current financial situation when negotiating. However, think long term. Consider how the loan and its associated terms will impact your financial stability over the entire duration of the agreement.

- Focusing Solely on the Interest Rate: While securing a low interest rate is essential, it's not the only factor to consider. Other terms, such as prepayment penalty (This is the penalty you may receive for paying off your loan early. Although not all lenders impose prepayment penalty), late payment fees, and the flexibility of the repayment schedule, can significantly affect the overall cost and ease of repaying the loan.

Loan with Confidence

As we bid farewell to this journey through the intricacies of loan agreements, remember that knowledge is your most potent ally. You've learned about the key components, various types, and essential legal considerations that underpin these agreements. Armed with this wisdom, you can navigate the loan landscape with confidence, making informed decisions that align with your financial goals.

So, whether you're chasing personal dreams, fueling your business aspirations, or securing your future with a secured loan, you're now better equipped to embark on your financial adventure. Trust in the process, and let your trusty co-pilot, the loan agreement, guide you toward your desired destination.