Got an asset? Congratulations, because you may be approved for a collateral loan should you ever need one! Learn more about it in this tell-all blog about this secured loan.

Some of us are lucky enough to have items of value or assets. It could be a roof over our heads, a car, valuable equipment, or the like. Apart from using it the way it’s meant to be used, we could also take advantage of them in times of need, like when we’re short on money.

Enter the world of collateral loans. They’re a secured type of loan wherein you surrender your chosen asset to a bank or similar financial institution (more on this below). Secured loans are much easier to get than unsecured loans due to this.

But like any loan, it comes with pros, cons, and everything in between. Is getting a collateral loan truly worth it in the end? Read on to find out.

Table of Contents

TOC

What is a Collateral Loan?

Collateral loans are a type of secured loan where you pledge an asset such as a car or your property as collateral to be able to take out a loan. You basically borrow some money but also exchange something of value that the lender will be keeping until the debt is paid. Popular collateral loans are offered by companies like AsiaLink Finance and traditional banks such as Security Bank, Metrobank, BDO, and others.

TOCTypes of Collateral that are Being Accepted in the Philippines

- Property – Property is the most common type of collateral accepted in the Philippines. Property can range from vehicles such as cars and motorcycles, real estate, personal assets, and others. Out of all these, real estate is the least risky due to its high value, however, you also put yourself in danger of losing it if you don’t follow the payment terms.

- Cars – Car collateral loans are also known as OR/CR sangla in the Philippines. You usually don’t have to surrender your entire car and just hand over the OR (LTO Official Receipt) and CR (Certificate of Registration) as collateral. For this loan, credit history is normally not required, and the application is typically fast. And you get your loan proceeds instantly. A con is that interest rates for this may be high.

- Equipment – This includes anything that allows you to keep your business functional, such as computers, printers, copy machines, and the like. If you choose to surrender your business equipment as collateral, the lending company will most likely ask you for the receipt of the item/s to check how valuable it is.

- Inventory – You could also choose to hand over inventory as collateral, like your stock for a business that you’re running. In case you don’t make payments on time, the lender may seize your entire inventory and sell everything listed there.

- Cash – Another option is using cash as collateral. To do this, you have to get a loan from a bank where you already have an account in. Because you’re handing this account and the cash inside it over to them, they could use your money to pay out your loan in the case of faulty or mishandled payments.

TOC

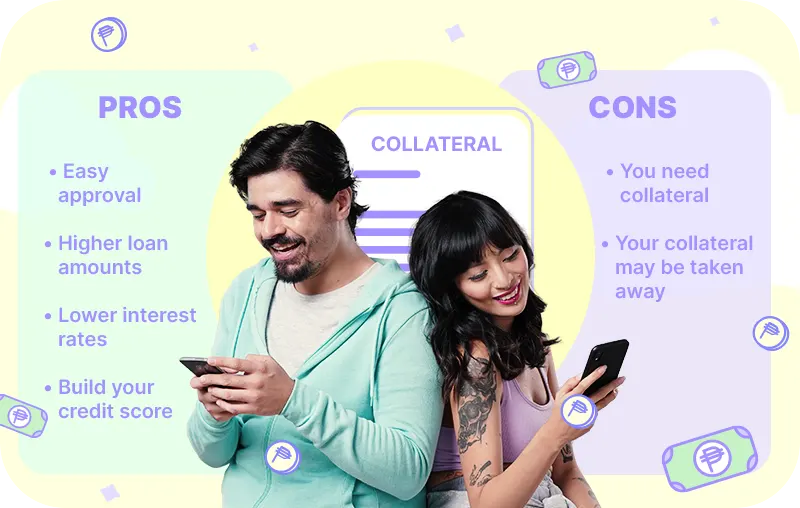

Pros & Cons of Collateral Loans

Pros of Collateral Loans:

- Easy approval – Since your loan is secured by a collateral, approval would be easier and more guaranteed as compared to unsecured loans. Yass!

- Higher loan amounts – Someone trying for a collateral loan can apply for a big amount based on the value of their asset. There’s no max amount that can be loaned.

- Lower interest rates – Again, this is because your loan is secured by collateral, so interest rates would be low as well.

- Build your credit score – Barely have any credit history? A collateral loan will help you build on a good score if you pay on time.

Cons of Collateral Loans:

- You need collateral– Of course, you can’t take out a collateral loan if you don’t have anything of value! If you do, you need to be okay having something valuable of yours be offered as collateral. If you don’t, then maybe other loan options are better for you.

- Your collateral may be taken away – Another reason why you should always pay your debts and most importantly, on time. If you don’t do this, it is possible that the bank or company that you loan from may seize your assets, which could be a big deal if you surrendered something particularly huge or valuable, like a car or a house.

Take note! If you’re planning to take out another loan, you can only use a particular collateral once. That means, if one is already in force under one loan, it won’t be eligible for use for a different loan, whether from the same loan firm or not.

Suggested Post: Loan Statistics in the Philippines [2023]

TOCSecured vs. Unsecured Loans

Wondering what the difference is between a secured loan and an unsecured loan? We made it super easy for you and built a handy table for comparison right here.

|

Secured |

Unsecured |

|

Requires collateral |

Does not require collateral, so if you don’t have anything to surrender, this might be more for you. |

|

Bigger loan amounts due to the presence of a collateral |

Smaller loan amounts |

|

Best for those with little to no credit history |

You’re most likely to get approved if you have good credit history |

|

Lower interest rates |

Higher interest rates |

|

Cannot be procured online |

Available through online lenders and credit unions |

Best Alternatives to Collateral Loans

-

TOC

- Credit Builder loans – A good alternative to a collateral loan is a quick online loan! This is especially helpful if you don’t have any collateral in your possession. Digital banks and fintechs offer loans that are easy to apply for. An example is Tonik’s Credit Builder Loan, which you can get when you download the Tonik App and onboard for an account. The process takes around 30 minutes after you fill up the information needed on your phone. All that and loan disbursement from the palm of your hands! Getting a loan has never been easier. TOC

- Pawn loans – There are loads of pawn shops in the Philippines and that’s because it allows people to get money the easy way. All you need to do is hand over a valuable object as collateral to the pawn shop, whether it’s an expensive piece of jewelry, a gadget, a luxury item, a car, land title, etc. The shop will then give you a loan should they accept your valuable. TOC

- P2P lending – This is short for “Peer to Peer” lending, meaning you loan from actual individuals and peers instead of a financial institution, like a bank. You get the loans from a pool of money from investors (sometimes, even just one investor). An example of a P2P lending platform is Blend.ph, where you can both borrow or invest. It’s a little like how a mutual fund works.

Tips for Getting Collateral Loans in the Philippines

- Double check your bank or lender’s authenticity and records – If banks and lenders do background checks, you should do the same with them and make sure they’re reputable institutions that you can trust. Apart from that, look and compare terms, interest rates, and reviews from customers. Have relatives or close friends who got collateral loans? Get their recommendations and ask about their experience with certain companies or lenders. It’s always a good thing to consult with someone who’s had first-hand experience with the lender or institution you’re considering.

- Assess the condition of your collateral – Make sure your asset is in good shape before presenting it as collateral. This is particularly important if you’re giving up a vehicle, like a car. Some companies are strict about things like your car’s model, age, condition, etc. Its market value still must be high for it to be accepted as collateral. So, check out your property first before anything!

- Understand the risks of a collateral loan –We've said this multiple times across this blog, but despite the upsides of a collateral loan, it will always come with the risk of you losing the asset you present as collateral. Weigh your priorities and check if you truly need the money or not. Do you value your asset more, or will the loan be more helpful in the long run? Acknowledge the risks of it and make sure you’ll be able to return your dues within the agreed period of time.

- Think of how you’re going to pay your loan back –Before getting any type of loan, you should always assess your finances and situation. Ask yourself, will I be able to pay for the loan in the future? Is your job stable enough for that? How much more money will you be getting in the coming months? It’s best to make a plan and be prepared financially before committing to an entire loan.

Sources:

- What is a Collateral Loan?

- The pros and cons of collateral loans

- What are the pros and cons of collateral loans?

- OR/CR Sangla Guide: All About Car Pawning in the Philippines

- Collateral vs Non-Collateral Loans

- 5 Tips for Using Collateral to Secure a Small-Business Loan

- OR/CR Sangla Guide: All About Car Pawning in the Philippines