A couple of years ago, it was hard to imagine that we would one day be able to carry around a powerful computer in our pockets. Now, we can't imagine living without them.

Indeed, gadgets have become a staple in our lives, and they're here to stay. We heavily rely on them as communication tools, entertainment hubs, and productivity boosters. Some may think that we rely on them too much, but no one can deny that they make our lives easier and more fun.

Let's be real, though. Keeping up with the latest gadgets can be heavy on the wallet. As smartphones, laptops, and gaming consoles become more advanced, they also get more expensive.

Fortunately, we have gadget loans to offer a financial lifeline for those who are always looking for the latest tech!

If this is your first time hearing about gadget loans, don't worry, luv. In this blog, we'll tell you everything you need to know - from the types available in the Philippines to the alternatives that you can apply for instead!

Table of Contents

TOC

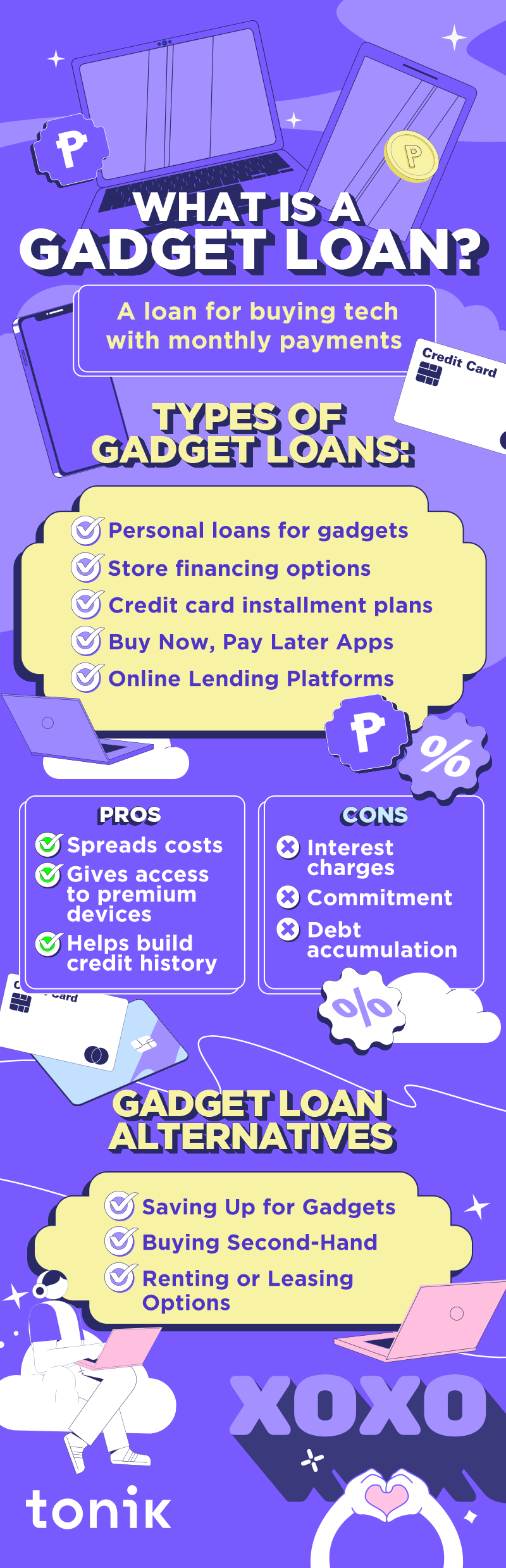

What is a Gadget Loan?

Simply put, a gadget loan is a form of financial assistance from a bank or lender that allows individuals to acquire the latest gadgets (like smartphones, laptops, or gaming consoles) without paying in full upfront.

Gadget loans typically provide a flexible repayment structure so you can start enjoying your desired gadgets while spreading the cost over manageable installments. Essentially, they make gadgets more affordable and accessible for everyone!

TOC

Types of Gadget Loans Available

The great thing about gadget loans – or loans in general – is that there are plenty of options to choose from to suit your specific needs. Check out the various gadget loans available in the Philippines below!

- Personal loans for gadgets - Personal loans can be used for a variety of needs, and that includes gadgets. They usually offer flexibility in terms of loan amount and repayment periods.

- Store financing options - Many gadget stores provide in-house financing, allowing you to buy devices with installment plans tailored to their products.

- Credit card installment plans - Credit cards often offer the option to convert gadget purchases into installment payments, spreading the cost over several months.

- BNPL apps (Buy Now, Pay Later) - Popular BNPL apps allow you to split gadget costs into smaller payments over time, often with zero or low-interest charges. Want to learn more about Buy Now, Pay Later product loans? We break it down for you here!

- Online lending platforms - Various online lenders offer specialized gadget loans with straightforward application processes and competitive terms, making tech financing more accessible.

What is the best gadget loan in the Philippines?

There are plenty of options in the Philippines to get gadget loans. A popular one is Home Credit known for its accessible in-store financing with low or zero down payments for gadgets like smartphones, laptops, and tablets. Meanwhile, UnionBank has a PayLater feature that lets customers spread the cost of gadget purchases into affordable payments directly from their credit card or app.

Tonik Bank’s Shop Installment Loan is a game-changer for Filipinos looking to buy their dream gadgets without the financial strain of upfront payments. With this loan, you can borrow up to Php 100,000 when you visit Tonik’s partner stores, purchase three gadgets with just one loan, enjoy flexible repayment terms of up to 12 months, and benefit from a digital application process through the Tonik app. The approval process is fast and hassle-free, with minimal requirements, making it accessible for first-time borrowers and tech-savvy individuals alike. It’s the perfect solution for those who want to shop now and pay later, all with the convenience of a trusted digital bank.

TOC

Pros and Cons of Gadget Loans

Nothing in this world is perfect, luv - not even loans that help you get that shiny new gadget. Check out the pros and cons of gadget loans below.

Pros of a Gadget Loan:

- Spreads Costs - Gadget loans let you spread the expense of tech upgrades over time, easing the burden on your budget.

- Gives Access to Premium Devices - You can own the latest gadgets without needing a hefty upfront payment, staying up-to-date with tech trends.

- Builds Credit History - Responsible repayment of gadget loans can positively impact your credit score, opening doors to better financial opportunities.

Cons of a Gadget Loan:

- Interest Charges - Gadget loans often come with interest, meaning you might pay more in the long run compared to an upfront purchase.

Commitment - Monthly repayments of can become a financial commitment, and failure to meet them could lead to penalties.

- Debt Accumulation - Taking multiple gadget loans can lead to a buildup of debt, impacting your overall financial health if not managed wisely.

TOC

How to Apply for Gadget Loans in the Philippines

Each type of gadget loan comes with its own set of instructions. However, there are a couple of similarities that you can pretty much apply for almost every loan! Read them step-by-step below.

Step 1: Research Loan Providers

Compare loan providers to find the right fit for your needs.

Step 2: Check Eligibility

Ensure you meet the bank or lending company’s age, income, and credit requirements.

Step 3: Gather Required Documents

They may ask for government IDs, proofs of income, and other necessary paperwork.

Step 4: Submit Your Application

Fill out the application form provided. If you choose a cool neobank like us, you’ll be able to do it easily through their app!

Step 5: Wait for Approval

Be patient while the lender reviews your application.

Step 6: Review the Loan Terms

Understand the terms and conditions. Pay close attention to interest rates, repayment schedules, and fees.

Step 7: Sign the Agreement

Sign the agreement outlining your responsibilities as a borrower.

Step 8: Receive Your Gadgets

Get your gadgets and make installment payments as agreed.

TOC

How Much are the Interest Rates for Gadget Loans?

Interest rates for gadget loans can vary and are subject to change, so it's super, ultra, extremely important that you conduct thorough research and comparisons before making your decision.

As a rule of thumb, aim for the lowest interest rate you can find. The interest rate represents the cost of borrowing money, and opting for a loan with a low interest rate can result in a budget-friendly experience.

However, it's important to note that the interest rate isn't the sole factor to consider. In the end, choose the option that aligns with your financial needs and budget.

TOC

Alternatives to Gadget Loans

If you don’t see yourself getting a loan for your tech needs, there are other options that you can explore! Here are a few of them.

- Saving up for gadgets - Not as fast and fun compared to taking out gadget loans, but it's a preferred route of many! Start a dedicated savings fund to buy gadgets outright when you have enough money.

- Buying second-hand - Consider purchasing pre-owned or certified refurbished gadgets, which can be more budget-friendly.

- Renting or leasing options - Explore various rental models, including simple rentals, purchase options, and rent-to-own choices, depending on your preferences and budget. To narrow down your search, you can check out iRent Mo now!

TOC

Get Your Must-Have Gadgets with Tonik Shop Installment Loan!

Shopping feels so much easier with low monthly payments. That’s why if you’ve decided on getting a gadget loan, look no further than Tonik Shop Installment Loan!

We have the lowest monthly payments (compared to consumer financing providers’ standard loan) and you can get approved within minutes as long as you have our minimal requirements ready. On top of that, we have zero processing fees!

Just head to one of our partner stores and look for the friendly promoters wearing our signature Tonik purple. See you there, luv!

How do customers like Tonik's Shop Installment Loan?

“Mabilis lang siya, it was quite good! [Kailangan lang ng] importante na information para ma-approve ang inaapplyan na loan.”

(It was fast, it was quite good! I just needed to provide some important information to get approved for the loan.)

- Iris, Tonik Shop Installment Loan Customer