Secured Loans vs. Unsecured Loans in the Philippines: Choosing the Right Path to Financial Freedom

Welcome to the world of borrowing in the Philippines! Whether you're dreaming of purchasing a new home, a shiny car, or simply need to build your credit, understanding the difference between secured and unsecured loans is just that important, luv.

That’s why in this blog, we'll break down the distinctions between these two loan types, helping you make better financial decisions.

Table of Contents

- Secured Loans vs. Unsecured Loans: Key Differences

- Collateral: The Core Distinction

- Interest Rates and Terms

- Application and Approval Process

- Pros and Cons of Secured and Unsecured Loans

- Consequences of Default

- Who Should Opt for Which Loan?

- Scenarios or Profiles Best Suited for Secured Loans

- Scenarios or Profiles Best Suited for Unsecured Loans

- Tips for Potential Borrowers

- Start Your Loan Journey with Tonik Digital Bank

Secured Loans vs. Unsecured Loans: Key Differences

Secured Loans

Definition and Characteristics

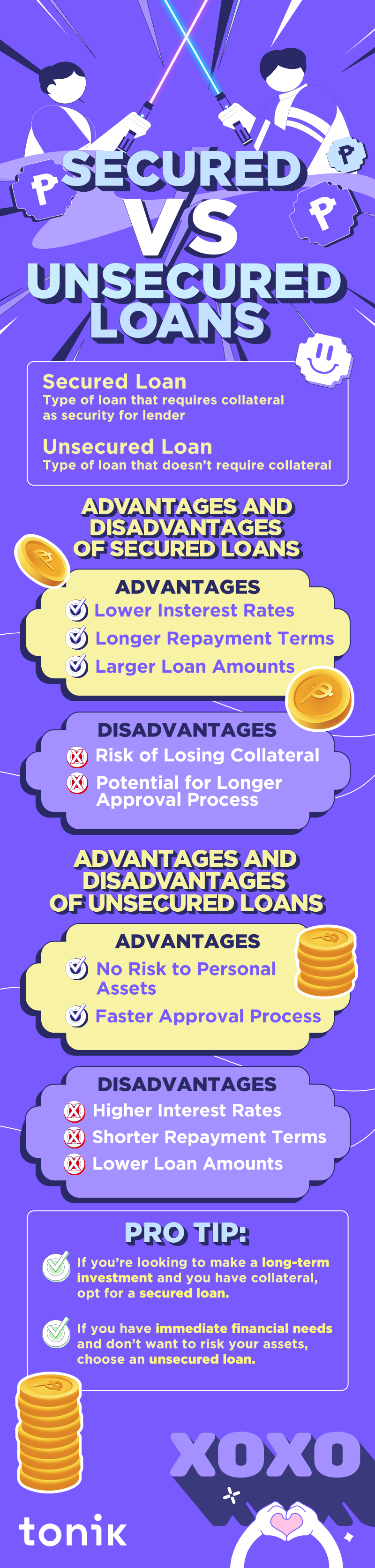

Secured loans are a form of borrowing backed by collateral, an asset that you pledge to the lender as security for the loan. This collateral reduces the lender's risk and allows for more favorable terms for borrowers.

Common Examples

In the Philippines, secured loans commonly include home loans (mortgages) and auto loans. When you take out a mortgage, your house serves as collateral. Similarly, an auto loan uses your vehicle as collateral.

Unsecured Loans

Definition and Characteristics

Unsecured loans, on the other hand, do not require collateral. Lenders rely on your creditworthiness and income to approve these loans. This makes unsecured loans more accessible for many borrowers but often comes with higher interest rates.

Common Examples

Personal loans and credit card loans are typical forms of unsecured loans in the Philippines. Personal loans provide you with cash for various purposes, while credit card loans allow you to make purchases on credit.

TOCCollateral: The Core Distinction

Collateral is the linchpin that distinguishes secured loans from unsecured ones. It acts as a safety net for lenders, assuring them that they can recover their money even if you default on the loan.

Common Types of Collateral in the Philippines

- Real Estate: Real estate properties generally appreciate in value over time, providing lenders with a tangible asset that can serve as a reliable guarantee for loan repayment. Vacant land or agricultural properties can be valuable assets, especially in areas with potential for development or agricultural use. Borrowers may use these properties as collateral for land acquisition or business expansion loans.

- Vehicles: Automobiles are commonly used as collateral, especially for auto loans. Borrowers who wish to purchase a car or need financing for vehicle-related expenses can offer their vehicle as collateral. Vehicles are relatively easy for lenders to liquidate in case of default. They have a ready market, and repossessing and selling them is a streamlined process.

- Other Forms of Collateral: In some cases, borrowers may use their own savings or time deposits as collateral for secured loans. This approach is less common but may be an option for those with substantial savings.

Implications of Not Having Collateral

If you opt for an unsecured loan, you won't need to provide collateral, but it comes with its own set of risks. Without collateral, lenders rely solely on your creditworthiness, which may lead to higher interest rates and stricter approval criteria.

TOCInterest Rates and Terms

Let's dive into the nitty-gritty details: how do secured and unsecured loans compare when it comes to interest rates and terms?

| Aspect | Secured Loans | Unsecured Loans |

| Interest Rates | Generally lower due to collateral | Typically higher, based on creditworthiness |

| Factors Influencing Rates | Collateral quality, credit score | Credit score, loan amount |

| Loan Terms | Longer repayment periods | Shorter repayment periods |

| Loan Amounts | Larger amounts available | Smaller loan amounts |

Secured loans generally offer lower interest rates because the collateral provides a safety net for the lender. On the other hand, unsecured loans rely heavily on your creditworthiness, which can lead to higher interest rates. Loan terms also differ, with secured loans offering longer repayment periods compared to the shorter terms associated with unsecured loans.

TOCApplication and Approval Process

Now, let's compare the application and approval processes for secured and unsecured loans:

| Aspect | Secured Loans | Unsecured Loans |

| Documentation and Requirements | Proof of collateral ownership, credit check | Proof of income, credit check |

| Duration of Approval Process | Typically longer due to collateral evaluation | Generally faster due to fewer documents |

| Intricacies of Approval | Involves property appraisal and legal checks | Focuses on credit history and income |

Secured loans often require extensive documentation related to the collateral, like proof of ownership and property appraisals. This process can be more intricate and time-consuming. In contrast, unsecured loans primarily rely on your financial stability, making the approval process quicker and more straightforward.

TOCPros and Cons of Secured and Unsecured Loans

Before deciding which loan type suits your needs, consider the pros and cons of both secured and unsecured loans:

| Secured Loans | |

|---|---|

| Advantages | Disadvantages |

|

|

| Unsecured Loans | |

|---|---|

| Advantages | Disadvantages |

|

|

Consequences of Default

When it comes to loan default, the consequences differ significantly between secured and unsecured loans.

Repossession and Foreclosure Processes for Secured Loans

In the case of secured loans, defaulting can lead to repossession or foreclosure. If you can't meet your repayment obligations, the lender may take possession of the collateral, like your house or your vehicle, to recover their losses.

Collection Practices and Credit Implications for Unsecured Loans

For unsecured loans, missed payments can result in collection efforts by the lender. This may include debt collection agencies contacting you for repayment. Additionally, defaulting on an unsecured loan can negatively impact your credit score, making it more challenging to secure future loans.

TOCWho Should Opt for Which Loan?

To help you decide which loan type is best for your financial situation, consider the following scenarios or profiles:

TOCScenarios or Profiles Best Suited for Secured Loans

- Long-Term Investment: If you're looking to make a long-term investment like buying a home or an expensive vehicle, secured loans offer lower interest rates and longer terms.

- Good Collateral: If you have valuable collateral to offer, such as a well-maintained property or vehicle, secured loans can provide access to larger loan amounts.

Scenarios or Profiles Best Suited for Unsecured Loans

- Immediate Financial Needs: Unsecured loans are ideal for covering immediate financial needs, like medical bills or emergency expenses.

- Limited Assets: If you don't have valuable collateral to offer or want to avoid risking your assets, unsecured loans are a safer choice.

Tips for Potential Borrowers

Before making any borrowing decisions, consider these best practices to ensure responsible borrowing and timely repayment:

- Assess Your Needs: Determine why you need a loan and how much you need. Don't borrow more than necessary.

- Compare Offers: Shop around and compare loan offers from different lenders, including those offering subprime loans, to find the best terms and interest rates. It's crucial to be thorough in this process, especially when considering subprime loans, as these can come with higher interest rates and less favorable terms.

- Budget Wisely: Create a budget that includes loan repayments, ensuring you can comfortably meet your financial obligations.

- Build Your Credit Score: No one really keeps tabs of their credit score in the Philippines, but it doesn’t mean you can’t build your creditworthiness before applying for a loan. A better credit score can lead to lower interest rates.

- Read the Fine Print: Carefully review the terms and conditions of the loan agreement to avoid surprises.

- Plan for Repayment: Have a clear repayment plan in place to ensure you can meet your obligations on time.

Start Your Loan Journey with Tonik Digital Bank

Understanding the differences between secured and unsecured loans is essential for responsible borrowing in the Philippines. By weighing the advantages and disadvantages of each option and considering your financial goals, you can make informed decisions that align with your needs.

But no matter your choice, we’re here for you, luv! We have both unsecured and secured loan products that are ready to help your quest in finding the best loan that fits your needs. Start your neobanking romance with us today and we’ll help you achieve your dreams.

Most Popular