Everyone wants to be an entrepreneur girlie these days, and who can blame them? It’s the yassified version of a 9-to-5! You’re your own boss, you have full creative control, and (ideally) you’re doing what you’re passionate about.

That is, of course, if you actually get that business up and running. Because the thing about businesses is that they cost a lot of money not just to start, but to run as well. And unless you’re filthy rich, it’s safe to assume that your savings aren’t going to cut it.

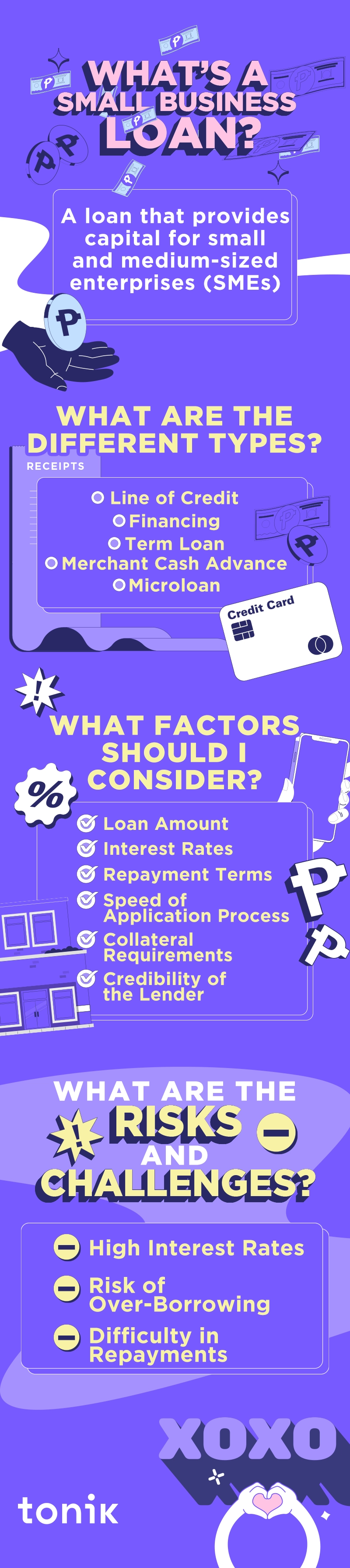

So how are you going to fund that small business and start living your girl boss fantasies? With a small business loan, of course!

In this blog, we’ll fill you in on small business loans, including the different types available, the best loans you can get, as well as the risks and challenges involved!

Table of Contents

What is a Small Business Loan?

Small business loans allow you to borrow capital for small and medium-sized enterprises (a mouthful, we know – let’s call them SMEs for short). You can use this money to grow, expand, or pay for daily operations.

Heads up though, small business loans come with specific terms and conditions. These include interest rates, repayment periods, and collateral requirements, which vary depending on the lender and the borrower's creditworthiness.

Small business loans can be secured or unsecured, and many of them offer flexible financing options for diverse business needs.

Whether you're looking to invest in equipment, manage cash flow, expand your inventory, or develop marketing strategies, a small business loan can be a valuable lifeline for turning your entrepreneurial visions into reality.

What are the Different Types of Small Business Loans?

Remember when we said small business loans are flexible to meet diverse business needs? Well, we weren’t kidding. Here are the different types of small business loans you can get!

Line of Credit

A line of credit is a flexible financing option that grants borrowers access to a predetermined amount of funds they can use whenever needed - kind of like a credit card!

Businesses can withdraw funds up to their approved limit, and they only pay interest on the amount borrowed. This makes it best for short-term cash flow fluctuations, covering unexpected expenses or seizing business opportunities swiftly without having to reapply for a new loan each time.

Equipment Financing, Invoice Financing, etc.

This type of small business loan is specifically designed for SMEs that acquire necessary equipment or bridge cash flow gaps caused by delayed payments from customers. Equipment financing provides funds to purchase machinery, vehicles, or technology essential for business operations, while invoice financing unlocks the value of outstanding invoices, allowing businesses to receive the money they are owed before the customer's payment is due.

Term Loan

With this loan, a fixed amount is provided to the borrower upfront, and repayments are made over a predetermined period. The loan term can range from a few months to several years, and the interest rate may be fixed or variable. SMEs often use this type of small business loan for long-term investments, like business expansion or real estate purchases.

Merchant Cash Advance

A merchant cash advance (MCA) is a financing option that allows businesses to receive a lump sum payment in exchange for a percentage of their future credit card sales or daily cash receipts. Repayments are typically deducted automatically from the business's daily sales until the advance and agreed-upon fees are fully paid off. Businesses with fluctuating revenue use this a lot, as repayments are linked to their sales performance.

Microloan

As you’ve probably already guessed, microloans are small-scale loans usually offered to early-stage startups or entrepreneurs who need a modest amount of capital to kick-start their ventures. These loans help promote economic development in underserved communities and for businesses with limited credit history. Because of the small scale, they often come with more accessible eligibility criteria and may be provided by government agencies, nonprofits, or specialized microfinance institutions.

TOCTop Small Business Loan Providers in the Philippines

We know you can’t wait to start applying for small business loans after seeing the different types. Before you do, take the time to read through some of the top small business loan providers in the Philippines!

Take note that the choice of lender or loan app is mostly subjective. These may be the top small business loan providers for us, but they may not be for some. See this neat ‘lil comparison table we made and judge for yourself!

| Lender | Product | Max. Amount | Lowest Monthly Interest Rates/One-Time Fees | Loan Terms |

|---|---|---|---|---|

| Tonik Digital Bank | Quick Loan | PHP20,000 | 4.24% (add-on rates) | 6-12 months |

| BillEase | BillEase Cash Loan | PHP40,000 | 3.49% | 1-12 months |

| Tala | Tala Loan | PHP25,000 | 15% (One-Time Fee) | Up to 61 days |

Alrighty, let’s start with your favorite neobank (yes, it’s a digital bank without a single branch, hun!). For unsecured, we have Quick Loan. Through Quick Loan, you can borrow up to P20K and pay the loan up to 12 months with minimal requirements. You can get approved quickly and conveniently from your Tonik App.

What else? Oh, right – BillEase! New customers can borrow up to PHP40,000 for 2-6 months, while repeat customers can unlock more flexible loan terms for 2-24 months at an interest rate of 11.90%. Their requirements are minimal, too, like a valid ID, proof of income, and proof of billing. Once approved, the amount can be disbursed into your BillEase app in just one day.

Last but not least, we have Tala. The Tala Loan offers a maximum loan amount of PHP25,000, which isn’t bad until you consider the steep interest rate of 14.74%. Their loan term of 1 to 61 days only can also be a dealbreaker for some. However, they do have their ease of application and the process that only takes up to 10 minutes!

TOCFactors to Consider When Choosing a Small Business Loan

Wait just a minute, luv, we’re almost done! Don’t start applying without reading these six important factors when choosing a small business loan.

-

✓Loan Amount - Evaluate your needs and plans to make sure you borrow the right amount. It has to be enough to cover the necessary expenses so as to avoid over-borrowing which could strain your repayment capacity.

-

✓ Interest Rates - Compare the interest rates offered by different lenders and consider whether they are fixed or variable. Understanding the total interest costs over the loan term helps you assess the feasibility of repayment and choose the most cost-effective option.

-

✓ Repayment Terms - The loan's repayment period plays a vital role in managing cash flow and financial planning. Carefully assess your business's ability to make regular repayments while keeping your operations on track. It’s also handy to know your chosen lending firm’s repayment terms so you know what to do in cases when you’re short for cash or if there’s a way to repay early. Here’s an example of Tonik’s repayment process.

-

✓ Speed of Application Process - The world of business is fast paced, so you have to be agile. Check out the application processes of different lenders, including their approval times, documentation requirements, and disbursement timelines. Opt for a lender with a streamlined and efficient application process to get the funds when you need them most.

-

✓ Collateral Requirements - Secured loans require collateral, which are assets like real estate, inventory, vehicles, or equipment. Note that providing collateral involves the risk of losing assets in case you can’t pay back your loan.

-

✓ Credibility of the Lender - You have to go with a lender that you can trust. Research the lender's reputation, reviews, and track record of working with businesses similar to yours. Verify their licenses and certifications to ensure they comply with regulatory standards.

Hit the Ground Running with a Small Business Loan

A small business loan can be a blessing and a curse. Get one that’s fit for your business, your needs, and your financial standing, and you hit the jackpot. But, if you get one that puts a strain on you financially, that’s going to be a huge pain in the neck.

When applying, make sure that you fully understand the type of small business loan you’re getting and, of course, that it serves its purpose well. Choose wisely, and don’t forget the potential risks, including high-interest rates, difficulty of repayment due to over-borrowing, and collateral mishaps.

Just keep all these in mind, luv, and you’ll be reaping from the value of the business you’ve always wanted in no time!