Imagine you need some extra cash for a passion project, an emergency, or a special purchase, but you don’t have enough money in the bank to fund it. You think of asking your family and friends for the cash, but then you realize that there’s a risk of damaging relationships if you go that route.

At this point, it may seem like a dead end. In actuality, you’re forgetting about one option that you can take, and that's unsecured loans!

These loans are like a financial helping hand when you need it most. In this blog, we'll explore how they work, what types are available, and the important things to consider before getting one. So, let's dive in and learn all about unsecured loans in the Philippines!

Table of Contents

- What is an Unsecured Loan?

- Types of Unsecured Loans in the Philippines

- Pros and Cons of Unsecured Loans

- Criteria for Eligibility

- Unsecured Loan Application Process

- Tips for Ensuring a Smooth Application Process

- Interest Rates and Fees

- The Role of Risk-Based Pricing

- Repayment and Default

- Regulations and Consumer Protection

- Tips for Borrowers

What is an Unsecured Loan?

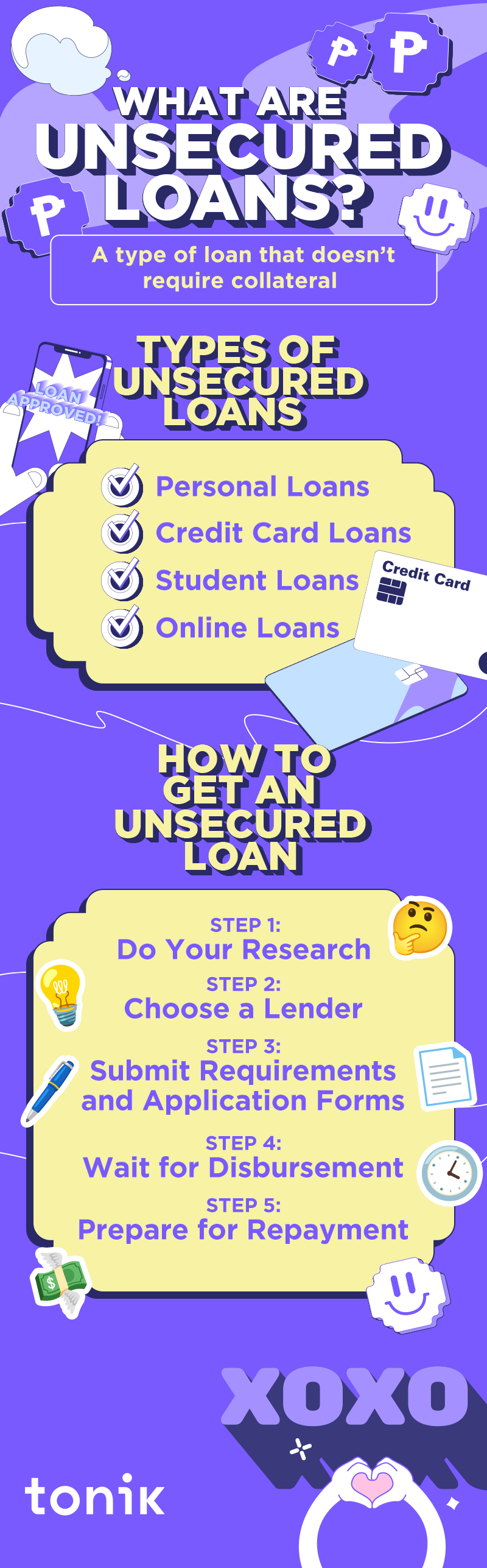

An unsecured loan is a type of loan that mainly uses your credit score to assess your creditworthiness. It does not require collateral to apply. However, interest rates and other fees may apply, depending on the bank or lender that you choose.

Now, let’s dive a bit deeper and check out the types of unsecured loans that are available in the Philippines.

TOCTypes of Unsecured Loans in the Philippines

There are various types of loans that you can choose from depending on your needs. Read about each one below:

- Personal loans - These are like general-purpose loans you can use for almost anything, whether it's for an unexpected expense, a vacation, or even debt consolidation.

- Credit card loans - If you have a credit card, you can use it to get a loan. Essentially, you’ll borrow a certain amount of money from your card provider, and you can repay it in installments.

- Student loans - Designed to help students pay for education expenses, these loans can cover tuition, books, and other school-related costs.

- Online loans - These are loans you can apply for and manage online, making them convenient and quick. Just be careful to choose reputable online lenders.

- Other specialized loan products – There are also loans that are highly specific to different needs, such as payday loans, emergency loans, and business expansion loans.

Pros and Cons of Unsecured Loans

One of the biggest mistakes you can make is treating a loan like a fairy godmother, or a genie in a lamp. They can’t solve your financial problems just like that, and they’re still responsibilities at the end of the day. Read through the pros and cons of unsecured loans first before you decide that it’s the financial solution for you!

Advantages

- No collateral required - Unlike secured loans that require assets like your house or car as security, unsecured loans don't need collateral. Not only does this make the application process easier, but it also means you won't risk losing valuable possessions if you can't repay the loan.

- Quick application and approval processes - Unsecured loans often come with faster application and approval times. This is great for addressing urgent financial needs since this gives you easier access to funds compared to other loan types.

- Flexibility in use - You can use unsecured loans for various purposes, from covering unexpected expenses to funding personal projects or consolidating debt. The lender generally doesn't restrict how you can use the borrowed money, giving you the freedom to meet your specific financial goals.

Disadvantages

- Typically higher interest rates – Depending on your bank or lender, unsecured loans often come with higher interest rates compared to secured loans because the lender takes on more risk without collateral. This means that you may end up paying more in interest over the life of the loan.

- Shorter repayment terms - Unsecured loans usually have shorter repayment periods. While this might sound appealing for quickly paying off a debt, it can also mean higher monthly payments, potentially straining your budget.

- Consequences of default – Failing to repay your loan can have serious consequences. Your credit score can be negatively impacted, and you may face collection efforts or legal actions from the lender. Additionally, the absence of collateral means the lender can't easily recoup their losses by seizing assets, which could result in more aggressive debt collection tactics.

Criteria for Eligibility

The requirements to qualify for unsecured loans can vary from lender to lender, but here are a few that are widely requested:

- Age requirements - Typically, you need to be at least 21 years old to apply for an unsecured loan in the Philippines. Some lenders may require you to be older, so it's essential to check the specific age criteria.

- Income criteria - Lenders want to ensure you have a stable source of income to repay the loan. They may also set minimum monthly incomes. Meeting these criteria demonstrates your ability to manage the loan responsibly.

- Credit history considerations - Your credit history plays a significant role in loan approval. Lenders will assess your credit score to determine your creditworthiness. A higher credit score increases your chances of approval and may even help you secure better loan terms.

- Documentation needed - To apply for an unsecured loan, you'll typically need to provide certain documents such as proof of identity, proof of income (like payslips or tax returns), and other personal information. Have these documents ready in advance so you can go through your application process without any hitches.

Unsecured Loan Application Process

Just like the criteria eligibility, the unsecured loan application process varies, but there are a few similarities you should expect. Here’s a step-by-step guide!

Step 1: Do your research

Start by researching different lenders and their loan offerings to find the one that suits your needs.

Step 2: Prepare the necessary documents

That includes your proof of identity, proof of income, and other documents.

Step 3: Fill out the application form

This will be provided by your chosen lender. If it’s from an online lender or a neobank like us, you’ll probably fill it out through their online loan app.

Step 4: Submit the requirements

Submit your unsecured loan application along with the required documents for review.

Step 5: Wait for approval

Now, for the waiting game. If approved, carefully review the loan terms, including interest rates and repayment schedules.

Step 6: Sign the loan agreement

Do this only if you’re comfortable with the terms. Again, luv, make sure to carefully review the contract!

Step 7: Receive the loan funds

This is the fun part! You can receive the funds through a bank transfer or a check, depending on the lender's procedures.

Step 8: Prepare a budget for loan repayment

Start repaying the loan as per the agreed-upon schedule. If you plan to apply for a Tonik Loan, you can learn how to repay in advance here.

TOC

Tips for Ensuring a Smooth Application Process

Aside from the steps provided above, you can follow these helpful tips to make sure your unsecured loan application process is a piece of cake.

- Double-check the completeness and accuracy of your application and documentation to avoid delays or rejections.

- Maintain a good credit score by paying bills on time and managing existing unsecured loans responsibly.

- Compare unsecured loan offers from multiple lenders to find the most favorable terms.

- Be transparent with the lender about your financial situation and any potential challenges in repaying the loan.

- Consider seeking financial advice or consulting a credit counselor if you're uncertain about the terms or your ability to repay the loan.

Interest Rates and Fees

Interest rates are a fundamental part of any loan. Think of it as the price you have to pay for the privilege of borrowing money.

Interest rates for unsecured loans can vary widely. They typically consist of two components: the nominal interest rate and other charges. The nominal interest rate is the base rate that reflects the cost of borrowing. In addition to the nominal rate, lenders may apply other charges like service fees or insurance premiums. These may include processing fees, which are charged for handling your loan application, and late payment fees if you miss a scheduled payment.

When exploring unsecured loan options, it's crucial to compare interest rates and fees among different lenders. You can use online loan comparison tools or consult with financial advisors to help you find the lender that offers the most favorable rates and fees for your specific financial situation.

TOCThe Role of Risk-Based Pricing

While we’ve touched upon interest rates and the various fees that come with unsecured loans, it's crucial to delve a bit deeper into how these rates are determined. Enter the concept of risk-based pricing.

You might wonder why your friend, who applied for a similar loan, received a different interest rate. The answer often lies in risk-based pricing. This is a strategy used by lenders to set the terms of your loan based on the risk you pose as a borrower. Essentially, the higher the risk they believe they’re taking by lending you money, the higher the interest rate you might be offered.

Factors like your credit score, income stability, and even the type of loan you’re applying for play a significant role in this risk assessment. It’s a lender’s way of protecting themselves against potential default while also offering competitive rates to those with solid financial standing.

Understanding this concept is crucial for two reasons. First, it emphasizes the importance of maintaining a good credit score and stable income. Second, it sheds light on the competitive nature of loan offers, encouraging you to shop around and find the best deal that reflects your risk level.

Now, let’s move on to how you can effectively manage your loan repayments to avoid falling into default, keeping in mind how risk-based pricing has influenced your loan terms.

TOCRepayment and Default

As mentioned earlier, missing your loan repayments and defaulting can have a negative impact on your financial health, specifically your credit score. In turn, that can make it challenging for you to get unsecured loans again in the future. On top of that, lenders could increase your interest rates or (worse) take legal action to recover the outstanding debt.

That's why it's essential to create a budget well before your due date. You can also set up reminders or automatic transfers to make sure you pay on time. If possible, consider paying more than the minimum amount due to reduce your overall interest costs and pay off the loan faster.

If you do find yourself at a point where paying back your loans is impossible, contact your lender as soon as possible. Many lenders are willing to work with borrowers to find solutions, which includes extending loan terms, temporarily lowering interest rates, and creating new repayment plans.

In case that's not an option, it's best to seek advice from a financial counselor or credit counselor who can guide you through managing your debt and improving your financial situation.

TOCRegulations and Consumer Protection

While your unsecured loan is your responsibility, and you should do everything you can to manage it well, don't forget that you also have rights as a borrower under Philippine law. This includes the right to be informed about the terms and conditions of your loan, including interest rates and fees, in a clear and understandable manner. You also have the right to fair and ethical treatment by lenders and the right to privacy regarding your financial information.

Central to ensuring these rights is the Consumer Act of the Philippines. This pivotal legislation offers additional layers of protection for borrowers by setting out the rights and obligations of consumers, as well as the responsibilities of businesses towards their customers. It emphasizes the importance of transparency in all consumer transactions, ensuring that consumers are fully aware of the terms and conditions of their financial products, including loans. It advocates for fairness in consumer transactions by mandating that all financial products, including loans, are presented in a way that is not misleading and respects the consumer's right to choose freely.

Helping protect your rights, alongside the Consumer Act, is the Bangko Sentral ng Pilipinas (BSP). It is their job to ensure that lenders follow a strict set of guidelines, which includes transparency in loan terms and conditions, fair interest rates, and responsible lending practices.

In case of issues or disputes with your lender, aim to resolve the matter with them directly first. If that doesn't help, you can escalate the issue to the BSP or other relevant regulatory bodies. Remember, the Consumer Act of the Philippines provides a framework for resolving such disputes, reinforcing your rights as a consumer. Additionally, financial counselors are available to offer advice and support. Here’s a quick tip for settling issues and disputes: make sure you document all communications and keep records of your loan agreements, as these can be invaluable in case of disputes!

TOCTips for Borrowers

Before we let you go on your unsecured loan journey in the Philippines, here are a few bonus tips that you should know!

Tip 1: Always check for credibility

Make sure that the lender is reputable and licensed by the Bangko Sentral ng Pilipinas (BSP) to operate. This helps you avoid potential loan scams or sketchy lenders.

Tip 2: Borrow only what you need

Don't give into the temptation of borrowing more than you need. Borrow only what you genuinely require to reduce the overall cost of your unsecured loan and make payments more manageable!

Tip 3: Make sure to read and understand the fine print

We can't stress this enough. Take the time to carefully read the terms and conditions before signing that document! If anything is unclear, seek clarification from the lender. This may seem tedious, but we're sure you'll thank us in the long run!

Tip 4: Consider debt consolidation (if you already have multiple existing debts)

This is the act of getting another loan with lower interest rates to pay off existing debts that have higher interest rates. This can simplify your finances, reduce monthly payments, and save you money!

TOCApply for Tonik’s Unsecured Loans Today!

Before you start your research on lenders in the Philippines, consider yours truly, Tonik Digital Bank!

Our new and improved Tonik Credit Builder Loan has flexible loan terms up to 12 months. This makes it easier for you to start building credit with us!

On top of that, Tonik is a neobank, which means we don’t have a physical branch. The entire loan process – from application to disbursement – takes place in the Tonik App!

Ready for this neobanking romance, luv? Download the Tonik App and apply today!