Quick Take: What’s the best buy now, pay later app in the Philippines?

Buy now, pay later with Tonik Shop Installment Loan. You only need 1 valid ID to apply, and it's super secure since we're a BSP-licensed digital bank. Borrow up to ₱100K for your home appliance needs using the app at any of our partner stores!

If shopping really is a must but you don’t have enough funds for it, try a Buy Now Pay Later loan. Who knows? It might be the best one for you.

Is that chair you’ve been working on from 9am to 6am giving you back problems? Need a new laptop after your old one crashed? Or do you just want to treat yourself to a shiny new tablet? You don’t need to wait forever and save up for it. You can actually just get a Buy Now Pay Later loan!

What’s Buy Now Pay Later, you might ask? Also known as BNPL, this is the loan that you get if you want to purchase something instantly, then just pay later on in installments. Its name is actually quite self-explanatory.

This form of loan exploded in popularity during the pandemic as multiple people shifted towards online shopping. We’ve got more interesting facts about Pay Later product loans in this article. But first, read below for the basics!

Table of Contents

TOC- Table FInd

What is Buy Now, Pay Later?

As said earlier on in this article, the Buy Now Pay Later loan is the kind of loan that people get to be able to purchase something while paying for it later, normally in installments. It’s more commonly known as BNPL, and it gained traction in the times of COVID-19 thanks to the rise of online shopping.

BNPL separates the expenses of your purchase in equal payments, with the rest of these billed to either your card, finance app, e-wallet, or bank account—it depends on where you get your BNPL loan from, of course. Lots of BNPL plans are available on e-commerce platforms, your favorite lending apps (hello, Tonik!), or even in physical stores.

There are different types of BNPL loans, with some having interest, and others with no interest.

TOC- Table FInd

Pros and Cons of Buy Now, Pay Later

Pros of BNPL

- 0% interest – There are BNPL offers that don’t offer any more interest, making it more convenient than paying via credit card.

- Instant gratification – You want it? You got it! When you choose a BNPL loan or program, then you can immediately get that item you’ve been eyeing! It’d be a win especially if it’s an appliance or gadget that you need.

- Long loan terms – There are BNPL installment terms that can go as long as 24 months. With Tonik, you choose the loan duration that you’re comfortable with, and we’re flexible like that!

- Offline presence – Apart from shopping online, BNPL companies have presence in appliance stores, and you can use apps like Tonik to buy something from there. Just open your app to get the loan and use it as a mode of payment. Other stores also have their own BNPL programs that you can try out.

Cons of BNPL

- Interest rates – Some BNPL programs don’t offer 0% installments, so you’ll end up paying more than the actual price of the item you purchased. The interest rates vary per lending company.

- The impulse to keep shopping/buying – Because of the choice to “pay later,” you may be tempted to just keep on shopping even if you don't have enough savings. Remember, you’d be spending money you don’t have, so this option might just tempt you to keep buying things, and therefore incurring even more debt. Try to manage your impulses when taking out BNPL loans.

- Transaction or late fees – Again, you might be spending more than you intended due to transaction or processing fees when you take out a BNPL loan or program. Also, if you pay late, you may be penalized with more fees just like a regular loan.

- May not build credit score – Unlike a regular loan, BNPL loans regularly don’t help with building credit, so you might want to consider this if you’re getting a BNPL partly because of this purpose.

TOC- Table FInd

Types of BNPL Loans

There are two kinds of BNPL loans to choose from:

- No-interest loans – These loans have no interest for the customer. With no interest BNPL loans, the merchant pays an amount to the lending company so that customer does not have to do so when getting the loan.

- Loans with interest - This type of BNPL loan allows the customer to buy their preferred item right then and there, but must pay interest. It’s kind of like paying with a credit card.

Both of these types of BNPL loans offer terms where the loan should be settled in full, with equal amounts per month. These are usually mentioned before you sign any loan offer. Like a regular loan, you’ll be charged with penalties and other fees should you be late or lacking in payments.

TOC- Table FInd

Third-Party BNPL vs. Credit Card BNPL Offers

BNPL programs offered by credit cards are a little different compared to those from third parties. The latter type of BNPL is usually offered when you make a purchase, while the former is not. Those given by credit cards are normally included as an option when you receive your statement, so you can decide whether to get a loan by then instead of immediately.

Credit card BNPL loans typically have monthly payment fees or interest. If your credit card is one that garners rewards, then you may earn points as well. As to what type of BNPL loan you prefer, whether it’s from a credit card or third-party, is up to you.

TOC- Table FInd

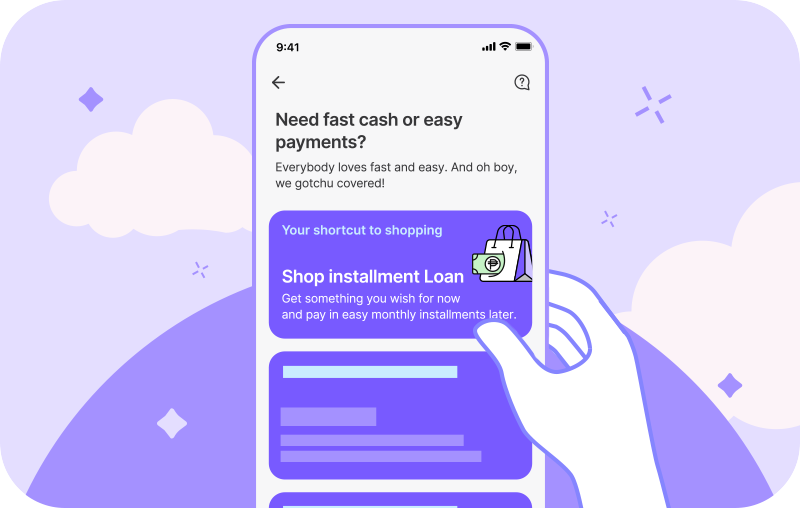

How to Shop on Installment using Tonik

One of Tonik’s available loans is its Shop Installment Loan! If you want to buy something like a television, laptop, speakers, etc., you can get a loan through the app! And the great thing about it is that it’s really simple and easy to get—plus it all takes 30 minutes or less.

Here’s how:

- Download the Tonik App onto your mobile phone and sign up for an account. This involves taking face biometrics and uploading a valid government ID to the platform. To know more about creating a Tonik Account, just follow the steps on our handy onboarding video.

- Once you have a Tonik Account, go to your app dashboard and click on the “Loans” tile.

- Choose the “Shop Installment Loan” tile.

- You’ll be shown a list of items you can buy with Shop Installment Loan. Choose the item you want to get. Remember: the item HAS to be on the list for you to be able to get the loan.

- Input how much money you need and your desired payment terms.

- Fill up your information on the app and upload income documents (such as your latest pay slips or bank statement).

- Wait a few minutes for approval. If you get approved (WOOHOO!), sign all the necessary forms, like the Promissory Note, Disclosure Statement, and the Amortization Statement.

- Check your Tonik App again to see your loan amount disbursed there. Yass! You can now go to your closest appliance store and get your dream purchase.

- Want a lower monthly interest rate? You can totally get it—simply upload your purchase’s official receipt within 7 days of you buying the item. Note that it needs your full name, the price of your item, and the item’s date of purchase.

And that’s it, luv! Still thinking of why you should try Tonik’s Shop Installment Loan? We got awesome highlights, of course!

- Super-duper fast approval and disbursement

- No need for down payment, credit cards, and credit history!

- Minimal documents needed—only 1 ID and 1 month-payslip or bank statement

- Loan up to a whopping PHP 100,000 to get your purchase

TOC- Table FInd

How to Find Safe Online Lending Platforms & Apps

If you’ve been reading this article from the start, then you understand that part of the risk of getting an online loan is the possibility of being scammed over the internet. Prevent this from happening and take precautions through these steps:

- Find reviews online – The easiest way to check if a company is legit? Reviews! Scroll through the internet for reviews, from all their social media sites to Google. Yes, reviews may either be biased or faked, but it doesn’t hurt to read them to research further and inform your judgment on whether the platform is the real deal or a potential scam.

- Search for a physical address - Okay, so digital platforms may operate online, but the legitimate ones still have a physical address displayed on their website. For example, Tonik’s office is located somewhere in Metro Manila. This information is easily accessible through a quick Google search.

- Check the website – You can easily enter the domain on whois.com to know who owns and runs the site as well as how long it’s been around. This’ll give you an idea of whether the lending company is legit or not.

TOC- Table FInd

Pro Tips for using BNPL Loans

- Get the BNPL plan for you – Note again that there are BNPL plans with interest and others with no interest. There are also BNPL plans offered by your credit cards. It all boils down to your priorities—can you afford the interest or not? Do you have a credit card? Do you have time to go to the store to physically purchase it or get it online? How long do you want to split the payment terms? There are different types of programs that you can look up, so lay down what you want from your loan and consider these before picking one.

- Learn how BNPL works and do your research - This goes for about any type of loan or program! Read the Terms & Conditions before agreeing to anything, because something that you overlook can bite you in the butt later on. Plus, BNPL loans are split into equal payments billed to your bank account, credit card, or debit card. You have to check if you can commit to that over the course of a short amount of time.

- Check your savings before getting a BNPL loan - First off—can you afford to place a loan into your budget? Look at your savings and see if you have enough to make regular payments in the future. Loans are a commitment, as we mentioned previously. Understand what you’re getting into.

- Know that most BNPL programs don’t build credit - Looking to build your credit? If this is the sole reason (or one of the major reasons) for you getting a BNPL loan, then you best not pursue it since most BNPL programs don’t report to credit bureaus. Try another loan or even a credit card instead.

- Don’t get tempted by them just because the option is there - A downside of BNPL loans is that it gives the illusion that you can keep on buying stuff just because it’s there. You might be drowning yourself in debt. As per usual when it comes to loans, tread carefully and be responsible! Money and finance are serious deals and nothing to be toyed with.

Now that everything’s been covered, are you ready to get a BNPL loan, luv? One option you can totally check out is Tonik’s Shop Installment Loan, where you can get a loan to purchase awesome stuff like TVs, furniture, appliances, and more. It’s fast, safe, and easy to get! You can read more about it here.

Sources:

- Buy Now, Pay Later

- What Is Buy Now, Pay Later?

- What Is Buy Now, Pay Later? Forbes

- What is Online Lending?

- Buy Now Pay Later plans: Tips to avoid the pitfalls