Quick Take: Where to obtain cash loans online with fast processing and disbursement?

Tonik Credit Builder Loan offers fast processing and disbursement via the Tonik App. Plus, through consistent and on-time payments, you can use it to build a strong credit history, which can then unlock better financial opportunities like low interest rates.

Getting a loan online has never been easier. If you need cash, you can just download an app or visit a website. After submitting requirements and answering a few questions, you’ll be able to get the money you need in minutes!

While online loans are super simple and easy, an online loan is still a responsibility. No worries, though, because we’re here to help.

Learn the basics, explore the benefits, and understand how to navigate online loans in the Philippines when you read this blog!

Need New Appliances?

We've got the lowest monthly payments for you.

Visit our partner stores and shop with Tonik Shop Installment Loan today!

Table of Contents

- The Rise of Online Lending in the Philippines

- Advantages and Disadvantages of Online Loans

- Tonik Bank’s Online Loan Products

- Eligibility Criteria and Required Documents for Online Loans in the Philippines

- Tips for a Successful Loan Application

- Steps to Apply for an Online Loan

- Tips for Getting Your Loan Approved

- Loan Repayment

- Tips for Managing Your Loan and Ensuring Timely Repayment

- Conclusion

The Rise of Online Lending in the Philippines

To give you some background, let’s start by asking why; specifically, “Why is online lending so prevalent in the Philippines nowadays?” We won’t bore you with too many details, luv. Here are a couple of bite-sized explanations.

- Accessibility: Online lending is just a few clicks away, making it incredibly convenient for Filipinos to apply for online loans using their smartphones.

- Speed: Quick approval and disbursement of funds are hallmarks of online lending, providing a lifeline in financial emergencies.

- Diverse Options: The market offers a wide range of loans to meet various needs, from personal and business loans to payday and installment options.

- Innovative Solutions: Fintech companies have introduced innovative lending solutions, including peer-to-peer platforms and mobile apps, leading to competitive rates and flexible repayment options.

- Financial Inclusion: Online lending has expanded financial access to previously underserved Filipinos, promoting financial inclusion.

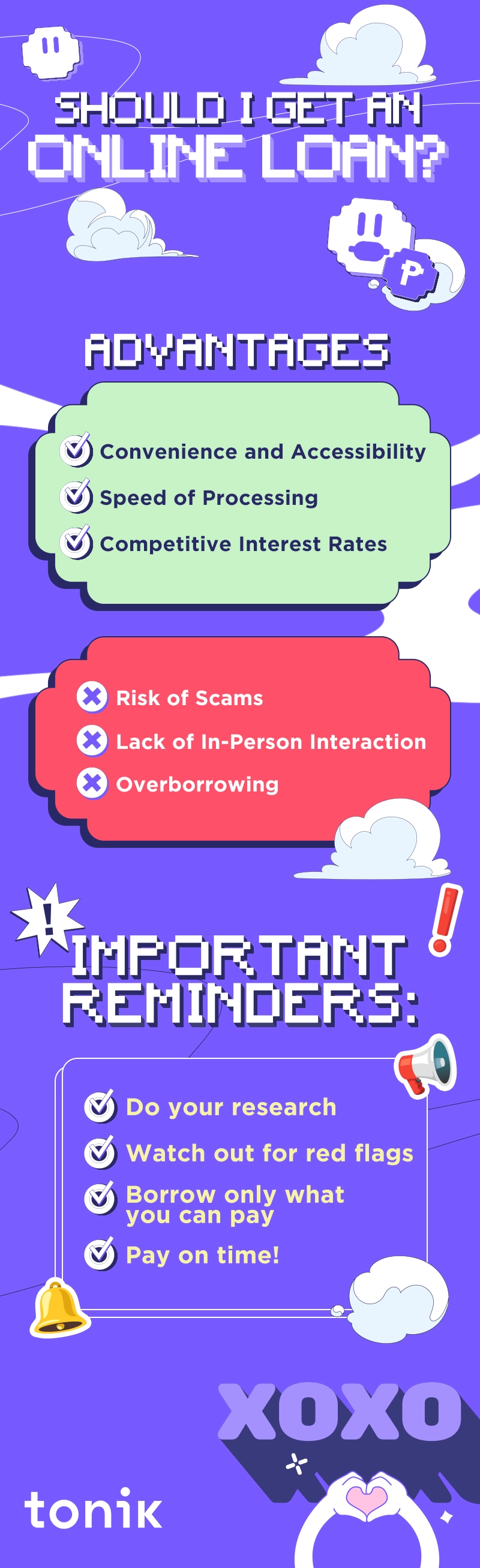

Advantages and Disadvantages of Online Loans

Online loans in the Philippines come with a set of advantages and disadvantages. If you’re still not fully onboard when it comes to online loans, these could certainly help you finally make that decision!

Advantages

- Convenience and Accessibility: Online loans offer unparalleled convenience. You can apply for a loan from the comfort of your home, 24/7 using the device of your choice. Because of this, accessibility is no longer an issue, as you can reach online lenders even if you're in remote areas without physical bank branches.

- Speed of Processing: Online lenders don’t like wasting time. They’re known for their swift approval and disbursement processes, with many online loans getting approved within minutes. That makes them ideal for urgent financial needs.

- Competitive Interest Rates: Online lending platforms often offer competitive interest rates due to lower operating costs compared to brick-and-mortar banks. While interest rates differ from loan to loan, that means you get higher chances of scoring lower interest rates!

Disadvantages

- Risks of Scams: While online loans provide convenience, they also carry certain risks. A glaring one is the risk of dealing with scammers. Before applying for a loan, you should make sure to verify their legitimacy. An easy way to do this is to check if they’re SEC-registered.

Pro tip for online loans: Beware of Facebook accounts messaging you personally about loans. Most of them will try to assist you for a “small service fee” and you may not know that most online loans actually don’t have agents that assist you since they’re designed to be easy, quick and service fee free.

- Lack of In-Person Interaction: Unlike traditional banks, online loans lack the face-to-face interaction with a loan officer. This can be a drawback if you prefer personalized advice or have complex financial situations.

- Overborrowing:The ease of online loan applications can lead to overborrowing. Ensure you borrow only what you need and can comfortably repay to avoid financial strain.

Tonik Bank’s Online Loan Products

If you're new to the Tonik App, you might be surprised to know that it's not just about high-interest Time Deposits and Stashes. Your local neobank luv, which is licensed by the Bankgo Sentral ng Pilipinas has got you covered when it comes to fraud risks. Plus, we’ve got three fantastic loan products worth considering as well!

Let me introduce you to Tonik Credit Builder Loan. It's an unsecured loan designed specifically to help you build a solid credit history. That's something you should strive for, because good credit can give you access to awesome financial perks like lower interest rates!

Tonik is all about making your financial journey smooth and accessible. Whether you're eyeing a big investment or need some extra cash for those unexpected expenses, our loan products have you covered.

TOCEligibility Criteria and Required Documents for Online Loans in the Philippines

Online loans may be easy to apply for, but they’re not sure-fire ways to get cash. You’ll still need to be eligible for them and have the right documents! Note that lenders require a wide range of loan requirements, but here are the usual suspects that you should know.

General Eligibility Criteria for Online Loans

- Age: You must be of legal age, usually 21 years old or older, to qualify for most online loans in the Philippines.

- Residency: Lenders often require borrowers to be Philippine residents or citizens.

- Income: You should have a stable source of income, which may include employment, business, or other verifiable sources of revenue.

- Creditworthiness: Some lenders may check your credit history, while others offer loans to those with no credit or bad credit. However, better credit scores can often lead to more favorable terms.

List of Documents Required

- Valid ID: You'll typically need a government-issued ID such as a passport, driver's license, or TIN (Taxpayer Identification Number) card.

- Proof of Address: A utility bill or any document with your current address can serve as proof of residence.

- Income Documents: Depending on the lender, you may need to provide payslips, employment certificates, or business registration documents.

- Bank Statements: Some lenders may request bank statements to verify your income and expenses.

Tips for a Successful Loan Application

- Check Eligibility: Review the lender's eligibility criteria before applying to ensure you meet their requirements.

- Prepare Documents: Gather all necessary documents in advance to expedite the application process.

- Compare Lenders: Research multiple online lenders to find the best terms and interest rates for your needs.

- Loan Amount: Borrow only what you need and can comfortably repay to avoid overburdening yourself.

- Read the Terms: Carefully read and understand the loan terms, including interest rates, fees, and repayment schedules.

- Timely Repayments: Make sure to repay your loans on time to maintain a good credit history and avoid late fees.

Steps to Apply for an Online Loan

Now for the exciting part: the online loan application process. Just like the eligibility and requirements, the process varies from lender to lender. To help you out, we’ve laid out here some of the most common steps!

Step 1: Research and Compare Lenders

Start by researching different online lenders. Compare interest rates, loan terms, and customer reviews to find a reputable lender that suits your needs.

Step 2: Check Eligibility

Review the lender's eligibility criteria to ensure you meet their requirements.

Step 3: Gather Required Documents

Collect all necessary documents, including valid IDs, proof of address, income documents, and any collateral-related papers (if applicable).

Step 4: Fill Out the Online Application

Visit the lender's website or app and complete the online application form. Provide accurate information as requested.

Step 5: Upload Documents

Scan or take clear photos of your documents and upload them as per the lender's instructions. Make sure all necessary details are visible and clear.

Step 6: Wait for Approval

Once your application is submitted, the lender will review your documents and assess your eligibility. This process may take anywhere from a few minutes to a few days, depending on the lender.

Step 7: Review Loan Terms

If your loan is approved, carefully review the loan terms and conditions as well as the interest rate, loan amount, repayment schedule, and any associated fees.

Step 8: Accept the Loan Offer

If you are satisfied with the terms, accept the loan offer as per the lender's instructions. This may involve digitally signing an agreement.

Step 9: Receive Funds

After accepting the offer, the lender will disburse the loan amount to your designated bank account. The time it takes to receive the funds varies by lender.

TOCTips for Getting Your Loan Approved

- Maintain Good Credit: If you have a credit history, ensure it's in good standing by paying bills on time and managing your debts responsibly.

- Provide Accurate Information: Provide accurate information in your application to avoid delays or rejections.

- Submit Complete Documentation: Ensure you provide all required documents promptly and accurately.

- Review Eligibility: Only apply to lenders for which you meet the eligibility criteria to avoid unnecessary rejections.

- Borrow Responsibly: Borrow only what you need and can afford to repay comfortably.

- Timely Repayments: Make sure to repay your loans on time to maintain a good credit history and improve your chances of future loan approvals.

Loan Repayment

Online loan repayment is probably the least favorite topic among borrowers, since it’s a constant reminder that a loan is a responsibility.

However, if you want to maintain a good relationship with your lender, and if you want to be able to borrow again in the future, you should take note of the following tips. Let’s start with different options for loan repayment:

- Automatic Deductions: Many online lenders offer the convenience of automatic deductions from your bank account. This ensures that your monthly payments are made on time without the need for manual transactions.

- Bank Transfers: You can choose to make manual payments through online banking platforms. Ensure you have the lender's bank account details and follow their instructions for transfers.

- Payment Centers: Some lenders have partnerships with payment centers, allowing you to make cash payments in-person if online methods are not convenient for you.

- Mobile Apps: Several lenders provide mobile apps that facilitate easy loan management and repayment. You can check your loan status, make payments, and track your repayment schedule on-the-go.

Tips for Managing Your Loan and Ensuring Timely Repayment

- Set Up Payment Reminders: Use apps or calendar alerts to ensure you never miss a payment.

- Budget Wisely: Create a budget to manage your finances and accommodate loan repayments.

- Build an Emergency Fund: Save for unexpected expenses to avoid defaulting on payments during tough times.

- Review Loan Terms: Regularly check your loan terms, including interest rates and repayment schedules.

- Monitor Credit Score: Timely repayments positively impact your credit score, so regularly check your credit report for accuracy.

Remember to Loan Responsibly, Luv!

There’s no doubt that online loans have changed financial assistance in the Philippines for the better. However, it's crucial to remember that responsible borrowing is the key to a secure financial future.

By understanding the loan options, managing your finances wisely, and making timely repayments, you can harness the benefits of online lending while safeguarding your financial well-being.

Now go ahead and go on your loan journey, luv, but don’t forget – loan responsibly!