After scouring the internet for the best ways to borrow money, choosing the best personal loan for you, and preparing your loan application requirements, you finally got yourself an approved loan offer! Way to go, luv – now you can start funding that dream, chase that goal, or cover any emergency that may come your way.

But before you spend that cash, it’s important to know everything about loan repayments. Here we’ll help you make sense of how monthly installments work, fees and charges you need to be aware of, the most ideal payment channels, and most importantly, how you can re-borrow or get a higher loan amount next time.

Understanding Payment Terms

Most borrowers tend to skip this lengthy part of the loan offer, and who can blame them? It’s full of banking jargon that’s hard to grasp without the help of Google. We’ll help you get through the fine print by breaking down the most important concepts:

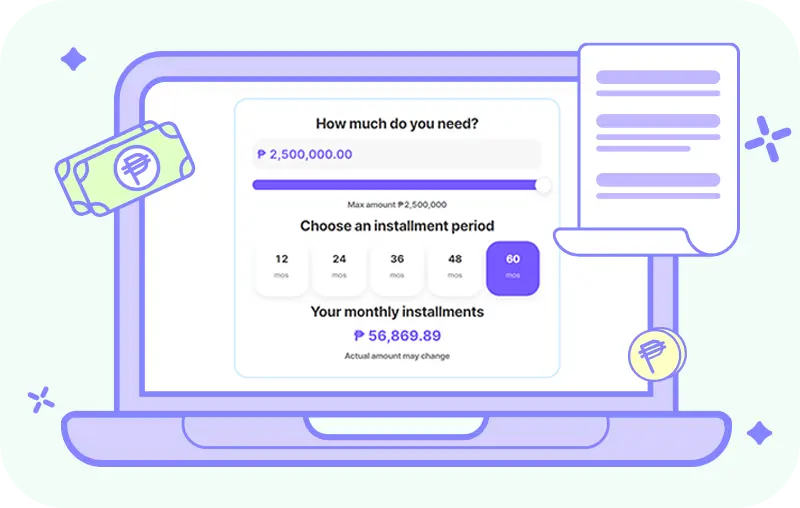

- Loan repayment period – for how long you’ll pay back the total loan amount. You can choose from 6, 9, or 12 months for Credit Builder Loan making repayment easier for borrowers.

- Monthly installments – the amount you’ll pay each month throughout the loan repayment period. You can see a breakdown of monthly installments in this sample amortization schedule.

- Payment due date - a fixed day when you pay your monthly installment. Tonik loans allow you to choose a due date close to your salary date. That way, you won’t be out of budget. Keep in mind, though, that you’re required to pay on or before the due date. If you miss it, you’ll get a late fee which can be quite hefty and damaging to your credit score.

- Rates and fees – the list of charges your lender makes for various processes and term violations. This includes the interest rate (which is at 7.29% on average), the late fee, as well as the loan processing fee, documentary stamp tax, and net proceeds that will be deducted to the total loan amount. Other personal loans may also include a pre-termination fee, which is charged when you fully pay your loan before the set loan repayment period.

Where to Pay

Now that you’ve got the basics covered, it’s time to check out payment channels you can explore.

Over-the-counter

The most common payment method would be over-the-counter transactions at Bayad Center, 7-Eleven, SM Customer Service, or remittance centers like Cebuana Lhuillier. However, some lenders may only have limited OTC partners, so make sure to double check where you can pay and how to fill up OTC payment forms.

E-wallets

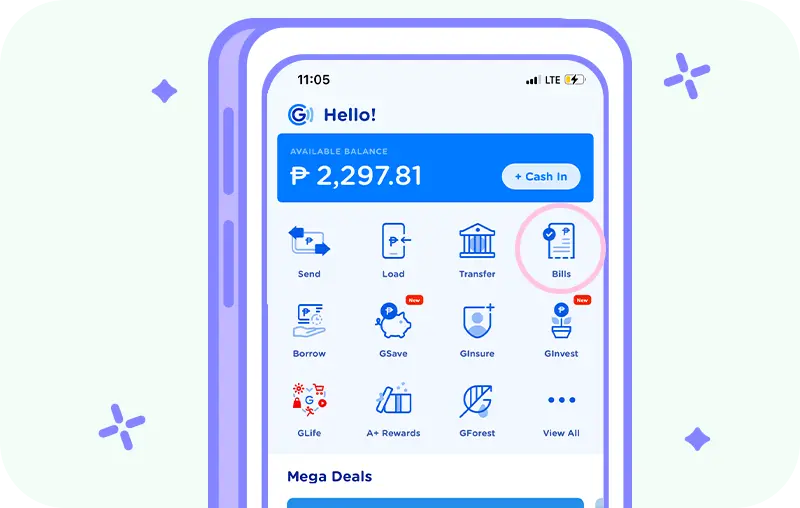

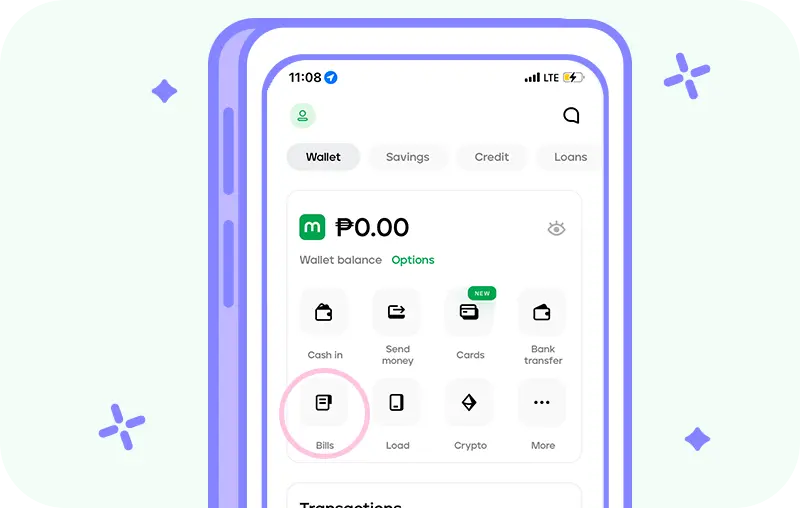

Nowadays, cashless is the way to go. If you’re the type who keeps their e-wallets full, paying via GCash or Maya would be ideal. Keep in mind that there’s a PHP10 fee for every transaction, though!

You can pay your loan through these easy steps:

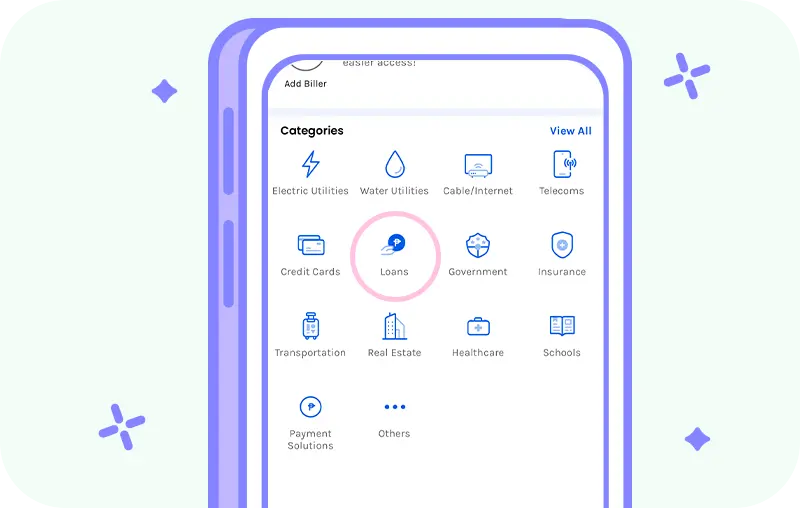

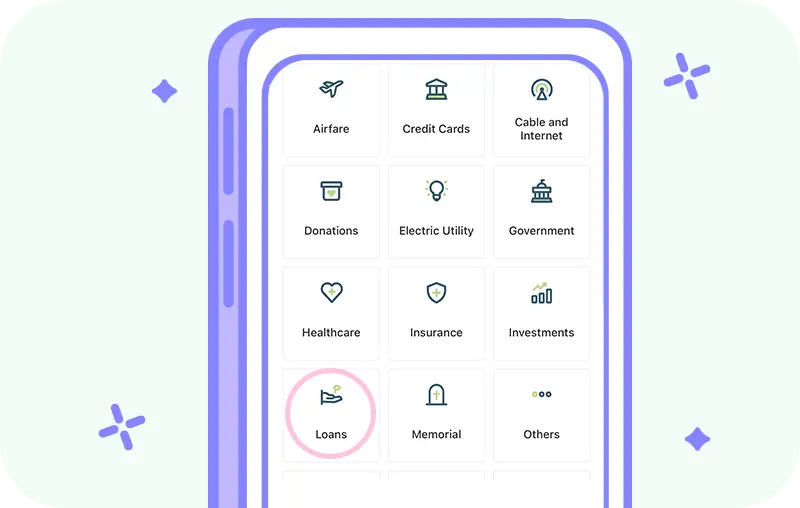

1. Go to Bills

2. Choose Loans

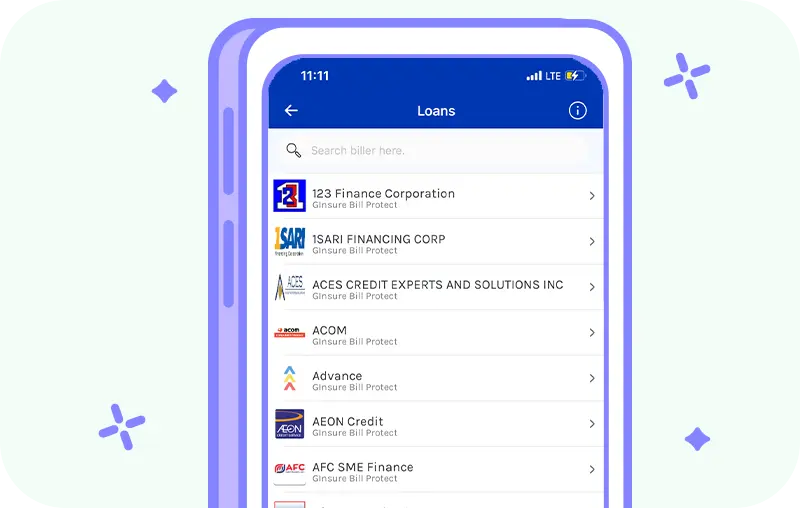

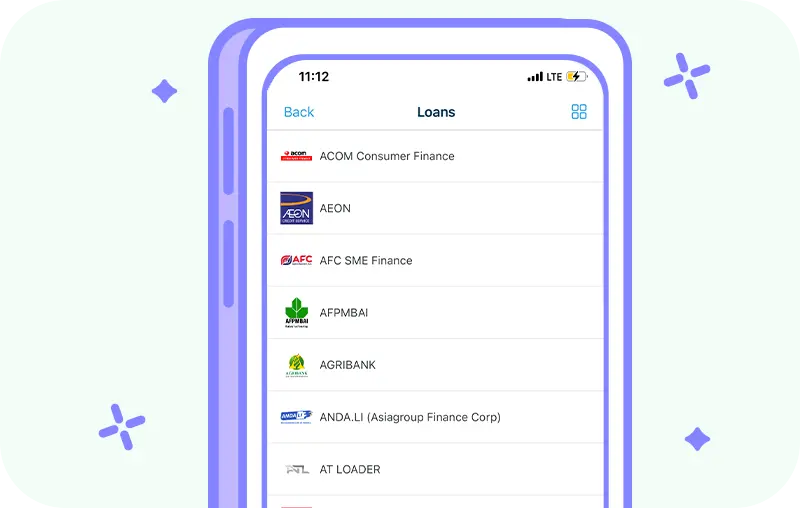

3. Search for your loan provider

4. Fill in your Reference Number, 11 Digit Mobile Number, and Email Address

Banks

Some loans require post-dated checks as payment for personal loans. Others accept payments via ATMs as well, so if you’re crunched for time and not a user of e-wallets, this could be a possible option. The easiest would be an in-app payment transfer though, especially if your lender has a banking app. With Tonik, all you need to do is top-up your Tonik account with your total monthly installment amount and it will automatically credit it to your loan. Sounds awesome, right?

PRO TIP: Starting April 30, 2023, the use of alphanumeric checks will no longer be valid.

Card-linking

Another way that can make your life 10x easier is card-linking. Whether it be your debit ATM card or your credit card, card-linking will automatically credit your payments on your due date religiously. Say goodbye to missed payments or even calendar alarms reminding you of your due date.

FAQs

1. Can I pay my loan in full before the loan repayment period?

Yes, you can pay off your loan in full before the loan repayment period. This is called a pre-payment and it may have a penalty fee, depending on your lender. Good thing Tonik allows pre-payment without extra fees, so feel free to pay your Tonik loan in advance.

2. What happens if I don’t pay my loan?

If you don't make your loan payments, your lender may take legal action against you to recover the money you owe. Your credit score will be negatively affected and your name will be blacklisted, making it more difficult to loan in the future. If your loan has collateral, it may be foreclosed by the bank.

3. Can I loan from the same lender?

Yes, you can loan from the same lender, as long as you meet their qualifications and credit requirements.